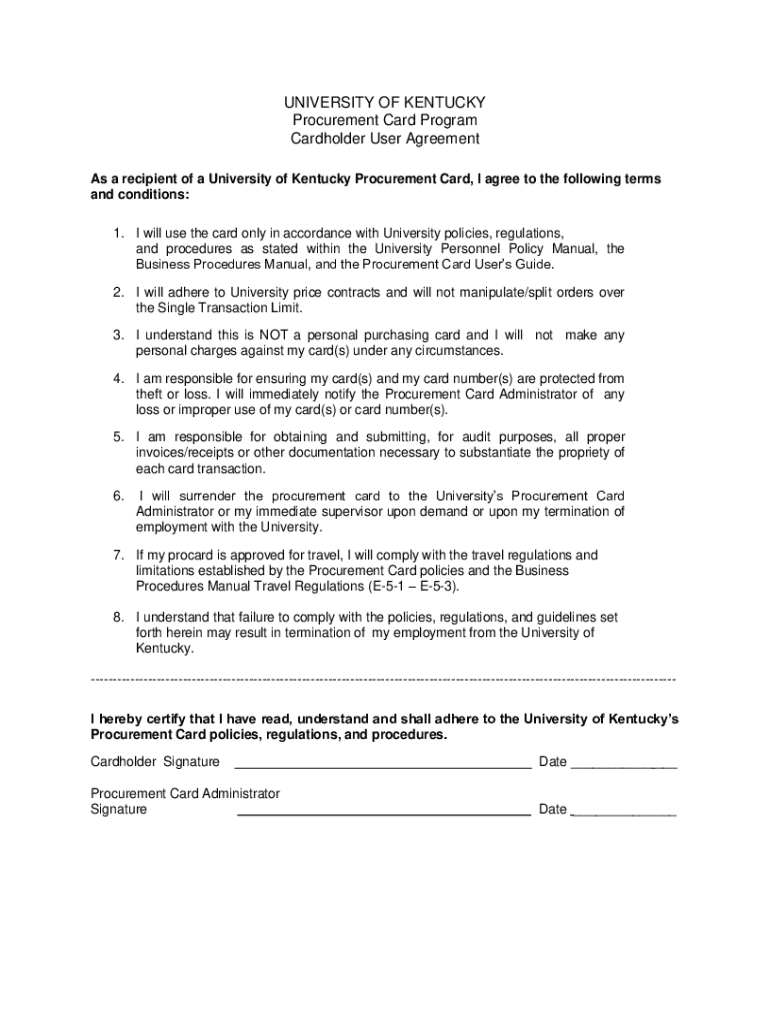

Get the free Cardholder User Agreement

Get, Create, Make and Sign cardholder user agreement

How to edit cardholder user agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cardholder user agreement

How to fill out cardholder user agreement

Who needs cardholder user agreement?

