Get the free Copy of V3IEPF-7 Final Dividend 23-24.xlsm

Get, Create, Make and Sign copy of v3iepf-7 final

How to edit copy of v3iepf-7 final online

Uncompromising security for your PDF editing and eSignature needs

How to fill out copy of v3iepf-7 final

How to fill out copy of v3iepf-7 final

Who needs copy of v3iepf-7 final?

Copy of v3iepf-7 Final Form: Your Comprehensive Guide

Overview of the v3iepf-7 final form

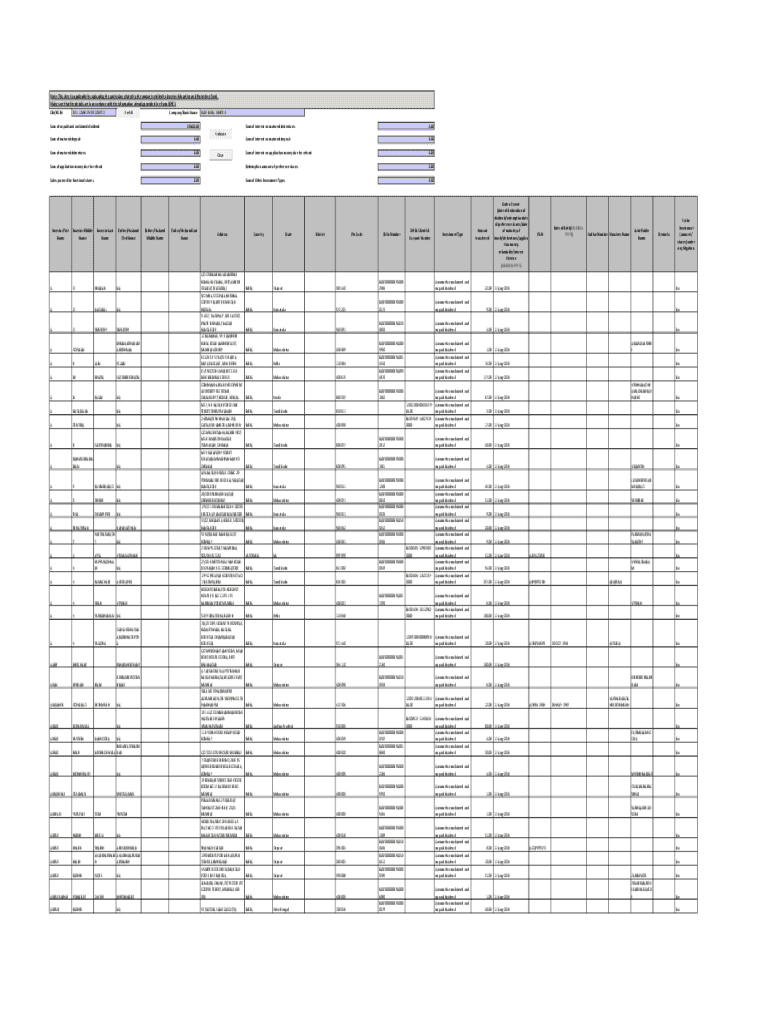

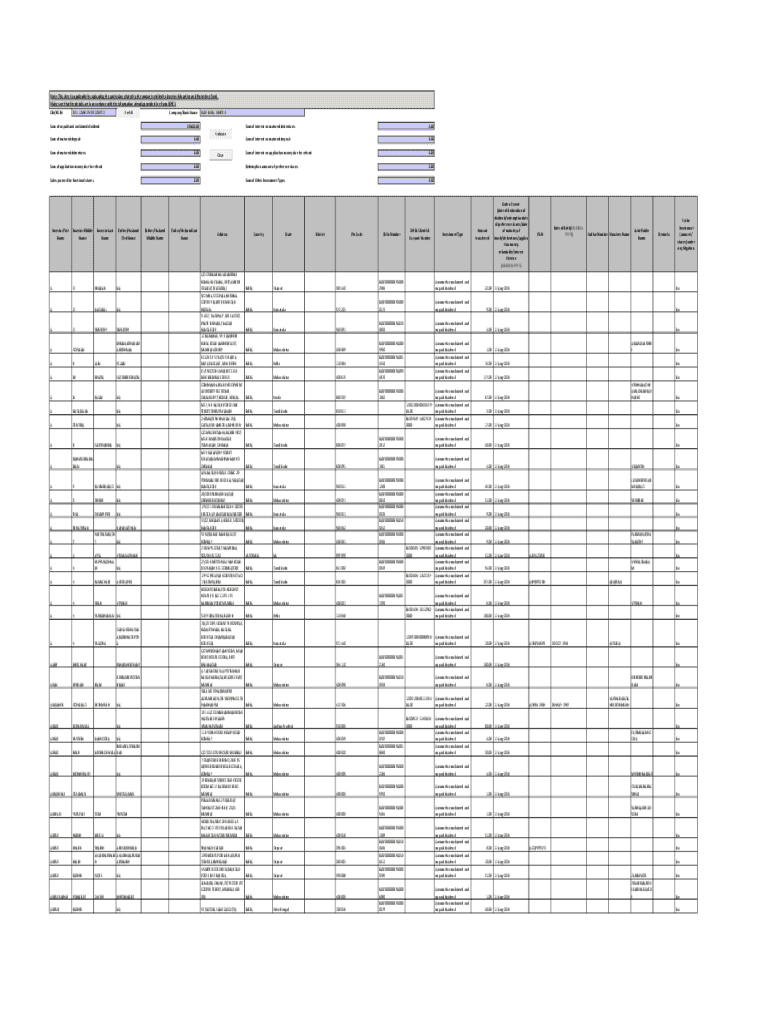

The v3iepf-7 final form plays a crucial role in the evolving landscape of corporate compliance in India. This form is specifically designed for the filing of certain statutory requirements applicable under the Companies Act, 2013. The significance of the v3iepf-7 lies in its facilitation of claims for the refund of shares and other dividends which remain unclaimed and are deposited with the Investor Education and Protection Fund (IEPF).

Companies, especially those with a large number of shareholders, need to utilize this form to ensure compliance and maintain transparency regarding unclaimed dividends. The failure to file this form can lead to penalties and additional complications, making it essential for companies to understand the circumstances under which this form is necessary.

Changes and updates in v3iepf-7

The version v3iepf-7 introduces critical amendments from its predecessors. Notably, the merging of the v3iepf-7 and Form IEPF-1 streamlines the entire filing process for companies, reducing redundancy and making it easier for users to comply with regulatory demands. This merger aims to enhance clarity and reduce the chances of errors when filing, thus promoting regulatory adherence.

Another significant change is the introduction of more intuitive guidance within the form itself, leading to fewer errors and a higher success rate in submissions. These updates reflect constant monitoring and adjustments by regulatory authorities to simplify the compliance process for companies.

Understanding the requirements for filing

