Get the free Minimum Wage Employer Signature Form

Get, Create, Make and Sign minimum wage employer signature

Editing minimum wage employer signature online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minimum wage employer signature

How to fill out minimum wage employer signature

Who needs minimum wage employer signature?

Understanding the Minimum Wage Employer Signature Form

Understanding the minimum wage employer signature form

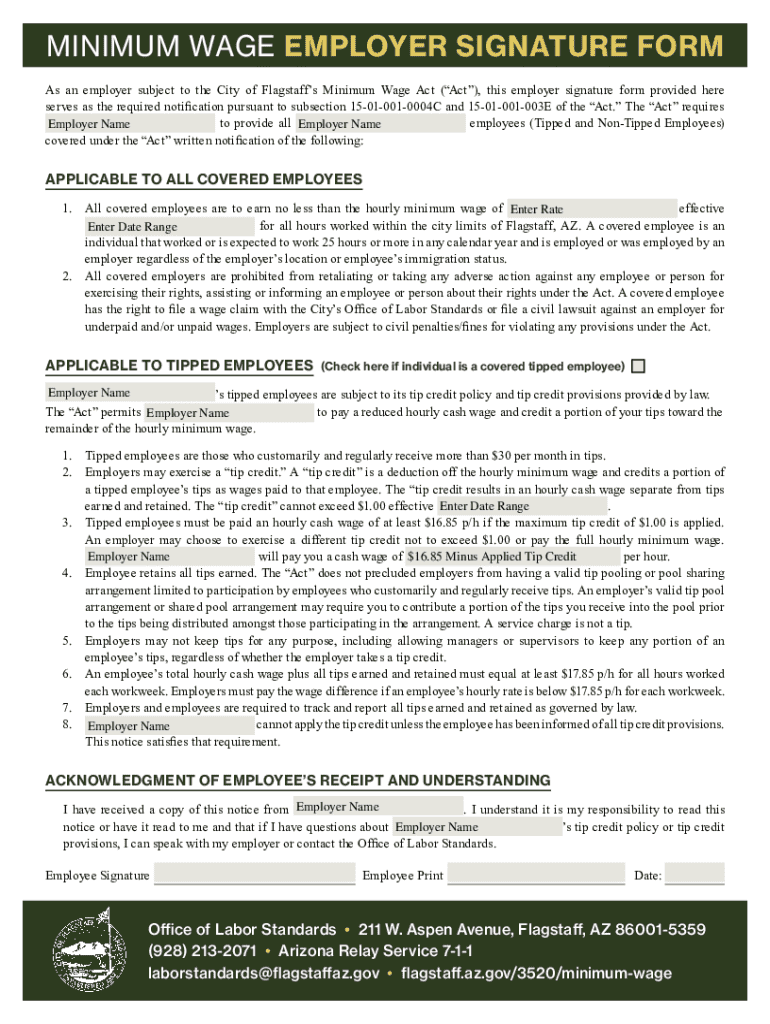

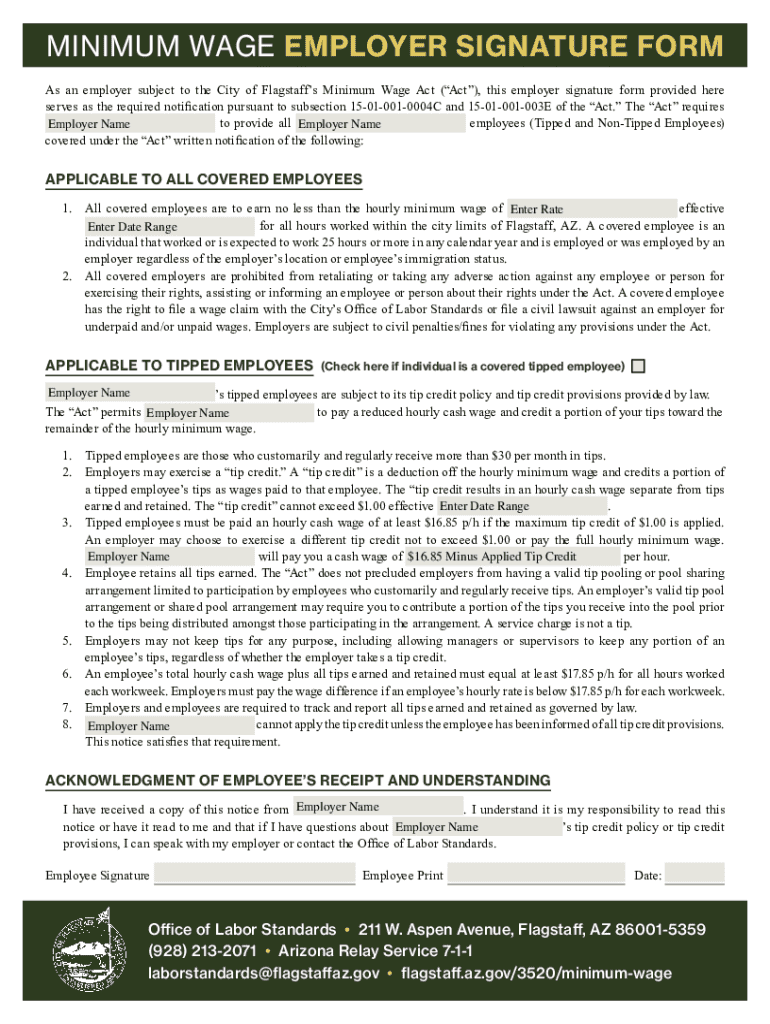

The minimum wage employer signature form serves as a vital document that verifies a comprehensible understanding between employers and employees regarding wage agreements. Its primary purpose is to confirm that employees are aware of their wage status and that employers are compliant with mandated wage laws. This form acts as an essential piece of the broader compliance landscape, ensuring that minimum wage employees receive at least the legally required pay, which varies from one jurisdiction to another.

Compliance with local minimum wage laws is not merely a legal obligation but a pivotal aspect of ethical business practice. By utilizing the minimum wage employer signature form, employers can safeguard themselves against potential disputes regarding wage payment. Furthermore, understanding minimum wage regulations enhances an employer's credibility and fortifies trust in employer-employee relations.

Eligibility for minimum wage act

Understanding who must utilize the minimum wage employer signature form is crucial to avoid compliance issues. Generally, any business or organization that employs individuals paid at or near the minimum wage must fill out this form. This includes, but is not limited to, service industries, retail operations, and hospitality sectors where minimum wage laws are particularly relevant.

Both employers and employees bear particular responsibilities in terms of compliance. Employers need to maintain accurate records and ensure payment aligns with minimum wage laws, while employees must understand their rights regarding pay. A common misconception is that only large companies need to comply with wage laws; in reality, even small businesses must adhere to these regulations, ensuring all employees are compensated fairly regardless of business size.

