Get the free Cash Balance Benefit Program

Get, Create, Make and Sign cash balance benefit program

Editing cash balance benefit program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash balance benefit program

How to fill out cash balance benefit program

Who needs cash balance benefit program?

Understanding the Cash Balance Benefit Program Form

Understanding cash balance plans

A cash balance plan is a type of retirement plan that combines features of both defined benefit and defined contribution plans. Under this system, employees earn a benefit defined in terms of a hypothetical account that grows over time. Every year, the employer credits the account with a set percentage of the employee's pay, alongside a fixed interest rate based on the plan terms.

Key features of cash balance plans include guaranteed fixed interest rates, which are often higher than conventional savings accounts. The benefit calculation is straightforward: it typically involves the annual contribution added to the accrued interest. As a result, employees can see their retirement savings grow predictably, making cash balance plans appealing for both employers and employees.

When compared to traditional pension plans, cash balance plans differ chiefly in benefit accrual methods. Traditional pensions provide retirement benefits based on a formula that considers the employee's salary and years of service, while cash balance plans provide a more transparent structure where employees can easily understand and track their accrued benefits.

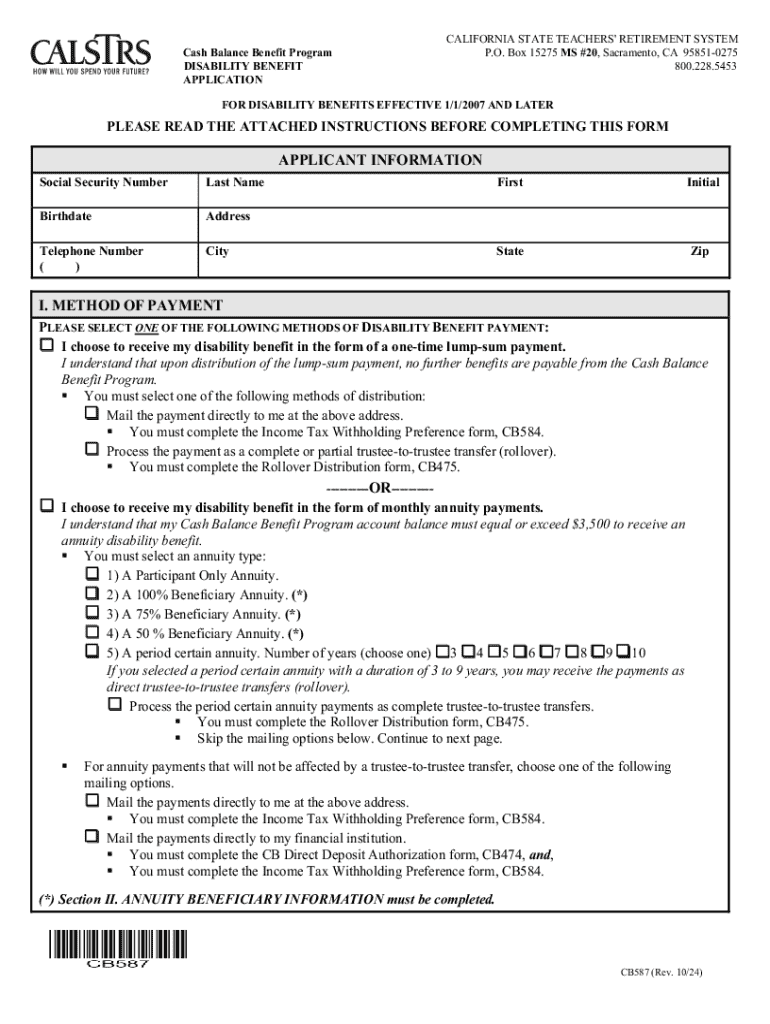

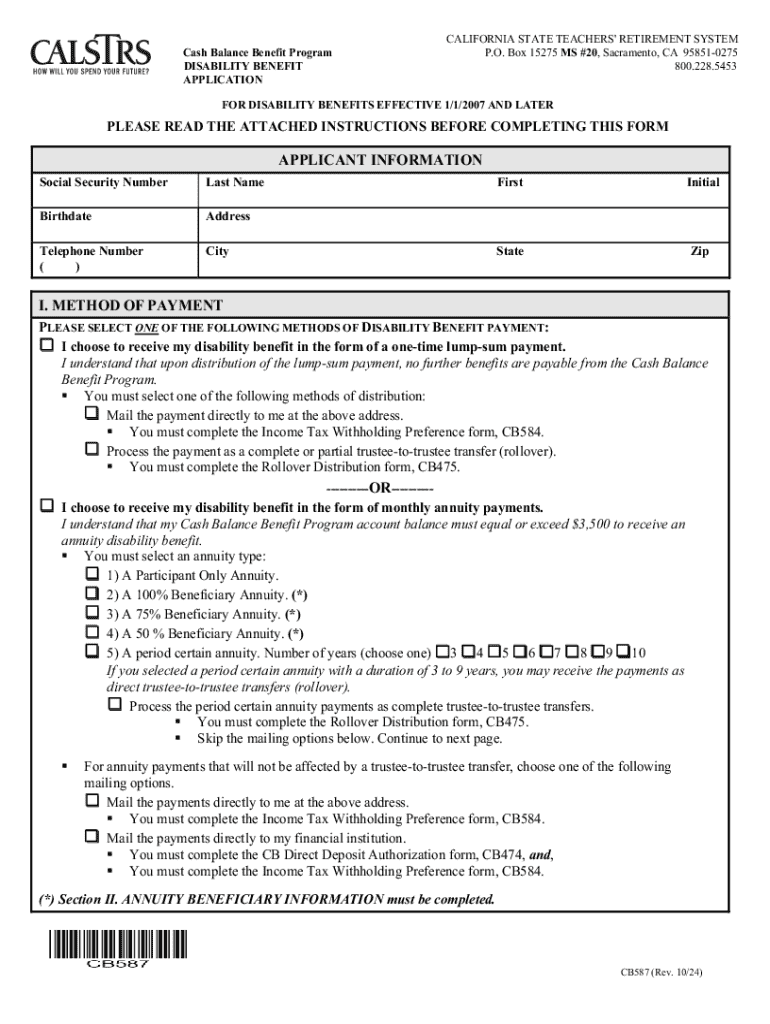

Importance of cash balance benefit program forms

The cash balance benefit program form serves a vital role in ensuring that employees and employers can manage their cash balance plans effectively. Completing this form is necessary for any employee transitioning to or participating in a cash balance plan. The form captures essential data that helps employers calculate benefits accurately and provides clarity regarding each participant's retirement savings.

Anyone who transitions into a cash balance plan, whether they're new employees or current employees switching from another retirement plan, needs to complete this form. Employers also need the form to administer and communicate plan details to employees properly. Using tools like pdfFiller can simplify this process by providing secure online access to the form, ensuring smooth management and submission.

Navigation of the cash balance benefit program form

Navigating the cash balance benefit program form requires understanding its sections. The primary sections include personal information, where employees provide their details like name, social security number, and employment status, as well as the beneficiary designation section, where they can indicate whom they want to benefit from their plan in case of unforeseen circumstances.

Common pitfalls include submitting incomplete sections or failing to furnish necessary signatures. It's crucial to review the entire form to ensure that all elements are filled out accurately and completely to avoid processing delays or complications in future benefit calculations.

Step-by-step instructions for filling out the cash balance benefit program form

Gathering the required information is the first step in completing the cash balance benefit program form. Employees should prepare their personal details, including their full name, address, and social security number, as well as providing their employment history, which may include job titles and start dates.

When filling in your personal information, ensure that all entries are accurate to prevent future issues. Completing the beneficiary designation section is equally crucial. You must designate a beneficiary who will receive benefits in case of your passing. Take the time to review the entire form for accuracy, checking each section thoroughly.

For submission, you can electronically submit the form via pdfFiller, which also offers secure storage and easy access for future edits. Alternatively, you can file it physically in accordance with your employer's procedures.

Managing your cash balance benefit program form

Once the form is submitted, you may need to manage updates or changes. pdfFiller allows users to edit form data easily with interactive tools. This user-friendly platform ensures that you can make adjustments with minimal hassle and quickly prepare a new version of the form if needed.

