Get the free Certificate of Exemption – Agar 2024/25 Form 2

Get, Create, Make and Sign certificate of exemption agar

Editing certificate of exemption agar online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of exemption agar

How to fill out certificate of exemption agar

Who needs certificate of exemption agar?

Understanding the Certificate of Exemption AGAR Form

Understanding the Certificate of Exemption AGAR form

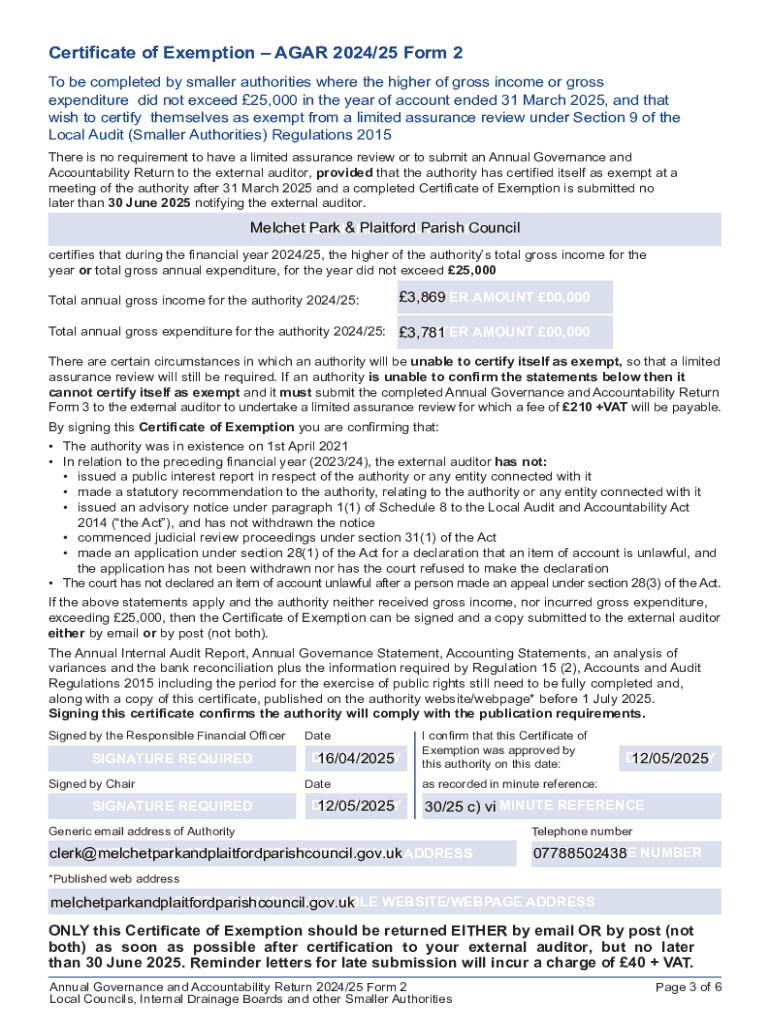

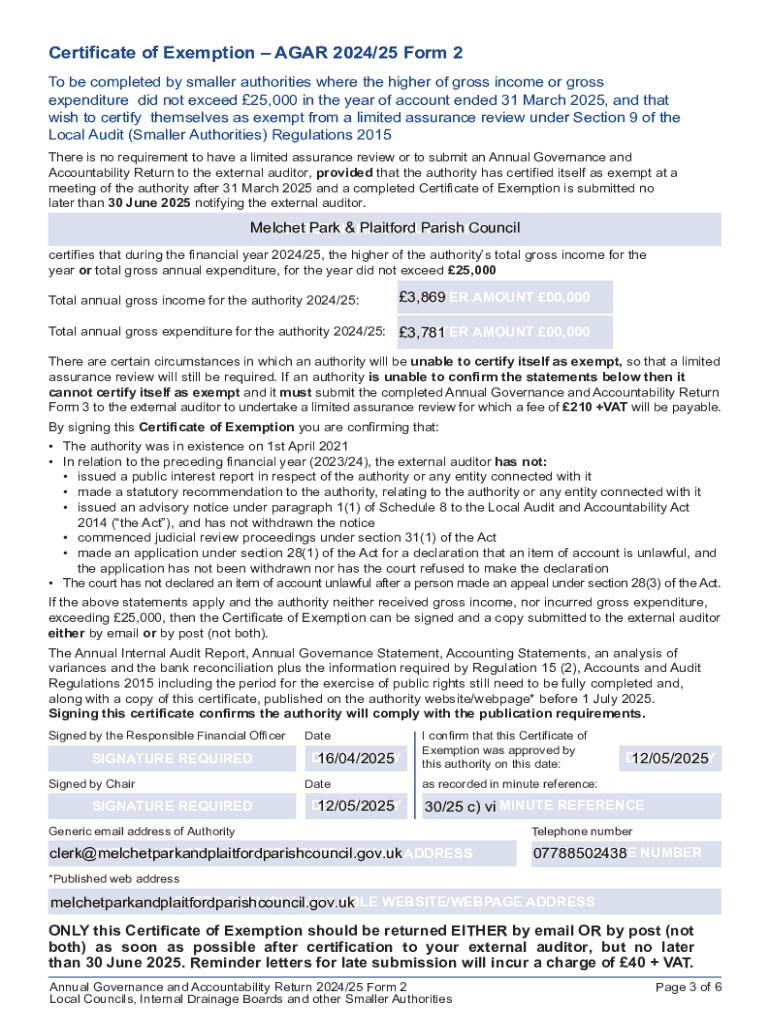

The Certificate of Exemption AGAR Form is a crucial document designed for organizations within the public sector and certain community-led entities. Its primary purpose is to declare that the organization is exempt from undergoing a detailed external audit and allows them to provide simpler accounts based on specific financial criteria.

This form is especially relevant for smaller organizations which may not have the resources to support the extensive financial requirements traditionally expected of larger entities. The Certificate of Exemption facilitates a pathway for these organizations to maintain governance and accountability without overwhelming them with bureaucratic constraints.

Eligibility criteria for using the AGAR Certificate of Exemption

To utilize the Certificate of Exemption AGAR Form, organizations must meet specific eligibility criteria, which often include financial thresholds and operational stipulations. For instance, local councils, charities, and community interest groups can apply for exemption if their income falls below a certain limit, which can vary annually based on inflation and regulatory changes.

