Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

A Comprehensive Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

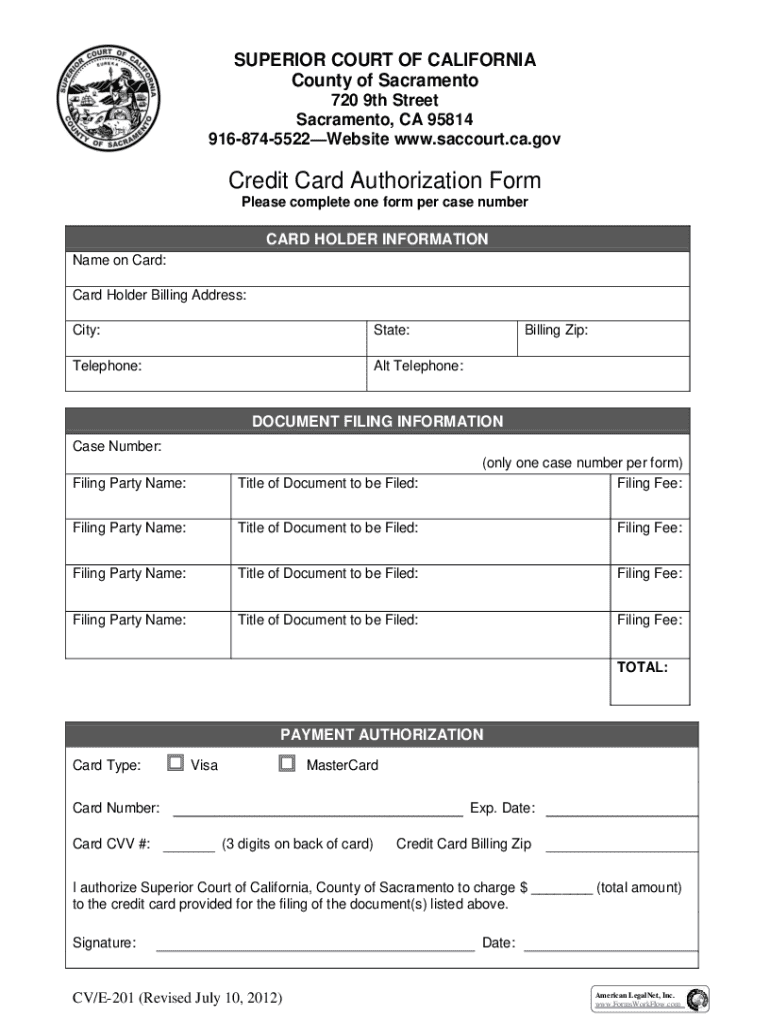

A credit card authorization form is a document that allows a business to charge a customer’s credit card for services or products. This form serves as a legal agreement between the cardholder and the merchant, granting explicit permission to process a payment, which is essential in minimizing fraud and ensuring smoother transactions.

Key components of this form typically include the cardholder’s name, billing address, credit card number, expiration date, the amount to be charged, and an authorization signature. Having these elements in place helps establish a clear record of consent, making it easier to authenticate transactions.

Importance of credit card authorization forms for businesses

Credit card authorization forms are vital for businesses, particularly those that deal with substantial transactions or subscription models. One of the primary advantages is that they help in preventing chargeback abuse, which occurs when a customer disputes a charge, leading merchants to lose revenue. By obtaining a signed authorization, businesses have proof of consent, making it easier to defend against chargeback claims.

Moreover, this form enhances transaction security. In an era where online fraud is rampant, having documented authorization helps confirm the legitimacy of transactions. This layer of protection can bolster customer trust and improve overall satisfaction.

When to use a credit card authorization form

Certain business scenarios necessitate the use of credit card authorization forms. Often, they are needed for recurring payments associated with subscription services. Once consent is given, businesses can automatically charge customers on a schedule, ensuring continual service provision without needing to re-enter card information.

