Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Understanding the Credit Card Authorization Form: A Comprehensive Guide

Understanding the credit card authorization form

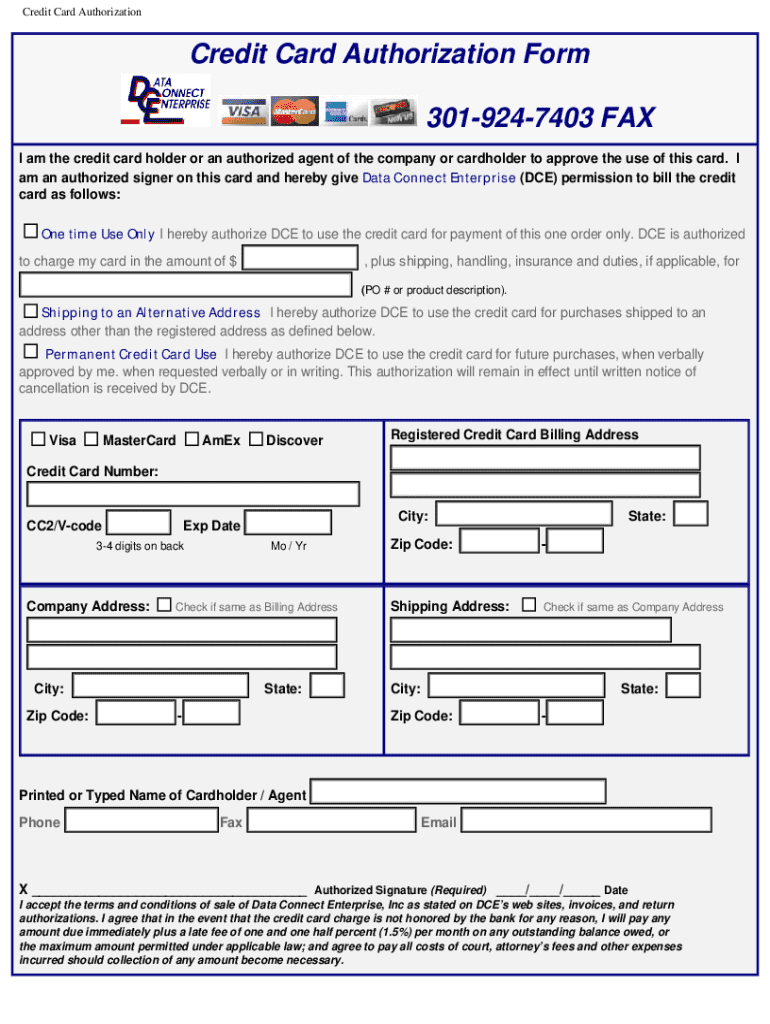

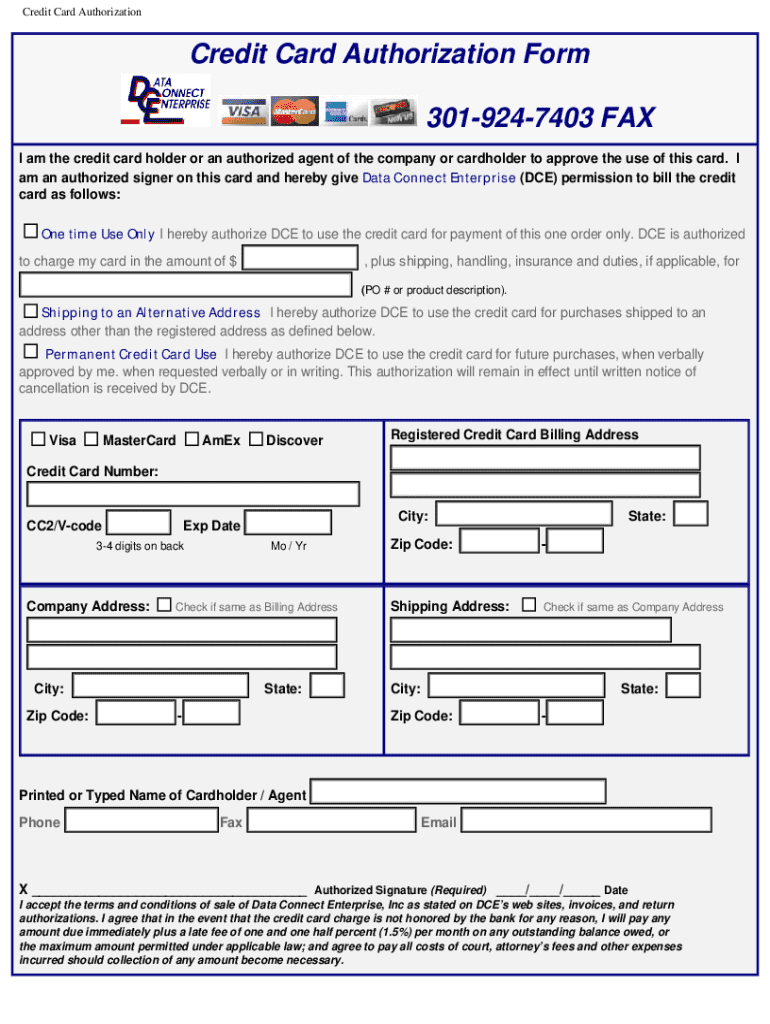

A credit card authorization form is a vital document used by merchants to obtain permission from a cardholder for a transaction. It allows businesses to charge a designated amount to a customer’s credit card, ensuring that both parties maintain transparency during the payment process. This form acts like a written contract, detailing the terms of the transaction and establishing trust between the merchant and cardholder.

