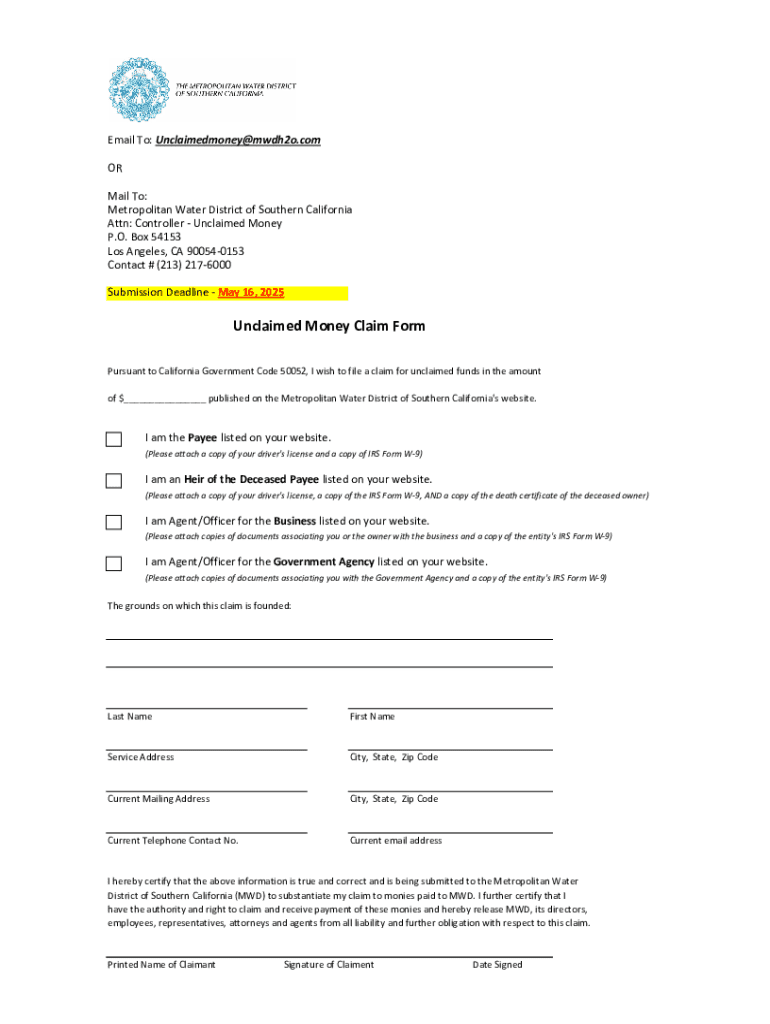

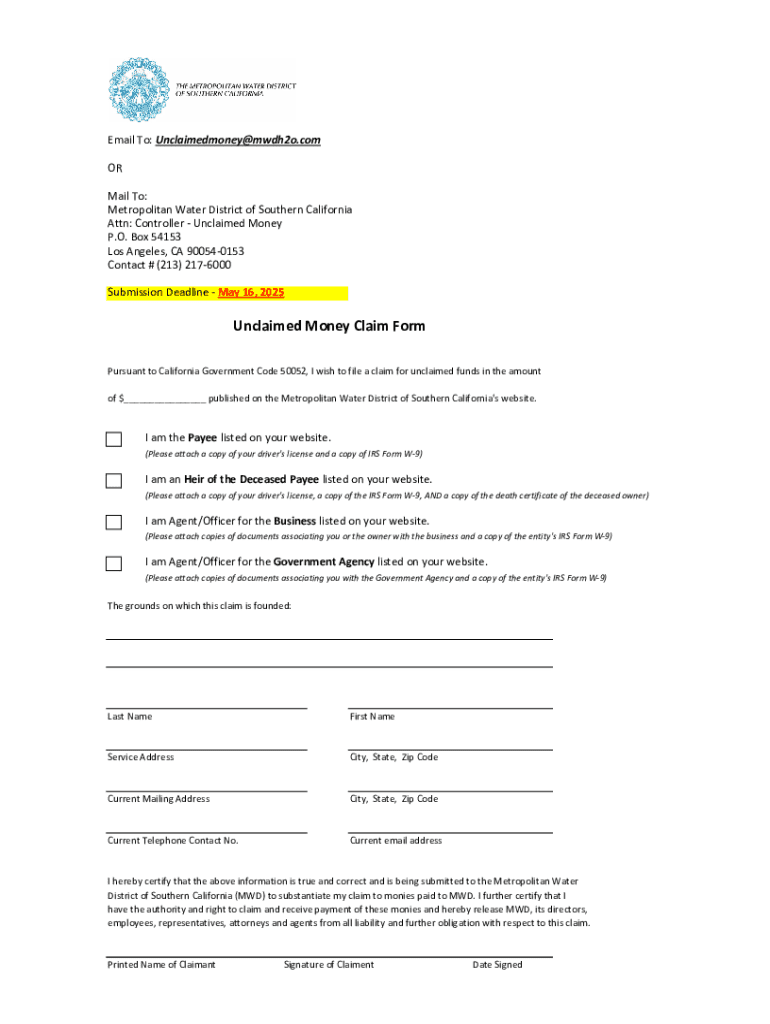

Get the free Unclaimed Money Claim Form

Get, Create, Make and Sign unclaimed money claim form

How to edit unclaimed money claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unclaimed money claim form

How to fill out unclaimed money claim form

Who needs unclaimed money claim form?

