Get the free Form Adv

Get, Create, Make and Sign form adv

Editing form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

Navigating the form adv form: A comprehensive how-to guide

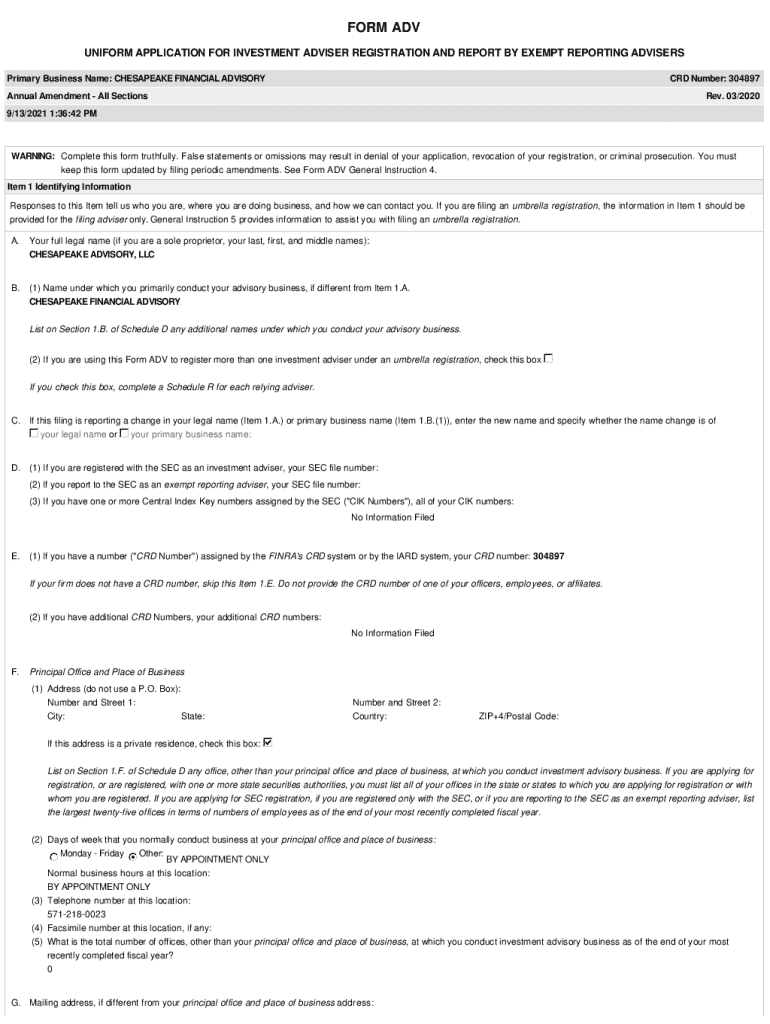

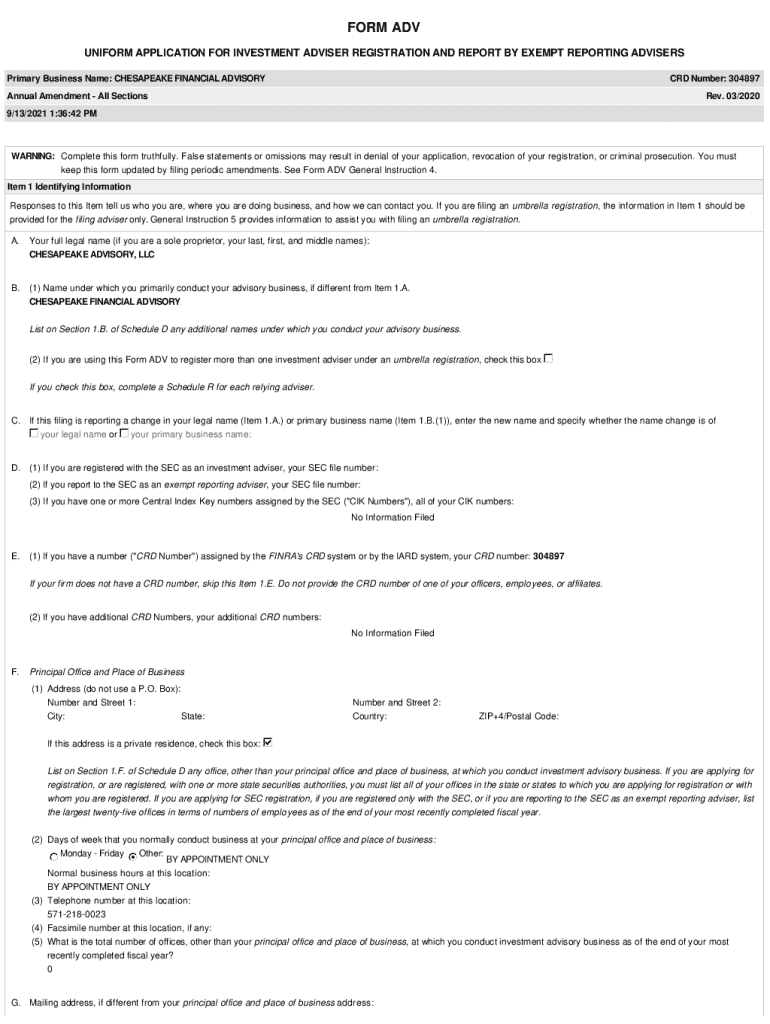

Understanding Form ADV: The basics

Form ADV is a crucial document for anyone involved in the investment advisory industry. It serves dual purposes: informing clients and regulators about the adviser’s qualifications, services, and fees while also ensuring that firms comply with regulatory requirements. For investors, this form is vital in assessing whether a financial adviser is trustworthy, qualified, and aligned with their investment goals.

Investment advisers—individuals or firms that provide investment advice for a fee—must file Form ADV with the Securities and Exchange Commission (SEC) or state regulators, depending on their jurisdiction. Understanding who needs to file is essential for determining what information is accessible to the public and enhances investors' capability to make informed choices.

The structure of Form ADV: An overview

Form ADV is split into two key parts. Part I provides essential business and operational information about the adviser, focusing on broad aspects such as the types of services offered and the structure of the firm. It establishes a foundation that allows prospective clients to understand what services they can expect.

Part II delves into the specificities of the advisory services. This section is critical as it includes disclosures about fees, the investment strategies utilized, and potential conflicts of interest. Investors are encouraged to scrutinize this part closely as it lays out the bases for what they will pay for and the risks involved in the advisory relationship.

How to access and interpret Form ADV

Accessing a firm’s Form ADV is straightforward. The SEC provides a centralized database where investors can find the ADV filings of registered advisers. This transparency is designed to protect investors and promote informed decision-making.

To effectively interpret Form ADV, focus on key sections such as the services offered, fee structures, and disciplinary history. Checking for consistency between Part I and Part II can also provide insights into how well the adviser communicates their value proposition.

Insights beyond the numbers: What Form ADV doesn’t tell you

While Form ADV provides crucial quantitative data, it does not capture the qualitative aspects of the advisory relationship. Factors such as the adviser’s approach to fiduciary duty, client satisfaction, and the firm’s market reputation can significantly influence an investor's decision.

Reading between the lines often involves assessing an adviser's commitment to putting clients' interests first. Look for evidence of a track record of performance, client testimonials, and third-party evaluations. These elements, though not part of the FORM ADV structure, are critical for a comprehensive evaluation.

