Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form - How-to Guide

Understanding credit card authorization forms

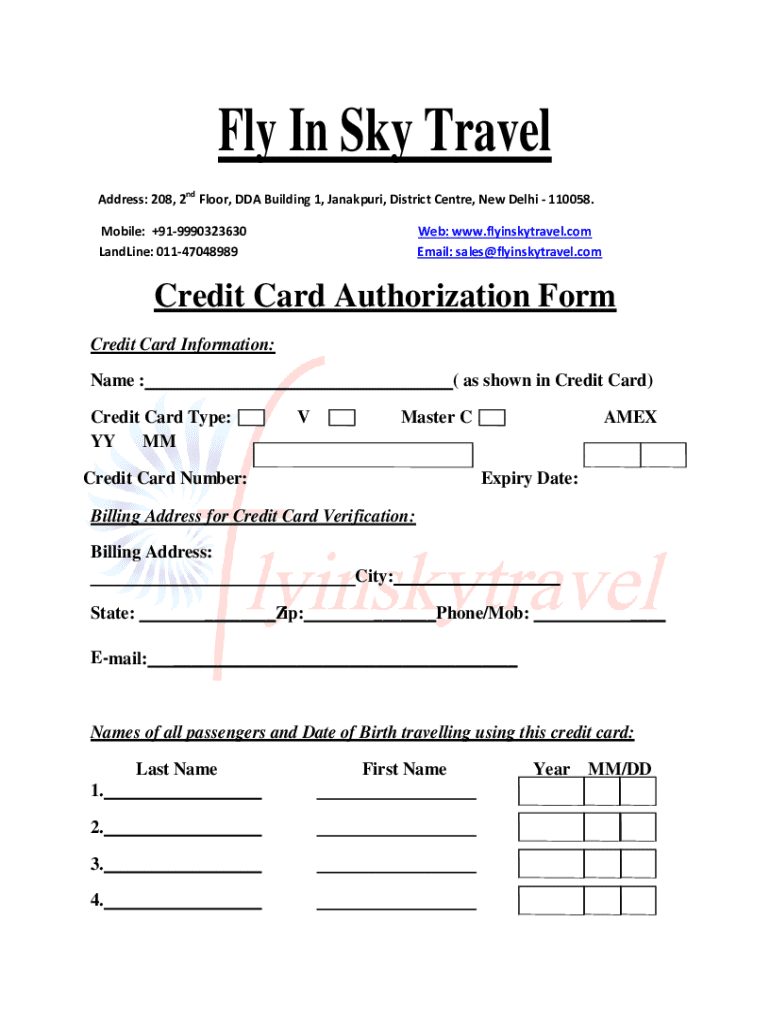

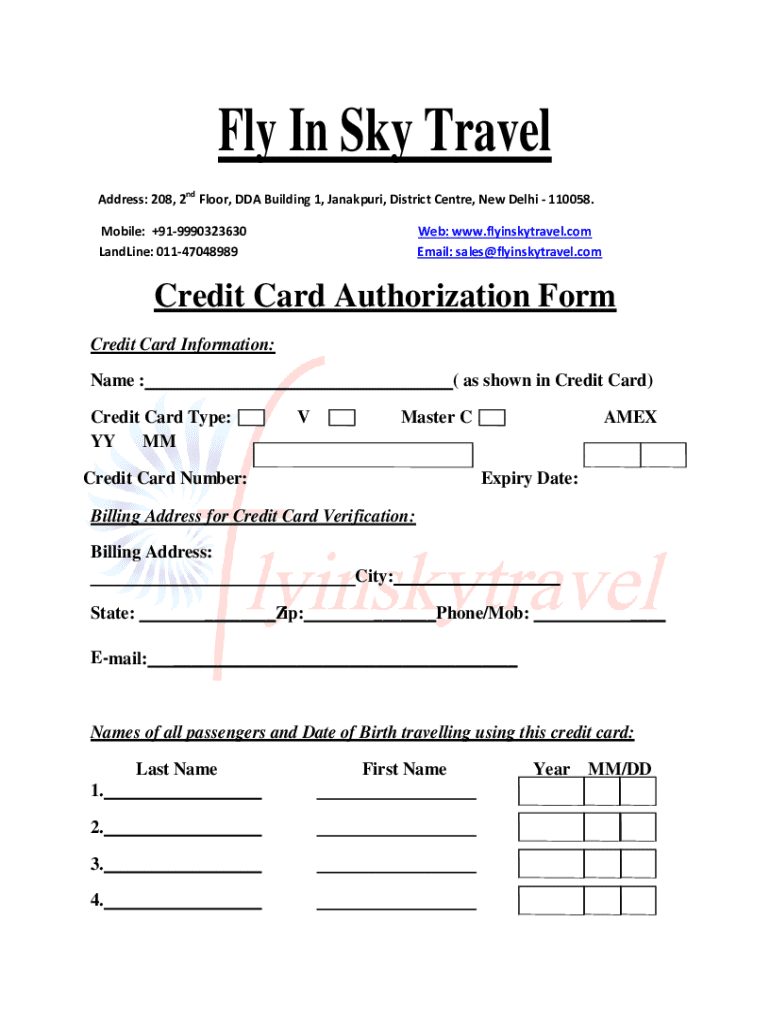

A credit card authorization form is a document used by businesses to obtain permission from a cardholder to charge their credit or debit card for a specified amount. This form acts as a safeguard for both the merchant and the customer, ensuring that transactions are legally binding and authorized.

