Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Comprehensive Guide to Credit Card Authorization Forms

Overview of credit card authorization forms

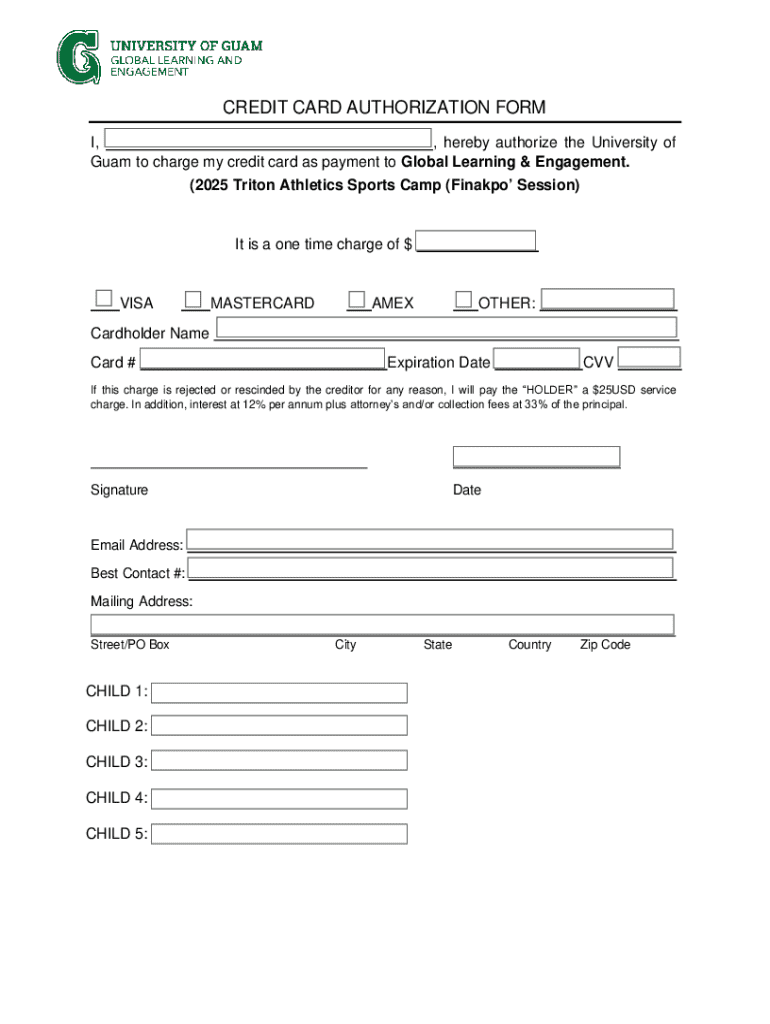

A credit card authorization form is a document that allows a merchant to charge a customer’s credit card for a specific transaction. This form includes essential details such as the cardholder’s name, credit card number, expiration date, and the amount to be charged. The primary purpose of this form is to ensure that the payment process is legitimate and authorized by the cardholder.

In the realm of financial transactions, the importance of credit card authorization forms cannot be overstated. They serve as a safeguard for businesses against fraudulent charges and unauthorized transactions. By obtaining authorization from a customer, businesses can mitigate the risks associated with chargebacks, enhancing their financial security.

What is a credit card authorization form?

A credit card authorization form typically includes several key elements. These include the cardholder’s personal information, the credit card details, the payment amount, and an authorization signature. It can be used for one-time transactions or recurring payments, depending on the business needs.

Authorization types vary; one-time authorizations are often used for single purchases, while recurring authorizations are utilized for subscription services. Comparing credit card authorization forms with other payment methods, such as direct bank transfers or digital wallets, reveals that forms offer a unique layer of security and transparency, further enhancing customer and merchant confidence.

Uses and applications of credit card authorization forms

Credit card authorization forms are crucial for any seller who processes card payments. They should be used whenever a customer intends to make a payment that involves storing their card details or when the transaction amount is significant. Examples include situations where services are provided before payment, like hotel reservations or car rentals.

Various industries employ credit card authorization forms, including eCommerce, hospitality, and subscription-based services. Scenarios requiring these forms typically involve online sales, where customers may not be physically present, or subscription services that bill customers on a recurring basis.

How credit card authorization forms help prevent chargeback abuse

Chargebacks occur when customers dispute a transaction, demanding a refund; they significantly impact businesses financially. In 2020 alone, chargeback losses in the U.S. reached approximately $19 billion. The utilization of credit card authorization forms plays a pivotal role in minimizing these risks. By providing a documented proof of consent for the transaction, businesses can defend against disputes more effectively.

