Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive How-to Guide

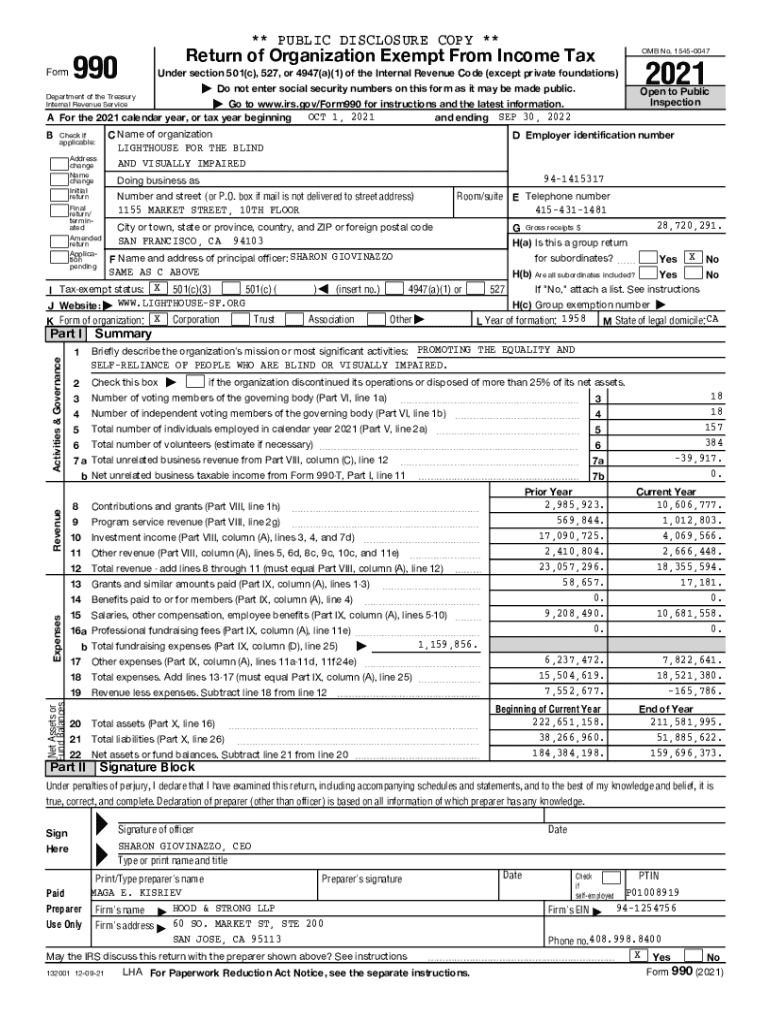

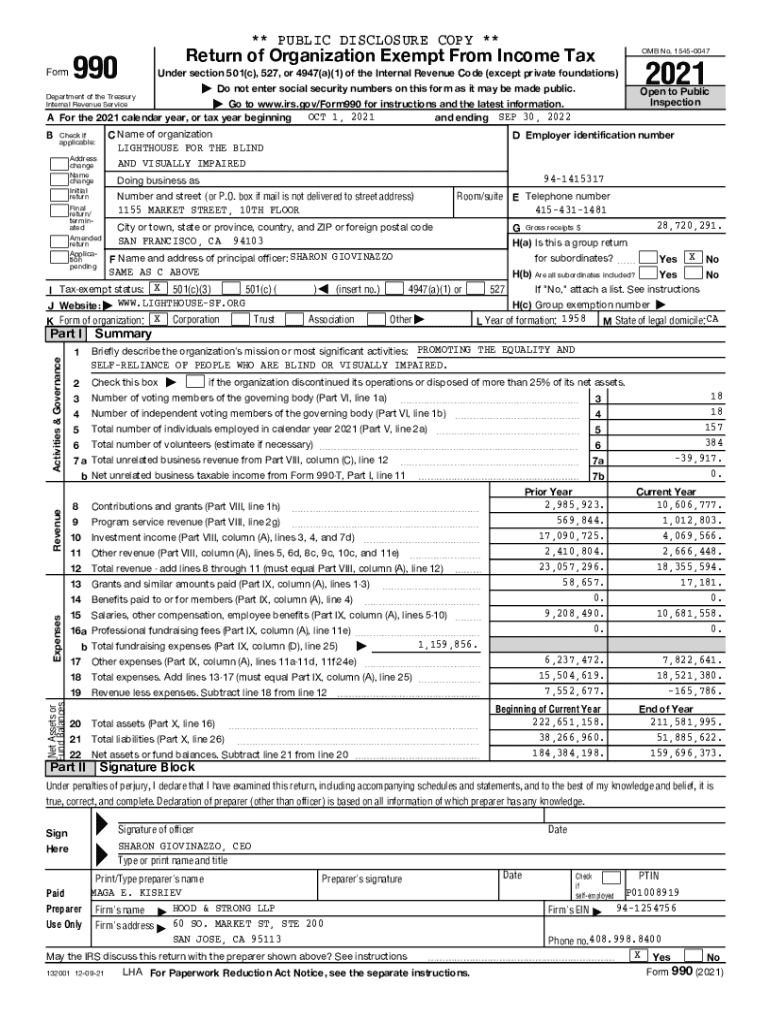

Understanding Form 990

Form 990 is a critical document that nonprofit organizations must file annually with the IRS. It serves as a public disclosure form, ensuring transparency and accountability in the activities and finances of tax-exempt organizations. Unlike traditional tax forms that report income tax, Form 990 provides a wealth of information about an organization’s mission, programs, and finances to the public, donors, and the IRS.

The importance of Form 990 cannot be overstated, as it plays a pivotal role in evaluating nonprofit organizations. This form helps potential donors assess the credibility and effectiveness of a nonprofit, contributing to well-informed donation decisions. It also helps keep organizations honest, as transparency is key to maintaining public trust.

Key features of Form 990

Form 990 is structured to provide a comprehensive overview of a nonprofit organization’s activities and finances. The first section is the summary, which offers a snapshot of the organization’s mission and major activities. Following this, there is a signature block, confirming that the information presented is accurate and complete.

Part III delves into the organization’s program service accomplishments, showcasing how it fulfills its mission. Part IV serves as a checklist for required schedules, while Parts V through XI provide a detailed look at financial information and organizational governance, including revenue and expenses, program services, and board governance details.

Filing requirements and deadlines

