Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Understanding Credit Card Authorization Forms: A Comprehensive Guide

Understanding credit card authorization forms

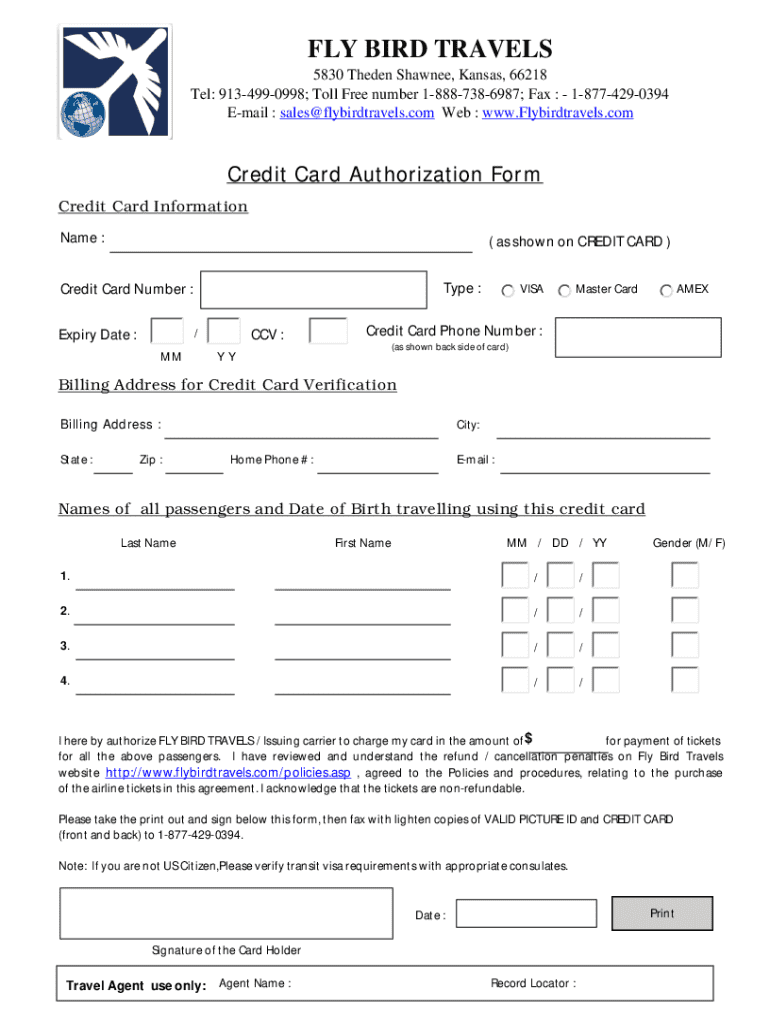

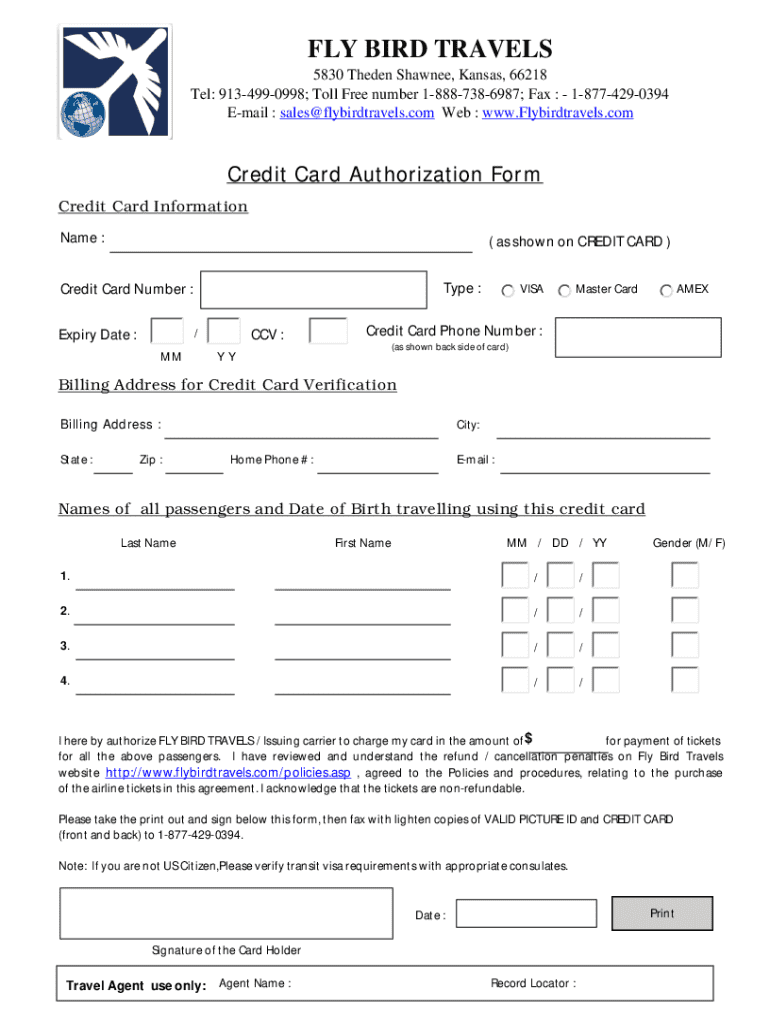

A credit card authorization form serves as an official document that allows a merchant to charge a customer's credit card. This form is crucial in the payment process as it confirms that the cardholder has granted permission to use their credit card for specified transactions.

