Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Complete Guide to Credit Card Authorization Forms

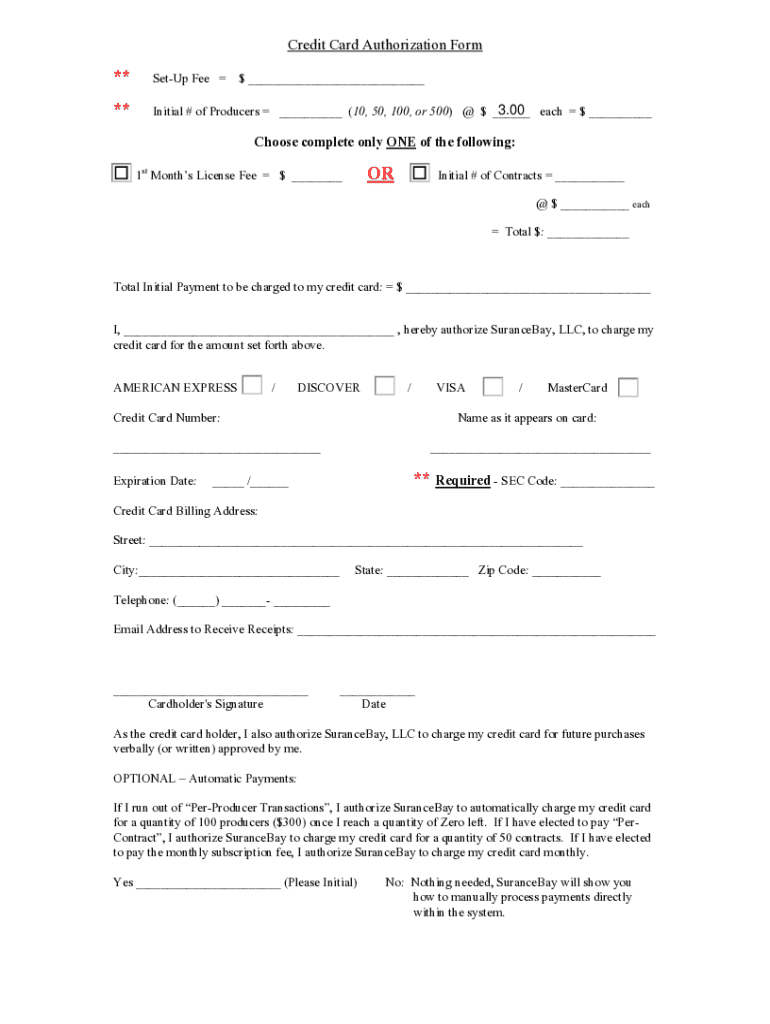

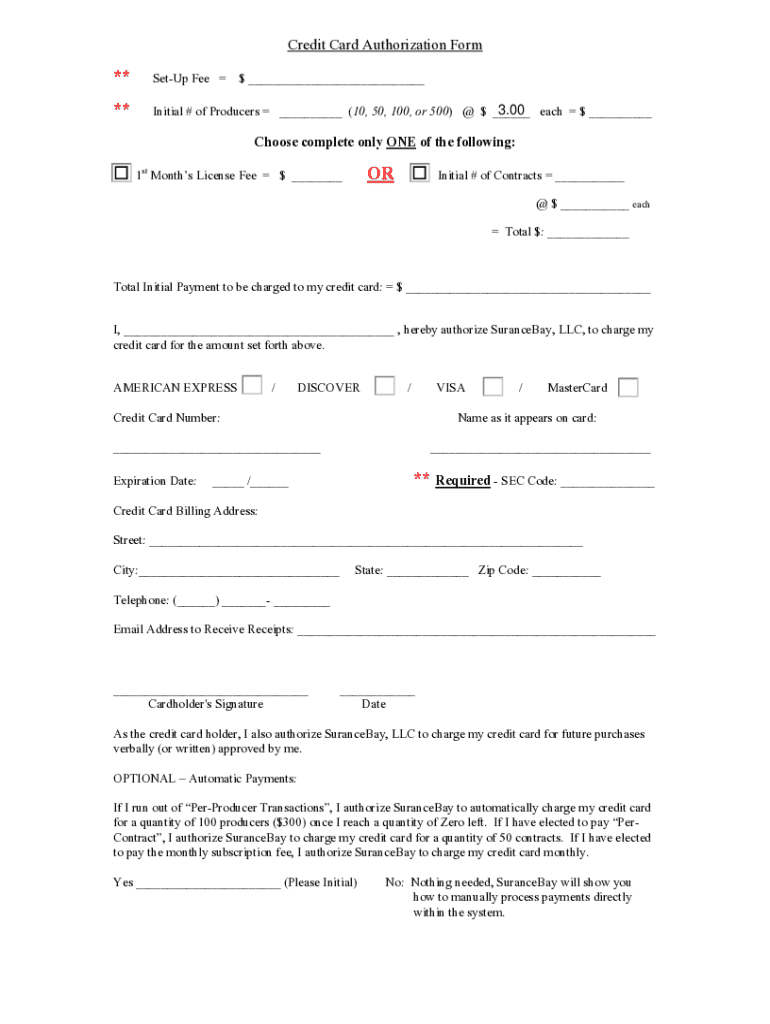

Understanding the credit card authorization form

A credit card authorization form is an essential document that allows a merchant to charge a customer's credit card for goods and services. This authorization is crucial for preventing disputes over charges and ensuring that transactions are legitimate. The form is commonly used in various scenarios, including online purchases, subscriptions, and service agreements, where cash transactions are impractical.