The primary purpose of a credit card authorization form is to reduce the likelihood of fraudulent charges and to provide a clear acknowledgment of the transaction. This form is especially vital in card-not-present transactions, where physical cards are not swiped, such as online purchases, phone orders, or recurring billing.

Common use cases for these forms stretch across various industries, including hospitality for reservations, healthcare for patient billing, e-commerce for online orders, and real estate for deposits. By having a well-structured credit card authorization form, businesses can mitigate risks associated with unauthorized charges.

Components of a credit card authorization form

A credit card authorization form typically contains essential information required to process a transaction. This includes:

Optional components can enhance the efficacy of the authorization form, such as including the CVV code. The Card Verification Value (CVV) is crucial for ensuring the card’s authenticity during card-not-present transactions. Although not always required, additional terms and conditions can clarify the scope and limitations of the authorization.

Benefits of using credit card authorization forms

Implementing credit card authorization forms can significantly enhance payment security and reduce fraud. As more transactions move online, fraud is becoming rampant, making such a form an imperative tool for businesses. These forms create a paper trail that can be invaluable in disputing chargebacks.

Mitigating chargeback claims is crucial for business sustainability. When a customer disputes a charge, the documentation provided by a signed authorization form can be used as evidence to counter the claim. This leads to more stable financial operations and lower transaction costs.

Streamlining payment processes for businesses is another significant advantage. Standardizing a payment authorization form allows employees to quickly verify transactions while ensuring compliance with internal policies. Additionally, customers appreciate the trust that comes with a formal authorization process, enhancing customer satisfaction and loyalty.

How to fill out a credit card authorization form

Filling out a credit card authorization form can be straightforward when following a few steps. Here’s a step-by-step guide:

To ensure accurate completion of the form, double-check all entered information and confirm with the cardholder regarding any critical details. This reduces the likelihood of subsequent chargebacks or disputes.

Legal considerations regarding credit card authorization forms

When using credit card authorization forms, compliance with Payment Card Industry Data Security Standards (PCI DSS) is non-negotiable. These standards are designed to protect sensitive card information from breaches and theft. Businesses must ensure they have security measures in place to safeguard this data, especially when storing or processing forms.

Secure storage and handling of completed forms is critical. This means that physical forms should be kept in locked locations, while digital forms should be secured behind strong access controls. Moreover, it's essential to understand the recommended duration for keeping completed forms, typically ranging from one to three years, depending on business policies.

Implications of e-signing and digital approvals must also be considered. E-signatures are legally binding in many jurisdictions; however, businesses must ensure that they comply with regulations surrounding electronic signatures to maintain their validity.

Frequently asked questions (FAQ)

Several common questions emerge around credit card authorization forms, including:

Best practices for managing credit card authorization forms

Effective management of credit card authorization forms can mitigate risks and enhance operational efficiency. One of the best practices includes organizing and storing forms in a secure digital format. Leveraging platforms like pdfFiller allows for safe storage, easy retrieval, and secure sharing, minimizing the chances of data leaks.

Regularly reviewing and auditing stored forms is crucial. This ensures that outdated or unnecessary forms are purged, reducing the amount of sensitive data at risk. Additionally, utilizing techniques for automating the process with cloud solutions can significantly streamline operations, making it easier to handle forms efficiently and securely.

Enhancing customer experience with credit card authorization forms

Integrating interactive credit card authorization forms not only simplifies the process for customers but also improves their overall experience. Smart features, such as autofill options, can speed up the data entry process on digital forms, making it convenient for users.

Utilizing tools like pdfFiller for seamless eSignature integration can facilitate quicker approvals and confirmations from customers. By ensuring that forms are mobile-friendly and easy to navigate, businesses can increase their chances of securing timely and authorized transactions.

Other payment acceptance solutions

Understanding card-not-present (CNP) transactions is essential for businesses that operate online or through remote services. CNP transactions are riskier due to the lack of physical card presence, which can lead to higher instances of fraud.

In addition to credit cards, businesses can benefit from accepting digital payment solutions like Apple Pay or other e-wallets. These methods can enhance convenience for customers while potentially reducing transaction fees.

Understanding the differences between credit card and ACH payments can also expand a business’s capabilities in payment processing, providing more options and flexibility for customers.

Integrating credit card authorization forms into your business workflow

Integrating credit card authorization forms into existing business workflows can maximize efficiency and security. Recommended tools and platforms include pdfFiller, which allows for quick form customization and secure sharing.

Examples of effective implementation can be drawn from various sectors such as hospitality, where online reservations demand quick and secure processing. Future trends may indicate a rise in automation, with AI and machine learning tools helping to streamline the authorization process even further.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit card authorization form in Chrome?

Can I sign the credit card authorization form electronically in Chrome?

Can I create an electronic signature for signing my credit card authorization form in Gmail?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.