Get the free Credit Card Authorized User Designation

Get, Create, Make and Sign credit card authorized user

How to edit credit card authorized user online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorized user

How to fill out credit card authorized user

Who needs credit card authorized user?

Credit Card Authorized User Form - How-to Guide Long-Read

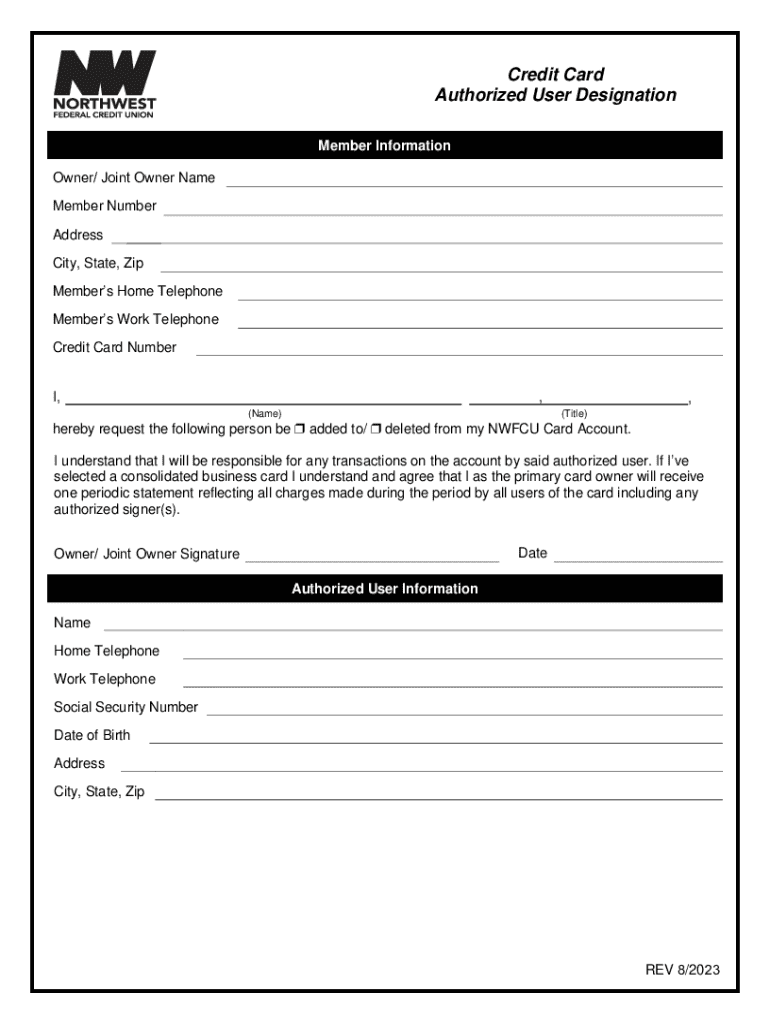

Understanding the credit card authorized user form

A credit card authorized user form is a pivotal document that allows the primary cardholder to add another individual as an authorized user on their credit card account. This form is essential in formally establishing the authorized user’s rights to make purchases using the credit card without being the account holder themselves.

The importance of authorized user forms cannot be understated. They play a critical role in financial transactions, ensuring that both parties are aware of their rights and responsibilities. Having an authorized user can help individuals build their credit history, as responsible use of the card can positively impact their credit score.

Moreover, authorized user forms act as a safeguard against fraud and chargeback abuse. By requiring formal documentation for adding users, financial institutions can trace responsibility and activity, minimizing potential disputes and unauthorized charges.

When to use a credit card authorized user form

There are several common scenarios where utilizing a credit card authorized user form is beneficial. It is often used for personal purchases, such as when a spouse or family member needs access to funds without a separate credit line. This convenience often arises in managing household expenses or making shared purchases.

In business transactions, authorized users can help streamline processes, particularly in cases where employees need to make purchases but do not have individual cards. Family financial management also frequently employs this form, as it allows guardians to oversee spending and limit potential overspending by younger family members.

