Get the free California Schedule P (100)

Get, Create, Make and Sign california schedule p 100

How to edit california schedule p 100 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california schedule p 100

How to fill out california schedule p 100

Who needs california schedule p 100?

Understanding the California Schedule P (100) Form: A Comprehensive Guide

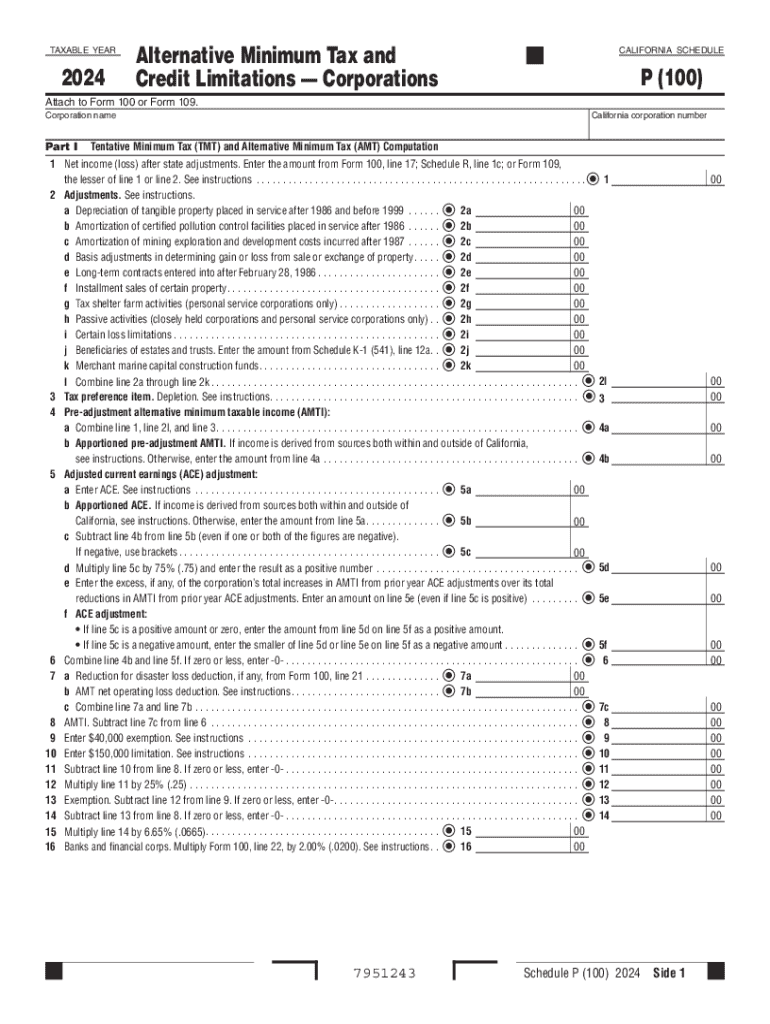

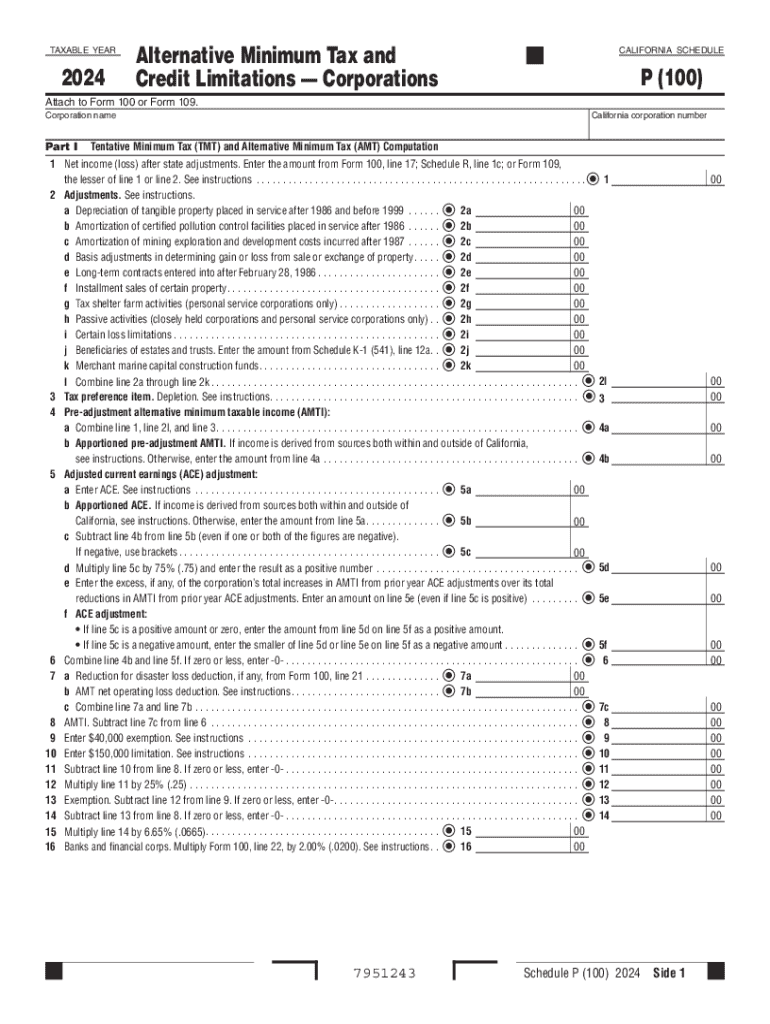

Overview of California Schedule P (100)

The California Schedule P (100) form is a critical component of corporate tax filing in the state, designed specifically for corporations subject to the Alternative Minimum Tax (AMT). This form serves to calculate a corporation's Tentative Minimum Tax and to identify any credits available to offset tax liabilities. By accurately completing this form, corporations can ensure compliance with state tax regulations while minimizing tax obligations. As of 2023, several adjustments and updates have been made to enhance clarity and usability, making it imperative for corporations to stay informed.

