Get the free Cal-card Missing Receipt Form

Get, Create, Make and Sign cal-card missing receipt form

How to edit cal-card missing receipt form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cal-card missing receipt form

How to fill out cal-card missing receipt form

Who needs cal-card missing receipt form?

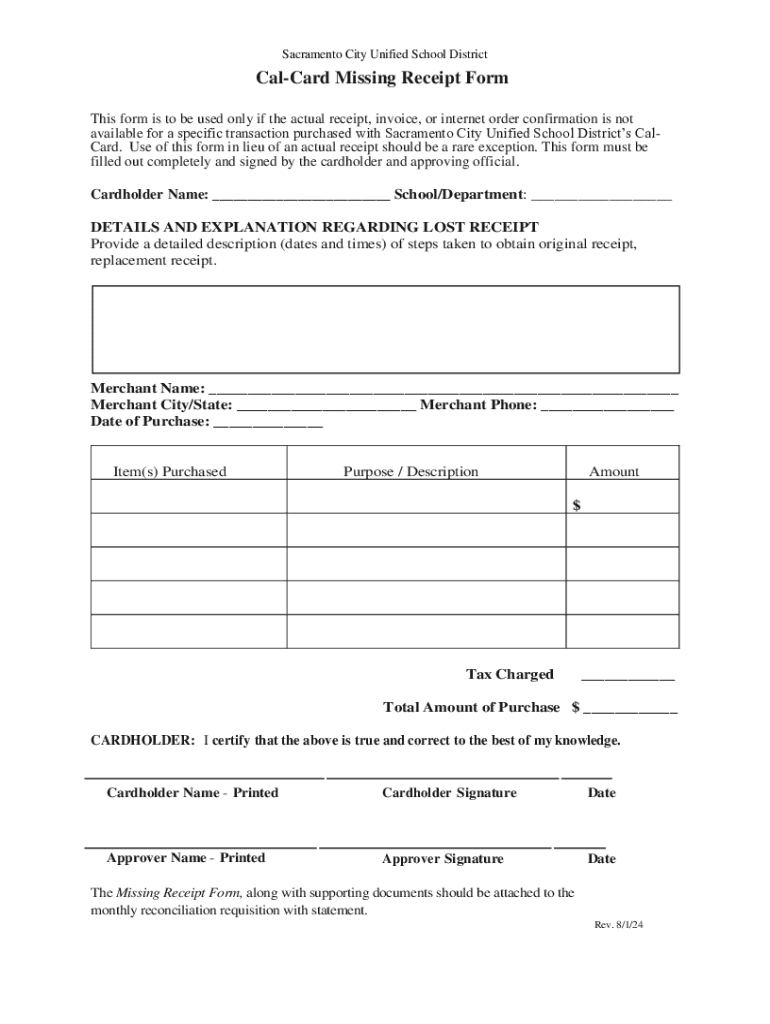

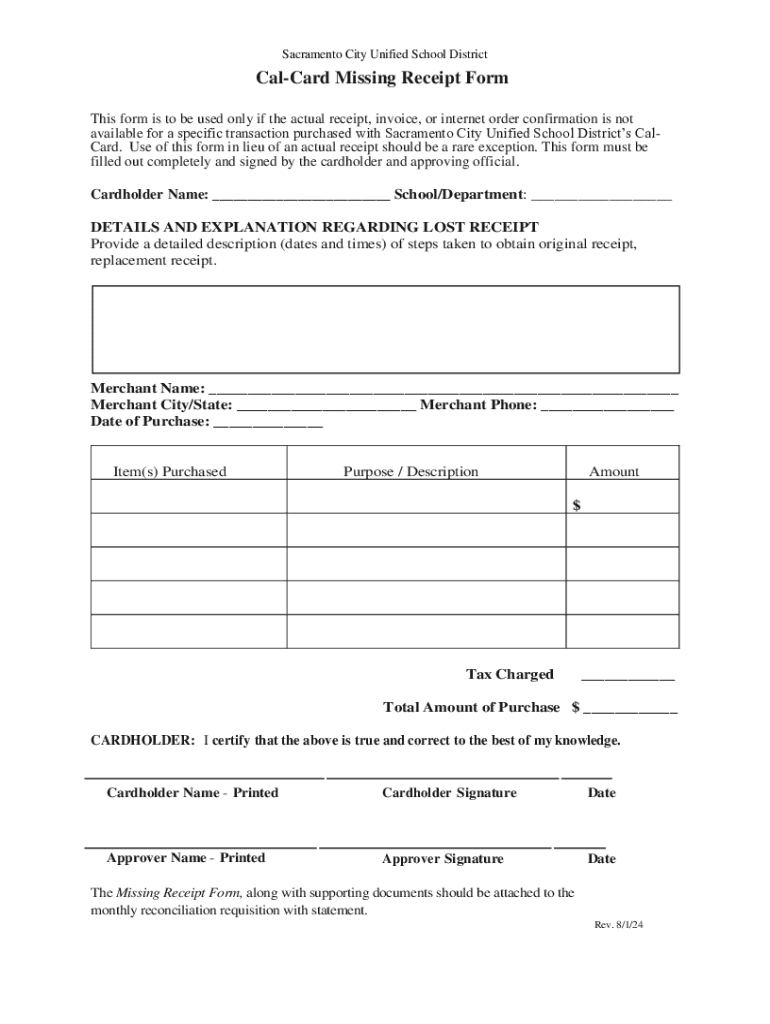

Understanding and Utilizing the Cal-Card Missing Receipt Form

Understanding the Cal-Card Program

The Cal-Card program is an essential tool for state employees in California, aimed at simplifying the purchasing process for official business. Through this program, employees can make purchases directly using a state-issued credit card without the need for complex procurement procedures. Proper documentation is a key component of this financial process, ensuring expenditures are accounted for and compliant with state regulations.

