Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

A Comprehensive Guide to Form 990 for Nonprofits

Understanding Form 990

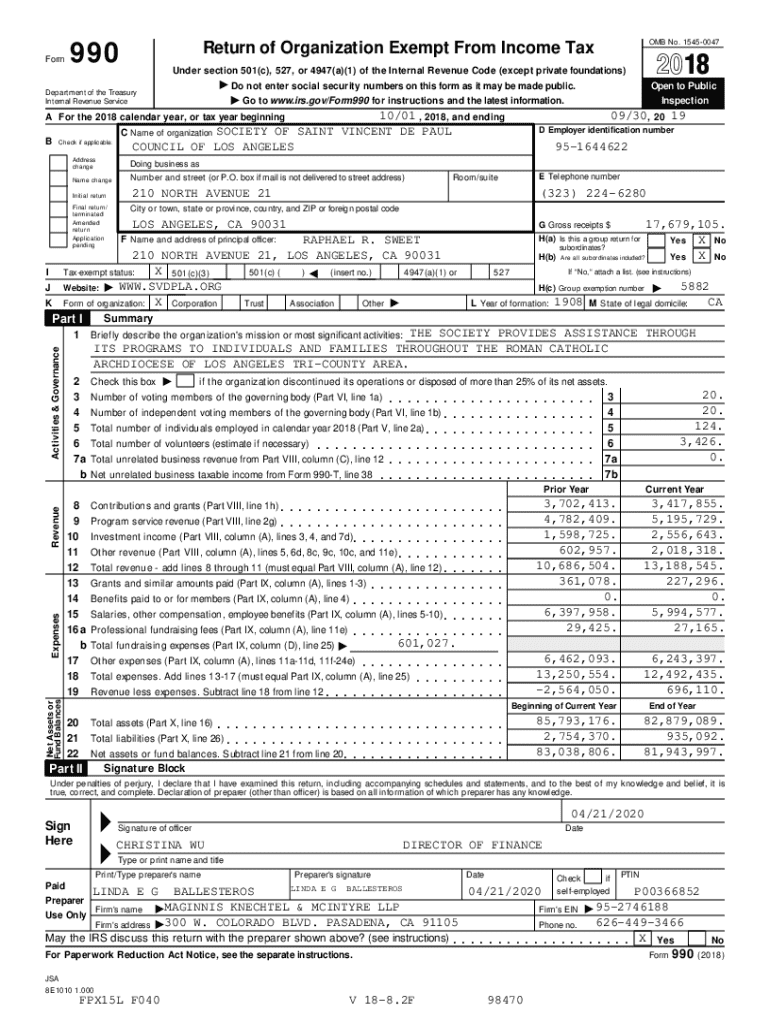

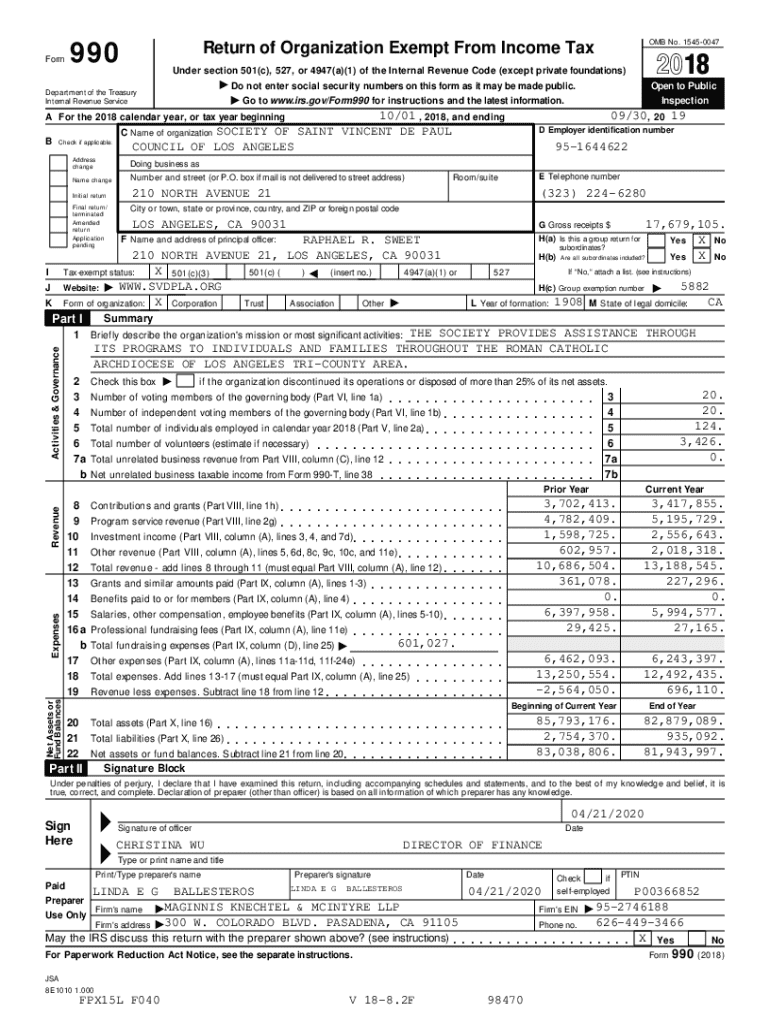

Form 990 serves as the annual information return for tax-exempt organizations, providing the IRS and the public insight into a nonprofit's financial health, governance practices, and compliance with federal regulations. Primarily, the purpose of the form is to ensure transparency and accountability within the nonprofit sector. Form 990 captures essential financial data about revenue, expenses, and activities of nonprofit entities, which can be critical for stakeholders, including donors and regulators.

For nonprofit organizations, filing Form 990 is vital not just for compliance but also for establishing credibility and trust with supporters and the general public. The form aids in the evaluation of the organization’s financial management and operational effectiveness, making it an essential tool for stakeholders wishing to understand the organization's impact and sustainability.

Variants of Form 990

There are several variants of Form 990, each tailored to suit different types of nonprofit organizations and their financial situations. The main forms include Form 990, Form 990-EZ, and Form 990-N. Understanding the differences among these forms is crucial for organizations to ensure they are filing correctly based on their revenue and operational size.

Form 990 is designed for larger organizations with more complex finances, while Form 990-EZ simplifies reporting for smaller nonprofits with annual revenues under $200,000 but over $50,000. Lastly, Form 990-N, often referred to as the e-Postcard, is a succinct form meant for organizations with gross receipts that do not exceed $50,000 in a year. Each form requires different levels of detail and has unique submission criteria.

Filing requirements

Determining who must file Form 990 largely depends on the size of the organization and its structure. Generally, all tax-exempt organizations with gross receipts over $50,000 are required to file some version of Form 990. However, certain entities, such as religious organizations and some government entities, may be exempt from this requirement, which highlights the importance of understanding the IRS guidelines.

The frequency of filing is annually, with deadlines pertinent to the organization’s tax year-end. Nonprofits typically have until the 15th day of the fifth month after the close of their fiscal year to submit their Form 990. For example, if your fiscal year ends on December 31, the filing deadline would be May 15. Organizations should also be aware of specific exemptions or grace periods that may apply in certain situations.

