Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out tax year 2024 checklist

Who needs tax year 2024 checklist?

Tax Year 2024 Checklist Form: Your Complete Guide

Understanding the tax year 2024

Tax Year 2024 introduces several important updates that taxpayers should be aware of. As the IRS streamlines the tax process, understanding the specifics of this year’s tax season is crucial for an easy filing experience. Knowing key dates and deadlines is imperative to avoid last-minute hassles and ensure that your returns are filed accurately.

Key tax-filing dates typically include the last day for filing your federal tax return, which is April 15th, unless it falls on a weekend or holiday. For Tax Year 2024, don't forget about early tax filing options and state-specific deadlines that may differ from federal guidelines. Preparing early allows you to address any unforeseen issues, maximizing your potential refunds and minimizing stress.

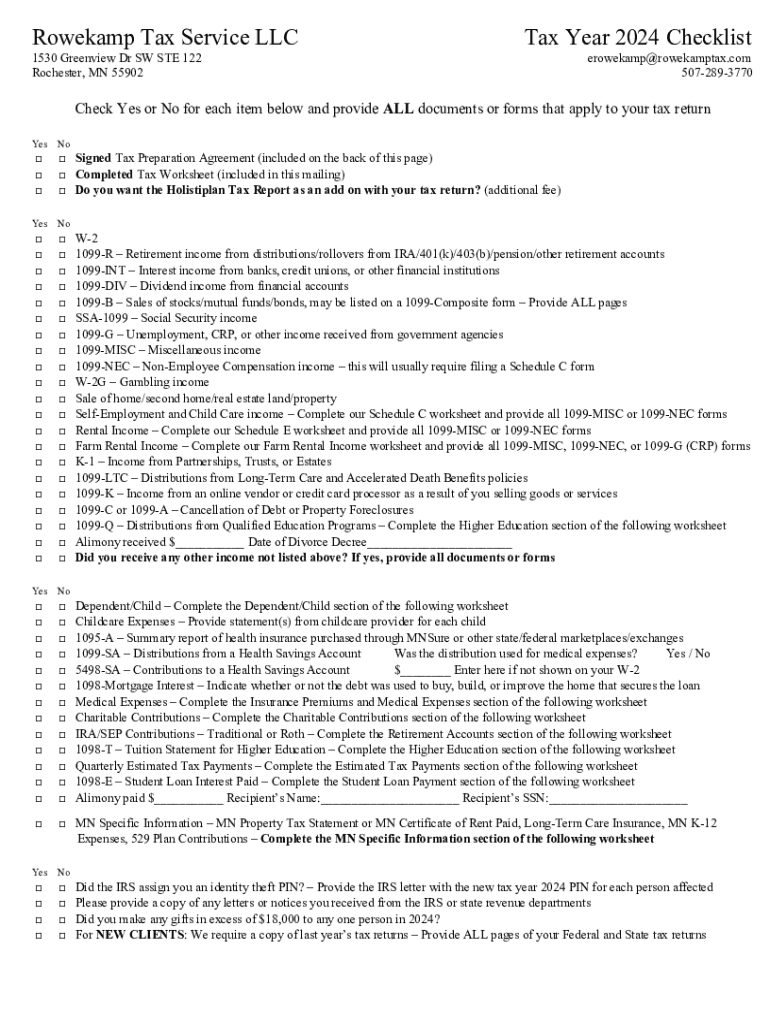

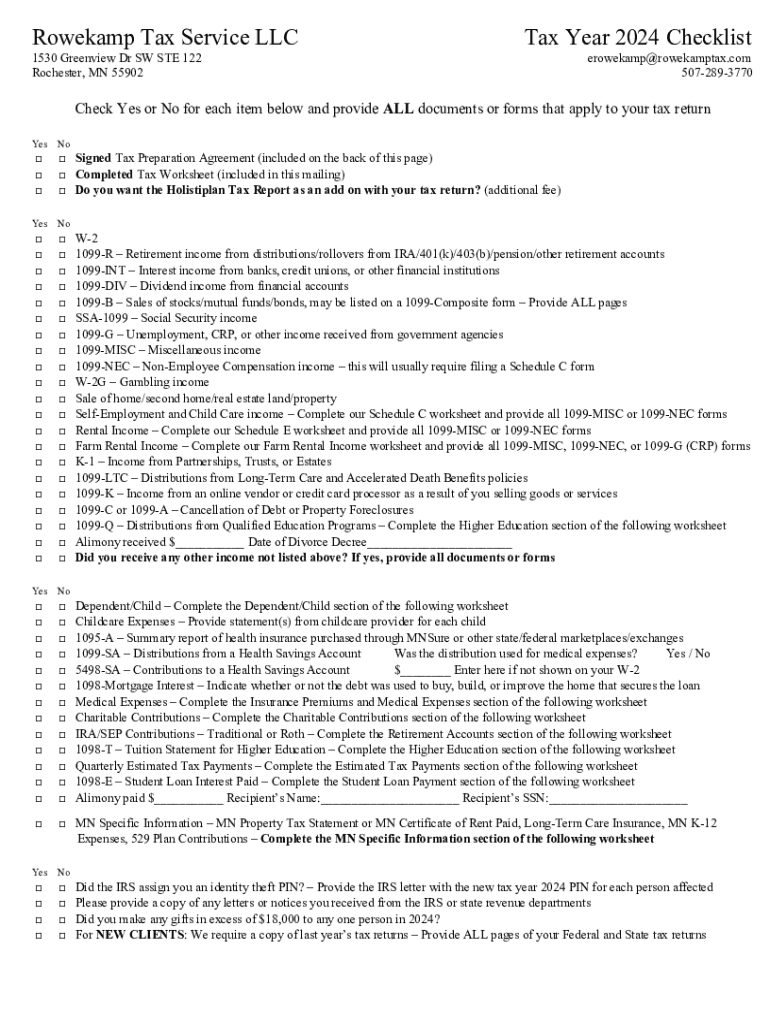

Essential documents for filing taxes

Gathering essential documents is paramount when filing your taxes. Among the most critical documents are W-2 forms, which report wages earned as an employee. Without these forms, accurately reporting your income becomes impossible. Typically, employers provide these forms by January 31st.

