Get the free Calpers Supplemental Income 457 Plan

Get, Create, Make and Sign calpers supplemental income 457

How to edit calpers supplemental income 457 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out calpers supplemental income 457

How to fill out calpers supplemental income 457

Who needs calpers supplemental income 457?

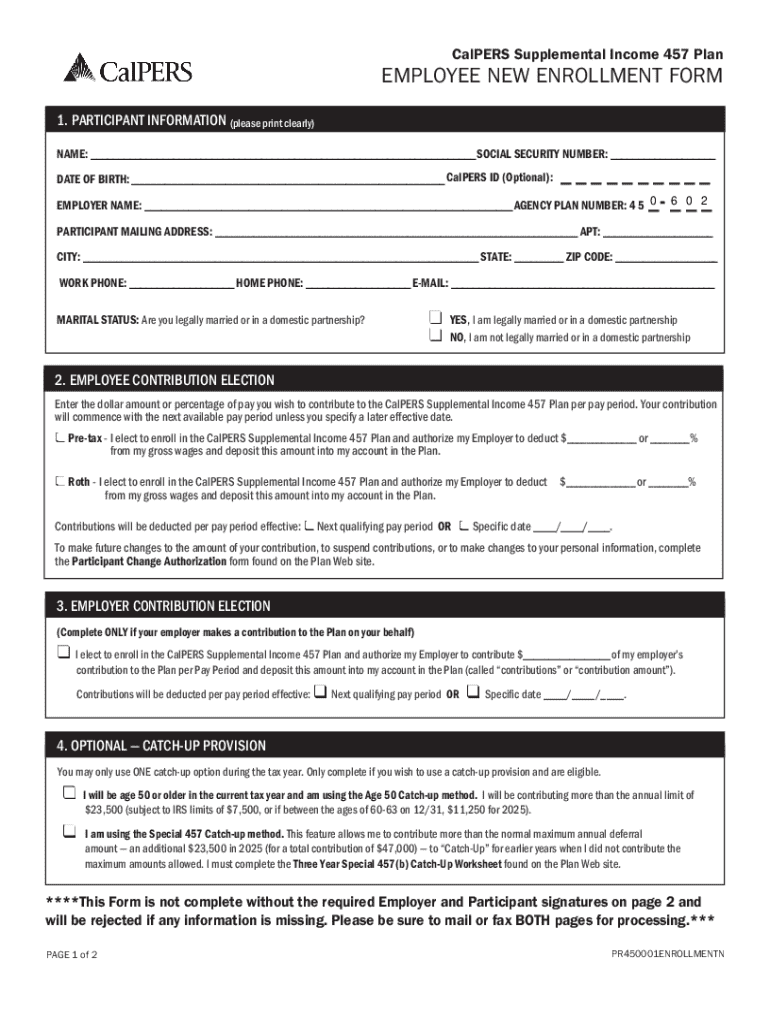

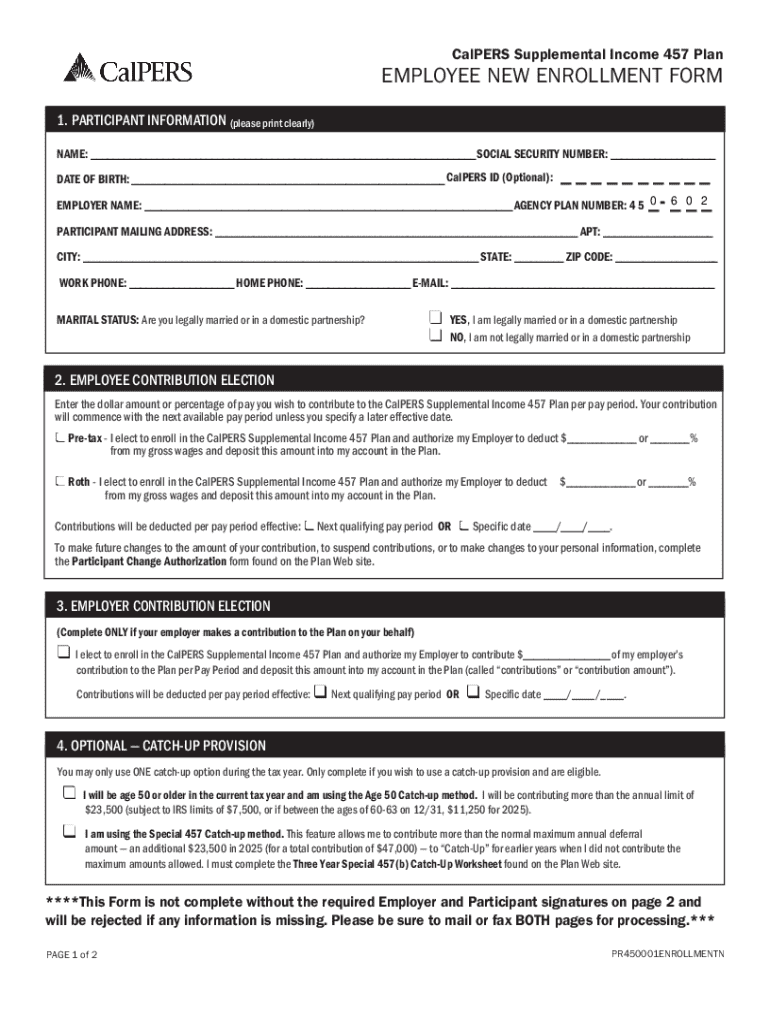

CalPERS Supplemental Income 457 Form: Your Comprehensive How-To Guide

Understanding the CalPERS Supplemental Income 457 Plan

The CalPERS Supplemental Income 457 Plan is a vital tool for maximizing retirement savings. It allows public employees in California to set aside a portion of their income for retirement on a tax-deferred basis. This means that contributions made to the 457 plan are deducted from your taxable income, effectively lowering your taxable earnings during your working years.

