Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form: A Comprehensive Guide

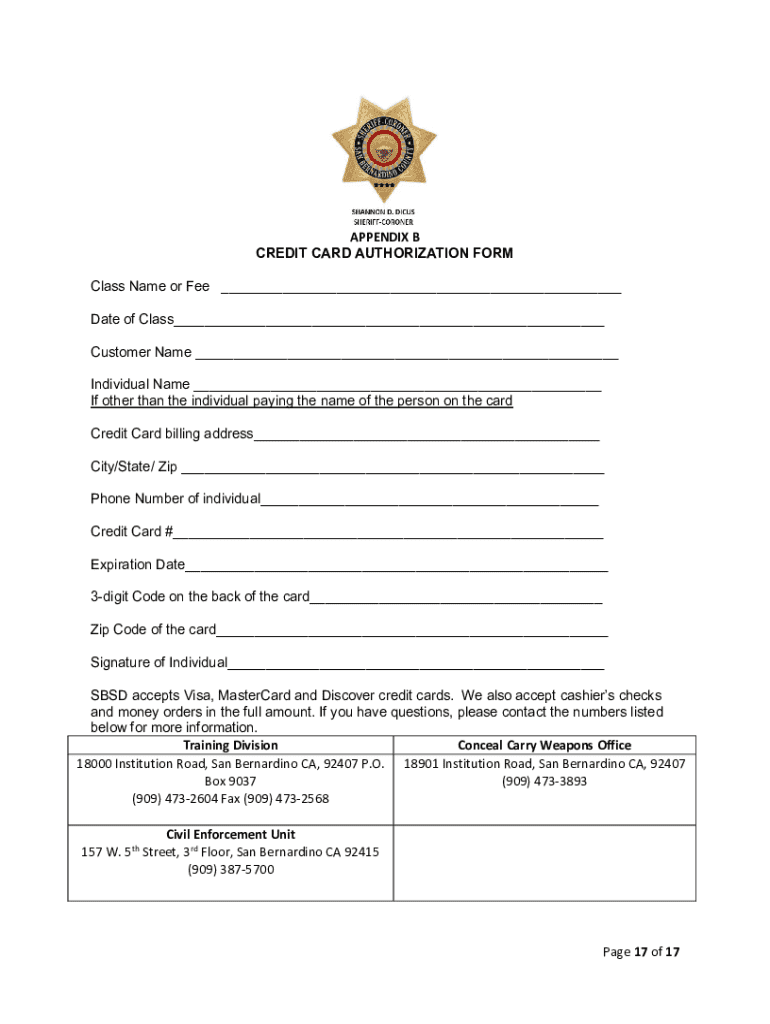

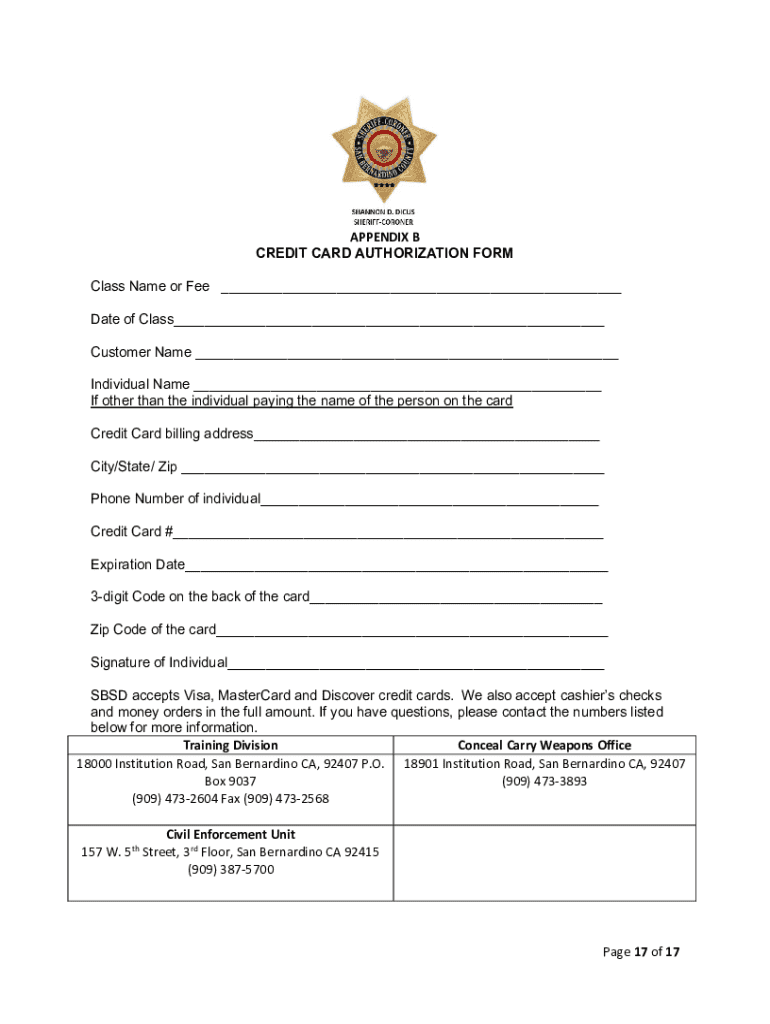

What is a credit card authorization form?

