Get the free Certificate of Exemption – Agar 2024/25 Form 2

Get, Create, Make and Sign certificate of exemption agar

Editing certificate of exemption agar online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of exemption agar

How to fill out certificate of exemption agar

Who needs certificate of exemption agar?

Certificate of Exemption AGAR Form: A Comprehensive Guide

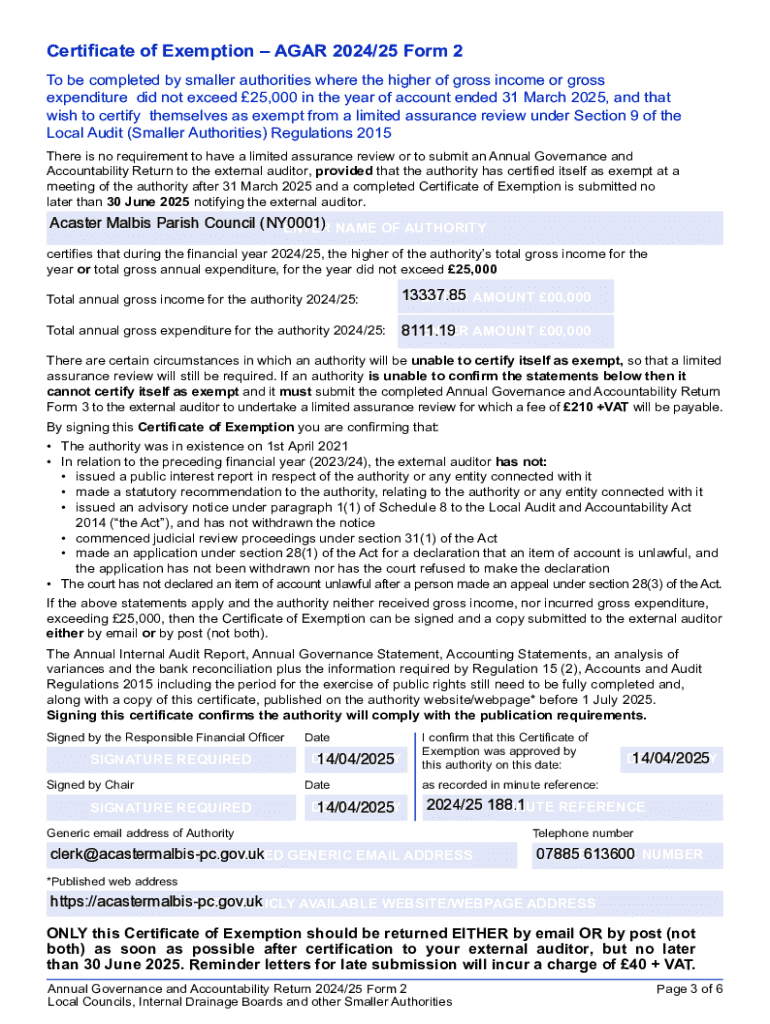

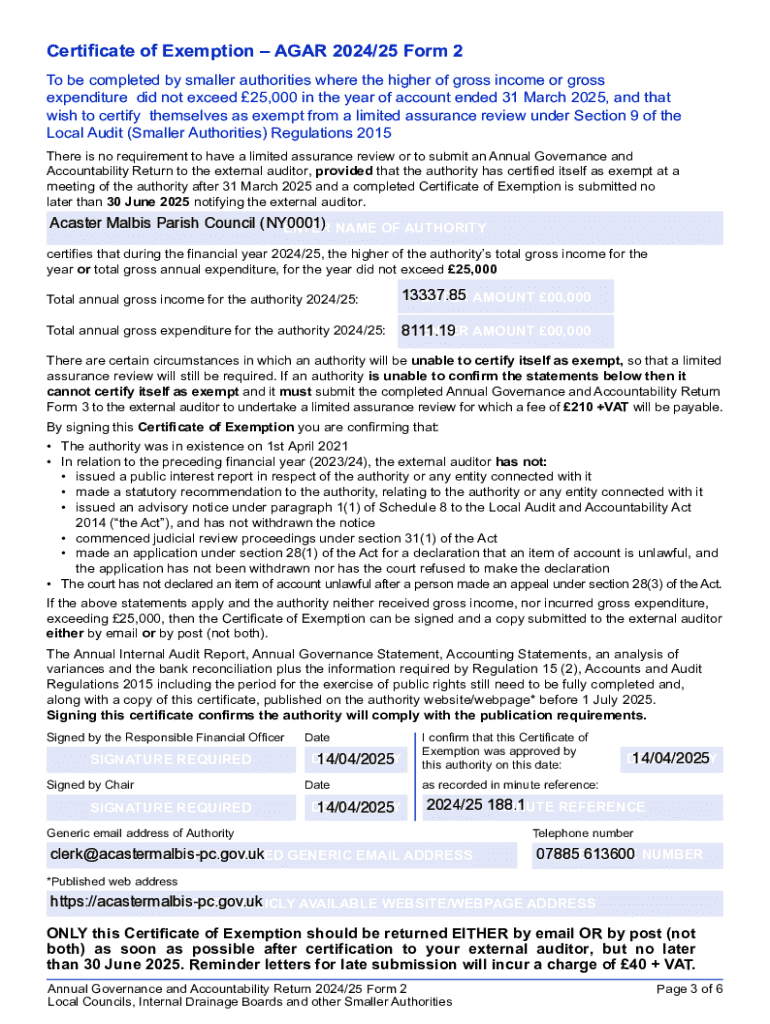

Understanding the certificate of exemption AGAR form

The Certificate of Exemption AGAR form serves as an essential document for organizations seeking to be exempted from audit requirements. It is particularly relevant for smaller entities that operate within certain financial thresholds. Understanding its purpose and significance can facilitate compliance with financial regulations while simplifying the reporting process.

The importance of this form cannot be overstated, as it allows qualifying organizations to avoid the time-consuming and often costly audit process. Additionally, it enhances transparency in governance and reporting, assuring stakeholders of financial integrity.

Eligibility criteria

Eligibility for exemption can vary based on a range of factors, including financial status, turnover, and the specific nature of the organization. To qualify for the Certificate of Exemption AGAR, your organization must meet two critical criteria: first, it must have an annual income below a predefined threshold—typically £25,000—and secondly, it should not possess significant assets.

It's crucial for organizations to evaluate whether they fit these eligibility criteria regarding both their income and financial structure. Additional aspects, such as whether the organization is a charity or involved in public service, can also influence exemption status.

Key components of the certificate of exemption AGAR form

The Certificate of Exemption AGAR form comprises several essential sections, which collectively provide a comprehensive overview of the organization's financial status. The key segments include the organization’s details, financial data summary, and the declaration section, where the responsible parties affirm the correctness of the information provided.

Each section requires specific details: from basic organizational information to in-depth financial figures. For example, in the financial data section, organizations must indicate their total income, expenditure, and asset values. Understanding the nuances of these sections is crucial for a smooth application process.

Common terminology used in the form

The form includes terms that may require clarification. For instance, ‘turnover’ refers to the total revenue generated by the organization in a given year, while ‘assets’ denote the value of resources owned by the organization. Familiarizing oneself with these terms ensures accurate filling of the form and helps prevent errors during submission.

Preparing to complete the certificate of exemption AGAR form

When preparing to fill out the Certificate of Exemption AGAR form, gathering all necessary documentation is crucial. Financial statements are essential, including your organization's income statement, balance sheet, and any other relevant records from the financial year. Organizing these documents before starting will streamline the completion process.

Once your documentation is organized, assess your organization's eligibility for exemption. This step can be simplified by following a clear, structured evaluation process. Check your organization’s annual income against the threshold and evaluate asset values to determine if you meet all criteria for exemption.

