Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Comprehensive Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

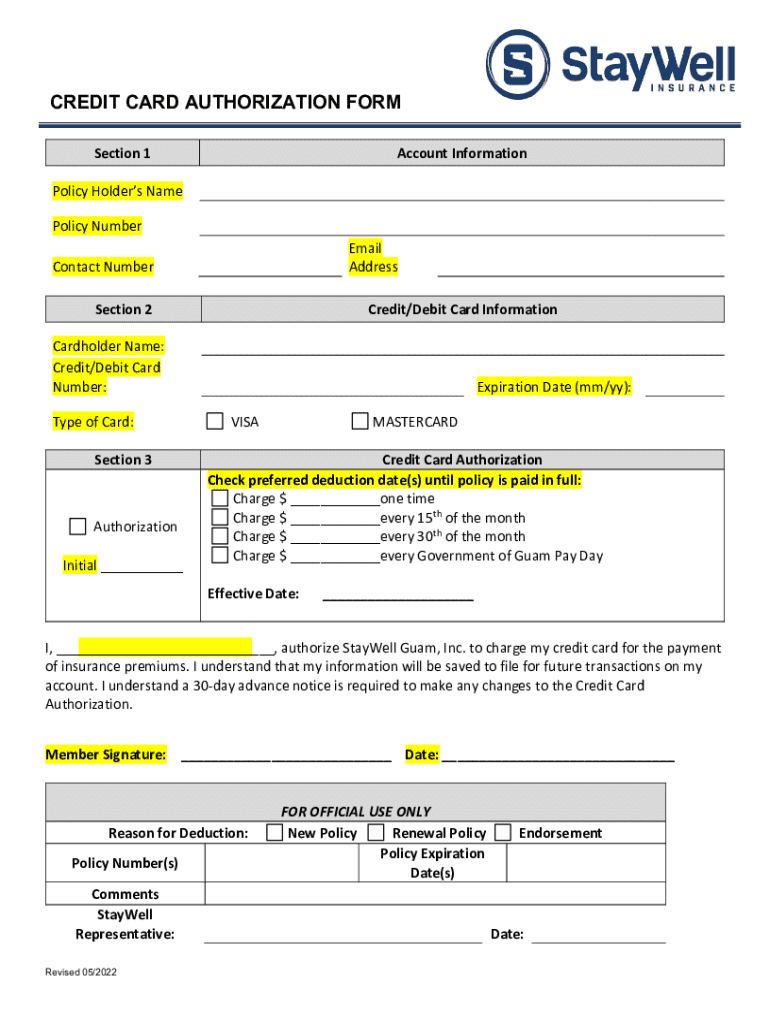

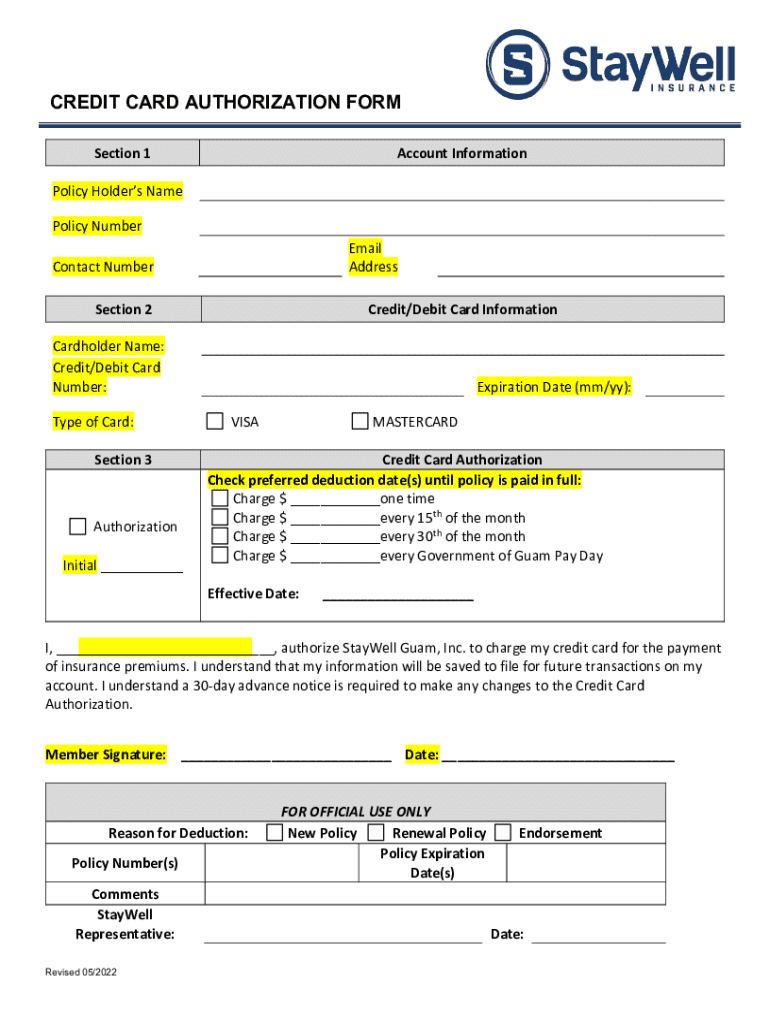

A credit card authorization form is a document that enables a merchant to securely obtain permission from a cardholder to charge their credit card for a specified amount. Its primary purpose is to facilitate the payment process while ensuring both parties are protected against unauthorized transactions.