Every tax-exempt organization must evaluate whether it is required to file Form 990. Key criteria include the organization’s annual revenue and structure. Organizations with annual gross receipts exceeding $200,000 or total assets exceeding $500,000 must file the full Form 990. Smaller entities may qualify for Form 990-EZ or 990-N.

Exceptions to the requirement to file can apply to certain types of nonprofits, including churches and governmental organizations. However, knowing your obligations is essential to avoid penalties. Failure to file can lead to significant consequences, including automatic revocation of tax-exempt status after three consecutive years of non-filing.

How to locate and access Form 990

Locating Form 990 on the IRS website is straightforward. The IRS provides a dedicated page where all variations of Form 990 and associated instruction booklets are available for download. Simply visit the IRS Forms and Publications page to find the appropriate form for your organization’s needs.

Accessing previous filings can be equally important for organizational transparency. The IRS requires that organizations make their Form 990 filings available for public inspection. Users can check databases like GuideStar or the IRS website to review past filings from various nonprofits, ensuring donors and stakeholders can easily evaluate an organization’s financial health.

Step-by-step instructions for filling out Form 990

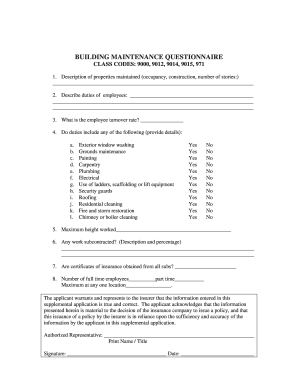

Filling out Form 990 requires careful preparation of your financial data. Start by gathering your organization’s financial information, including revenue, expenses, net assets, and program activities over the past year. Ensure you have documentation to support the figures reported, including bank statements, invoices, and receipts for significant expenses.

