Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out grant deed

Who needs grant deed?

Understanding the Grant Deed Form: A Comprehensive Guide

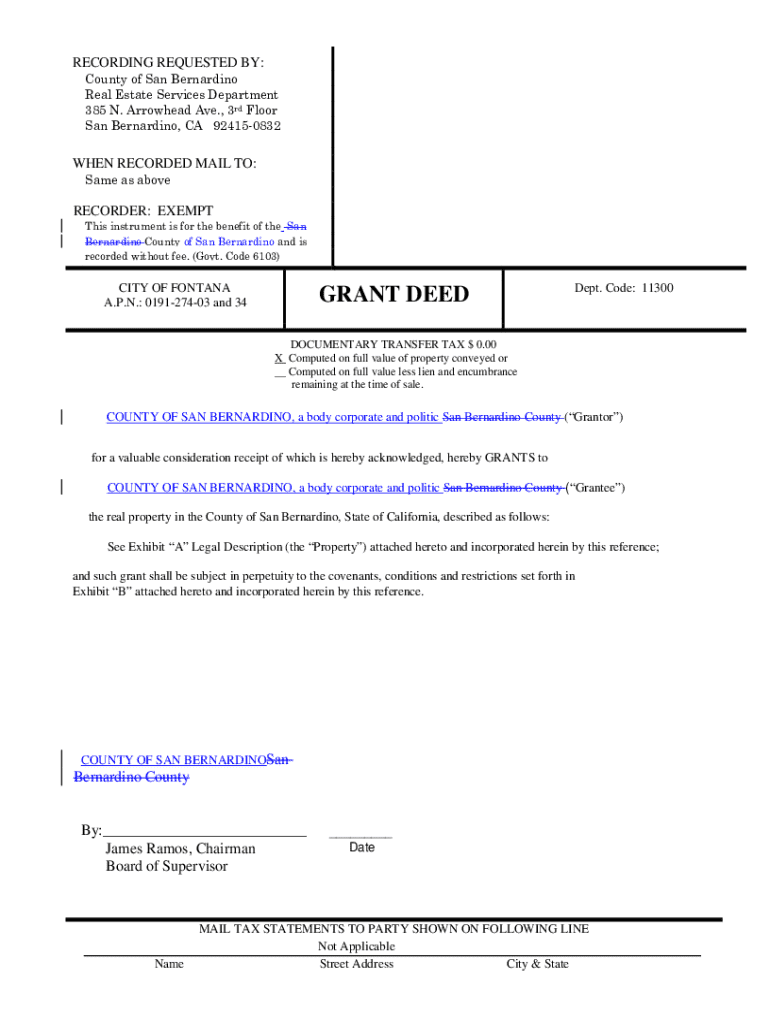

Understanding grant deeds

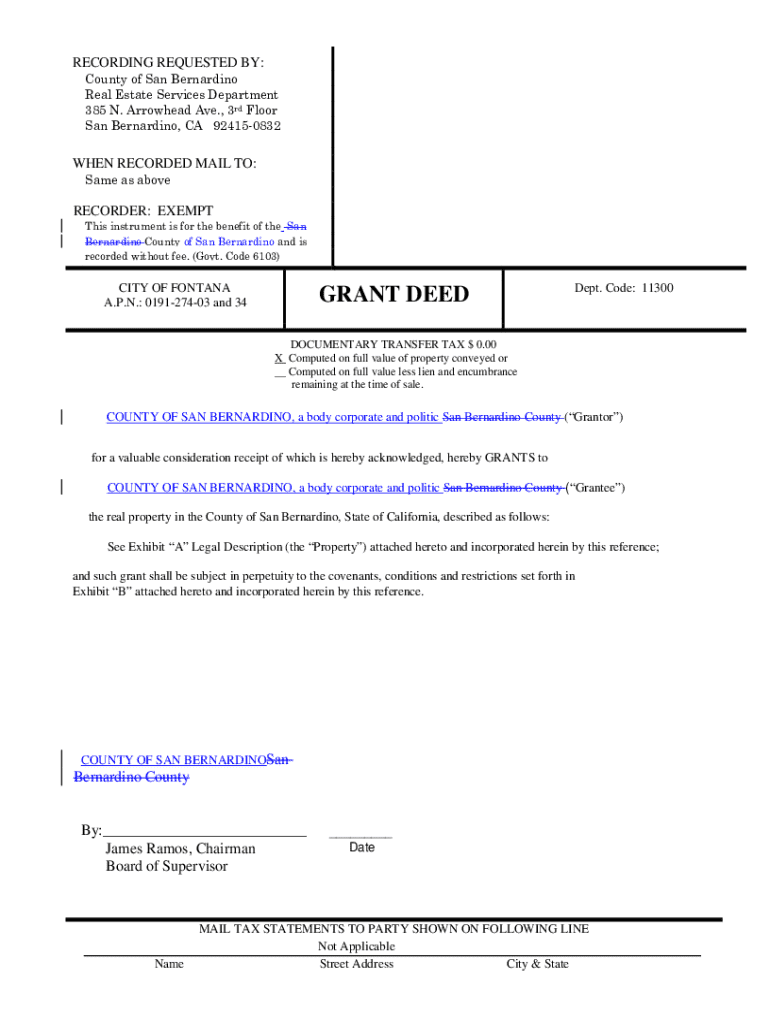

A grant deed is a fundamental legal document used in real estate transactions to transfer property ownership. It assures the grantee—that is, the person receiving the property—that the grantor, the person transferring it, has the legal authority to do so and that the property is free from encumbrances, except those expressly stated in the deed. This provides an essential layer of assurance in property deals, ensuring the transaction's integrity.