Who must file Schedule P (100)?

Not all corporations are required to file the California Schedule P (100); this obligation primarily falls on those entities that are subject to the Alternative Minimum Tax (AMT). This includes most corporations with tax liabilities that exceed a certain threshold. However, some exemptions apply, such as certain types of corporations that fall under specific classifications or are under particular revenue ceilings. Understanding these nuances is crucial for corporations to determine their filing obligations.

Understanding alternative minimum tax (AMT)

The Alternative Minimum Tax (AMT) is a parallel tax system intended to ensure that corporations pay at least a minimum amount of tax, regardless of deductions and credits they may utilize. For corporations, the AMT is calculated using a different set of rules compared to regular taxable income, which often results in a higher taxable base. This system was established to prevent high-income corporations from overly reducing their tax liabilities through various loopholes.

Under the AMT, corporations are required to make adjustments to their taxable income by adding back specific tax preference items and adjusting for certain accelerated depreciation claims. Depending on these calculations, corporations may find their tax obligations significantly impacted, sometimes resulting in higher tax bills than expected. Understanding how AMT functions is vital for strategic financial planning within any corporate entity.

Detailed instructions for completing Schedule P (100)

Completing the California Schedule P (100) can seem daunting, but breaking it down into manageable sections can simplify the process. The form is structured into multiple parts, each addressing different aspects of the AMT calculation and credits available for reduction. Start with Part I, where you will compute your Tentative Minimum Tax (TMT). Ensure you pay close attention to key lines, as these will dictate your tax obligations.

To avoid common pitfalls, maintain accurate records and consult guidance on each section’s requirements. Use calculators and interactive tools provided by platforms such as pdfFiller to simulate calculations and streamline the filing process. Tools like these can make your tax preparation experience more efficient, saving substantial time and effort.

Understanding key tax preference items

Tax preference items play a significant role in determining your Alternative Minimum Tax (AMT) obligations. These items include specific deductions and credits that typically lower taxable income but are added back when calculating AMT. Some common examples include accelerated depreciation, intangible drilling costs, and percentage depletion on oil and gas properties. Accumulating these preference items can significantly influence a corporation's AMT situation.

When reporting tax preference items on Schedule P (100), be meticulous. Each item requires distinct documentation and proper classification to ensure compliance and accuracy. Utilizing tools that assist in assembling these items, such as automated document services found on pdfFiller, can enhance organization and clarity in your filings.

Adjusted current earnings (ACE) computation

Adjusted Current Earnings (ACE) is a crucial component in the calculation of the AMT for corporations. Essentially, ACE reflects a corporation's earnings with specific adjustments aimed at standardizing income over various tax calculations. Corporations need to utilize ACE computations to ensure compliance with AMT rules effectively.

Getting ACE right involves a detailed process where corporations adjust their financial statements to meet AMT guidelines. In the ACE worksheet, attention must be paid to specific adjustments related to expenses, revenues, and different accounting methods. Follow step-by-step instructions to ensure accurate calculation.

Special considerations for specific industries

Certain industries may have unique reporting requirements when it comes to the California Schedule P (100). For example, financial corporations might have distinct nuances in the reporting of income and deductions due to regulatory obligations. Similarly, tax shelter corporations must adhere to different standards that could alter their AMT calculations. Awareness of these industry-specific challenges can streamline the filing process.

It's advantageous for corporations within specific sectors to seek assistance or consult resources tailored to their industry. This ensures accuracy in filings and adherence to state tax regulations.

Frequently asked questions (FAQs)

Resources for further assistance

For further assistance, the California Franchise Tax Board offers a wealth of information on their official website. This includes interactive filing tools and educational resources about corporate tax obligations. Tools offered by pdfFiller can also enhance your filing experience, allowing for easy document creation and management from anywhere.

Using pdfFiller for Schedule P (100)

pdfFiller facilitates a seamless experience when managing the California Schedule P (100) form. With its cloud-based platform, users can create, edit, and eSign forms with ease. The platform emphasizes collaboration, allowing multiple team members to work together on tax documentation safely and efficiently.

Important dates and deadlines

For corporations in California, adhering to filing deadlines is essential to avoid penalties. Key dates for corporate tax filings generally align with the federal tax calendar, but always verify state-specific deadlines. The deadline for filing Schedule P (100) remains critical within the context of overall tax compliance.

Related forms and document management

Alongside Schedule P (100), corporations may encounter various related forms that complement tax reporting needs. Familiarity with related documents and regulations streamlines the tax preparation process and ensures compliance is maintained across the board. Utilize pdfFiller not only for your Schedule P (100), but also for organizing all pertinent tax documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find california schedule p 100?

How do I execute california schedule p 100 online?

How do I edit california schedule p 100 in Chrome?

What is california schedule p 100?

Who is required to file california schedule p 100?

How to fill out california schedule p 100?

What is the purpose of california schedule p 100?

What information must be reported on california schedule p 100?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.