A credit card authorization form is a document that allows businesses to obtain permission from a cardholder to charge their credit or debit card for goods or services. This form serves as a critical component in the payment processing ecosystem, ensuring that the transaction is authorized by the individual whose card is being used.

The importance of this form cannot be overstated. Businesses rely on it to mitigate the risk of unauthorized transactions and chargebacks. Whenever a purchase is made, having a signed credit card authorization form helps affirm that the cardholder understands and agrees to the charges, safeguarding both the business and the customer.

Key components of a credit card authorization form

Every credit card authorization form must include essential information to be considered valid. This typically consists of the cardholder's name, the card number, expiration date, and the billing address. Each of these components is crucial for its verification during the transaction process.

Furthermore, the authorization signature of the cardholder is vital. It serves as a formal consent, indicating that the subscriber is aware of the charges being made. In addition to these essentials, businesses can also include optional areas for the CVV number and detailed terms and conditions, to clarify the responsibilities of each party involved in the payment.

How credit card authorization forms help prevent chargebacks

Chargebacks can significantly impact a business’s financial standing. They occur when a cardholder disputes a transaction, leading to the reversal of funds. Understanding this phenomenon is essential for all entities processing payments. Credit card authorization forms play a critical role by providing proof that the cardholder agreed to the transaction, establishing a solid defense against chargebacks.

Implementing these forms into your payment processes can lower the risk of disputes significantly. They not only help to verify customer consent but also create a documented trail that can be referenced in case of disagreements. Several companies have successfully utilized authorization forms to reduce chargebacks by as much as 30%, reinforcing their importance in effective risk management.

Do you legally need a credit card authorization form?

While credit card authorization forms are not mandated by law for every business, they are considered a best practice for many industries, particularly those where the risk of chargebacks is higher. Additionally, certain sectors like travel and hospitality often face stringent regulations that necessitate obtaining customer's authorization.

Understanding the legal implications is crucial for any business. Using a credit card authorization form not only protects against potential fraud but also fosters a level of trust between the business and customer. For companies, it’s essential to stay informed about industry-specific requirements, lest they leave themselves vulnerable to legal repercussions.

Steps for creating a credit card authorization form with pdfFiller

Creating a credit card authorization form with pdfFiller is straightforward and efficient. First, access the extensive library of templates available on the platform. You can easily find a credit card authorization form that meets your needs or customize an existing one.

Next, customize the form fields to ensure all essential information is captured accurately. Take advantage of payment security features, such as secure connections for handling sensitive information. After customization, users can easily add eSign capabilities, allowing for seamless signing and approval. Finally, ensure that your document is stored securely in the cloud, accessible only to authorized people.

Best practices for using credit card authorization forms

To ensure that credit card authorization forms serve their intended purpose, it is crucial to follow best practices in their usage. One significant step is ensuring accurate data entry. Double-checking details not only minimizes processing errors but also reduces complications in future disputes.

Regular updates to the form template are equally important, as they can reflect changes in legal requirements or best practices within the industry. Moreover, businesses should adopt strict guidelines for secure storage of signed forms, ensuring that sensitive information is protected. Additionally, establishing clear guidelines on how long to retain these documents—based on legal recommendations—will further strengthen compliance.

How to integrate credit card authorization forms into your business workflow

Integrating credit card authorization forms into your business workflow can streamline operations and enhance security. Start by setting up digital signatures to facilitate quick approvals. This not only saves time but also offers a modern way for customers to engage without the hassle of printing and scanning.

Next, sync these forms with your accounting and payment systems to ensure seamless processing. This integration can help keep the transactions organized and provide valuable insights into payment patterns. Furthermore, offering training for staff on the proper use and compliance of these forms can create a standardized approach, minimizing errors and reinforcing your business's credibility.

FAQs: Addressing common concerns

Addressing common concerns aids in better understanding the significance and practicalities of credit card authorization forms. One frequently asked question is about the absence of a space for CVV on the form. While not all templates include this security feature, many businesses choose to omit it to avoid storing sensitive information on paper platforms.

Regarding the use of templates from various industries, ensure that any chosen template aligns with specific business needs and complies with regulations governing your sector. If a chargeback occurs despite a signed form, businesses should refer to the authorization form as key evidence in disputations, emphasizing the necessity of keeping these forms securely archived.

Customer stories: Success with credit card authorization forms

Customer feedback on the implementation of credit card authorization forms illustrates their effectiveness in enhancing business operations. Many users report a noticeable reduction in chargebacks after using these forms, emphasizing the importance of documentation in every transaction. Success stories often highlight a more streamlined workflow, where both teams and clients appreciate the ease of handling payments.

Testimonials from various industries reaffirm their value; for instance, a small catering business shared how they nearly eliminated chargebacks since instituting an authorization form. Overall, stories like this illustrate how effectively using these forms can lead to financial security and customer trust.

Why choose pdfFiller for your credit card authorization needs?

Choosing pdfFiller for your credit card authorization form needs means leveraging a tool designed specifically for seamless document management. The platform offers features tailored for creating, editing, and securely storing authorization forms, ensuring compliance and efficiency in your payment processes.

Moreover, being a cloud-based solution allows users to access documents anytime, anywhere, which is especially valuable for businesses with remote teams. Collaboration capabilities enhance teamwork on documents, while built-in compliance features keep your business aligned with best practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card authorization form to be eSigned by others?

Can I create an electronic signature for the credit card authorization form in Chrome?

How do I fill out credit card authorization form using my mobile device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.