Missing receipts can complicate financial tracking and auditing, leading to potential issues with reimbursement and compliance. Common reasons for missing receipts include lost documentation during travel, transactions made on behalf of others, or even human error in receipt handling. Understanding how to manage these situations is crucial for maintaining good financial practices.

What is the Cal-Card Missing Receipt Form?

The Cal-Card Missing Receipt Form serves as an official document used to report and explain the absence of receipts for specific transactions made with a Cal-Card. This form is crucial in maintaining transparency and ensuring compliance with state financial regulations. Instances where this form becomes necessary include misplace receipts, lost documentation during travel, or receipt damage.

Using the Cal-Card Missing Receipt Form benefits both the individual and their team. The individual can avoid complications in expense reporting, while the team maintains a clear record of expenditures, simplifying audits and financial assessments. Moreover, the form acts as a safeguard, providing a narrative to justify missing documentation, thus preserving integrity in financial reporting.

Accessing the Cal-Card Missing Receipt Form

Obtaining the Cal-Card Missing Receipt Form is straightforward, particularly through platforms like pdfFiller. Users can access the form by visiting the pdfFiller website and searching for the Missing Receipt Form template. Alternatively, users can download the form directly in PDF format or fill it out online using pdfFiller's tools.

For those opting for offline completion, downloading the form allows for traditional printing followed by handwriting. On the other hand, using the online form-filling option permits immediate electronic submission, enhancing efficiency in managing receipts and reimbursements.

Step-by-step instructions for completing the form

Completing the Cal-Card Missing Receipt Form correctly is vital for ensuring accurate reimbursements. Follow these steps to fill out the form effectively.

Tips for dealing with missing receipts

To minimize complications with missing receipts in the future, consider adopting efficient tracking methods. Keeping a digital record of receipts can significantly improve the management process. Use apps or software to scan and store receipts electronically, making retrieval easier if a receipt goes missing.

Additionally, it's beneficial to establish best practices for maintaining digital documentation across teams. Regular training sessions focused on document management and compliance can also foster a culture of accountability and diligence in financial administration.

Consider using tools that offer document management features beyond the Cal-Card program, ensuring all financial documentation is accessible and organized. Services that provide cloud storage solutions can also improve overall team collaboration.

Common questions about the Cal-Card Missing Receipt Form

Users frequently have concerns regarding the Cal-Card Missing Receipt Form, often relating to the specifics of filing the form and the impact of missing receipts on reimbursements. One common question is, 'What if I can’t find certain transaction details?' In such cases, providing the best possible approximations is key to maintaining transparency during the reimbursement process.

Another concern often revolves around potential consequences of missing receipts. While it can complicate the approval of expenses, the Cal-Card Missing Receipt Form mitigates these issues by offering a documented explanation. Users should also be aware that timely submission of the form helps avoid unnecessary delays in reimbursement, which can lead to funding shortfalls.

Resources for further assistance

For further guidance on the Cal-Card Missing Receipt Form, users can contact support through pdfFiller's platform. They typically offer chat support, email assistance, and resources for frequently asked questions.

Moreover, there are links available on the pdfFiller website to related forms and templates which may come in handy. Engaging with community forums or user groups can also yield valuable insights from experienced users who navigate similar challenges.

Complementary features of pdfFiller

pdfFiller offers a suite of document management tools that enhance collaboration and streamline workflows. Apart from filling out the Cal-Card Missing Receipt Form, users can collaborate on documents in real time with their team members, track changes, and manage versions of documents effortlessly.

The platform also includes digital signature capabilities, allowing for seamless approvals and making the process of handling paperwork far less cumbersome. Since all documents are stored in the cloud, teams can access their records from anywhere, ensuring that important documents are always at hand, regardless of location.

User stories and testimonials

Countless users have successfully navigated the complexities of managing receipts and reimbursements using the Cal-Card Missing Receipt Form through pdfFiller. For example, an administrative assistant at a state department was able to resolve an audit discrepancy by quickly generating the Missing Receipt Form and explaining the missing documentation with clarity.

Such stories illustrate the effectiveness of pdfFiller in simplifying the complexities of public fund management and enhancing accountability in financial reporting. Users often note that the platform not only aids in efficiently processing missing receipts but also fosters a culture of better management practices across their teams.

Related links and resources

For users seeking additional resources, pdfFiller provides quick links to other relevant forms and templates that align with the Cal-Card program. Keeping abreast of compliance and best practices for managing public funds is vital. Users are encouraged to explore educational articles, webinars, and workshops offered by financial training organizations, which can further enhance their understanding and efficiency in handling financial documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cal-card missing receipt form in Gmail?

Can I sign the cal-card missing receipt form electronically in Chrome?

Can I create an eSignature for the cal-card missing receipt form in Gmail?

What is cal-card missing receipt form?

Who is required to file cal-card missing receipt form?

How to fill out cal-card missing receipt form?

What is the purpose of cal-card missing receipt form?

What information must be reported on cal-card missing receipt form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.