Get the free 2025-2026 Verification Worksheet – Independent Student

Get, Create, Make and Sign 2025-2026 verification worksheet independent

Editing 2025-2026 verification worksheet independent online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 verification worksheet independent

How to fill out 2025-2026 verification worksheet independent

Who needs 2025-2026 verification worksheet independent?

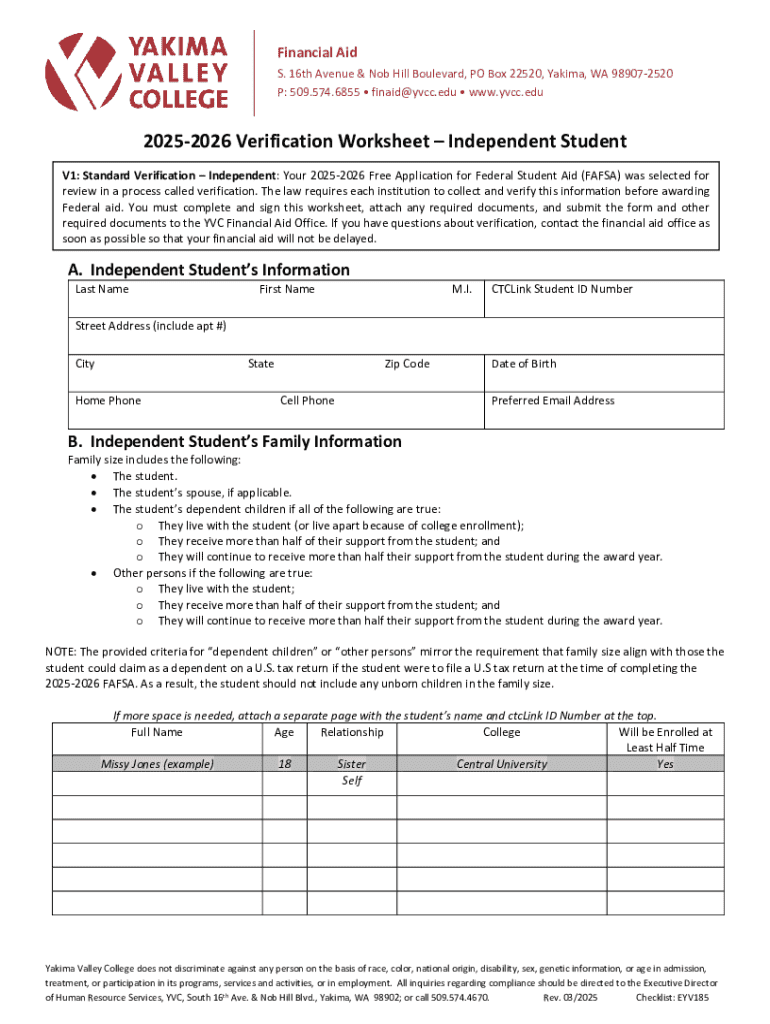

Understanding the 2 Verification Worksheet Independent Form

Understanding the 2 verification worksheet independent form

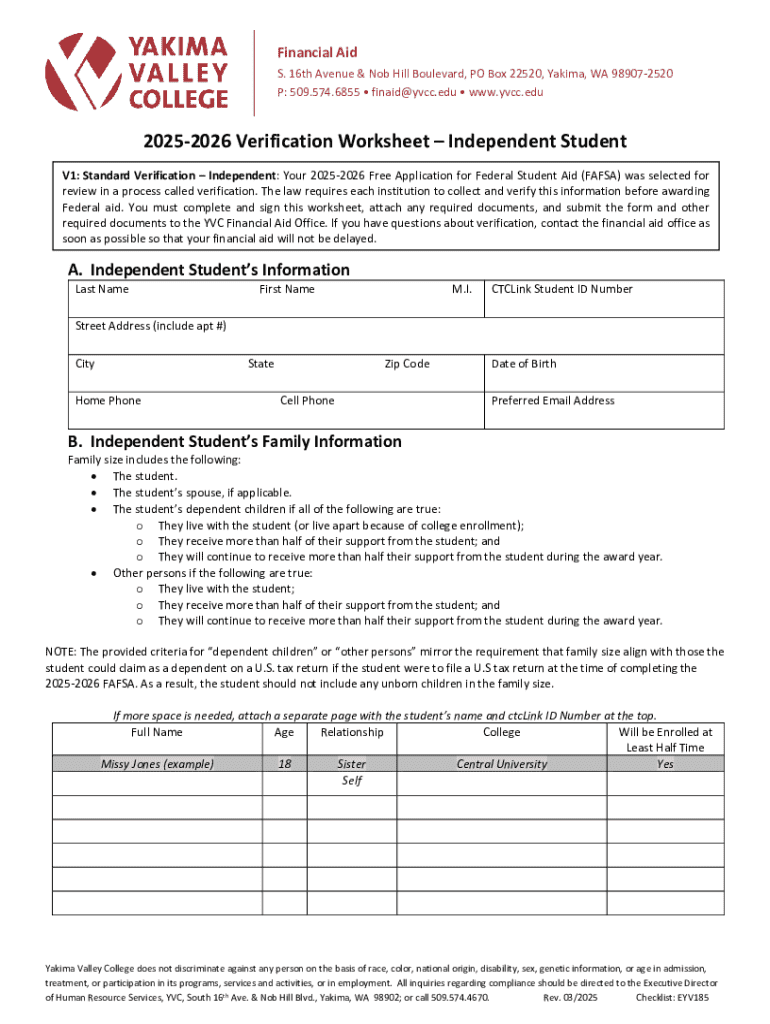

The 2 verification worksheet independent form plays a critical role in the financial aid process for students classified as independent. This form verifies the information provided on your Free Application for Federal Student Aid (FAFSA) and ensures that you receive the appropriate aid based on your actual financial situation.