Preparing for filing Form 990

Before diving into the completion of Form 990, nonprofits need to gather various documents that will support the financial and operational data reported on the form. Required documentation typically includes financial statements, balance sheets, and records of contributions and expenditures. Organizations should also ensure that they have their governance documents, such as bylaws and board meeting minutes, ready for inclusion.

Key areas to focus on when compiling information for Form 990 include understanding your organization’s revenue streams, detailing expenses accurately, and ensuring that all required disclosures are prepared. A proactive approach to record-keeping will greatly enhance accuracy and streamline the filing process, making it crucial for organizations to adopt robust systems for tracking financial transactions and operational activities.

Step-by-step guide to filling out Form 990

Completing Form 990 requires attention to detail and a clear understanding of the various sections included in the form. Start with the Identification Section, where the organization's basic information is provided, such as its legal name, address, and Employer Identification Number (EIN). From there, move to the Financial Statements section, which requires detailed reporting on total revenue, expenses, and net assets.

Key areas like Functional Expenses should clearly outline how funds are allocated towards programs, management, and fundraising. It’s essential to provide accurate figures to reflect the organization's operations accurately. The Governance, Management, and Disclosure section requires insights into the structure, policies, and practices of the nonprofit, including board composition and oversight procedures. It’s beneficial to familiarize yourself with common mistakes organizations make, such as misclassifying expenses or omitting critical information.

eSigning and submitting Form 990

With the growing trend toward digital solutions, electronic filing of Form 990 has become a popular and efficient option. Nonprofits can e-file their Form 990 directly through the IRS e-File system or through authorized e-File providers. Utilizing an intuitive platform like pdfFiller allows organizations to complete and eSign Form 990 seamlessly, ensuring all information is processed securely and promptly.