With your data ready, you can begin filling out the form. Each section typically requires specific information; thus, following the instruction guide associated with Form 990 can be immensely helpful. Be vigilant about common mistakes, such as confusion between revenue types or underreporting expenses, which may lead to inaccuracies that could raise red flags with the IRS.

Editing and managing your Form 990

Utilizing tools like pdfFiller can streamline the editing process for Form 990. pdfFiller allows users to upload their forms, making any necessary adjustments in real-time. The platform’s interactive features enable multiple users to collaborate, ensuring all data is accurate and up-to-date before filing.

In addition to editing, managing signed documents is made easier with pdfFiller. This includes eSigning documents directly in the platform and sharing completed forms securely with stakeholders. Archiving your filed Form 990 properly is also essential; consider storing backups both digitally and in hard copy to ensure that you have access to them whenever needed.

Public inspection regulations

Form 990 is not only a compliance tool for nonprofits; it is also a mechanism for public access. Organizations must comply with regulations stipulating that their Form 990 filings be available for public inspection. This is a crucial aspect of maintaining trust and integrity within the nonprofit sector, allowing stakeholders access to financial data and programmatic effectiveness.

To request copies of Form 990 from other organizations, interested parties can directly contact the organization or access the databases where these forms are stored. Most nonprofits are required to provide copies upon request, usually at no charge, thus promoting accountability.

Importance of Form 990 for donors and researchers

Form 990 is a vital source of information for donors and researchers, as it contains invaluable data regarding an organization’s financial performance, program effectiveness, and governance practices. This transparency helps donors make informed decisions about where to allocate their charitable contributions. Furthermore, researchers utilize Form 990 as a data source to analyze trends and impacts within the nonprofit sector, contributing to the broader understanding of social issues.

Through reviewing Form 990 filings, stakeholders can gauge important financial indicators, such as revenue growth, funding sources, and the efficiency of spending. Variables such as program spending as a percentage of total expenses can provide insights into the organization’s operational priorities and alignment with its mission.

Recent changes and updates to Form 990

The IRS periodically revises Form 990 to improve reporting accuracy and transparency. Recent amendments have introduced new compliance requirements, such as enhanced reporting of executive compensation and greater clarity in the classification of revenue and expenses. These updates reflect the evolving landscape of nonprofit operations and aim to facilitate public understanding.

Understanding these amendments is crucial for nonprofits to stay compliant and avoid potential penalties. Organizations must prepare for changes by reviewing their reporting practices, ensuring that their finances are in order and that their governance structures meet new regulatory standards.

Additional resources for Form 990 filers

Filing Form 990 can be a complex process, and having access to resources can simplify navigation through regulations. The IRS provides official guidance documents, forms, and instructions for completing Form 990, all of which can be found on their website. External resources such as nonprofit professional organizations also have immense value, offering guidance on best practices in reporting and compliance.

Utilizing community forums and support groups can assist organizations in gaining insights from peers facing similar challenges. Sharing experiences can lead to better ways of managing documentation, filing requirements, and overall governance practices.

Frequently asked questions (FAQs) about Form 990

Many organizations have questions regarding Form 990, especially concerning their filing status and compliance requirements. Common queries include whether an organization should file Form 990 if it falls below the revenue threshold and what information must be disclosed within the form. It’s important to clarify these doubts as failing to file or providing inaccurate information can lead to penalties.

Resources for troubleshooting common issues, such as missing deadlines or confusion about the form itself, are widely available on the IRS website and community forums. Moreover, engaging with consultants who specialize in nonprofit financial management can provide tailored guidance to meet specific needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 990?

How do I edit form 990 online?

How do I fill out form 990 using my mobile device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.