Several case studies demonstrate the effectiveness of these authorization forms in reducing chargeback incidents. For example, a retail company that implemented rigorous authorization protocols saw a 30% decrease in chargeback claims after adhering to best practices for documentation and compliance.

Components of a credit card authorization form

When creating a credit card authorization form, certain components are essential for effective authorization. Required information typically includes the cardholder’s full name, billing address, credit card number, expiration date, payment amount, and a space for the authorization signature.

Optional components may also enhance the form’s effectiveness, such as the card verification value (CVV) and notes regarding transaction specifics or terms. Including thorough information in the form ensures that the transaction is clear and reduces the potential for disputes.

Managing credit card authorization forms

Proper management of credit card authorization forms is vital for businesses. Best practices involve securely storing signed forms to prevent unauthorized access and ensure data protection. Using a cloud-based platform, like pdfFiller, allows for safe storage and easy accessibility.

Generally, documents should be retained for a minimum of one year after the last transaction for compliance and auditing purposes. Additionally, businesses must adhere to relevant data protection regulations, such as GDPR or PCI DSS, to ensure absolute security and mitigate any legal implications.

FAQ about credit card authorization forms

Understanding legal obligations is essential for businesses considering credit card authorization forms. While not all merchants are required to use them, employing such forms is a best practice that offers significant legal protection. Over time, numerous questions arise regarding the limitations of these forms.

Steps to create and use a credit card authorization form

Creating a credit card authorization form can be a straightforward process when using a platform like pdfFiller. Businesses can easily begin by choosing a template that suits their needs. Following this, the next step involves customizing the form to include all relevant information specific to the business.

After the form is ready, it can be shared with customers digitally, ensuring convenience and accessibility. Capturing electronic signatures for verification is the next step, followed by managing completed forms through a secure cloud platform. This streamlined approach enhances efficiency and reduces paperwork.

Advanced features of pdfFiller for credit card authorization forms

pdfFiller provides numerous advanced features for creating and managing credit card authorization forms. Users benefit from interactive tools that allow for easy form creation and editing tailored to their business specifics. The standing of pdfFiller as a cloud-based platform also ensures that users can access their documents from any device.

Moreover, the eSigning capabilities allow for legally valid electronic signatures, which enhance the transaction authorization process. Collaboration tools enable teams to work together seamlessly while maintaining marketing insights and analytics to improve form utilization, ultimately driving better business decisions.

Integrating credit card authorization forms with other solutions

Integration capabilities enhance the usability of credit card authorization forms. By connecting these forms with payment gateways and customer relationship management (CRM) systems, businesses can streamline their operations. This approach not only saves time but improves accuracy and reduces errors.

Case studies show successful integration processes where businesses saw increased transaction efficiency and better customer relations after implementing such systems. The synergy between credit card authorization forms and additional solutions exemplifies how technology can drive business growth.

The future of credit card authorization forms

As digital payment processes evolve, credit card authorization forms are likely to see significant enhancements. Trends suggest a shift towards more secure, streamlined authorization processes to further protect businesses and consumers alike. Additionally, evolving payment technologies might necessitate a re-evaluation of existing authorization protocols.

Legislative changes are also on the horizon, which may impact how authorization forms are regulated. Staying ahead of these potential changes will be vital for businesses looking to maintain compliance and capitalize on the future landscape of digital transaction authorizations.

Key takeaways for users of credit card authorization forms

Utilizing credit card authorization forms simplifies payment processes while providing a low-risk environment for businesses. They not only enhance security and compliance but also maintain customer trust through transparency in transactions. Leveraging a cloud-based solution, such as pdfFiller, offers superior accessibility and document management capabilities.

By adopting best practices for form management and security, businesses can secure themselves against fraudulent activities and ensure that they are prepared for any potential transaction disputes.

Why choose pdfFiller for credit card authorization management?

Choosing pdfFiller for managing credit card authorization forms empowers users with comprehensive tools designed for efficiency. The platform supports collaborative document management while providing flexibility through cloud-based access. This ensures that users can effectively manage their documents, regardless of their location.

With advanced features like electronic signatures and customizable templates, pdfFiller stands out as a solution that enhances the payment authorization process, ultimately contributing to better business practices and satisfied customers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit card authorization form?

Can I create an electronic signature for the credit card authorization form in Chrome?

How do I complete credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.