When eSigning your Form 990 using pdfFiller, the process is straightforward. After filling out the required fields, you can upload your verified eSignature, thus minimizing the need for paper-based submissions. Organizations should also consider their submission method—e-filing is generally faster and more convenient than traditional paper filing, which may involve mailing physical documents to the IRS.

Post-filing considerations

After submitting Form 990, organizations should expect some level of scrutiny given the form's public nature. Form 990 is available for public inspection, and stakeholders might review it for transparency regarding financial practices and governance. Organizations should also be prepared to respond to any inquiries from the IRS, which might arise as part of their compliance monitoring efforts.

Understanding the public disclosure regulations is crucial for nonprofits; Form 990 provides vital information that beneficiaries, donors, and grantmakers use to assess the organization. Organizations should maintain organized records post-filing to facilitate any potential audits or follow-up requests from the IRS, ensuring they are always prepared to address concerns raised by the public or regulatory bodies.

Penalties for non-compliance

Non-compliance with Form 990 filing requirements can lead to significant penalties, including monetary fines and loss of tax-exempt status. Late filings are subject to fines, which can accumulate quickly if not addressed timely. Nonprofits must also be cautious of inaccuracies in their filed form, as they could trigger further scrutiny or complications with IRS regulations.

To avoid these potential pitfalls, organizations should establish a compliance calendar that marks key filing dates and ensures that all documentation is prepared in advance. Regular training sessions on IRS guidelines for staff involved in the filing process can also help mitigate risks. When in doubt or facing complexities, seeking professional assistance from tax advisors familiar with nonprofit regulations can be invaluable in ensuring compliance.

Public inspection regulations

Public inspection of Form 990 is an essential feature that promotes transparency in the nonprofit sector. Organizations must make their Form 990 available for public inspection, either by filing it with the IRS or making it available upon request. This practice not only helps facilitate accountability but also allows researchers, grantmakers, and the public to access information about the organization’s activities and finances.

For stakeholders looking to evaluate nonprofits, accessing Form 990 of other organizations offers insights into financial health, governance practices, and how effectively funds are utilized. Nonprofits should remain proactive about complying with public inspection regulations and consider how the information disclosed on their Form 990 can influence public perception and donor trust.

Using Form 990 for assessment

Form 990 offers a wealth of information that stakeholders can utilize to evaluate a charity’s performance, financial stability, and operational efficiency. By dissecting the financial sections of Form 990, interested parties can analyze how effectively a nonprofit allocates its resources, manages expenses, and reaps revenues. Nonprofits that report strong financial health stand to gain a competitive edge in attracting funding and support.

Moreover, stakeholders can leverage pdfFiller tools when conducting comparative analyses of multiple nonprofits’ Form 990s. By comparing the financial metrics, governance structures, and programmatic activities, funders and researchers can make informed decisions about their contributions and engagement with various organizations, ultimately enhancing the impact they can have in the nonprofit sector.

FAQs about Form 990

Several common concerns can arise when dealing with Form 990. One frequent question is about qualifying for Form 990-N, commonly known as the e-Postcard. Organizations with gross receipts not exceeding $50,000 may be eligible but must verify this threshold regularly. Another common query involves amending a filed Form 990; organizations can file an amendment for any errors or omissions found post-filing by following the IRS established procedures. Lastly, nonprofits should be aware that they are required to retain supporting documents for at least three years after filing.

Case studies and examples

Examining case studies of successful nonprofits that have navigated the Form 990 filing process can provide valuable insights. For instance, organizations that meticulously track their expenses and maintain accurate financial records often report better experiences during IRS reviews. An illustrative example comes from a community-based nonprofit that enhanced transparency by adopting digital record-keeping practices, leading to smoother Form 990 filings and more trust from stakeholders.

Learning from the experiences of these successful nonprofits shows the high value of meticulous financial documentation and proactive communication with stakeholders. Additionally, benchmarking against industry standards through Form 990 data can reveal areas for improvement and efficiency, driving organizations to enhance their practices and better serve their missions.

Interactive tools and resources

Engaging with interactive tools offered by pdfFiller showcases user empowerment in managing their document needs. The platform not only allows for convenient editing and eSigning of Form 990 but also equips users with resources for further learning about nonprofit compliance and reporting. Nonprofits can navigate through various tutorials and instructional materials that guide them through the complexities of filing this essential form.

These resources aid organizations in streamlining their processes, making filing Form 990 less daunting. pdfFiller stands ready to support ongoing document management needs, ensuring that organizations maintain compliance while focusing on executing their missions effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 990 online?

How do I make edits in form 990 without leaving Chrome?

How do I fill out form 990 using my mobile device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.