Get the free Credit Card Authorization Form for Payment of Insurance Premium

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Comprehensive Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

A credit card authorization form is a document that allows a merchant to charge a customer's credit card for a specific transaction. It serves several purposes, primarily ensuring that the customer consents to the charge and providing a legal record of this consent. This form acts as a safeguard for both businesses and customers, creating trust in the transaction process.

The importance of credit card authorization forms cannot be overstated. For businesses, they are essential in preventing misunderstandings related to service alterations or additional fees. For customers, these forms provide peace of mind, knowing their payment information is handled securely and their financial agreements are honored. Such forms are commonly used in various scenarios, including subscription services, hotel bookings, and any e-commerce situation where a card-not-present transaction occurs.

Benefits of using a credit card authorization form

Using a credit card authorization form comes with numerous benefits that significantly enhance the transaction experience for both parties involved. One sizeable benefit is its role in preventing chargeback abuse. Chargebacks can lead to financial losses and processing fees for businesses; having an authorization form minimizes such risks by providing documented proof of customer consent.

Moreover, credit card authorization forms bolster security measures against fraud. With identity theft on the rise, implementing these forms is a proactive approach businesses can take to protect themselves and their customers. Furthermore, authorization forms streamline payment processes by clarifying payment obligations. This is especially crucial in settings such as e-commerce, where the customer and merchant may never meet face to face.

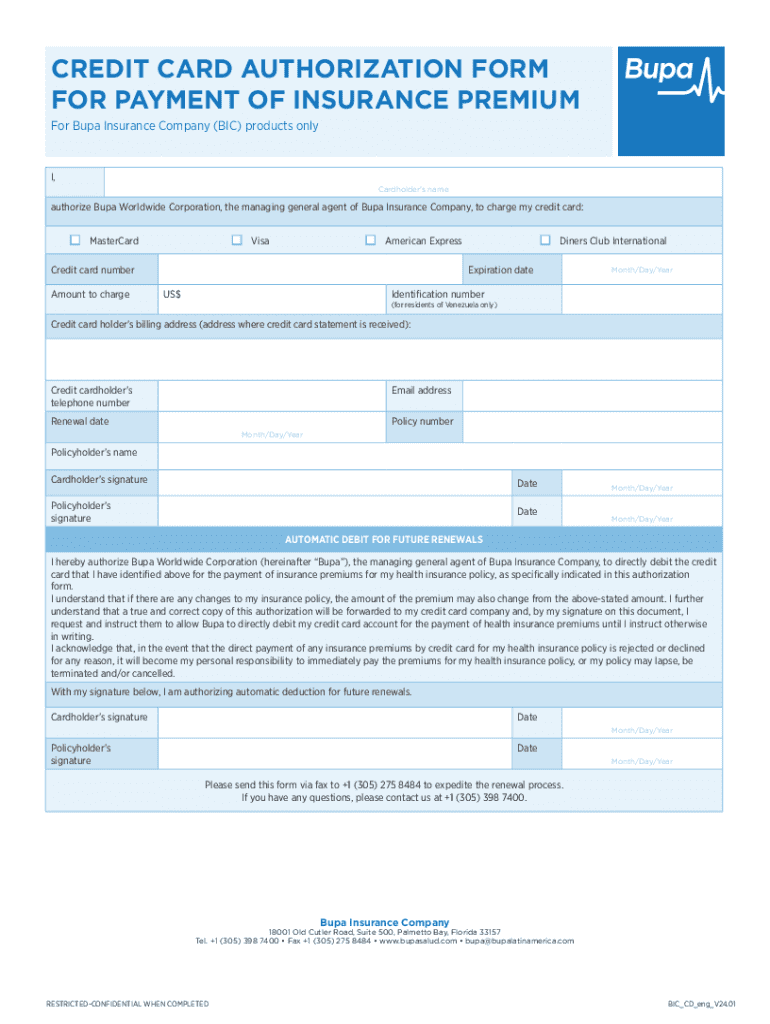

Key components of a credit card authorization form

A well-structured credit card authorization form includes several essential details that safeguard both parties in a transaction. Firstly, cardholder information is crucial; this includes the name on the card, billing address, and contact details. Secondly, payment details must be clearly specified, including the transaction amount, date, and description of the goods or services being purchased.

Additionally, merchants should include their information in the form, such as business name, address, and contact details. Legal disclaimers and conditions are also significant; these establish the terms of use and provide clarity regarding any potential disputes. Finally, signature requirements are critical, as they legally bind the cardholder to the authorization provided, verifying that consent has been given for the transaction.

How to fill out a credit card authorization form

Filling out a credit card authorization form accurately ensures that the transaction proceeds smoothly. Here is a step-by-step guide to completing the form:

Accuracy is paramount; therefore, take extra care in entering all information. Double-check card numbers and expiration dates to avoid transaction errors which can lead to delays or complications.

Customizing your credit card authorization form

Customization of credit card authorization forms can enhance their effectiveness and align them more closely with specific business needs. Using pdfFiller, businesses can easily edit and personalize forms to suit their branding or particular transaction types. This tool offers flexibility in design and layout, allowing users to create forms that resonate more with their customer base.

Moreover, utilizing templates can significantly increase efficiency, especially for businesses that frequently handle transactions. Templates save time while ensuring that vital information is consistently collected. Interactive tools offered by pdfFiller provide best practices for form creation, enabling users to design forms that comply with industry standards and enhance user experience.

Managing and storing credit card authorization forms

Effective management and secure storage of credit card authorization forms are critical, given the sensitivity of the information they contain. Businesses should implement best practices to store sensitive customer information securely, protecting it from unauthorized access or potential breaches. Encryption and secure cloud storage solutions can significantly mitigate risks associated with data theft.

Compliance with regulations such as the Payment Card Industry Data Security Standard (PCI DSS) is essential when managing credit card details. These regulations outline obligations for businesses in handling credit card information securely. Additionally, businesses should determine an appropriate duration for retaining signed forms; generally, retaining documents for one to three years post-transaction is a recommended practice.

Special considerations for different businesses

Different businesses may have unique needs regarding credit card authorization forms. For instance, sellers using Square or other mobile payment platforms should incorporate authorization forms to prevent disputes over charges and improve customer trust. In retail environments, forms can ensure that customers understand return policies and charge amounts during transactions.

Additionally, services such as event planning or subscription services often utilize these forms to secure payment commitments ahead of service delivery. By understanding how these forms work within specific sectors, businesses can tailor their strategies to optimize customer satisfaction while minimizing risks.

FAQs about credit card authorization forms

Download templates to get started

To kickstart your process with credit card authorization forms, downloading templates can streamline your efforts. pdfFiller offers a range of templates that are easily accessible. Users can quickly create, edit, and share completed forms without hassle, allowing for a smooth transaction process.

Instructions for editing and sharing are user-friendly, ensuring that you can customize the document to suit your business needs swiftly, without needing extensive design skills or prior experience.

Related topics to explore

Conclusion and next steps

Implementing a credit card authorization form isn't just a best practice; it's a crucial step toward protecting your business and providing customers confidence in their transactions. The integration of such forms into your payment processes can significantly benefit your operations.

Utilizing pdfFiller enhances the document management experience, empowering users with tools to edit, eSign, and collaborate from a single platform, ultimately making transactions smoother and protecting both sides in the agreement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card authorization form directly from Gmail?

How do I make edits in credit card authorization form without leaving Chrome?

How can I fill out credit card authorization form on an iOS device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.