Get the free Consumer Credit Counseling: Continuing Professional Education Course Approval Applic...

Get, Create, Make and Sign consumer credit counseling continuing

Editing consumer credit counseling continuing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumer credit counseling continuing

How to fill out consumer credit counseling continuing

Who needs consumer credit counseling continuing?

Consumer Credit Counseling Continuing Form: A Comprehensive Guide

Understanding consumer credit counseling

Consumer credit counseling is a service designed to help individuals manage their debt and improve their financial situation. These services provide education and support to those struggling with debt, guiding them towards a path of financial stability. By working with a certified credit counselor, clients can learn about budgeting, debt management strategies, and how to improve their overall financial health.

The significance of consumer credit counseling cannot be overstated, particularly in today's economy where many individuals face massive student loans, credit card debts, and unexpected expenses. Credit counseling not only helps in managing debts but also plays a crucial role in enhancing credit scores. This is key for individuals looking to obtain loans or mortgages in the future.

The role of continuing education in credit counseling

For credit counselors, ongoing education is essential for maintaining effectiveness and relevance in their role. The financial landscape is constantly evolving, which makes it crucial for professionals in this field to stay updated with the latest practices and regulations. Continuing education ensures that credit counselors are equipped with the most current knowledge and tools necessary to assist their clients successfully.

Moreover, various industry standards dictate specific continuing education requirements for credit counseling professionals. These standards are often set forth by recognized organizations to ensure a consistent level of service across the industry. By participating in ongoing training, credit counselors can improve their skills, thereby enhancing their ability to support clients.

