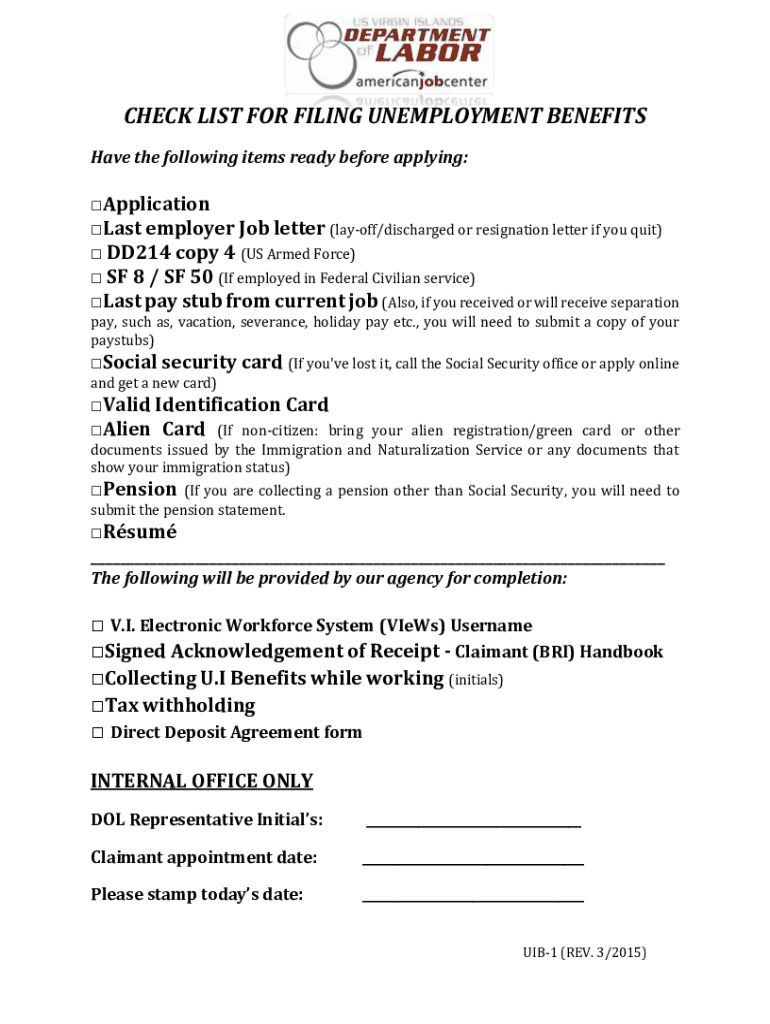

Get the free Check List for Filing Unemployment Benefits

Get, Create, Make and Sign check list for filing

Editing check list for filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check list for filing

How to fill out check list for filing

Who needs check list for filing?

Check list for filing form: A comprehensive guide to ensure smooth submissions

Understanding the filing process

Filing forms is a crucial aspect of many personal and professional tasks, from submitting tax returns to applying for permits. Each document requires precise attention to detail and adherence to specific guidelines. Without a systematic approach to document filing, individuals risk missing deadlines or providing inaccurate information, leading to potential penalties or delays.

Creating a structured checklist aids in streamlining the filing process. It serves as a roadmap, guiding users through the necessary steps and ensuring that no crucial detail is overlooked. This comprehensive guide aims to empower individuals and teams with a practical checklist approach to filing forms effectively.

Essential documents for filing any form

To file any form properly, specific documentation must be gathered. Each category of documentation serves a distinct purpose in verifying identity, establishing financial status, or providing historical data. Below are the essential types of documents required for successful form filing.

Creating your customized filing checklist

Creating a customized checklist is instrumental in personalizing the filing process according to individual needs. This approach not only ensures that all required documents are collected systematically but also enhances the accuracy and efficiency of the filing.

Follow these steps to create your tailored filing checklist:

Step-by-step instructions for completing your form

Completing forms accurately is pivotal. With pdfFiller, users can navigate to the specific form needed with ease. Here’s a step-by-step guide to ensure accuracy in your filing.

Strategies for editing and managing your forms

Managing multiple versions of a form can be daunting. However, leveraging pdfFiller’s editing tools vastly simplifies the process. Users can make instant modifications, ensuring that their documents are up-to-date.

Here are effective strategies for form editing and management:

eSignature: The key to paperless submissions

Adopting electronic signatures saves time and enhances efficiency in the filing process. With pdfFiller’s integrated eSigning tools, users can securely sign documents without the need for physical paperwork.

Consider these points regarding eSigning:

Common mistakes to avoid when filing

Mistakes during the filing process can result in failures to comply with regulations or missing out on valuable deductions. Awareness of common pitfalls can significantly improve filing outcomes.

Frequently asked questions (FAQs) about filing forms

Navigating the filing landscape can lead to numerous questions. Here are some of the most frequent queries individuals have regarding the filing process.

Tips and tools for a smooth filing experience

For a streamlined filing experience, employing the right tools and strategies is crucial. PdfFiller provides a robust suite of features designed for user convenience.

Staying informed: Updates and changes

Filing requirements can change annually, making it essential to stay informed about any updates that may affect your submission. Keeping abreast of these changes ensures compliance and aids in avoiding unnecessary complications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in check list for filing?

Can I create an eSignature for the check list for filing in Gmail?

How do I fill out check list for filing on an Android device?

What is check list for filing?

Who is required to file check list for filing?

How to fill out check list for filing?

What is the purpose of check list for filing?

What information must be reported on check list for filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.