Common use cases for exemption include smaller charities that generate limited contributions, village councils managing minimal budgetary lines, or community sports clubs. These entities typically require an easier method to meet governance obligations without the strain of comprehensive audit processes. The key here is transparency and ensuring that every organization, regardless of size, maintains accurate financial tracking.

Detailed breakdown of the AGAR form components

The AGAR Form consists of several components that ensure comprehensive documentation and transparency. The structure typically starts with identification information that includes the organization's name, address, and registration details. Following this, various financial data entries provide a summary of income and expenditure, illustrating financial health clearly and concisely.

Also, at the end of the form, signatures and certifications from responsible officers substantiate the authenticity of the details provided. Filling out these sections accurately is crucial, as they are essential for compliance and public trust.

To avoid common mistakes, organizations should always cross-check their data entry against previous records and ensure consistency. Moreover, frequently reviewing budgeting processes can assist in maintaining accurate figures for the AGAR form.

Tips for filling out the Certificate of Exemption AGAR form

Accuracy and compliance are key when completing the Certificate of Exemption AGAR Form. Adopting best practices for documentation and data entry can significantly improve the likelihood of a successful submission. For accurate filling of this document, here are some helpful tips:

Supporting documentation is equally vital. Attach any required evidentiary documents that reinforce your claims, such as bank statements or previous financial reports. This may include verification of the income threshold or evidence of low expenditures. Having these documents at hand can greatly streamline the review process.