Unclaimed Money Claim Form: A Comprehensive How-to Guide

Understanding unclaimed money

Unclaimed money refers to funds or property that have been abandoned or forgotten by their rightful owners. Often, individuals are unaware that they are entitled to these assets, which can range from forgotten bank accounts and uncashed checks to insurance payouts or even assets from deceased relatives. Unclaimed property is not just a figment of imagination; in the U.S. alone, billions of dollars are reported as unclaimed annually, highlighting how common this issue is.

Understanding unclaimed money is crucial as it provides a pathway to securing additional financial resources. Individuals often overlook assets such as utility deposits, life insurance payouts, or refunds from canceled services, all of which contribute to unclaimed funds. The emotional and financial impact of reclaiming unclaimed money can be significant, providing a surprise windfall that could help alleviate debts or fund personal projects. Stories of people discovering long-lost bank accounts after years serve to remind us of the importance of claiming what is rightfully ours.

The unclaimed money claim process

Claiming unclaimed money requires the following steps, ensuring that you are eligible and equipped with the necessary information before diving in. The eligibility to claim varies by state but often includes criteria such as needing proof of identity and the nature of the unclaimed funds. Understanding the age of the claim is equally important, as some states have different deadlines for claiming funds.

Most states will require claimants to provide personal details, including full name, address, and social security number. Additional documentation might include identification proof and any relevant financial records. Preparing these documents in advance simplifies the claim process and increases the chances of a successful claim.

Finding your unclaimed money

Finding unclaimed money can be as easy as consulting online resources and state-specific databases. The first step is to utilize your state's unclaimed property website, which provides search tools for residents to find their unclaimed funds. Various online platforms also offer databases that collate information from multiple states, streamlining the search process.

For individuals who have lived in multiple states, it's critical to conduct searches across all relevant jurisdictions. Many states provide an easy search option for former residents, so make use of national databases such as the National Association of Unclaimed Property Administrators (NAUPA). This ensures that no potential unclaimed assets are overlooked.

Completing the unclaimed money claim form

Once you have located your unclaimed money, the next step is to complete the unclaimed money claim form. This form typically includes sections for personal information, a description of the claim, and verification details. Ensuring that each section is accurately filled out is crucial for a smooth claim process.

When filling out the claim form, double-checking all entered information is vital to avoid common mistakes. Missing details or inaccuracies could lead to claims being delayed or denied altogether, making careful review an essential step.

Submitting your claim

After completing your claim form, it's time to submit it according to the guidelines provided by your state’s unclaimed property office. Most states offer multiple methods of submission including online submissions and mail-in options. Choose the method that suits your needs best, but online submissions often allow for quicker processing.

After submitting your claim, it’s important to understand the review process. The time frame for processing can vary significantly by state, so staying patient while monitoring for updates can be key. Knowing what to expect allows you to navigate the uncertain waiting period more effectively.

Expert tips for maximizing your claim

Each state has its own regulations regarding unclaimed money claims, so familiarizing yourself with your state’s specific requirements can significantly improve your chances of a successful claim. Understanding any variations in process can also save you time and frustration in the long run.

When in doubt or if you encounter unusual offers for assistance, trust your instincts. Look out for red flags such as fees for help in retrieving unclaimed money, as legitimate claims should not incur costs. Staying informed and cautious can protect you from scams.

Frequently asked questions (FAQs)

Many individuals have questions about claiming unclaimed money, particularly about processes and timelines. Below are some commonly asked questions that can clarify concerns you might have.

Conclusion of the claim process

Keeping detailed records of your claim process is a wise step after submission. Document all pertinent information, correspondence, and tracking numbers provided. This will not only assist in addressing any issues that may arise but also serve as a reminder for future opportunities to claim unclaimed money that you may discover.

Regularly checking for unclaimed money should become part of your financial practices, as states frequently update their records. This proactive approach can lead to additional financial benefits down the road.

Additional tools and resources

For those looking for tools to track unclaimed money, pdfFiller provides a robust platform to manage your documentation needs. With its interactive tools that aid in filling, editing, and signing forms, users can easily navigate the claim forms and keep records organized. Enhancing your financial literacy is also essential — utilizing available resources on financial wellness can equip you with knowledge for better personal finance management.

Connect with experts

pdfFiller offers comprehensive support for all your document needs, including assistance with unclaimed money claim forms and beyond. Engaging with community forums and discussions can also provide insights from others' experiences, enriching your understanding of the process while sharing tips and best practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send unclaimed money claim form to be eSigned by others?

Can I create an electronic signature for the unclaimed money claim form in Chrome?

How can I fill out unclaimed money claim form on an iOS device?

What is unclaimed money claim form?

Who is required to file unclaimed money claim form?

How to fill out unclaimed money claim form?

What is the purpose of unclaimed money claim form?

What information must be reported on unclaimed money claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.