Get the free Check-off Remittance Report

Get, Create, Make and Sign check-off remittance report

How to edit check-off remittance report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check-off remittance report

How to fill out check-off remittance report

Who needs check-off remittance report?

Comprehensive Guide to the Check-off Remittance Report Form

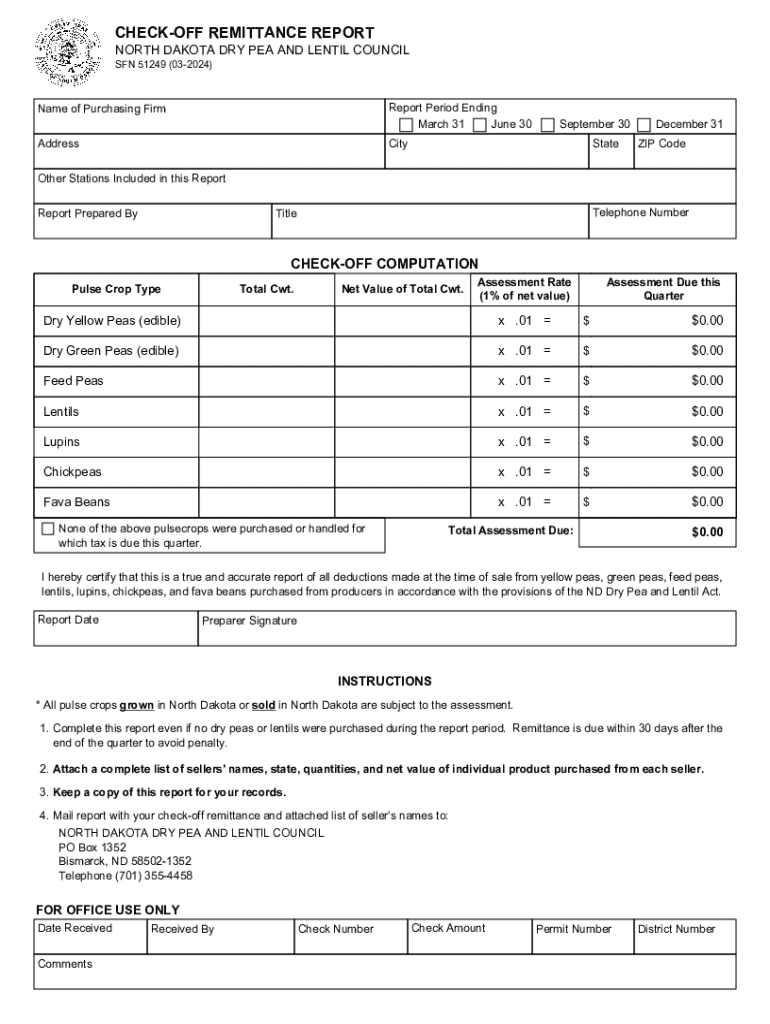

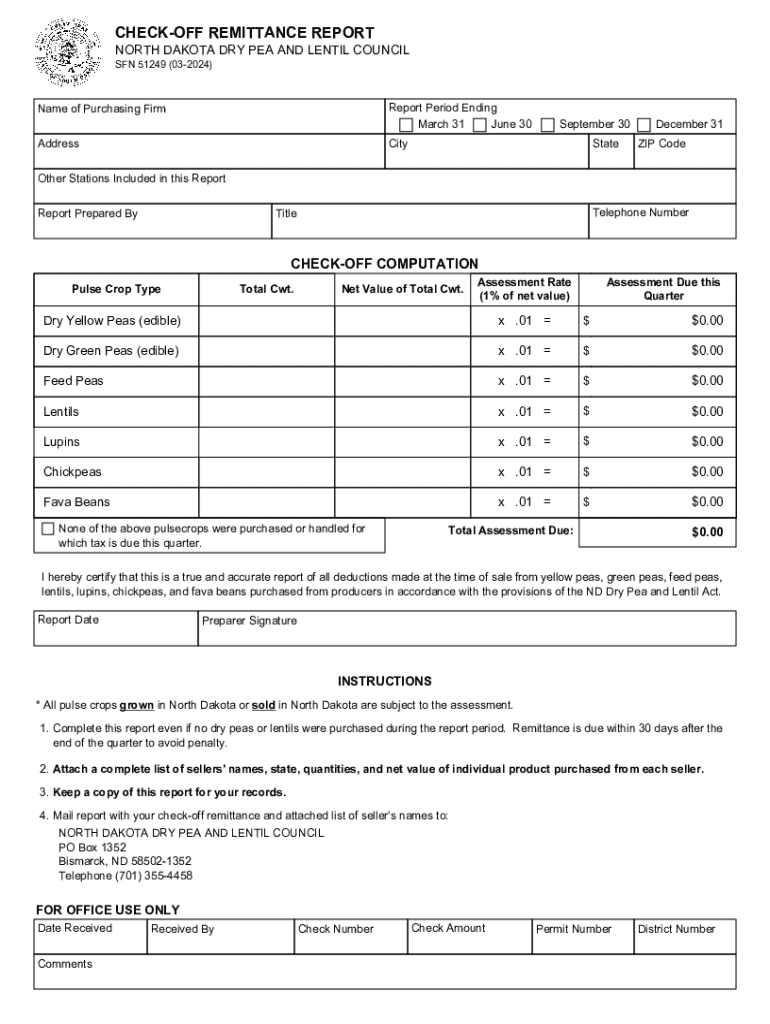

Understanding the check-off remittance report form

The check-off remittance report form is a crucial document used to manage financial transactions, primarily in environments where regular contributions or payments are made. It streamlines the reporting process, facilitating accurate payments and record-keeping. This form is essential for individuals, teams, and organizations who need an organized way to track their financial obligations and ensure transparency.