Key features of the minimum wage employer signature form

The minimum wage employer signature form is structured to capture essential information that enables compliance with applicable wage laws. Key components of this form include an employee information section, where details such as name, address, and employment status are captured. Simultaneously, the employer information section requires the business name, address, and contact information, ensuring transparency from both sides.

Another critical element is the signature requirement, which confirms that both parties have agreed to the stated terms. To submit this form successfully, specific documentation may also be necessary, such as proof of minimum wage rates, employment contracts, and identification papers. Gathering this information ahead of time facilitates a seamless completion process.

Step-by-step guide to completing the minimum wage employer signature form

Completing the minimum wage employer signature form involves several clear steps to ensure accuracy and compliance. The first step is gathering all required information. This includes specific employee details such as full name, address, and start date of employment, as well as employer details like business name and corresponding address.

Once the information is gathered, the next step is filling out the form accurately. It's crucial to ensure that all details are correctly entered to avoid potential complications. Common mistakes to avoid include typos in the names or addresses and incorrect wage amounts. After filling out the form, double-checking the information is vital. This verification process helps to ensure all entries are accurate and reduces the risk of errors.

The fourth step is securing signatures from both parties, which can often be accomplished electronically, saving time and ensuring efficiency. Finally, submitting the form can be done through various methods, including email or physical mailing. Confirming receipt can also help maintain a comprehensive record of compliance.