Before filing the v3iepf-7 final form, it is imperative to understand the eligibility criteria. Only registered companies under the Companies Act, 2013 can file this form. Directors or their designated representatives must file this form on behalf of the company, ensuring that all requisite documentation is in place.

Necessary documentation includes details such as the company registration number, particulars of the unclaimed dividends, and information regarding the claimant. Additionally, companies must maintain a thorough record of communications with shareholders concerning their unclaimed dividends, further supporting the claims filed through this form.

Legal foundation

The v3iepf-7 final form operates under a comprehensive regulatory framework established by the Ministry of Corporate Affairs (MCA). Companies must navigate through various compliance aspects dictated by the Companies Act, 2013, and the rules associated with the IEPF. Understanding these regulations is crucial for companies to avoid penalties and ensure smooth filing of their claims.

Moreover, regular updates and compliance requirements necessitate that companies stay informed about changes in the law and best practices for filing. The legal structure is intricate, but by keeping abreast of the latest developments, companies can mitigate risks and streamline their compliance processes.

Detailed process for filing the v3iepf-7 form

Filing the v3iepf-7 form may seem daunting, but the process is straightforward if you follow it step-by-step. Start by accessing the MCA V3 portal, where all the forms and necessary resources are available. This portal is user-friendly and designed to facilitate a seamless filing experience.

Upon accessing the MCA V3 portal, select and download the v3iepf-7 form. Filling out the form accurately is critical; ensure that you pay attention to all key fields, particularly those related to shareholder details and unclaimed amounts. Common pitfalls include incorrect entries or missing information, which can lead to the rejection of the application.