The purpose of the check-off remittance report form extends beyond mere documentation; it serves as an effective tool for maintaining financial integrity within various sectors including nonprofits, corporate finance, and personal management. Accurate completion of this form ensures that all stakeholders are aware of their contributions, reducing misunderstandings and potential disputes.

Key features of the check-off remittance report form

Modern check-off remittance report forms come equipped with various features that enhance usability. One prominent feature is the inclusion of interactive elements, such as checkboxes and dropdowns, which streamline the input process and minimize errors. These elements allow users to fill out forms quickly and accurately, dramatically improving the user experience.

Furthermore, the cloud-based access provided by platforms like pdfFiller allows users to edit, sign, and share this form from anywhere. This flexibility is essential in today’s fast-paced environments where teams may not be physically co-located. Lastly, collaboration tools integrated into these platforms facilitate team-based submissions, allowing multiple users to work on a single form simultaneously, ensuring comprehensive data collection.

Step-by-step guide to accessing the check-off remittance report form

Accessing the check-off remittance report form through pdfFiller is a straightforward process. Start by navigating the pdfFiller dashboard upon signing in. The intuitive layout makes it easy to locate the forms you need.

To find the check-off remittance report form, use the search bar or browse through the documents in the appropriate category. Once located, selecting the form brings up the option to view it and edit it without needing to download. Users can benefit from pre-filled information if they have previously filled out this form or if it is saved from a different session, saving valuable time.

Completing the check-off remittance report form

When completing the check-off remittance report form, attention to detail is essential. Each section has specific requirements that must be filled out correctly to avoid processing delays. The first section typically asks for personal details such as your name, address, and contact information, which helps in identifying the contributor.

The second section focuses on payment information including the amounts, dates of transactions, and specific references to what the payment pertains to. The final section may ask for any additional notes or context needed about the submission. Common errors to avoid include misplacing decimal points, omitting essential information, or failing to check the necessary boxes. Taking time to review your entries can prevent such mistakes.

Editing the check-off remittance report form

Once you have filled out the check-off remittance report form, you may find the need to edit it. pdfFiller offers a variety of editing tools that make modifying the document simple and efficient. Users can add text, images, or additional fields to capture every requirement accurately.

To remove or modify content, simply highlight the text or elements you wish to change. pdfFiller also allows you to save different versions of the document. This feature is not only useful for tracking changes but also helps maintain a record of previous entries for cross-reference.

Signing the check-off remittance report form

Security is paramount when signing the check-off remittance report form. Through pdfFiller, users can eSign documents securely and ensure that all signatures are legally binding. The platform provides several options for adding signatures, whether it's a single signatory or multiple witnesses are needed.

After signing, it’s crucial to verify the signatures for compliance purposes. Many organizations require additional steps or confirmations for internal documentation, and having a digital record ensures that all parties can validate their contributions easily.

Managing and storing the completed check-off remittance report form

After completing and signing the check-off remittance report form, proper management and storage are vital. pdfFiller offers multiple options for organizing your documents. Creating folders based on the different types of forms or departments can significantly enhance your document retrieval process.

Additionally, with cloud storage options, documents remain accessible at any time. Sharing with stakeholders is also simplified with customizable permission settings, enabling you to control who has access to view and edit documents efficiently.

Frequently asked questions about the check-off remittance report form

It's common to have questions while navigating the check-off remittance report form. One frequent concern is what happens if a mistake is made during completion. Fortunately, pdfFiller allows users to go back into their completed forms and make corrections before final submission.

For those needing to update a previously submitted report, it's advisable to contact your organization’s relevant department to clarify the process required for changes. For additional help, pdfFiller offers robust customer service that assists users with any technical issues or inquiries.

Resources and tools to optimize your experience

Utilizing the full potential of pdfFiller goes beyond simply filling out forms. The platform seamlessly integrates various useful features that help in optimizing your experience. For instance, templates for similar documents can save time and effort in drafting new forms that require similar information.

Additionally, pdfFiller provides a wealth of support resources and documentation that guide users through every aspect of form management. Familiarizing yourself with these tools empowers you to tackle document-related tasks more efficiently.

Related document management solutions

Beyond the check-off remittance report form, many other forms serve similar financial or compliance-related purposes. In choosing the right document management solution, consider your specific needs and the types of documents most frequently utilized within your organization.

Trends in document management indicate a growing emphasis on integrated systems that reduce redundancy while enhancing security protocols. As organizations evolve, keeping an eye on these advancements in e-signature processes and document management can inform better practices.

Departmental contacts and further support

Effective communication is key to resolving issues related to the check-off remittance report form. It is advisable to know which departmental contacts are useful for specific queries, ensuring that problems can be addressed promptly.

Additionally, connecting with other users through forums or support channels can provide valuable insights and tips. Leveraging shared experiences can enhance your understanding of how to manage forms more effectively.

Notes on compliance and record-keeping

Accurate record-keeping is fundamental to operating effectively within regulated environments. The importance of maintaining integrity in documentation should not be underestimated; it safeguards against audits and discrepancies.

Legal considerations surrounding the check-off remittance report form include compliance with local regulations that dictate how financial records must be kept and maintained. Implementing a solid record management strategy is essential to ensure documents are managed safely and effectively, minimizing risks of data breaches or loss.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send check-off remittance report to be eSigned by others?

Where do I find check-off remittance report?

How do I edit check-off remittance report in Chrome?

What is check-off remittance report?

Who is required to file check-off remittance report?

How to fill out check-off remittance report?

What is the purpose of check-off remittance report?

What information must be reported on check-off remittance report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.