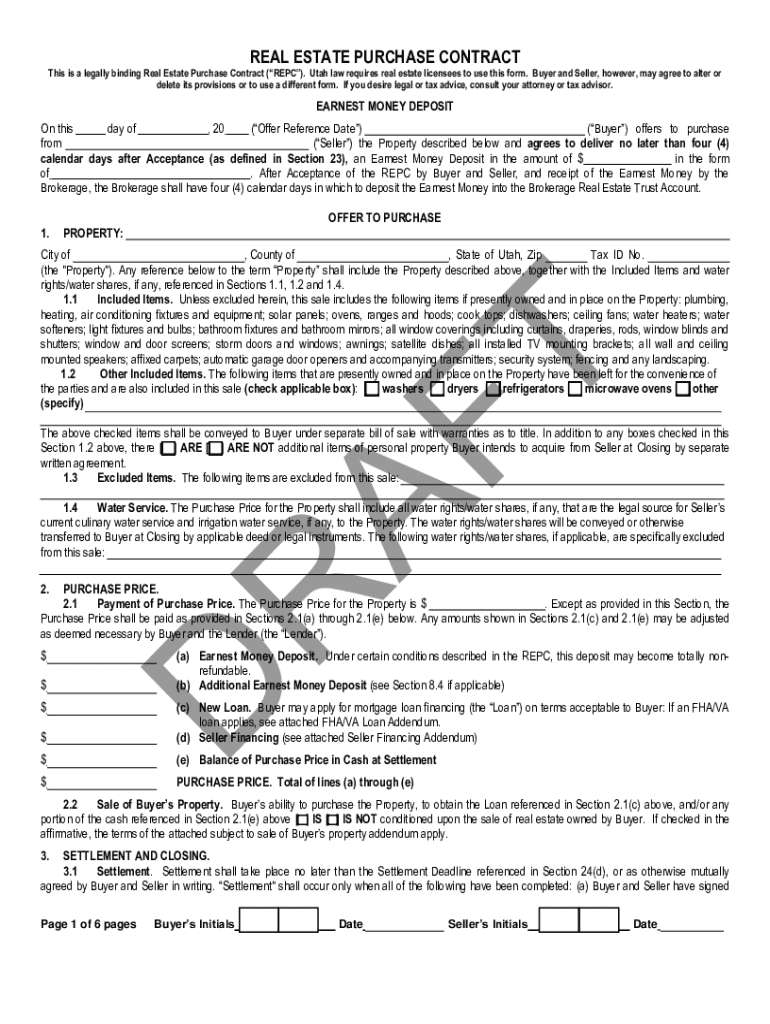

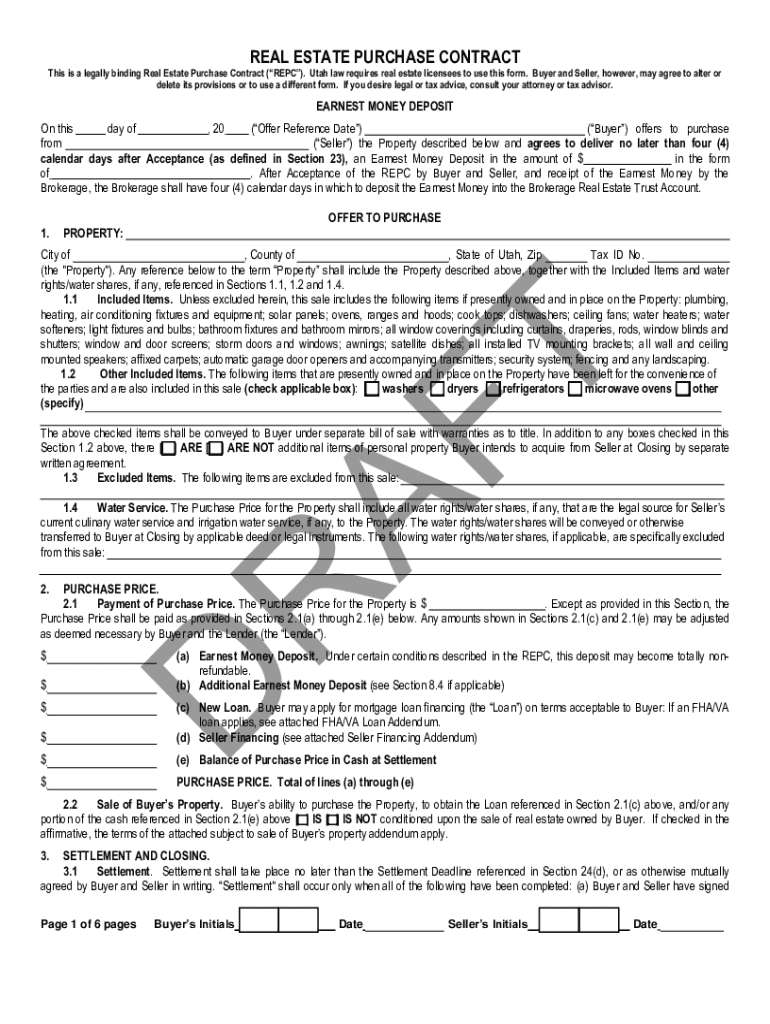

Get the free Real Estate Purchase Contract

Get, Create, Make and Sign real estate purchase contract

How to edit real estate purchase contract online

Uncompromising security for your PDF editing and eSignature needs

How to fill out real estate purchase contract

How to fill out real estate purchase contract

Who needs real estate purchase contract?

A Comprehensive Guide to Real Estate Purchase Contract Forms

Understanding the real estate purchase contract

A real estate purchase contract is a legally binding agreement between a buyer and a seller detailing the terms under which a property will be sold. This document serves as a foundation for real estate transactions, outlining essential elements such as the sale price, property description, terms of payment, and contingencies that must be met for the sale to proceed.

The importance of having a purchase contract cannot be overstated. It protects the rights of both parties by ensuring that all terms are agreed upon and documented. Without this formal agreement, misunderstandings can arise, potentially leading to disputes or, worse, financial loss.

Key components of the contract typically include the identities of the buyer and seller, a detailed description of the property, the purchase price, financing details, earnest money requirements, and any contingencies that must be satisfied before closing.

Types of real estate purchase contracts

Different types of real estate transactions require different purchase agreements, tailored to their specific needs and circumstances.

Steps to create your real estate purchase agreement

Crafting a solid real estate purchase agreement requires several critical steps.

