Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form: A Comprehensive How-to Guide

Understanding credit card authorization forms

A credit card authorization form serves as a document that allows businesses to charge a customer's credit card for a specified amount of money. This process is crucial for ensuring that the transaction is legitimate and that the cardholder has granted permission for the charges. Without proper authorization, businesses could face significant financial risks, including chargebacks and fraudulent transactions.

Authorization is vital in financial transactions, as it protects both customers and businesses. For instance, it helps prevent unauthorized charges and maintains a record of what is agreed upon between the two parties. There are different types of forms, such as single-use forms for one-time charges and recurring authorization forms for subscriptions or ongoing services.

Benefits of using credit card authorization forms

Using credit card authorization forms offers numerous benefits to businesses. Firstly, it enhances fraud prevention by certifying that the cardholder has authorized the transaction. This mitigates the risk of chargeback abuse, where customers might dispute legitimate charges.

To illustrate, a case study involving an e-commerce company revealed that the use of authorization forms reduced chargebacks by over 30%. Customers had a clear understanding of what they were being charged for, which minimized disputes.

Additionally, these forms allow better control over transactions by helping businesses properly manage recurring payments. This is especially important for subscription-based models, where ensuring timely billing is crucial. Enhanced record-keeping further allows for smoother financial audits and transparency.

Finally, using a credit card authorization form builds customer trust. When customers see that a business takes steps to ensure their security, they feel more confident about providing their payment details, leading to an improved customer experience.

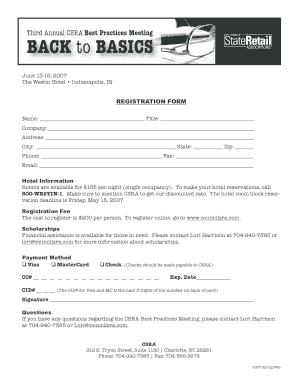

Key components of a credit card authorization form

A well-structured credit card authorization form should contain several essential elements. Firstly, it must include the cardholder's name and their contact information to verify who is making the authorization. Secondly, a clear statement of the payment amount along with a description of the services being rendered or products being purchased should be explicitly stated.

Moreover, specific card information, including the card number and expiration date, is critical. An optional yet advisable field to include is the Card Verification Value (CVV) to enhance security. Additionally, a signature line for the authorizer's signature and date is another key aspect, providing a physical confirmation of consent.

Best practices for creating a credit card authorization form

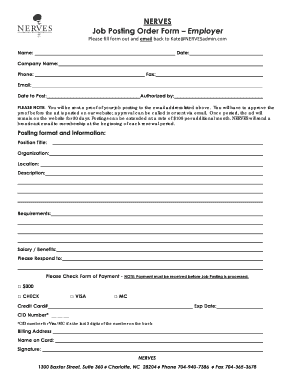

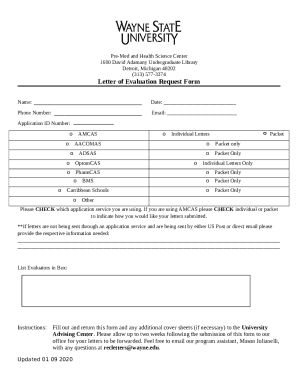

When creating a credit card authorization form, customization is crucial. Utilizing tools like pdfFiller allows businesses to create personalized forms that align with their branding. This not only enhances professionalism but ensures legal compliance, adapting to specific regulation stipulations across jurisdictions.

Additionally, clear instructions on how to complete the form should be incorporated. Guiding customers in filling out the authorization form helps minimize errors, and highlighting key areas for attention can prevent any misunderstandings regarding what the authorization entails.

Using credit card authorization forms effectively

Understanding when to use a credit card authorization form is key for effective usage. Authorization forms are essential in scenarios involving either one-time charges or recurring payments. For businesses offering services that automatically bill customers, having a robust authorization form helps in mitigating financial risks.

Conversely, there may be instances where authorization is optional, such as low-risk transactions. Therefore, determining the need for an authorization form boils down to the specific business context and the relationship with the customer.

Integrating these forms with your payment processing system is another best practice. Many reliable payment gateways, such as Stripe or PayPal, support authorization forms, facilitating smoother transactions. Additionally, considering automation and digital solutions streamlines the authorization process, making it efficient and user-friendly.

Managing authorizations post-collection

Once a credit card authorization form has been collected, secure storage of these documents becomes crucial. Simple oversight can lead to sensitive customer information falling into the wrong hands. Utilizing secure storage methods, such as encrypted cloud solutions, ensures protection.

Additionally, compliance with data security regulations, such as PCI DSS, is not just recommended but often required. Maintaining proper protocols protects not only your business but also fosters customer trust. It's also essential to consider recommended timeframes for retaining signed forms to mitigate legal risks while efficiently managing document space.

Frequently asked questions (FAQ) about credit card authorization forms

Many individuals may wonder whether they're legally required to use a credit card authorization form. While it isn't a universal law, businesses operating in industries with higher fraud rates are often advised to implement them to reduce financial risk.

Another common query revolves around the absence of a CVV space on some forms. Certain businesses may eliminate this field to comply with PCI regulations that restrict the storage of CVV information beyond initial authorization.

Regarding what happens if a customer closes their account after authorization, businesses may face complications when attempting to charge that card. It's crucial to manage these situations proactively to avoid disputes. Finally, having a credit card authorization form can greatly assist in handling chargebacks, providing documented proof that a transaction was authorized.

Leveraging technology for credit card authorization

Using technology, especially cloud-based document platforms like pdfFiller, enhances the efficiency of credit card authorization processes. The advantages include easy access, collaboration features, and e-signing options that eliminate the need for physical paperwork.

Additionally, utilizing tools and features within these platforms can streamline your authorization processes. Incorporating existing business software with integrated solutions means a seamless workflow, reducing time spent on administrative tasks and promoting effective organization.

Real-world applications and examples

Successful implementations of credit card authorization forms can be seen across various industries. For instance, subscription services often utilize these forms to ensure automatic billing is authorized, which significantly reduces payment issues. A testimonial from a fitness studio indicated that switching to a digital credit card authorization form resulted in a 50% drop in payment-related disputes.

Similarly, e-commerce platforms have reported higher customer satisfaction ratings when they provide clear authorization forms before charging. The ease of use and transparency in billing helped to build consumer trust, contributing to increased sales.

Conclusion

Credit card authorization forms play a crucial role in ensuring secure transactions between customers and businesses. By adopting these forms, businesses can protect themselves against fraud while enhancing customer trust. Utilizing pdfFiller provides an efficient way to manage these documents seamlessly, ensuring compliance with legal standards and promoting a secure transaction environment.

Embracing credit card authorization forms not only safeguards your operations but also elevates your brand's credibility. It’s an investment in the integrity of your financial transactions and the trust of your customers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute pdffiller form online?

How do I edit pdffiller form online?

How do I edit pdffiller form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.