However, before authorizing someone as a user, careful consideration is essential. This includes evaluating the trustworthiness of the user and understanding the financial implications of their spending habits. Authorized users can potentially impact the primary cardholder’s credit rating, so it's crucial to ensure responsible usage.

Components of a credit card authorized user form

A well-structured credit card authorized user form contains several essential components. Initially, it must capture the cardholder's information, which includes their full name, address, and account number. The section dedicated to authorized user details must include the user’s full name, address, and date of birth to ensure accurate identification.

Additionally, financial institutions may have specific requirements that must be adhered to for the form to be accepted. This includes any identification numbers or documents the bank may request. Further, it's prudent to include terms and conditions regarding the use of the card, detailing liability and responsibilities. Signature and date fields are also crucial, as they provide legal acknowledgment from both the cardholder and the authorized user.

Step-by-step guide to filling out the form

Filling out the credit card authorized user form can be straightforward if you follow a few key steps. First, gather all necessary information, such as personal details of both the cardholder and the authorized user. This includes names, addresses, and any relevant identification information.

Next, proceed to fill out the form accurately. Start with the cardholder section, providing required details clearly. Then move to the authorized user section, ensuring that each entry is precise. Be aware of any additional requirements set by the financial institution, such as specific identification or the inclusion of other documentation.

Before submission, review the completed form for accuracy. Utilize a checklist to confirm that all sections are completed and no errors are present. Finally, submit the form as directed by the issuing bank; it could be done online, through mail, or in person, depending on the institution’s policies.

Editing and managing credit card authorized user forms

Once a credit card authorized user form has been submitted, circumstances may arise that require changes or updates. Making amendments to an existing authorized user form could involve contacting the financial institution directly to request modifications or submitting a newly completed form.

Keeping track of authorized users is crucial for maintaining financial integrity. Best practices involve creating a file that includes signed authorized user forms for each person listed. Securely store this documentation to ensure confidentiality and easy access when needed for reference, which helps manage financial responsibilities effectively.

Legal considerations regarding credit card authorized users

While there may not be a legal obligation to utilize an authorized user form, doing so helps clarify financial responsibilities and liabilities. Each party’s rights should be outlined in the form to ensure all parties understand their roles and obligations. Understanding liability can also mitigate risks associated with unauthorized transactions.

To ensure compliance with financial regulations, it’s wise to review any state-specific laws regarding financial documents and authorization processes. Being informed about both federal and state regulations can help prevent potential legal issues and foster responsible financial management.

FAQ about credit card authorized user forms

Understanding credit card authorized user forms can evoke various questions. One common query is why the authorization form does not include a CVV. This is because the form is a registration document, rather than a transaction medium, where CVV is typically required.

Another frequent concern involves the repercussions if an authorized user misuses the card. While the authorized user can make charges, the primary cardholder is ultimately responsible for any debt incurred. Formulating clear terms and communicating openly with authorized users can help prevent misuse.

Lastly, many users wonder how long they should keep signed authorized user forms. A general recommendation is to retain these documents for a minimum of five years after the authorized user has been removed from the card to safeguard against any potential financial disputes that may arise later.

Related topics and tools

Understanding the nuances of financial documentation extends beyond the credit card authorized user form. Familiarity with other essential financial documents, such as personal loan agreements and mortgage applications, is equally important for maintaining organized financial records.

Additionally, having access to templates for common documents can save time and ensure accuracy. Interactive tools for document management facilitate collaboration and eSigning, enhancing productivity. All these resources help streamline the frequently cumbersome process of managing financial documents.

Stay informed

The landscape of financial documents is constantly evolving, making it crucial to stay informed about new practices and updates. Subscribing to tips and resources on document management can empower users in organizing their financial documentation efficiently.

Keeping financial documents organized and up-to-date is invaluable; not only for day-to-day management but also for future planning and investment opportunities. Efficient document management processes contribute positively to financial well-being and help users maintain oversight on their economic responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card authorized user to be eSigned by others?

Where do I find credit card authorized user?

Can I create an electronic signature for the credit card authorized user in Chrome?

What is credit card authorized user?

Who is required to file credit card authorized user?

How to fill out credit card authorized user?

What is the purpose of credit card authorized user?

What information must be reported on credit card authorized user?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.