Practical steps: Filling out and managing Form ADV

Completing Form ADV requires careful preparation. Advisers must gather accurate information regarding their business structure, advisory services, and financial disclosures. Missing or incorrect details can lead to compliance issues or regulatory penalties.

Utilizing tools like pdfFiller can expedite this process. With its cloud-based platform, financial advisors can easily edit, fill, sign, and manage their Form ADV documents, ensuring seamless compliance and organization.

Common mistakes to avoid when submitting Form ADV

One major pitfall for advisers is the failure to provide complete or accurate information, which can lead to fines or revocation of registration. Additionally, neglecting to update the Form ADV over time can reflect poorly on the adviser’s transparency and accountability.

Another common mistake is misunderstanding fiduciary obligations. Advisers are expected to act in their clients' best interests, and failing to adequately communicate this commitment can hinder trust and client relationships.

Finding the right financial advisor: Evaluation tips

When searching for a financial advisor, consider using resource platforms popular within your local area, as these can help narrow down choices effectively. Local offerings can provide personalized service that accounts for regional investment trends and preferences.

Key questions during the interview process can help reveal whether an adviser is a good fit. Hyper-focusing on fees, investment philosophies, track record, and service structures can provide important insights.

Conclusion: Your path forward with Form ADV

Navigating the investment landscape relies heavily on informed decision-making. Understanding the ins and outs of Form ADV is a critical part of establishing a transparent advisory relationship. Proper documentation enhances trust and efficacy in managing your investments.

Emphasizing meticulous completion of Form ADV along with understanding its implications can have a significant positive impact on investors' financial outcomes. Knowledge is power, and in investing, this adage rings particularly true.

Interactive features: Enhance your experience

Starting with pdfFiller provides a range of options for enhancing your documentation experience. With its intuitive interface and features, users can create, edit, sign, and manage Form ADV documents effectively.

Engaging with pdfFiller means not only managing your documents but also staying updated with relevant resources surrounding financial regulations and best practices for document management. This ensures you are always equipped to handle your advisory engagements with utmost professionalism.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form adv for eSignature?

How do I complete form adv online?

Can I sign the form adv electronically in Chrome?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.