Completing this form is not merely a bureaucratic step; it is essential for securing federal grants, loans, and institutional aid. Accurate and timely submission of your verification form can expedite your financial aid award, allowing you to focus on your educational goals without financial stress.

Key dates and deadlines for submitting the verification worksheet are typically aligned with the FAFSA deadlines. It’s crucial to check both the federal and your specific state deadlines to ensure you remain eligible for the maximum financial aid available to you.

Eligibility and requirements

The criteria for independent student status primarily revolve around age, marital status, and financial independence. Typically, you must be 24 years old or older, married, or have dependents of your own. In some cases, being a veteran or being homeless may also qualify you as an independent student.

Verification requirements include various documentation to substantiate your financial circumstances. Below is a comprehensive list of acceptable documents:

Unique circumstances may require additional paperwork. For example, if you were recently divorced and your financial situation has changed significantly, you must provide that information to your financial aid office.

Detailed instructions for completing the verification worksheet

Completing the verification worksheet can seem daunting, but breaking it into steps simplifies the process. Here’s a step-by-step breakdown:

Common pitfalls include incorrect income figures and failure to sign the form, both of which can delay your verification process. Double-checking your entries can mitigate these issues.

Updating and correcting information

If you find discrepancies or need to update your information after submission, prompt action is essential. You can contact your financial aid office for instructions on how to proceed.

Corrections can typically be made directly within the verification worksheet if you notice errors before it is processed. If changes occur due to new financial circumstances, you should submit a new worksheet with the updated information.

Should additional documentation be required after your initial submission, be prepared to provide it quickly to avoid further delays.

Specific scenarios in verification

Certain unique circumstances can complicate the verification process. For example, confinement or incarceration may necessitate special considerations in documentation and eligibility.

Students with special situations, such as those who are homeless or in foster care, must provide relevant documentation that reflects their unique circumstances. Detailing any assets and additional sources of income is also critical to ensure accurate assessment of financial aid.

Each situation is different, so consulting with your institution’s financial aid office can clarify requirements specific to your status.

Frequently asked questions (FAQs)

After submitting your 2 verification worksheet independent form, you may be wondering about what to expect next. Generally, you will receive notification from the financial aid office regarding the status of your verification. This notification will also indicate any missing documents or issues that need addressing.

The verification process duration varies but typically takes between 1 to 4 weeks, depending on the workload of the financial aid office. Keep in mind that missing documentation can delay this process further.

If your verification is denied or if you disagree with the findings, an appeal can be submitted. Guidelines for this appeal vary by institution but generally require a formal written request along with supporting documentation.

Interactions with other financial aid components

The 2 verification worksheet independent form is interconnected with your FAFSA and other financial aid applications. Successful completion can directly influence the level of aid awarded to you. If verification is pending, this can delay disbursements and overall funding.

Understanding interim disbursements is also vital. While waiting for the verification process to complete, some colleges may provide provisional funding based on estimated financial need. However, any discrepancies found during verification may result in necessary adjustments to your award package.

Managing your verification document efficiently

Using tools like pdfFiller to fill out and edit your 2 verification worksheet independent form can greatly enhance your experience. pdfFiller allows you to fill out forms directly online, reducing the chances of errors associated with handwritten documents.

eSigning your verification form is another feature that streamlines the process. By using digital signatures, you can submit your forms instantly, keeping everything organized in one place. Additionally, managing your documents in the cloud ensures easy access and storage, helping you to maintain all necessary documentation for future reference.

Finalizing the verification process

Once your verification worksheet has been submitted and processed, final steps include reviewing the outcome and understanding your financial aid package. The financial aid office will notify you of your eligibility results, detailing any awards you have qualified for.

It's crucial to understand the contents of your financial aid package. Familiarize yourself with any loans, grants, or scholarships you may receive and be aware of any conditions associated with them. This knowledge will enable you to make informed decisions about funding your education.

Support and resources

If you encounter any challenges or have questions during the process, accessing official financial aid help is essential. Many institutions offer dedicated financial aid offices with professionals ready to assist you in navigating the verification process.

Utilizing pdfFiller’s features helps streamline your experience with the verification worksheet. From filling out forms electronically to managing your documents efficiently, the platform ensures that you can complete everything you need from anywhere.

For direct support, reach out to your financial aid office. They can provide tailored assistance based on your situation, ensuring you have the right information to move forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2025-2026 verification worksheet independent without leaving Google Drive?

Can I edit 2025-2026 verification worksheet independent on an Android device?

How do I fill out 2025-2026 verification worksheet independent on an Android device?

What is 2026 verification worksheet independent?

Who is required to file 2026 verification worksheet independent?

How to fill out 2026 verification worksheet independent?

What is the purpose of 2026 verification worksheet independent?

What information must be reported on 2026 verification worksheet independent?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.