Interactive tools for managing your minimum wage employer signature form

Utilizing tools such as pdfFiller enhances the management of the minimum wage employer signature form, providing a seamless experience for users. With pdfFiller, organizations can enjoy features that allow for easy editing and collaboration on forms across teams. This platform offers a cloud-based solution that facilitates access from anywhere, making it ideal for today’s fast-paced work environment.

The document editing capabilities allow users to make necessary adjustments directly within the form without requiring any specialized software. Additionally, its collaboration tools enhance user experience by enabling multiple team members to work on the document simultaneously, ensuring all opinions are accounted for before finalizing the submission.

When comparing pdfFiller with other document management solutions, its unique combination of features, pricing, and ease of use sets it apart. Empowering users to streamline their document workflows, pdfFiller emerges as a preferred choice for those managing minimum wage employer signature forms.

Navigating common challenges with the minimum wage employer signature form

Completing the minimum wage employer signature form can sometimes present challenges, particularly for those unfamiliar with the required processes or documentation. Common issues may arise during form completion, such as confusion over required signatures or the need for additional documentation, leading to delays or denials. Having a checklist can simplify the you’re-work-by ensuring all sections are completed and necessary documentation is attached.

In the unfortunate event of a denial, knowing how to handle corrections becomes crucial. Reviewing the reasons for denial can provide insight into what to fix or adjust before resubmitting. For individuals facing ongoing difficulties, reaching out to local labor boards can provide clarification and guidance on wage laws and correct processes.

Legal considerations and employer rights

Understanding the legal obligations tied to the minimum wage employer signature form is essential for all business owners. Non-compliance with wage laws can lead to severe repercussions, including penalties, fines, and potential legal actions. Employers must remain vigilant and proactive regarding adherence to wage regulations to protect their operational integrity.

Additionally, it's important to recognize the rights of employees concerning wage disputes. Employees have the right to seek legal recourse if they believe they are not being compensated fairly, creating a need for clear documentation that proves compliance. Maintaining comprehensive records through forms like the minimum wage employer signature form can play an essential role in safeguarding an employer’s interests in such scenarios.

Frequently asked questions (FAQs) about the minimum wage employer signature form

Employers frequently ask whether the minimum wage employer signature form is necessary for all employees. The answer is yes; any staff receiving minimum wage should have this form on file. Another common query involves the legal terminology used within these forms. Employers should familiarize themselves with terms related to employee compensation and wage laws to effectively navigate potential disputes.

Moreover, different industries may require specific considerations regarding minimum wage compliance. For example, hospitality may include tips in wage calculations, warranting clarification in the form. Addressing these nuances upfront can prevent confusion and promote a better understanding of legal wage obligations across various sectors.

Maintaining compliance beyond the signature form

To ensure ongoing compliance with wage regulations, employers need to adopt proactive strategies, such as regularly reviewing legislative updates related to minimum wage laws. Establishing a system for document management and record-keeping is paramount; having detailed records not only supports compliance but also facilitates quick responses to potential audits or inquiries.

Furthermore, continued education about employment law is equally important. Attending workshops, participating in industry seminars, or engaging for consultation can offer valuable insights into evolving wage laws, helping employers stay informed about best practices regarding employee compensation and managing the minimum wage employer signature form.

Contact information for further guidance

For employers seeking further clarifications related to the minimum wage employer signature form, contacting the local labor board is a straightforward approach. These agencies can provide specific guidance and resources that cater to local regulations and employment laws. Furthermore, utilizing legal consultation can clarify complex issues surrounding wage policies and practices.

pdfFiller also offers robust support services for document-related inquiries, empowering users to navigate forms efficiently. Whether dealing with standard document creation or specific details regarding the minimum wage employer signature form, pdfFiller's support can streamline processes, ensuring compliance and user satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify minimum wage employer signature without leaving Google Drive?

How do I complete minimum wage employer signature online?

How can I edit minimum wage employer signature on a smartphone?

What is minimum wage employer signature?

Who is required to file minimum wage employer signature?

How to fill out minimum wage employer signature?

What is the purpose of minimum wage employer signature?

What information must be reported on minimum wage employer signature?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.