In essence, this form acts as a way to secure consent from the customer to charge their card, protecting both parties in a transaction. Businesses utilize this form not only to validate a purchase but also to establish a record that can help in the event of disputes or chargebacks.

Importance of credit card authorization forms

Credit card authorization forms play a vital role in mitigating risks associated with card transactions. By requiring explicit authorization, businesses can significantly reduce chargebacks, which occur when a customer disputes a charge with their bank. Chargebacks can be costly for merchants, both financially and reputationally, as they may incur fees and lose the product to the customer.

In addition to reducing chargeback risks, these forms also protect sensitive financial data. By gathering necessary information securely, merchants can ensure that they handle data in compliance with financial regulations, reinforcing the trust that customers place in their businesses.

Benefits of using credit card authorization forms

Using credit card authorization forms brings numerous benefits, primarily in preventing chargeback abuse. These forms enhance fraud detection capabilities by documenting the customer's consent for the transaction. In several chargeback scenarios, including cases of identity theft or service disputes, having a signed authorization form provides merchants with a defense against claims.

Moreover, they improve customer trust and security. By formalizing the transaction process and maintaining transparency, businesses can establish greater credibility with their clients. In an age where data breaches are increasingly common, customers are more likely to engage with businesses that demonstrate a commitment to secure payment methods.

Components of a credit card authorization form

A well-structured credit card authorization form typically includes several key components. These elements ensure that the form captures all necessary information for the transaction:

Optional sections can enhance the form’s functionality, such as including the billing address, shipping information, and a section for the customer to read and agree to terms and conditions. Including spaces for the customer’s signature and date reinforces the form's legitimacy.

When and how to use a credit card authorization form

Implementing a credit card authorization form is ideally suited for online transactions, in-person sales, and recurring payment setups. In online contexts, the form serves as a vital means of ensuring that cardholders authorize all charges, thus reducing fraud risks. Similarly, for in-person sales, obtaining authorization can protect against misunderstandings regarding charges.

For businesses handling recurring payments, such as subscription services, this form is particularly necessary. It allows merchants to charge the customer’s card at specified intervals without needing additional approval for each transaction.

Managing credit card authorization forms

Proper management of signed credit card authorization forms is crucial for compliance and security. Best practices include securing the storage of signed forms, ensuring they are protected from unauthorized access. It is generally recommended to retain these forms only for as long as necessary, commonly around three to five years, to align with typical business practices and legal guidelines.

Businesses should also consider the merits of digital versus physical storage. Utilizing cloud-based solutions, like pdfFiller, offers distinct advantages, such as easier access, enhanced security, and integrated document management capabilities. Digital storage can also streamline the process of retrieving information when needed, thus improving operational efficiency.

Downloadable templates for credit card authorization forms

For businesses looking to create a credit card authorization form quickly, pdfFiller provides a selection of customizable templates. Creating or editing a form using these templates can greatly simplify the process of ensuring all necessary information is captured.

Accessing these templates is straightforward on the pdfFiller platform, where users can follow step-by-step instructions to download and personalize their forms.

Frequently asked questions (FAQ)

Many aim to understand their legal obligations regarding credit card authorization forms, especially across different industries. While not universally mandated, specific sectors, particularly those in finance, e-commerce, and service industries, are often required to utilize these forms to ensure compliance and protect both parties involved in a transaction.

Storage and retention policies for signed forms also raise questions. Generally, guidelines suggest storing these forms securely for a specified duration, typically three to five years, depending on the nature of the transactions and industry standards.

Another common query relates to 'Card on File'. This term refers to the practice of storing a customer's credit card information securely for future transactions. Understanding its implications—whether in terms of customer trust or legal compliance—is beneficial for businesses operating within this framework.

Integrating with other solutions

To further streamline payment processes, businesses can integrate credit card authorization forms with various payment gateways and Customer Relationship Management (CRM) systems. Using platforms like pdfFiller enhances this integration, allowing businesses to incorporate forms easily and ensure consistent records across operations.

Achieving better results is about tracking authorizations efficiently and managing chargebacks through automated systems. These tools provide businesses with comprehensive insights into authorizations, enabling timely responses which are crucial for maintaining customer relationships and financial stability.

Exploring related topics

Understanding chargebacks and how to prevent them is vital for business owners. Chargeback processes can quickly spiral, impacting cash flow and customer relationships negatively. Additionally, it is essential to engage with security measures when accepting credit card payments, ensuring both business protection and customer satisfaction.

Setting up recurring invoices is another area that directly correlates with effective credit authorization management. Best practices in invoicing support smoother transactions, thereby enhancing customer retention and satisfaction.

Interactive tools and resources

Utilizing interactive tools available on the pdfFiller platform can significantly enhance document management. Features that facilitate collaboration and real-time updates allow teams to engage with each document efficiently. The benefits of a cloud-based document solution extend to ease of access and security, framing a more dynamic approach to credit card authorization management.

Staying updated with industry trends is crucial for businesses to adapt promptly to changes that could impact payment processes. Subscribing to newsletters, or accessing dedicated resources from pdfFiller, provides ongoing insights beneficial for maintaining robust transaction practices.

Learn more and engage

Discovering the full range of product offerings from pdfFiller reveals how its document management solutions can streamline business processes significantly. By facilitating the editing, signing, and management of documents seamlessly, pdfFiller empowers users to handle transactions adeptly and execute efficient workflows.

For personalized assistance, various support options are available, including guidance on effectively utilizing pdfFiller's features. Businesses can also benefit from invitations to webinars or workshops focused on enhancing document management, ensuring they stay ahead in their operational capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit card authorization form from Google Drive?

Can I edit credit card authorization form on an Android device?

How do I complete credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.