In today's eCommerce and service-driven marketplaces, where fraud is prevalent, a credit card authorization form serves a critical purpose. It not only helps in processing payments but also plays a significant role in preventing potential disputes by documenting the cardholder's consent.

The importance of credit card authorization forms

Credit card authorization forms are primarily instrumental in preventing chargeback abuse. Chargebacks occur when a customer disputes a transaction, resulting in a reversal of the transaction amount. With the rise in online purchases, such situations have become frequent, putting merchants at risk of significant losses. By implementing a credit card authorization form, businesses can safeguard against chargebacks, as they possess documented proof of the customer’s consent for the transaction.

In addition to mitigating chargeback risks, legal obligations surrounding payment processing require businesses to adhere to specific regulations. The form acts as a safeguard, ensuring compliance with financial regulations and industry standards. With proper documentation of customer consent, merchants can demonstrate diligence in their financial practices, fostering trust and reliability.

Filling out the credit card authorization form

Completing a credit card authorization form requires careful attention to detail. Start by gathering all necessary information – this will typically include the cardholder's full name, billing address, credit card number, expiration date, and CVV. The accuracy of this information is essential for successful payment processing and minimizing disputes.

Here’s a quick step-by-step guide for filling out the form accurately:

Adhering to these steps will not only reduce the likelihood of errors but also enhance the efficiency of your payment processes.

Securing your customer's data

The personal and financial information contained in credit card authorization forms is sensitive and must be handled with utmost care. To ensure the secure storage of signed forms, businesses should consider both physical and digital storage methods. Physically, store paper forms in secure, locked locations and limit access to authorized personnel. Digitally, utilize encrypted storage solutions to protect sensitive data from unauthorized access.

Another important consideration is the retention period of these forms. Compliance standards often dictate how long businesses must maintain signed authorization forms. Typically, it's advisable to keep these records for at least six months after the transaction date, while ensuring they are securely deleted after reaching the end of their retention cycle.

Maintaining customer privacy involves not just storage but also careful handling of the forms. Businesses must train staff on best practices for dealing with such sensitive information to prevent any breaches or mishandling.

Editing and managing credit card authorization forms

Editing and managing credit card authorization forms efficiently saves time and reduces errors. Tools like pdfFiller provide an interactive platform that allows users to modify forms quickly without the hassle of starting from scratch. Users can easily add, delete, or adjust information directly within the document.

Besides editing, pdfFiller offers collaboration features that enable teams to work seamlessly on form management. Users can share documents in real-time, ensuring that all stakeholders can contribute to and review the form as needed. This sort of collaborative environment is great for maintaining accuracy and ensuring that the authorization process is both secure and efficient.

Common questions about credit card authorization forms

Frequently, individuals and businesses have questions about the legalities surrounding credit card authorization forms. For instance, do you legally need one? The answer can vary based on industry standards and the nature of your transactions. In high-risk sectors such as travel or subscription services, having a credit card authorization form is often considered best practice to protect both parties and minimize risk.

Another common question is why some forms lack a CVV section. This occurs when businesses adopt varying policies regarding sensitive information collection. While it's usually recommended to have a CVV section, some organizations may decide against it to enhance user convenience or comply with specific regulations.

Lastly, businesses might explore alternatives to credit card authorization forms. Viable options include digital payment gateways, where authorization is built into the transaction process, or recurring payment systems that automatically bill the customer based on prior agreements.

Industry-specific uses for credit card authorization forms

Different industries utilize credit card authorization forms in various ways tailored to their unique needs. For example, in retail, a straightforward credit card authorization form supports one-time purchases and returns. In eCommerce, businesses might handle online transactions with digital forms that capture customer information securely and send confirmations via email.

Service-based industries, such as healthcare or subscription services, often require ongoing authorization to manage recurring payments. This is particularly crucial for businesses that rely on long-term customer relationships and need to maintain a steady cash flow. Specific forms tailored to industry regulations can streamline these processes while ensuring compliance with legal standards.

Transitioning to a cloud-based platform

Transitioning to a digital solution such as pdfFiller allows organizations to leverage the benefits of a cloud-based system. A cloud platform offers flexibility and accessibility, enabling users to manage credit card authorization forms from anywhere with internet access. This is especially beneficial for remote teams or businesses with multiple locations, as it centralizes document management.

Additionally, digital solutions often come equipped with advanced features, such as automated reminders for form completion, secure storage, and eSignature functionalities. These ensure that organizations remain compliant and efficient while reducing the risk of errors associated with traditional paper-based methods.

Conclusion and next steps for users

To summarize, a credit card authorization form is a crucial document that simplifies and secures payment transactions for businesses and consumers alike. Utilizing platforms like pdfFiller can enhance efficiency by providing tools to edit, manage, and store these forms securely. By understanding and implementing best practices for credit card authorization forms, users can streamline their payment processes, foster customer trust, and adhere to compliance standards.

For those ready to take the next step, exploring pdfFiller's interactive tools will empower you to manage your document needs effectively. Dive into the world of secure, cloud-based document management and transform how you handle credit card authorization forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit card authorization form from Google Drive?

How can I send credit card authorization form to be eSigned by others?

How do I complete credit card authorization form on an iOS device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.