Fee structure

There are certain fees associated with filing the v3iepf-7 form. It is important for companies to be aware of the fee structure to budget accordingly. Typically, the fees may vary based on the amount claimed and other factors as prescribed by the MCA. Companies can consult the MCA's official fee locality to ascertain the exact charges.

Payment can be made through several options, including online payment via the NTRP (National Treasury Management Agency) and Bharatkosh payment portals. Make sure to retain the necessary payment documentation, as it will be vital for linking payment with your v3iepf-7 submission.

Processing time and deadlines

After filing the v3iepf-7 form, companies must remain mindful of important timelines. Each submission is subject to specific review periods as prescribed by the MCA. Knowing these timelines is essential; if deadlines are missed, companies may face substantial penalties or delays in processing their claims.

Typically, after filing, it can take anywhere from a few weeks to several months to receive acknowledgment of the submission. Companies are advised to routinely check their filing status on the MCA portal to track the progress of their application.

Linking payment (UTN/NTRP/Bharatkosh)

Linking your payment to the v3iepf-7 submission is a critical step that ensures your application is processed without delay. The first step is generating a Unique Transaction Number (UTN) on the MCA portal. This number is essential for tracking and confirming your payment.

Following the UTN generation, initiate payment through the NTRP or Bharatkosh portals. After making the payment, be sure to confirm it is linked correctly with your v3iepf-7 submission. Lack of proper linkage can result in complications or non-processing of your application.

Common payment issues

Despite the straightforward payment procedures, users may encounter common issues such as payment failures or mismatched UTNs. In such cases, validating transaction references and ensuring all payment details match exactly as required by the ministry is crucial. If discrepancies persist, companies should not hesitate to reach out to technical support for assistance.

Moreover, maintaining communication with your banking institution to resolve any potential safeguard issues that may arise during the payment process is advisable.

Important notes and disclaimers

Understanding the nuances of the v3iepf-7 is essential, especially regarding distinguishing it from the IEPF-1 form. While both involve claims related to unclaimed funds, the v3iepf-7 specifically targets unique circumstances such as refunds of shareholders. This distinction is critical for entities navigating these forms and their respective regulations.

Additionally, errors in the filing process can lead to penalties from the MCA. Such penalties may range from monetary fines to additional scrutiny on future filings. Therefore, meticulous attention to detail during the filing process is paramount to avoid such pitfalls.

Frequently asked questions (FAQs)

Here are some commonly asked questions regarding the v3iepf-7 form to assist you in ensuring correct filings and understanding the entire process.

Additional support and contact information

For any further inquiries regarding the v3iepf-7 final form and its filing process, firms can contact technical support through various channels. The MCA provides an array of resources, including contact numbers and email support, making it easier for users to obtain the help they need.

Furthermore, if navigating the complexities of corporate compliance seems daunting, it may be beneficial to consult with a legal expert or accountant who specializes in corporate law. Their expertise can ensure that all filings are accurate and compliant with applicable regulations, ultimately saving companies time and potential fines.

Success stories and testimonials

Many companies have successfully navigated the filing process for the v3iepf-7 form with minimal setbacks. These success stories often highlight the importance of organizational preparedness and meticulousness in documentation. Positive experiences shared by users demonstrate how clear understanding and proper tools can lead to efficient submissions.

Additionally, users have found that pdfFiller’s tools simplify the management of the v3iepf-7 process, allowing for easy editing and collaboration among team members. Such testimonials underscore the benefits of utilizing the right document management solutions in achieving compliance.

Interactive tools and resources

To aid users in the filing process, the availability of fillable templates for the v3iepf-7 form on pdfFiller allows for a streamlined approach. These templates facilitate accurate completion of necessary fields and reduce the likelihood of submission errors.

In addition, pdfFiller offers various document management tools tailored for optimizing the filing and management of forms like v3iepf-7. Users can take advantage of features such as e-signing, collaborative document editing, and secure file storage, all accessible from anywhere, promoting a more efficient filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find copy of v3iepf-7 final?

How do I make edits in copy of v3iepf-7 final without leaving Chrome?

How do I edit copy of v3iepf-7 final on an iOS device?

What is copy of v3iepf-7 final?

Who is required to file copy of v3iepf-7 final?

How to fill out copy of v3iepf-7 final?

What is the purpose of copy of v3iepf-7 final?

What information must be reported on copy of v3iepf-7 final?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.