The primary functions of a grant deed include not only the transfer of ownership but also the ability to establish clear title, which is critical in real estate. It serves as proof that a person has the right to sell and that the property has been conveyed without any undisclosed claims or problems. This legal significance makes grant deeds essential tools in property transactions, protecting the interests of all parties involved.

Key components of a grant deed

A complete grant deed must contain certain essential elements to be legally binding. These include the names of the grantor and grantee, a detailed description of the property being transferred, and the date of the transaction. Additionally, the document should outline any relevant covenants that accompany the transfer, which serve as formal promises regarding the property's status and its future use.

Terms such as 'grantor' and 'grantee' indicate who is selling (or granting) the property and who is receiving it. The property description must be clear enough for someone to identify the location and boundaries definitively, often employing legal descriptions. Covenants in a grant deed may include promises that the property is free from encumbrances or that the grantor maintains ownership until the transaction is complete.

A sample grant deed would exhibit these components prominently, often divided into sections that simplify the transfer process. For instance, this can help users visualize how to complete each part effectively, ensuring they meet all legal requirements.

When to use a grant deed

When deciding on the appropriate deed for a property transfer, it’s vital to recognize the scenarios where a grant deed is most applicable. Grant deeds are ideal when the seller can assure clear title and ownership, making it a preferred choice over a quitclaim deed, which offers no such assurances. If you are transferring property in a sale or gift where the title's security is crucial, a grant deed is the preferred option.

Conversely, situations warranting the use of a quitclaim deed may arise, such as transferring property between family members where trust exists. More commonly, misunderstandings about grant deeds stem from their perceived complexity. Users often mistakenly think any deed will suffice regardless of ownership assurances, which could lead to future disputes.

Steps to prepare a grant deed form

Preparing a grant deed form necessitates careful attention to detail and adherence to legal standards. The first step is gathering all necessary information about the property and the parties involved in the transaction. This includes specifics about the property location, legal description, and full names of the grantor and grantee.

Selecting the correct template is also crucial. Tools like pdfFiller provide an array of interactive templates that simplify this process. Once the correct form is selected, it is vital to fill it out accurately by following step-by-step instructions. Each section must reflect the appropriate details to avoid common errors, such as incorrect property descriptions or misidentified parties.

After filling the form, utilizing pdfFiller’s editing tools can aid in reviewing the details to ensure clarity and correctness before finalizing the document.

Signing and notarizing the grant deed

A signed grant deed is essential for legal validity. Typically, the grantor must sign the document, thereby affirming the accuracy of the information presented and presenting a final acceptance of the transfer. Various jurisdictions may require that the grantee also sign, especially when formalizing the transaction.

Notarization adds an extra layer of authentication to grant deeds, which helps prevent fraud. The notarization process involves having a notary public witness the signing and confirm the identities of those involved. Many are now also exploring digital solutions, like using pdfFiller for eSigning, to further ease this process while maintaining legal integrity.

Recording your grant deed

Once executed, grant deeds must be recorded to protect the grantee's interests legally. Recording a deed creates a public record and notifies all potential claimants that ownership has changed hands. The steps for recording the deed typically include locating the local recording office, filling out the necessary forms, and paying any associated fees.

Understanding local recording offices is crucial, as each jurisdiction has its specific requirements. The timeline for recording a grant deed can vary based on the volume of submissions and the efficiency of the office. Generally, expect a few days to a couple of weeks for confirmation.

FAQs about grant deeds

Various questions often arise surrounding grant deeds and their nuances. One of the most common inquiries is the difference between a grant deed and a title. While a grant deed facilitates the transfer of property ownership and indicates a clear title, it does not constitute ownership itself—the title represents legal ownership.

Obtaining a copy of a grant deed typically involves accessing local county recorders or property assessment offices, where such public records are maintained. Additionally, individuals may wonder about the implications if a grant deed is not recorded, which could lead to disputes over ownership or claims. Should any issues arise during or after the transaction regarding a grant deed, understanding the recourse available is critical.

Related documents and forms

In the realm of property transfers, several related documents and forms can be used alongside grant deeds. Recognizing these can clarify the best choice for a specific situation. Quitclaim deeds are simpler, transferring existing rights without any warranties; warranty deeds provide robust protections against future claims; transfer on death deeds permit the transfer of property upon the grantor's death; while bargain and sale deeds serve as hybrid options.

Using pdfFiller, users can manage these different forms effortlessly, ensuring all necessary documentation is completed accurately. Having the right tools simplifies the process of obtaining these related documents.

Seeking legal assistance

Navigating the complexities surrounding grant deeds sometimes necessitates professional legal assistance. If questions arise regarding specific situations or disputes concerning the deed, hiring a lawyer can guide one through the intricacies of property law. Understanding when to seek help ensures that individuals are adequately protected and informed during property transactions.

Users seeking reliable legal support can utilize resources available through pdfFiller to find trusted services efficiently. Finding legal assistance tailored to document verification or transaction complexities can lead to a more seamless property transfer experience.

Get help as you go

Encountering difficulties during the grant deed process is not uncommon. Common issues may arise around filling out forms accurately or understanding local requirements for recording deeds. However, professional assistance is just a click away. Utilizing pdfFiller’s customer support can help resolve these issues in real time, allowing users to focus on achieving a successful property transfer.

Real user testimonials often highlight the efficacy of pdfFiller in streamlining the document management process. By employing its tools for grant deeds, customers can feel confident in their ability to create, edit, and sign documents that meet all legal requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pdffiller form to be eSigned by others?

How do I make changes in pdffiller form?

Can I create an electronic signature for the pdffiller form in Chrome?

What is grant deed?

Who is required to file grant deed?

How to fill out grant deed?

What is the purpose of grant deed?

What information must be reported on grant deed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.