Step-by-step instructions to fill out the form

Section 1: Organization information

Filling in your organization's details correctly is essential. You'll need to include the name, address, and registration details. Ensure this information matches your official records to avoid discrepancies during processing.

Section 2: Financial data

Accurate reporting of financial information is crucial. Be prepared to provide precise figures regarding your total income and expenditure for the financial year. Most importantly, double-check these figures against your financial documents to ensure accuracy.

Section 3: Declaration

The final section requires a declaration, affirming that all provided information is correct to the best of your knowledge. This section may require signatures from authorized representatives of the organization. The declaration is essential because it holds legal implications and reinforces the credibility of your submission.

Common mistakes to avoid

Common pitfalls include inaccuracies in reporting financial data, omitting required signatures, or failing to keep documentation aligned with the submitted form. Simple mistakes can delay processing or lead to rejection. Therefore, thorough reviews of the form and associated documents are advisable.

Editing and finalizing the certificate of exemption AGAR form

Utilizing tools like pdfFiller can streamline the editing process. Users can upload their AGAR form directly to pdfFiller’s platform, enabling simple and efficient text corrections. The platform's user-friendly editing tools allow adjustments while ensuring document integrity.

Using pdfFiller for document editing

To begin editing, simply create an account on pdfFiller, upload the AGAR form, and use the intuitive editing interface to make necessary changes. It’s possible to highlight specific sections, add notes, or correct any errors before finalizing the document.

eSigning the form

Incorporating e-signatures through pdfFiller enhances the submission process. Electronic signatures are legally recognized and add convenience by allowing multiple parties to sign without physical presence. You can seamlessly integrate e-signatures into your form, ensuring a secure and efficient completion.

Submitting the certificate of exemption AGAR form

Once your Certificate of Exemption AGAR form is complete, it’s time to submit it. The submission can typically be completed either online or via postal service, depending on the requirements set by your local authority. It's essential to follow the specific instructions provided to ensure the form reaches the appropriate office.

Key deadlines must be adhered to, typically aligning with the fiscal year-end. For instance, if your financial year closes on March 31, ensuring submission before the specified deadline is crucial for compliance.

Confirmation of submission

To confirm successful submission of your form, retain copies of the submitted documents or any submission confirmation emails. Many organizations offer tracking systems to verify that forms have been received. This serves as proof in case any questions about your exemption status arise in the future.

Managing AGAR forms and keeping records

Best practices for post-submission management include maintaining organized records of all submitted documents, correspondence, and confirmations. This helps ensure you can easily access important information if required for future audits or evaluations.

Collaboration features on pdfFiller

Utilizing collaboration capabilities on pdfFiller can further improve transparency within your team. You can share the form with relevant stakeholders, allowing for real-time feedback and input for records and compliance. This ensures everyone stays informed and aligned throughout the management process.

FAQs about the certificate of exemption AGAR form

As with any regulatory process, several common questions often arise when dealing with the Certificate of Exemption AGAR form. For instance, organizations may wonder what steps to take if their eligibility status changes or if a submission is rejected by the authority.

Additional tools and resources

pdfFiller offers a robust set of interactive tools designed to assist users in managing their forms and deadlines effectively. These tools help track submission deadlines and provide reminders, ensuring compliance remains manageable throughout the financial reporting cycle.

Accessing customer support through pdfFiller for guidance on document creation and submission is straightforward. These resources help users navigate through any confusion or difficulties that may arise, ensuring a seamless experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit certificate of exemption agar from Google Drive?

How do I make changes in certificate of exemption agar?

How can I fill out certificate of exemption agar on an iOS device?

What is certificate of exemption agar?

Who is required to file certificate of exemption agar?

How to fill out certificate of exemption agar?

What is the purpose of certificate of exemption agar?

What information must be reported on certificate of exemption agar?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.