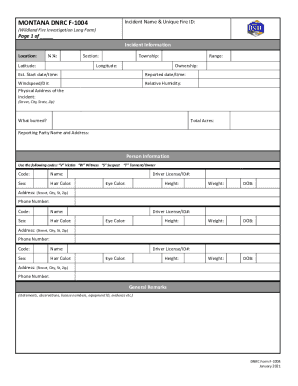

Get the free r 1056

Get, Create, Make and Sign r 1056 form

Editing r 1056 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out r 1056 form

How to fill out r-1056

Who needs r-1056?

A comprehensive guide to the R-1056 form

Understanding the R-1056 form

The R-1056 form serves as a vital document to facilitate various compliance and tax-related processes. Primarily utilized by individuals and organizations, its purpose centers around collecting essential information and authorizations required for specific legal and financial actions. Recognizing its importance in ensuring proper compliance with regulatory frameworks is imperative for avoiding potential pitfalls. The R-1056 form simplifies these processes, making it an indispensable tool for both personal and professional documentation needs.

Key features of the R-1056 form

Understanding the components of the R-1056 form is crucial for effective utilization. This form generally includes several distinct sections that must be accurately filled out to ensure compliance and processing. Here’s a breakdown:

In terms of use cases, the R-1056 form is particularly beneficial for professionals dealing with compliance issues. Individuals engaging in tax preparation, loan applications, or even governmental processes will find its structured approach invaluable.

How to access the R-1056 form

To access the R-1056 form, pdfFiller provides an efficient platform where users can conveniently download and fill out the form. The site offers not only the form itself but interactive features that facilitate a smooth filling process, making it accessible anywhere and anytime. Simply navigate to pdfFiller’s designated area for downloadable forms, type 'R-1056' in the search bar, and find the document you need.

Utilizing pdfFiller to access the form involves straightforward steps. Start by entering the site, then search and click on the R-1056 form link to preview it before initiating the download. The platform allows for immediate editing, ensuring you can work on it in real-time.

Step-by-step instructions for filling out the R-1056 form

Before filling out the R-1056 form, it is crucial to gather all necessary information to streamline the process. Key documents and data you should prepare include recent tax returns, proof of income, and any existing financial agreements. Having these at your disposal speeds up the process and minimizes errors.

Filling out the R-1056 form requires careful attention to each section. Complete the personal information first, ensuring all details match your legal documents to avoid discrepancies. Next, proceed to the financial section; double-check figures and ensure clarity in each line entry.

Once you’ve completed the form, utilize pdfFiller’s editing tools to enhance your document. You can add notes, highlight crucial sections, or include comments that might be necessary for reviewers.

Signing and submitting the R-1056 form

Signing the R-1056 form electronically is a seamless process with pdfFiller. Best practices suggest that eSigning should involve a clear verification of identity, and pdfFiller offers features that are both secure and user-friendly. You can apply your electronic signature directly within the platform, ensuring your submission is timely and valid.

Regarding submission options, you have various methods available for sending off your completed form. Users can easily email it to relevant parties, print and mail it, or upload it directly to designated systems, depending on the requirements of the involved institutions.

Managing the R-1056 form after submission

Once you've submitted the R-1056 form, tracking its status becomes crucial for peace of mind and future planning. pdfFiller provides tools for monitoring submissions, allowing you to check on the progress of your form through your account. This feature can be particularly useful for users managing multiple submissions.

Additionally, be prepared for follow-up requests regarding your submission. Whether clarification or additional documentation is needed, responding promptly helps maintain smooth communication with reviewers and ensures there are no unnecessary delays.

Troubleshooting common issues with the R-1056 form

Filling out the R-1056 form can present challenges, particularly if you are uncertain about required information or intricacies in submissions. Common issues include incomplete sections, mismatched data, or technical errors in uploading or sending forms.

To resolve these issues, utilizing pdfFiller’s support resources can be highly beneficial. The platform offers a straightforward path to reach customer support, alongside an extensive FAQ section which addresses many common queries related to the R-1056 form, ensuring users can overcome hurdles efficiently.

Benefits of using pdfFiller for the R-1056 form

Choosing pdfFiller for managing the R-1056 form presents numerous advantages. The platform's ability to facilitate document management seamlessly stands out, bolstered by unique functionalities that enhance user experience. Testimonials from satisfied customers highlight how pdfFiller has streamlined their document processes, reduced errors, and improved compliance adherence.

When comparing pdfFiller to traditional methods of handling the R-1056 form, the differences are significant. Users enjoy advantages such as real-time collaboration, accessible storage options, and automated updates, making pdfFiller a superior choice for managing important documents.

Additional insights for users

For effective document management, maintaining an organized system for storing forms and related documents is essential. Consider categorizing files based on purpose or frequency of use to expedite retrieval when needed. Leveraging tools such as cloud storage along with pdfFiller’s features ensures you can access your documents easily, providing peace of mind.

Staying updated with changes regarding the R-1056 form is vital. Regularly checking the official resources or utilizing pdfFiller’s notifications will alert you to any modifications in requirements or processes, helping you to remain in compliance and ahead of deadlines.

Explore more with pdfFiller

If you’re interested in exploring further, pdfFiller offers access to a plethora of related forms and resources similar to the R-1056. Users can easily locate other templates that may complement their document management needs, ranging from tax forms to legal agreements.

Consider joining online communities or forums dedicated to users of the R-1056 form and pdfFiller. Engaging with other users allows for the exchange of tips and experiences, providing added insights and further enhancing your proficiency with the platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my r 1056 form directly from Gmail?

Can I create an electronic signature for signing my r 1056 form in Gmail?

How do I complete r 1056 form on an Android device?

What is r-1056?

Who is required to file r-1056?

How to fill out r-1056?

What is the purpose of r-1056?

What information must be reported on r-1056?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.