Comprehensive Guide to the Cardholder User Agreement Form

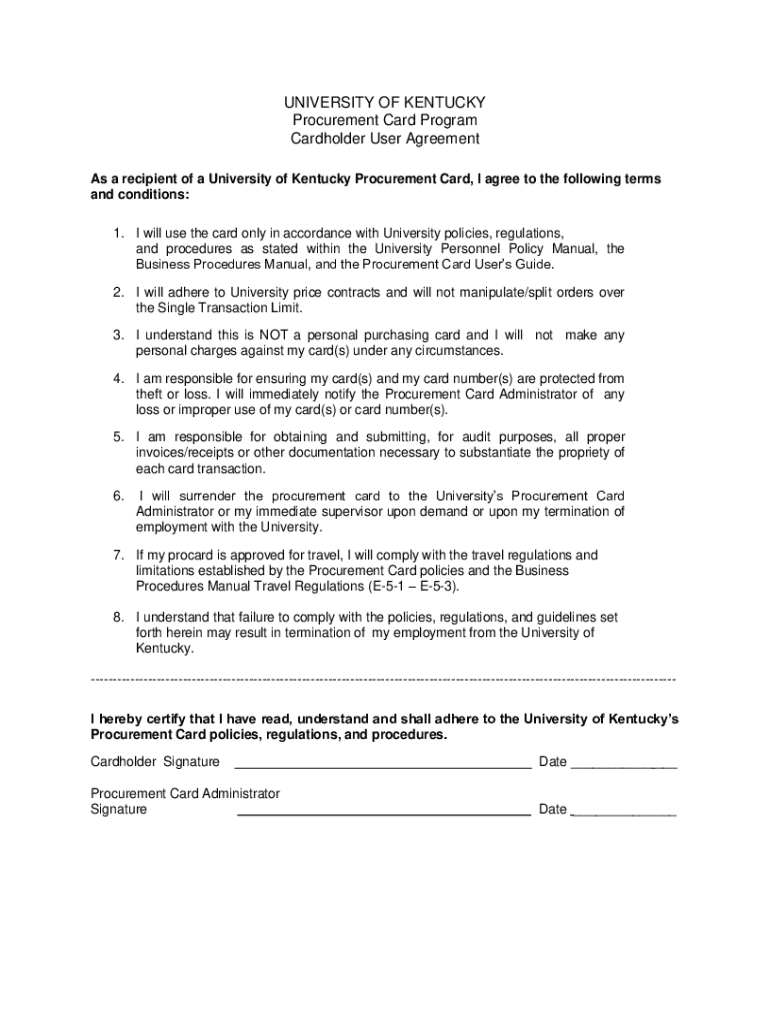

Understanding the cardholder user agreement

The cardholder user agreement is a crucial document that outlines the terms and conditions governing the relationship between a cardholder and the card issuer. It functions not only as a legal framework but also as a guide for responsible financial management. This agreement clarifies the rights and obligations of both parties involved, fostering transparency and trust in their financial interactions.

Key terminology in the cardholder user agreement includes the cardholder—the individual authorized to use the credit card—and the issuer, which is the financial institution that provides the card and sets the related policies. Understanding these terms is critical, as they form the backbone of the financial agreement.

Eligibility criteria for cardholders

Not everyone can hold a credit card; specific eligibility criteria must be met. Generally, to qualify as a cardholder, individuals must meet certain age and residency requirements. Most issuers require applicants to be at least 18 years old, although some cards may be available for younger individuals, provided a parent or guardian co-signs.

Additionally, applicants must establish residency within the country where they are applying. This often involves providing proof of address, such as a utility bill or lease agreement. Moreover, individuals must provide certain information during the application process, which may include financial details to help the issuer assess creditworthiness.

General usage guidelines

The cardholder user agreement outlines how the card is to be used and the responsibilities that come with ownership. Cardholders should only use their cards for authorized transactions, such as purchases, bill payments, and approved cash advances. Misuse of the card can lead to penalties, including fees, increased interest rates, or even account closure.

Certain actions are prohibited under the agreement. For instance, using the card for illegal activities, failing to make timely payments, or exceeding credit limits can result in serious consequences. Cardholders must also manage their credit wisely, ensuring that their spending aligns with their financial capacity. This involves understanding their financial limits and monitoring expenses closely.

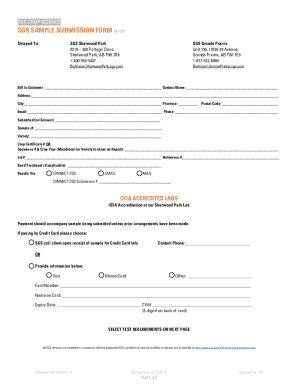

Filling out the cardholder user agreement form

Completing the cardholder user agreement form can be straightforward if you follow specific steps carefully. Begin by gathering all necessary documents and information, such as personal identification details, financial information, and proof of residence. When ready to fill out the form, ensure you carefully input required fields such as your full name, address, social security number, and income details.

While filling the form, remember that some fields may be mandatory while others are optional. Pay close attention to these details to avoid delays or rejections in your application. Additionally, ensure you double-check your entries to avoid typos or incorrect information that could affect your application status.

Editing and customizing your cardholder agreement

Once you've completed the cardholder user agreement form, you may wish to edit or customize the terms. pdfFiller allows users to modify various aspects of the agreement to fit personal needs easily. Navigate to the form within the platform and make adjustments wherever necessary. This flexibility is paramount, ensuring that the agreement terms can be tailored to individual situations.

