Get the free Coverdell Education Savings Account (cesa) Transfer Form

Get, Create, Make and Sign coverdell education savings account

How to edit coverdell education savings account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out coverdell education savings account

How to fill out coverdell education savings account

Who needs coverdell education savings account?

Comprehensive Guide to Coverdell Education Savings Account Form

Understanding the Coverdell Education Savings Account (CESA)

The Coverdell Education Savings Account (CESA) is a specialized savings account designed to help families save for their children's education expenses. Given the rising costs of education, whether for elementary, secondary, or higher education, having a CESA can provide a much-needed financial cushion. It offers tax-free growth on contributions, allowing parents to invest in their child’s future in a beneficial way.

One of the primary benefits of using a Coverdell account for education savings is its flexibility. Funds can be withdrawn tax-free for qualified education expenses, which include tuition, fees, and, in certain cases, room and board. This feature makes it an attractive option for many parents looking to save efficiently for their children’s educational needs.

Eligibility requirements

Only individuals with a modified adjusted gross income below specific thresholds can open a CESA. For 2023, individual filers with incomes below $110,000 and couples filing jointly under $220,000 can make the full contribution. If your income exceeds these levels, the contribution limit gradually phases out. Moreover, anyone under 18 can be named a beneficiary on a CESA, making it a great tool for saving from an early age.