Key features of the CalPERS 457 Plan include flexible contribution limits, diverse investment options, and significantly reduced taxes upon withdrawal during retirement. Participants can defer a substantial amount of each paycheck, allowing for wealth accumulation that can be vital for supporting a comfortable retirement.

Importance of the 457 Form

The CalPERS Supplemental Income 457 Form is essential for setting up and managing your participation in the plan. This form captures your personal information, intended contributions, and beneficiary designations. Filling out the form accurately is crucial for ensuring that your retirement savings are aligned with your financial goals.

By properly submitting the 457 Form, you actively contribute toward a financially secure future. It serves as a formal agreement that enables you to benefit from the available tax advantages and investment opportunities of the CalPERS 457 Plan.

Who should use the CalPERS 457 form?

Not every public employee in California is eligible to participate in the CalPERS 457 Plan. Understanding the eligibility criteria is key to determining whether this retirement saving option is right for you. Generally, employees of state and local governments and certain non-profit organizations may qualify.

Eligibility primarily extends to individuals who are part of the CalPERS retirement system. However, those who are not in this system may still have access through specific employment statuses. Always check your employment classification for confirmation.

Understanding deferred compensation

Deferred compensation refers to income that is earned in one period but paid out at a later date. In the context of the CalPERS 457 Plan, it allows you to set aside part of your salary before taxes are taken out, which can serve to increase your retirement income significantly.

One of the primary advantages of deferred compensation is that it lowers your taxable income for the current year, leading to potential tax savings. Furthermore, the funds can grow tax-free until withdrawal, allowing for compound growth over time. The CalPERS 457 Plan plays a crucial role in this strategy, as it provides a structured way to save and invest for retirement while deferring taxes.

Step-by-step guide to filling out the CalPERS Supplemental Income 457 Form

Filling out the CalPERS Supplemental Income 457 Form can be straightforward if you tackle it step by step. First, you'll need to download the form from the CalPERS website or other official resources like pdfFiller. Make sure you have the latest version of the document to prevent errors in submission.

Where to obtain the form

The CalPERS Supplemental Income 457 Form is readily accessible online. You can download it directly as a PDF from the official CalPERS website or through document management platforms like pdfFiller. These platforms typically provide user-friendly interfaces to fill out forms electronically, which saves time and effort.

Detailed instructions for completing each section

Editing and submitting your CalPERS 457 form

Once you have completed the necessary sections, it's crucial to review your form meticulously. Utilizing pdfFiller can make this process much more manageable. The platform boasts features like real-time editing, spell-check, and prompt suggestions to ensure that users submit accurate forms.

Utilizing pdfFiller for editing

With pdfFiller, you can upload your filled-out CalPERS Supplemental Income 457 Form easily. The platform's intuitive editing tools allow for corrections without hassle. Ensure that your information matches the official requirements, and make use of the comparison features that allow you to crosscheck with standard forms.

Signing instructions

After verifying your information, you will need to electronically sign your form. pdfFiller provides a straightforward process for eSigning. Follow the prompts to add your digital signature securely, and remember that this signature is legally binding just like a handwritten one.

Submission process

You can submit your completed CalPERS 457 Form either by mail or electronically, depending on your preference. If mailing, ensure you send it to the correct CalPERS office. If opting for electronic submission through pdfFiller, simply follow their submission process, which typically includes confirmation of receipt to avoid any misplaced documents.

Managing your CalPERS 457 plan documents

Managing paperwork for your CalPERS 457 Plan is vital for thorough tracking and future updates. Document organization can significantly ease your transition into retirement. Utilize folders, both digital and physical, labeled accordingly to categorize forms by year, type, and importance.

Document organization tips

Excel spreadsheets or simple document management systems can help keep track of contributions and changes over time. pdfFiller's cloud-based storage options further simplify this process by enabling you to access your documents anywhere, anytime, reducing the risk of loss or misplacement.

Updating your information

As your career progresses and life circumstances change, keeping your information current is crucial. You can easily update your CalPERS 457 Form through the pdfFiller platform, which allows for effortless modifications to your existing documents. This is essential to ensure that your retirement benefits are accurately reflected.

Frequently asked questions (FAQs)

Navigating the CalPERS Supplemental Income 457 Form can raise several questions. Knowing the answers can facilitate smoother completion and management of your retirement savings plan.

Additional considerations for future planning

The CalPERS Supplemental Income 457 Plan plays a crucial role in the broader context of retirement strategy. When combined with other retirement vehicles such as IRAs or 401(k)s, it can create a robust financial safety net, ensuring various income sources during retirement.

The role of the 457 plan in overall retirement strategy

Using the 457 plan wisely can set you on a path to financial independence later in life. Consistent contributions and strategic withdrawals can maximize your overall income, maintaining your desired lifestyle.

Long-term financial planning

Consistent monitoring of your account, as well as strategic planning based on market conditions and personal financial situations, are paramount. Utilizing tools available in platforms like pdfFiller to manage your documentation will bolster your overall financial strategy. Ensure that your future remains as bright as your ambitions!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my calpers supplemental income 457 directly from Gmail?

How do I edit calpers supplemental income 457 on an Android device?

How do I complete calpers supplemental income 457 on an Android device?

What is calpers supplemental income 457?

Who is required to file calpers supplemental income 457?

How to fill out calpers supplemental income 457?

What is the purpose of calpers supplemental income 457?

What information must be reported on calpers supplemental income 457?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.