Alongside W-2s, 1099 forms play a significant role, especially for freelancers and contract workers. There are various types, including the 1099-MISC for miscellaneous income and the 1099-NEC specifically for contractor payments. Additional documentation includes receipts for deductions, records of tax credits, and proof of identity and bank details for direct deposit.

Comprehensive checklist for completing the tax year 2024 form

Completing the IRS Form 1040 can seem daunting, but breaking it down into manageable steps can simplify the process. Start by gathering all your personal information such as your Social Security number, addresses, and that of your dependents.

Reporting income accurately is crucial; include all sources, including wages, interest, dividends, and self-employment income. Adjustments to income may involve student loan interest deductions, retirement contributions, or medical savings, allowing you to lower your taxable income.

Maximize your refund by carefully evaluating eligible tax credits. When calculating your tax liability, ensure all entries are correct, including selecting your filing status—either single, married filing jointly, or head of household. Finally, it’s essential to sign and date your tax return before submission, confirming your responsibility for the tax accuracy.

Interactive tools for form management

Utilizing online tools can significantly ease the process of managing your tax forms. With pdfFiller, you can seamlessly edit tax documents to ensure all information is accurate before submission. This platform allows for easy navigation through the editing process, ensuring that even the most complex forms are handled with ease.

To begin, simply upload your tax form to the pdfFiller platform. You will find intuitive editing features that allow you to fill in fields, add dates, and include signatures. Leveraging e-signature capabilities enhances document security and expedites the filing process. Collaboration features also allow you to work alongside tax professionals, ensuring that your forms are perfectly prepared.

Special situations in tax year 2024

Various situations can affect how you file your taxes for 2024. Freelancers and self-employed individuals may need to consider additional forms, such as Schedule C for reporting income and expenses. This demographic often encounters unique deductions and credits that can substantially affect their tax outcome. It's beneficial to maintain accurate records of all earnings and expenses throughout the year.

Moreover, taxpayers must remain aware of recent changes in tax laws that may impact deductions or credits available in Tax Year 2024. The lingering effects of COVID-19 interventions might also influence filings, particularly concerning unemployment compensation and tax credits related to dependents. Homeowners need to keep in mind potential property tax deductions and considerations for mortgage interest.

Common mistakes to avoid when filing taxes

Filing taxes mistakes can lead to significant complications or delays in refunds. One common pitfall is overlooking pertinent deductions and credits that could lead to a lower tax bill. Carefully reviewing available above-the-line deductions and credits specific to your situation could yield added savings. Reporting income incorrectly is another frequent error—ensure all income sources are accurately documented.

Filing status is another critical aspect where misunderstandings can occur. Choosing the wrong status could affect tax brackets and available credits. Furthermore, always check that you have signed and dated your form; failure to do so may lead to processing issues. Lastly, missing deadlines can trigger penalties and additional interest on amounts owed.

Post-filing checklist

After you have filed your tax return, it’s important to confirm that the IRS has received it. Tracking the status of your refund can help you stay informed about any potential delays or issues. Consider using the 'Where's My Refund?' tool provided by the IRS to monitor your refund's status efficiently.

Additionally, preparing for a possible audit can save you from last-minute scrambles. Keep all relevant records organized for at least three years following your submission. Maintaining meticulous records not only aids in audits but also helps in preparing for future tax seasons. By adopting robust record-keeping practices, you can streamline your process year after year.

Additional insights and faqs

Navigating Tax Year 2024 can bring questions. Be proactive in seeking answers through credible sources. Frequently asked questions often pertain to deadlines, eligibility for various credits, or how to claim deductions you might be unsure about. Familiarizing yourself with common inquiries allows you to mitigate confusion and ensures a smoother filing process.

Furthermore, digging into state-specific tax information is paramount; as tax regulations can significantly vary. Relying on tools like pdfFiller can provide users with context-specific assistance tailored to your exact needs, along with direct access to a wealth of resources and information.

Staying informed

To efficiently navigate future tax seasons, staying informed about changes in tax laws is crucial. Following IRS updates and subscribing to tax newsletters can help keep you updated. Remember, tax laws can change annually, and being preemptively aware of these changes ensures you are prepared.

By leveraging tools like pdfFiller, users can maintain their document organization throughout the entire year. This not only makes tax filing less overwhelming but also opens up opportunities to collaborate with tax professionals. Connecting with experts provides ongoing guidance and can further enhance your overall tax management strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my pdffiller form in Gmail?

How do I fill out the pdffiller form form on my smartphone?

How do I complete pdffiller form on an Android device?

What is tax year checklist?

Who is required to file tax year checklist?

How to fill out tax year checklist?

What is the purpose of tax year checklist?

What information must be reported on tax year checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.