Immediate payment confirmation is another situation that calls for an authorization form. For instance, in the hospitality or transportation industries, where real-time processing is essential for service fulfillment, securing upfront authorization becomes critical. Merchants should evaluate their business models to determine where these forms can mitigate risks effectively.

Components of a credit card authorization form

Essentially, a credit card authorization form collects vital information that enables merchants to process payments securely. The cardholder details include the full name, billing address, and sometimes phone numbers or email addresses to verify identity. Payment details encompass the credit card number, type of card, expiration date, and the total amount to be charged.

Additionally, the cardholder's signature is pivotal. This signature acts as consent, confirming that the cardholder agrees to the charges applied. Businesses may also consider including optional elements like the card's CVV number for added security, although care must be taken to handle this information in compliance with PCI DSS standards. Furthermore, agreements to store the card on file for future transactions can make repeat purchases easier.

Legal and compliance considerations

While using a credit card authorization form is not legally mandatory, it is advisable under various federal and state regulations that aim to protect both consumers and businesses. Regulations can vary significantly by region, emphasizing the importance of staying informed about local laws governing payment processing and privacy.

Additionally, retaining signed forms plays a critical role in compliance. Organizations should ensure they store these documents securely per data protection laws such as GDPR or CCPA, which dictate how long businesses must keep sensitive information. Keeping records of authorization forms helps protect against legal disputes relating to transactions.

How to create and use a credit card authorization form

Creating a credit card authorization form involves a straightforward process. First, collect the necessary information, which should cover both cardholder details and payment specifics. Once you've gathered this information, clearly format the form, ensuring it’s easy to read and understand. If using digital forms, incorporating e-signature functionality can streamline the approval process.

Cardholders filling out the form should pay close attention to accuracy, particularly regarding card details and their signature. Common mistakes include providing incorrect card numbers or failing to date the signature appropriately. To avoid these pitfalls, template forms can be helpful, especially those available on user-friendly platforms like pdfFiller which support seamless document management.

Downloads and template availability

To facilitate the implementation of credit card authorization forms, pdfFiller provides templates that can be customized according to specific business needs. Accessing these templates is straightforward. Users can visit the pdfFiller website to download forms tailored for various industries—from subscriptions to one-time transactions—making it easy for businesses to remain compliant and secure.

These templates come with instructions that guide users on customization, ensuring that critical fields are filled out correctly. Subscribing to the pdfFiller newsletter offers additional benefits, including tips and updates on document best practices.

Frequently asked questions (FAQ)

One common query regarding credit card authorization forms is whether they help prevent chargeback abuse. The answer is, yes. By having a signed authorization, businesses can provide proof of consent in disputes, subsequently reducing chargeback incidents. This protective measure is especially critical for online businesses where digital confirmation is paramount.

Another frequent question concerns disputes over transactions. If a customer files a chargeback, businesses should first analyze the situation and gather documentation that includes the authorization form and any correspondence related to the transaction. This evidence is crucial for challenging the chargeback effectively.

Related topics and further reading

Understanding how to accept credit card payments is an essential skill for any business. Alongside this is the nuanced understanding of card-not-present (CNP) transactions, which are crucial for eCommerce operations and bring unique challenges that often require additional security measures. Furthermore, best practices for securing customer data are necessary to comply with regulations while building trust with your clients.

Interactive tools and resources

Leveraging interactive PDF editing tools can significantly enhance your form management experience. pdfFiller offers features that simplify the process of editing, signing, and sharing documents, enabling businesses to work more efficiently and effectively. These tools allow users to highlight, annotate, or integrate their forms directly into their existing workflow.

Moreover, pdfFiller’s integration options with other business solutions allow for a seamless experience in document management. Whether you’re syncing data with a CRM system or automating workflow processes, these integrations can streamline operations and enhance productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card authorization form without leaving Google Drive?

How can I get credit card authorization form?

How do I fill out the credit card authorization form form on my smartphone?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.