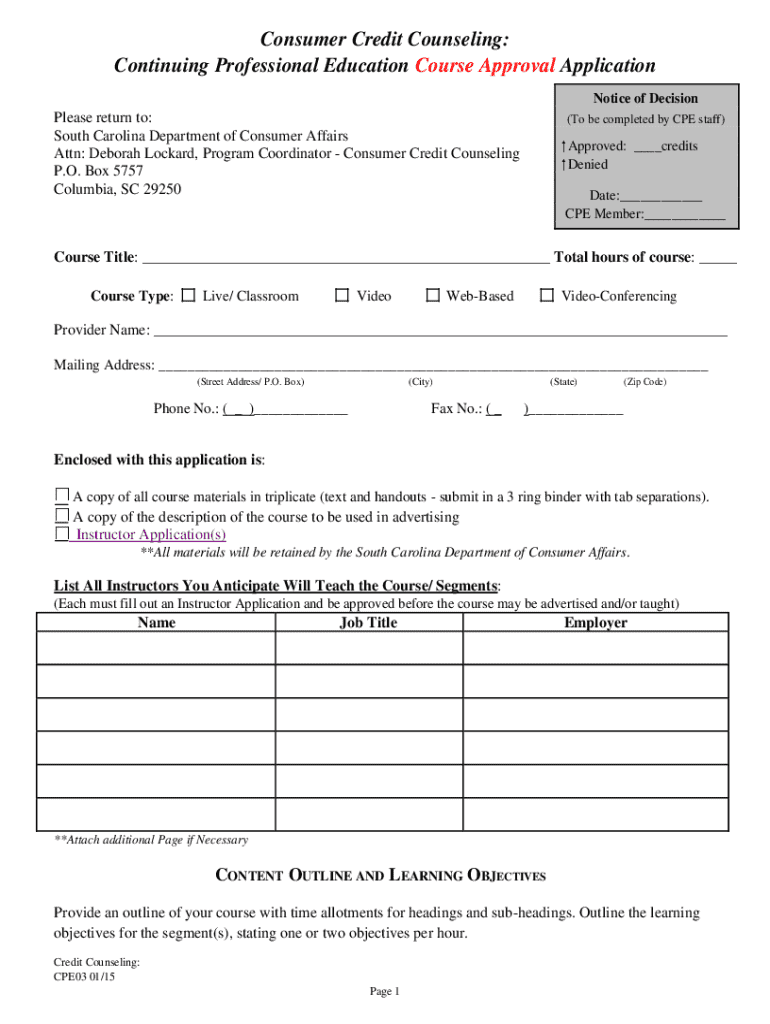

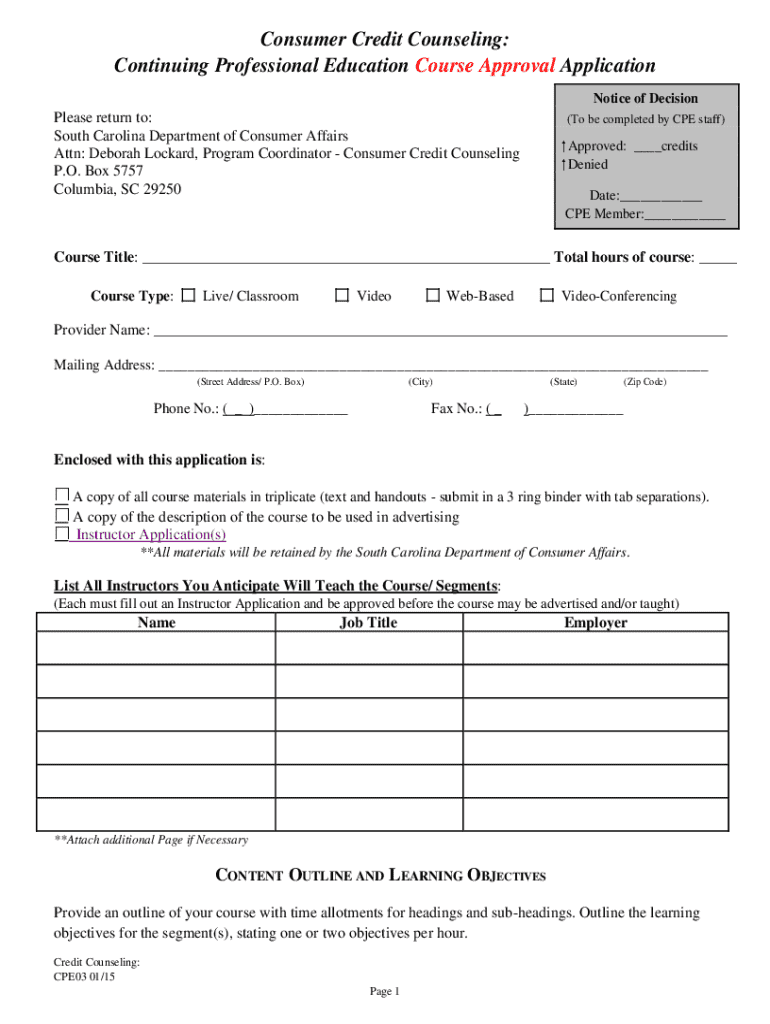

Overview of the consumer credit counseling continuing form

The consumer credit counseling continuing form serves several important purposes. Primarily, it is a tool for tracking the completed training and educational courses that credit counselors undergo. It also serves to verify a professional’s ongoing competency within the field. This is particularly important for maintaining certification and ensuring that clients receive high-quality service.

Typically, this form is required for certified credit counselors as well as organizations that provide counseling services. By utilizing the form, counselors can demonstrate their commitment to professional development and adherence to industry standards.

Step-by-step guide to filling out the continuing form

Filling out the consumer credit counseling continuing form may seem daunting, but breaking it down into manageable sections can simplify the process. Here's how to fill it out effectively:

Tips for efficiently completing the form

Efficiency is key when completing the consumer credit counseling continuing form. Here are some tips to streamline the process:

Common mistakes to avoid

While filling out the continuing form, there are several pitfalls that can lead to issues down the line. It's essential to be aware of these common mistakes:

Utilizing pdfFiller for your continuing form needs

pdfFiller enhances the process of filling out consumer credit counseling continuing forms in numerous ways. First and foremost, it provides a cloud-based platform allowing users to access forms anytime, anywhere, ensuring you’re never away from your documentation when you need it.

Useful features such as easy editing and customization of PDF forms enable users to create personalized documents that reflect their unique situations. The eSignature capability expedites submission, making the process quicker. Additionally, collaboration tools lend themselves well to team environments, ensuring that all team members can easily correct and manage forms together.

Frequently asked questions about the continuing form

Various questions often arise concerning the consumer credit counseling continuing form. Here’s a look at some commonly asked queries:

Resources for continuing education in credit counseling

Continuing education is vital in the field of credit counseling, as it informs counselors about new trends, tools, and techniques. Many resources are available to aid in this process. Websites offering online courses can provide flexibility and accessibility for busy professionals. Furthermore, professional organizations often offer certification programs and workshops designed to keep counselors informed and accredited.

Networking opportunities can also be incredibly valuable. Engaging with fellow professionals through forums, social media groups, or local networks can open doors to collaborative learning experiences and shared knowledge. These interactions can enrich your professional practice and offer insights into best practices across the field.

Next steps post-submission

After submitting the consumer credit counseling continuing form, understanding the review process is imperative. Typically, submissions may take a few weeks to be processed. During this time, it’s important to stay informed about the status of your application, especially if you are awaiting updated certification.

Additionally, planning for future continuing education requirements is critical. To maintain your certification, map out a timeline for upcoming training opportunities and put reminders in place to ensure you stay compliant with industry standards.

Leveraging professional feedback

Feedback can be a valuable tool in your professional development. Consider soliciting feedback from mentors or supervisors on your form submission to enhance credibility and accuracy. They can offer insights based on their experiences, which can shape your professional approach.

Additionally, engaging in peer reviews can be beneficial. Collaborating with colleagues to review each other’s forms can not only foster a culture of support but can also yield new perspectives and ideas for improvement.

Engaging with the community

Engagement within the credit counseling community is equally vital. Joining forums and support groups can provide a platform for sharing experiences and learning from others in the field. Participating in webinars and workshops not only expands your knowledge but also builds connections with fellow counselors.

These interactions reinforce your commitment to the industry and provide invaluable networking opportunities. Moreover, staying connected with peers offers avenues for collaboration on projects or initiatives that advance the field of credit counseling.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my consumer credit counseling continuing in Gmail?

How do I make changes in consumer credit counseling continuing?

How do I complete consumer credit counseling continuing on an iOS device?

What is consumer credit counseling continuing?

Who is required to file consumer credit counseling continuing?

How to fill out consumer credit counseling continuing?

What is the purpose of consumer credit counseling continuing?

What information must be reported on consumer credit counseling continuing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.