Moreover, pdfFiller provides customization options that allow users to create the most suitable document format. You can download the edited document in PDF format or export it into other compatible formats as needed, offering the flexibility required to manage your documents effectively.

Signing the cardholder user agreement

Once the form has been completed, the next crucial step is signing the cardholder user agreement. pdfFiller supports eSigning, enabling you to sign your agreement electronically without the need for physical paperwork. This modern approach not only saves time but also offers enhanced convenience, as documents can be signed from anywhere with an internet connection.

Electronic signatures are legally valid in many jurisdictions, provided they comply with regulations such as the Electronic Signatures in Global and National Commerce (ESIGN) Act. Additionally, if multiple signers are involved, pdfFiller allows you to manage a shared signing process efficiently, ensuring all parties can approve the document seamlessly.

Managing your cardholder agreement

Efficiently managing your cardholder agreement after signing is essential for maintaining your financial health. pdfFiller offers robust organizational tools to store and access your agreement from any location. Users can create folders, tag documents, and utilize search features to ensure that important documents are easily retrievable.

Moreover, pdfFiller provides sharing options, allowing you to share your cardholder agreement with financial advisors or family members as needed. Keeping your agreement organized and readily available ensures that you can respond swiftly to any questions or actions requiring attention.

Consequences for misuse of the card

Misusing your card can lead to various repercussions, both immediate and long-term. Common violations include late payments, exceeding credit limits, and fraudulent transactions. These actions can trigger penalties such as increased interest rates or account suspension, effectively impacting your credit score.

It’s crucial to report suspected misuse quickly to mitigate risks. Typically, issuers provide specific procedures for reporting suspicious activity, which may include contacting customer service directly. Furthermore, staying vigilant and regularly monitoring your accounts can help protect you against fraud and unauthorized activity.

Card deactivation guidelines

Deactivating your cardholder agreement may become necessary under several conditions, such as losing your card or identifying fraud. To ensure your financial security, it’s essential to follow an appropriate process when deactivating your card. Most issuers provide specific instructions that include contacting customer service or accessing your online account.

In the event of deactivation, understanding your options for account recovery is crucial. Users may need to provide identification proof or complete forms to reactivate their accounts, depending on the issuer's policies.

Frequently asked questions (FAQs)

As cardholders navigate their agreements, several common questions often arise. First, if you lose your card, it's essential to contact your issuer immediately to report the loss and prevent unauthorized charges. The issuer will aid you in canceling the lost card and issuing a replacement.

Updating personal information in your agreement is typically straightforward. Most issuers allow you to access your account online or through their customer service to make amendments. Additionally, be aware that maintaining your cardholder agreement may incur fees, which usually include annual fees or transaction charges, depending on the card utilized.

Connecting with our support team

For any inquiries regarding your cardholder user agreement, reaching out to customer service is highly recommended. pdfFiller provides various support options, including chat support, email assistance, and one-on-one consultations. These resources are invaluable for clarifying any uncertainties or concerns regarding the agreement process, ensuring you have expert guidance as you navigate your document management.

Moreover, the online resources available through pdfFiller allow you to explore help articles, FAQs, and user guides that can offer further insights into using the platform effectively.

Additional considerations

Maintaining your cardholder user agreement involves keeping meticulous records and documentation. Being organized facilitates quick access to important documents and helps in effective management of your financial health. Regularly reviewing your cardholder agreement for any changes in terms and conditions that may occur is equally crucial; understanding these changes will help you adjust your financial practices accordingly.

Adapting to potential changes, whether arising from the institution's re-evaluation of terms or external market conditions, ensures that your cardholder agreement remains relevant to your financial needs. As changes occur, proactive management enables cardholders to make informed decisions that contribute to long-term financial wellness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cardholder user agreement?

How do I edit cardholder user agreement online?

Can I create an electronic signature for the cardholder user agreement in Chrome?

What is cardholder user agreement?

Who is required to file cardholder user agreement?

How to fill out cardholder user agreement?

What is the purpose of cardholder user agreement?

What information must be reported on cardholder user agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.