Purposefully designed to protect both merchants and consumers, these forms help establish clear consent for payments, particularly in scenarios like online shopping or subscription services. Distinctively, they differ from other payment processing documents, such as receipts or invoices, by explicitly confirming authorization before the transaction occurs.

Importance of using credit card authorization forms

Utilizing credit card authorization forms significantly lowers the risk of chargeback abuse, where customers dispute transactions to reclaim funds. By having an authorization form in place, merchants can provide evidence that a customer consented to a transaction, thereby strengthening their position in disputes.

For instance, if a customer claims they did not authorize a payment for a service, a signed authorization form can counter such claims effectively. Additionally, many credit card networks and payment processors require adhering to these practices as part of compliance with payment regulations, underscoring their significance in safeguarding financial transactions.

Essential elements of a credit card authorization form

A well-structured credit card authorization form must include critical components to be considered valid. Notably, these components are:

Optional elements such as signature requirements and terms and conditions can further enhance security and establish clear expectations of the transaction.

Best practices for implementing authorization forms

Knowing when to employ a credit card authorization form is essential, especially in industries such as hospitality, e-commerce, and recurring billing sectors. For example, if a customer books a hotel room online, an authorization form ensures that the hotel can charge the guest's card upon arrival.

Key steps to determine the necessity of an authorization form include assessing the transaction type, examining customer relationships, and evaluating the potential for disputes. Moreover, compliance with data protection regulations necessitates securely storing signed forms. Enterprises should use encrypted digital solutions, such as pdfFiller, to manage documents responsibly and ensure sensitive information is protected.

Frequently asked questions

Entities involved in credit card transactions often have questions about authorization forms. One common inquiry is whether there’s a legal obligation to use these forms. While no strict law requires authorization forms, many payment processors and networks recommend them to avoid potential chargebacks.

Another point of confusion is the term 'Card on File.' This refers to the practice where merchants store a customer’s credit card information for future transactions. In this context, credit card authorization forms play a critical role as they provide initial approval to store the card details.

As for storage duration, best practices suggest retaining signed forms for at least two years, depending on the transaction type and relevant regulations.

Advantages of using pdfFiller for credit card authorization forms

pdfFiller stands out as a comprehensive platform for creating and managing credit card authorization forms. One significant advantage is its seamless editing capabilities, which allow users to customize forms easily, ensuring they meet specific business needs.

The eSign feature integrated into pdfFiller streamlines the signing process, enabling quick transactions without the hassle of printing and scanning. Furthermore, collaboration tools facilitate teamwork, allowing multiple users to access and manage documents efficiently. Being cloud-based, pdfFiller ensures that these capabilities are accessible anywhere, making it a robust solution for document management.

Advanced insights into credit card transactions

Understanding Card-Not-Present (CNP) transactions is vital, as these transactions present higher risks for fraud. Merchants need to implement robust verification processes, such as requiring credit card authorization forms alongside additional information to verify identity. Payment gateways also play a crucial role in ensuring secure transactions and can provide API integrations for enhanced security measures.

To prevent fraud from escalating into chargebacks, businesses should establish vigilant monitoring systems for unusual transaction patterns and promptly review authorization requests against a customer’s transaction history.

Enhancing security and efficiency in payment processing

Integrating credit card authorization forms with broader business solutions is a strategic approach to enhance efficiency and security. By utilizing automation technologies, businesses can expedite the authorization process and significantly reduce turnaround times, potentially by up to 90%.

Techniques to minimize chargebacks include implementing two-factor authentication during the checkout process and regularly reviewing transaction records to identify any discrepancies. Moreover, businesses can leverage analytics to gauge transaction security risks and adjust their authorization strategies accordingly.

Industry trends and future of payment authorization

The landscape of payment processing continues to evolve rapidly, with advancements in technology shaping the future of documentation. Several trends, such as increased use of biometric authentication and machine learning in fraud detection, are transforming the approach towards credit card authorization.

Upcoming features in document management solutions like pdfFiller are anticipated to enhance user experiences further, including AI-driven insights for better document handling and improved integration capabilities with other business applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in credit card authorization form without leaving Chrome?

How can I edit credit card authorization form on a smartphone?

Can I edit credit card authorization form on an Android device?

What is a credit card authorization form?

Who is required to file a credit card authorization form?

How to fill out a credit card authorization form?

What is the purpose of a credit card authorization form?

What information must be reported on a credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.