The importance of these forms in payment processing cannot be overstated; they serve as a crucial checkpoint that helps in verifying the legitimacy of the transaction before any funds are transferred. This is particularly significant in preventing fraud and maintaining trust in commercial transactions.

Components of a credit card authorization form

To ensure the effectiveness and compliance of a credit card authorization form, it’s essential to include certain critical fields. The cardholder's name, card details, transaction amount, and merchant information are fundamental components that establish the basic agreement.

Moreover, obtaining a cardholder signature is necessary to validate the authorization legally. Including optional fields, such as the CVV number and billing address, can significantly enhance security and reduce the risk of fraudulent activity.

When and why to use a credit card authorization form

There are specific scenarios where credit card authorization forms prove invaluable. E-commerce transactions, for instance, utilize these forms to capture customer consent prior to charging their card, thereby minimizing disputes and chargebacks.

Subscription services often rely on credit card authorization forms to facilitate recurring payments. These forms ensure that merchants have obtained express consent to bill the cardholder at regular intervals.

Event ticketing operations utilize authorization forms to confirm purchases, enhancing customer trust while also providing a clear record of authorization should any disputes arise.

Best practices for implementing credit card authorization forms

Creating a user-friendly credit card authorization form is crucial for both the merchant and the customer experience. The design should be clear, straightforward, and avoid clutter. Utilizing a simple layout not only enhances user experience but also reduces abandoned transactions.

Furthermore, mobile optimization is essential. With more individuals shopping on mobile devices, a responsive design allows users to fill out the form conveniently, increasing conversion rates significantly.

Incorporating robust security measures should be a priority; this includes utilizing encryptions to protect sensitive information, ensuring that all data submitted via the form is securely stored.

Filling out a credit card authorization form: step-by-step guide

Before filling out a credit card authorization form, ensure you have all necessary information readily available. This includes your credit card details, transaction amount, and any applicable merchant identification. Be mindful to double-check every piece of information to prevent future disputes.

When filling out the form, start with the cardholder's name and ensure it matches the name on the credit card. Next, accurately input the card number and expiration date, followed by the intended transaction amount that corresponds with your purchase or service.

Provide the merchant’s information clearly, including their business name and contact details. Finally, sign the form confidently to authenticate the authorization.

Storing and managing completed authorization forms

After a credit card authorization form has been completed, it’s important to manage it securely. Best practices suggest storage methods that protect sensitive information. Physical forms should be stored in locked locations, whereas digital forms should utilize encrypted storage solutions.

Access control measures are vital, ensuring that only authorized personnel can view completed forms. This helps in maintaining confidentiality and adherence to data protection laws.

Legal obligations require businesses to retain completed authorization forms for a specific duration, often dictated by industry regulations and jurisdiction. Typically, this would range from one to seven years, depending on the nature of the transaction.

Managing chargebacks with authorization forms

Understanding chargebacks is crucial for any business. A chargeback occurs when a cardholder disputes a transaction, prompting the issuing bank to reverse it. This can significantly impact a merchant’s finances and reputation.

Credit card authorization forms play a vital role in preventing chargebacks by providing definitive proof that the transaction was approved by the cardholder. In the event of a dispute, the authorization form acts as a critical piece of evidence to uphold your case.

In instances where a chargeback does occur, it's essential to respond promptly. Gather all relevant documentation, including the original authorization form, transaction details, and correspondence with the customer. This documentation supports your claim and can help mitigate potential losses.

FAQs about credit card authorization forms

Many potential questions arise regarding credit card authorization forms. One common inquiry is whether businesses are legally required to use these forms for every transaction. While not mandated by law, they are highly recommended to protect against unauthorized charges and disputes.

What happens if a cardholder disputes a charge? The correct documentation, particularly the authorization form, is crucial in mediating the situation and can significantly influence the outcome of the chargeback process.

Integrating credit card authorization forms with other solutions

Efficient integration of credit card authorization forms with other business solutions enhances operational efficiency. Many platforms provide tunable tools to create, manage, and store these forms effortlessly.

Cloud-based platforms augment this process, allowing for secure access from anywhere. This mobility facilitates quick responses to chargebacks and queries while seamlessly keeping track of transactions.

Utilizing solutions such as pdfFiller, businesses can enhance their workflows by automating form completion, tracking submission status, and securing signatures, leading to a more streamlined operation.

Success stories: real-life applications of credit card authorization forms

Many businesses have successfully integrated credit card authorization forms into their practices, demonstrating their importance. For example, a local gym introduced an authorization form for monthly memberships, resulting in increased customer compliance and a noticeable drop in chargebacks.

In another case, an e-commerce retailer implemented these forms for all high-ticket items, which greatly reduced fraudulent claims and bolstered customer trust. The transparency that the authorization forms provided allowed customers to feel secure in their transactions.

Innovative features of pdfFiller for credit card authorization forms

pdfFiller stands out in its ability to optimize the creation and management of credit card authorization forms. With easy form creation capabilities, users can quickly design tailored forms that meet their specific needs, ensuring all essential elements are present.

Additionally, pdfFiller offers robust e-signing capabilities. This not only saves time but also enhances the credibility of the authorization as it provides an electronic signature confirming the cardholder's approval.

Collaborative tools within pdfFiller allow teams to work on forms together, enhancing communication and efficiency in the process. This is particularly useful for businesses that handle numerous transactions and need a reliable way to manage them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card authorization form to be eSigned by others?

How do I execute credit card authorization form online?

How do I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.