Filling out the real estate purchase contract form

Completing the real estate purchase contract form can seem daunting, but a step-by-step approach simplifies the process. Follow these guidelines to ensure accuracy and compliance.

Common mistakes to avoid when drafting a purchase agreement

Even seasoned professionals can make mistakes when drafting a real estate purchase agreement. Awareness of common pitfalls can help ensure a smooth transaction.

Frequently asked questions (FAQs)

You may have some lingering questions about real estate purchase agreements. Here are some of the most frequently asked questions.

Managing your real estate purchase agreement with pdfFiller

Managing your real estate purchase agreement effectively can streamline the entire process. Using a cloud-based platform like pdfFiller offers numerous advantages.

State-specific considerations in real estate purchases

Real estate laws vary significantly from state to state, affecting purchase agreement requirements. Understanding these distinctions is crucial.

Next steps after signing your real estate purchase agreement

Once the real estate purchase agreement is signed, attention turns toward the closing process and transitioning to new ownership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify real estate purchase contract without leaving Google Drive?

How can I send real estate purchase contract for eSignature?

How do I edit real estate purchase contract straight from my smartphone?

What is real estate purchase contract?

Who is required to file real estate purchase contract?

How to fill out real estate purchase contract?

What is the purpose of real estate purchase contract?

What information must be reported on real estate purchase contract?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.