Lastly, be aware of your timeline; submissions typically have clear deadlines that align with annual reporting periods. Late submissions can incur penalties or additional scrutiny, emphasizing the importance of remaining organized.

Editing and managing your AGAR form with pdfFiller

Managing your Certificate of Exemption AGAR Form becomes notably easier with pdfFiller. The platform offers seamless PDF editing capabilities and online collaboration tools that empower individuals or teams to handle their documentation processes effectively. Users can upload forms, add necessary edits, sign documents digitally, and collaborate with others in real-time, eliminating the hassle of traditional methods.

Utilizing pdfFiller is particularly beneficial when needing to revisit a form for revisions. Here’s a quick step-by-step guide on how to manage your AGAR Form with pdfFiller:

The benefits of using pdfFiller for managing your forms include increased efficiency, enhanced collaboration, and the ability to access your documents from anywhere. This is especially valuable for organizations that operate on tight schedules and require quick turnaround times for document submissions.

Common challenges and solutions when submitting your AGAR form

Organizations often encounter various challenges when submitting their Certificate of Exemption AGAR Form. One of the primary obstacles is navigating regulatory requirements, particularly when understanding the nuances imposed by local governing bodies. Often, requirements can differ significantly, and missing these intricacies can lead to application errors.

Addressing common errors is essential to a successful submission. Frequent pitfalls include incorrect financial disclosures, missing signatures, or failing to submit within required timelines. The best solutions for these issues stem from diligent preparation, including early completion and thorough reviews of all submissions before deadlines. Additionally, proactively reaching out to local officials for clarifications can prevent costly misunderstandings.

Key dates and deadlines for AGAR submissions

Understanding the annual timelines for filing the Certificate of Exemption AGAR Form is vital for effective organization and compliance. Each year, organizations must submit their AGAR alongside their financial statements, often by the end of the fiscal year or in compliance with specific local regulations. Being aware of these key dates allows organizations to prepare thoroughly and avoid last-minute scrambles.

It is important to note the impact of late submissions, which may include penalties or increased scrutiny from regulatory bodies. Organizations that consistently miss deadlines may also face reputational damage, highlighting the importance of adhering to timelines.

Assistance and advice for completing the AGAR process

When navigating the complexities of completing the Certificate of Exemption AGAR Form, organizations can benefit from various resources available for guidance and support. Consulting with professionals who specialize in nonprofit or community organization finances can clarify many questions, ensuring proper adherence to local laws and best practices.

Additionally, many community forums and official support channels can provide insights and answers to common inquiries related to the AGAR process. Engaging with these communities can aid in alleviating concerns, especially for first-time filers.

Trust and reliability in AGAR submission

Trust and reliability are paramount in the AGAR submission process, as they foster community confidence in organizations’ financial practices. The significance of reliable record-keeping cannot be overstated; organizations must ensure their financial statements accurately reflect their activities and status.

Building trust within the community hinges on transparency and effective communication. Several case studies illustrate how diligent AGAR compliance has not only upheld financial responsibility but has also enhanced public trust in organizations’ operations over time.

More information on the AGAR process

Navigating the Certificate of Exemption AGAR Form requires a foundational understanding, but it's also vital to address common inquiries. Many individuals wonder about what constitutes exemption, the conditions for compliance, and how changes in financial status might affect their eligibility.

For further obfuscation, links to additional resources and services provided by pdfFiller are invaluable for users seeking more guidance. These resources can offer templates, instructional videos, and frequently asked questions that address various aspects of the AGAR process. Engaging with these materials can pave the way to a smoother and more informed submission experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my certificate of exemption agar in Gmail?

Can I sign the certificate of exemption agar electronically in Chrome?

How do I complete certificate of exemption agar on an iOS device?

What is certificate of exemption agar?

Who is required to file certificate of exemption agar?

How to fill out certificate of exemption agar?

What is the purpose of certificate of exemption agar?

What information must be reported on certificate of exemption agar?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.