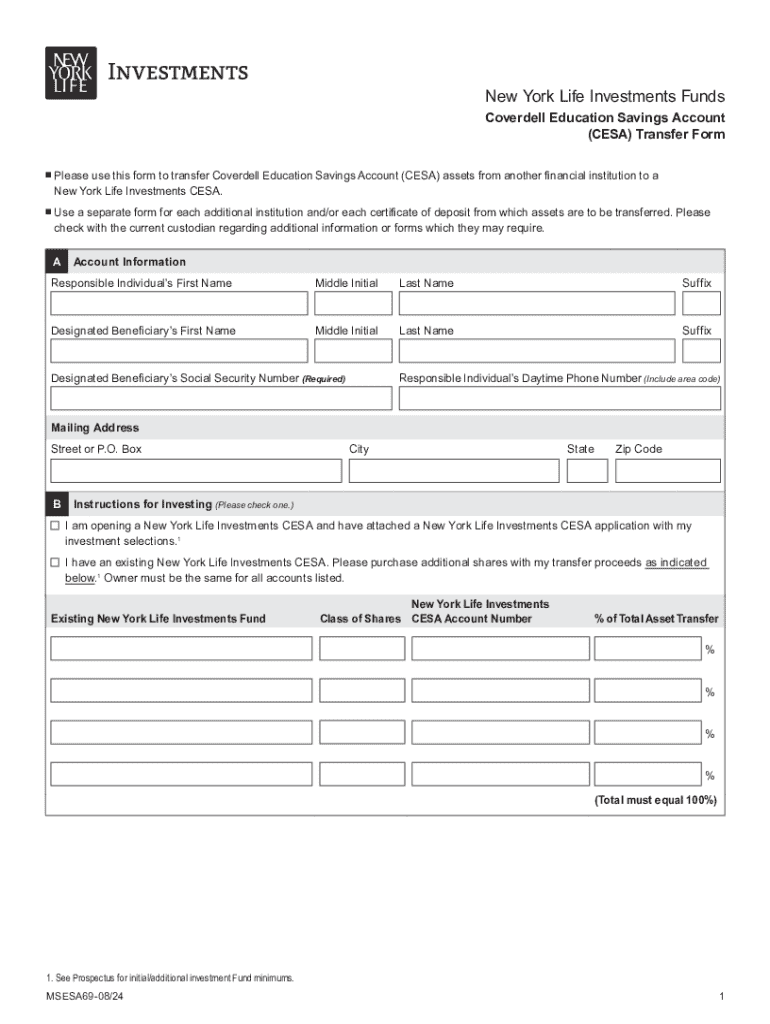

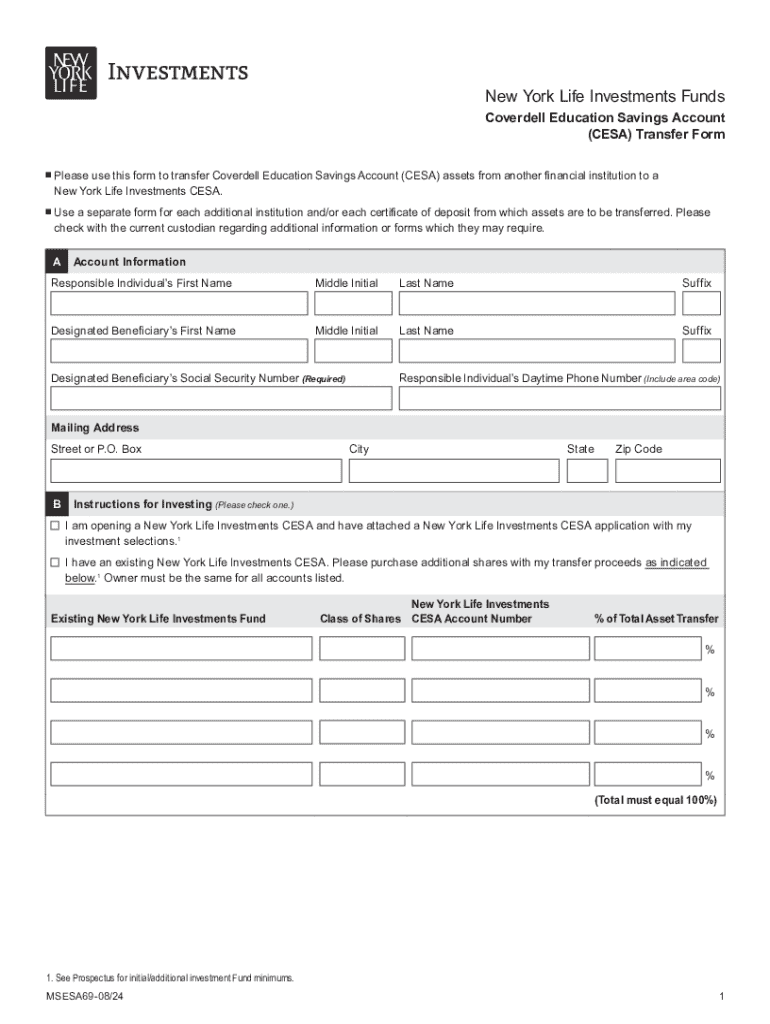

Overview of the Coverdell Education Savings Account Form

The Coverdell Education Savings Account form is crucial for managing your CESA. It serves multiple functions, including enabling contributions, distributions, and transfers of funds. Understanding the purpose of the form and the different types associated with it can streamline your experience.

In particular, there are several key forms that you will encounter. Contribution forms are used to deposit funds into your CESA. Distribution request forms help you withdraw money for educational purposes. Lastly, transfer forms allow you to move funds from one CESA to another, making it easier to consolidate accounts or change financial institutions.

Steps to fill out the Coverdell Education Savings Account form

Filling out your Coverdell Education Savings Account form accurately is essential for successful management of your account. Start by gathering all necessary information related to both the account holder and the beneficiary. This includes basic personal details like names, addresses, and Social Security numbers, as well as pertinent financial information regarding the contributions and distributions.

As you move to complete the form, pay particular attention to the following sections:

Editing and customizing your CESA form

Utilizing pdfFiller’s editing tools can greatly simplify the process of completing your Coverdell Education Savings Account form. Upon accessing the platform, you can easily upload your form and begin making necessary edits. Features such as text editing and annotations allow you to provide personalized notes and clarifications.

One standout feature is the ability to add electronic signatures. Signing forms digitally can save time and eliminate the hassle of printing. Simply follow the prompts to create your eSignature within pdfFiller. Notably, the platform incorporates verification and security measures to ensure your signature’s authenticity and confidentiality.

Submitting your Coverdell Education Savings Account form

Once your Coverdell Education Savings Account form is complete, the next step is submission. There are two main options available: mail-in submission or electronic submission. If you choose to send your form via mail, ensure your documents are properly addressed to the financial institution managing your CESA.

For electronic submissions, check if your financial institution allows this method, as it can expedite the process. Regardless of your submission method, tracking is essential. You can confirm the receipt of your CESA form by following up with the institution after a few days to ensure everything is in order.

Managing your Coverdell Education Savings Accounts

Managing your Coverdell Education Savings Accounts effectively involves maintaining accurate records. It’s crucial to keep copies of all submitted forms, as this can be invaluable for tax purposes and personal records. Additionally, safeguarding these documents digitally using pdfFiller can help streamline future access and updates.

Reviewing and updating your contributions annually is another critical aspect. Setting reminders at the beginning of each year can help you keep track of yearly contribution limits, currently capped at $2,000 per beneficiary. Adjusting contributions based on your educational needs or financial situation ensures that you're maximizing the effectiveness of your CESA.

Common mistakes to avoid when filing CESA forms

Several pitfalls can lead to complications when filing your Coverdell Education Savings Account forms. One major issue is submitting incomplete information. Double-checking every entry before submission is essential, as discrepancies can delay processing or even result in returns due to missing data.

Misunderstanding contribution limits is another common error. Stay informed about the contribution caps and their implications. Lastly, ignoring submission deadlines can create complications, particularly regarding tax considerations. Being proactive in your submissions ensures that you maximize your benefits from the CESA.

Frequently asked questions (FAQs) about the Coverdell Education Savings Account form

Understanding the nuances of CESA can raise several questions. For instance, what happens if you miss the contribution deadline? Typically, you may not be able to make contributions for that year, impacting your tax-advantaged savings potential. Additionally, can you change your beneficiary? Yes, updates to beneficiaries are allowed, providing flexibility as educational needs evolve.

Consider the tax implications of withdrawing funds; improper use can lead to tax penalties. Finally, how does using pdfFiller simplify form management? The platform allows for seamless document editing, collaboration, and tracking, making the entire process more efficient.

Utilizing interactive tools for efficient form management

pdfFiller supports efficient document workflow with its cloud-based application. Users can access forms from anywhere, simplifying the completion and submission process. The collaboration features allow teams to work on documents together, making it an ideal solution for family members and educational professionals managing multiple CESAs.

Templates for CESA and other forms are another significant benefit of using pdfFiller. These ready-to-use templates simplify form filling, allowing for quick customization on the go. With intuitive design options, users can adapt templates to meet their specific needs effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send coverdell education savings account to be eSigned by others?

How do I edit coverdell education savings account online?

How can I fill out coverdell education savings account on an iOS device?

What is coverdell education savings account?

Who is required to file coverdell education savings account?

How to fill out coverdell education savings account?

What is the purpose of coverdell education savings account?

What information must be reported on coverdell education savings account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.