The eSigning capability is another notable feature. Secure digital signatures enhance the form's authenticity and efficiency. You can initiate an eSignature directly through pdfFiller, streamlining the process for all parties involved. Collaboration with HR or legal teams becomes efficient too, as you can share forms for review and track submission statuses in real-time.

Addressing common questions and concerns

Errors on the cash balance benefit program form can happen. If you discover a mistake post-submission, it is essential to address it promptly by contacting HR or your plan administrator to understand the correction process. They can guide you through necessary actions to amend the mistake.

After submitting the form, it’s reasonable to expect follow-ups. Most employers have protocols in place to notify employees about the status after submission. You also retain the right to change your beneficiary after submission, but this process typically involves filling out a new beneficiary designation form, so it’s essential to stay informed on how to proceed.

Legal considerations relating to cash balance plans

Several federal laws govern cash balance plans. The Employee Retirement Income Security Act (ERISA) sets various requirements regarding plan management and fund protection, ensuring employee rights are safeguarded. Employers must adhere to these regulations to safeguard employee interests during plan modifications.

Employees maintain specific rights and protections when their employer changes retirement plans, including the requirement for proper notification and the ability to review plan details effectively. Understanding these aspects is crucial, especially when converting from traditional pension plans to a cash balance plan, as the consequences can impact an employee's retirement savings strategy significantly.

Real-life applications and case studies

Successful implementations of cash balance plans have produced positive outcomes for both employers and employees. Companies that have adopted cash balance plans report increased employee satisfaction related to retirement benefits and higher retention rates, especially among older, experienced employees who are looking towards retirement.

Testimonials indicate that users leveraging pdfFiller for form management appreciate the streamlined process and the capability to make necessary updates without hassle. Lessons learned from these cases reveal that effective communication and management contribute significantly to the success of implementing cash balance plans.

Additional tools and resources on pdfFiller

pdfFiller provides an extensive repository of templates for related forms, allowing users easy access to necessary documents for efficient retirement plan management. Whether users are seeking beneficiary designation forms or updates to existing plans, pdfFiller streamlines the documentation process.

Utilizing pdfFiller’s online resources, including webinars, tutorials, and user guides, can provide additional support and enhancement to the form-filling experience. The available customer support options ensure users receive assistance when needed, fostering confidence in managing essential retirement documentation.

The future of cash balance plans

The adoption of cash balance plans is rising, driven by demand for better retirement options among employees. Many organizations are finding that these plans provide predictable growth for employees while allowing greater flexibility in managing retirement funds.

Innovations in document management solutions, like those provided bypdfFiller, are continually evolving. These advancements promise to facilitate easier communication between employers and employees regarding their benefits, ensuring that transparency and understanding are at the forefront of effective benefit management.

As the landscape of employee benefits evolves, the expectation is that cash balance plans will adapt alongside emerging technologies, continuing to meet the needs of both employers and their employees well into the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cash balance benefit program directly from Gmail?

How do I edit cash balance benefit program online?

How do I edit cash balance benefit program straight from my smartphone?

What is cash balance benefit program?

Who is required to file cash balance benefit program?

How to fill out cash balance benefit program?

What is the purpose of cash balance benefit program?

What information must be reported on cash balance benefit program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.