Get the free Customizable Promissory Note Template

Get, Create, Make and Sign customizable promissory note template

Editing customizable promissory note template online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customizable promissory note template

How to fill out customizable promissory note template

Who needs customizable promissory note template?

Customizable Promissory Note Template Form: Your Comprehensive Guide

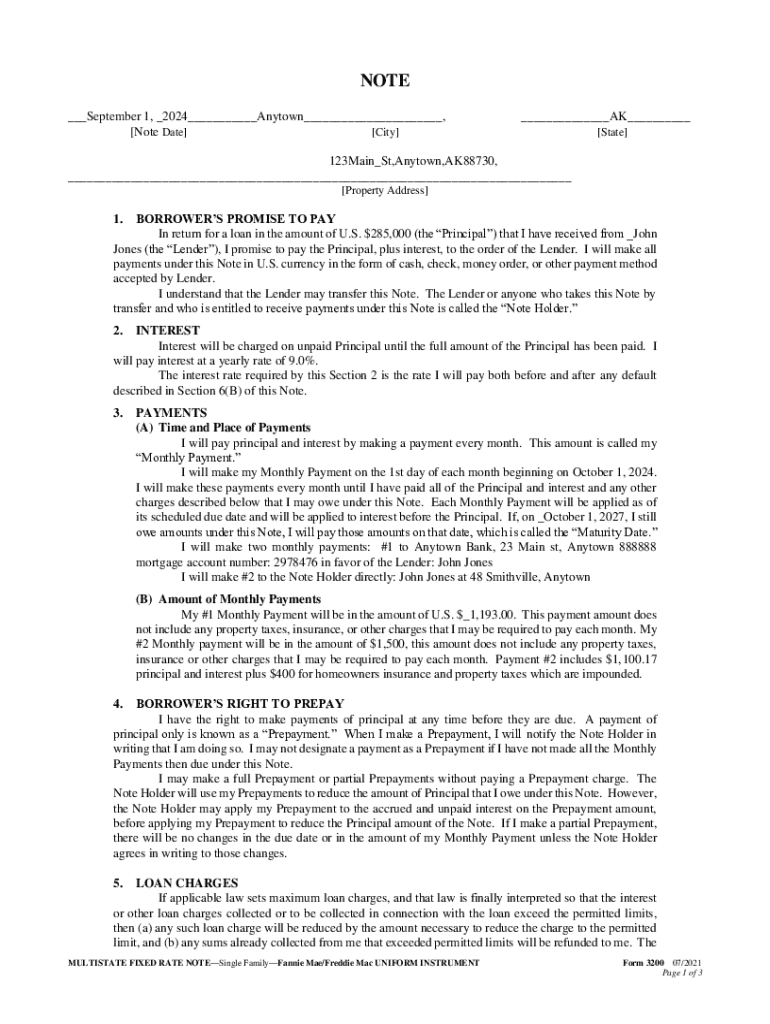

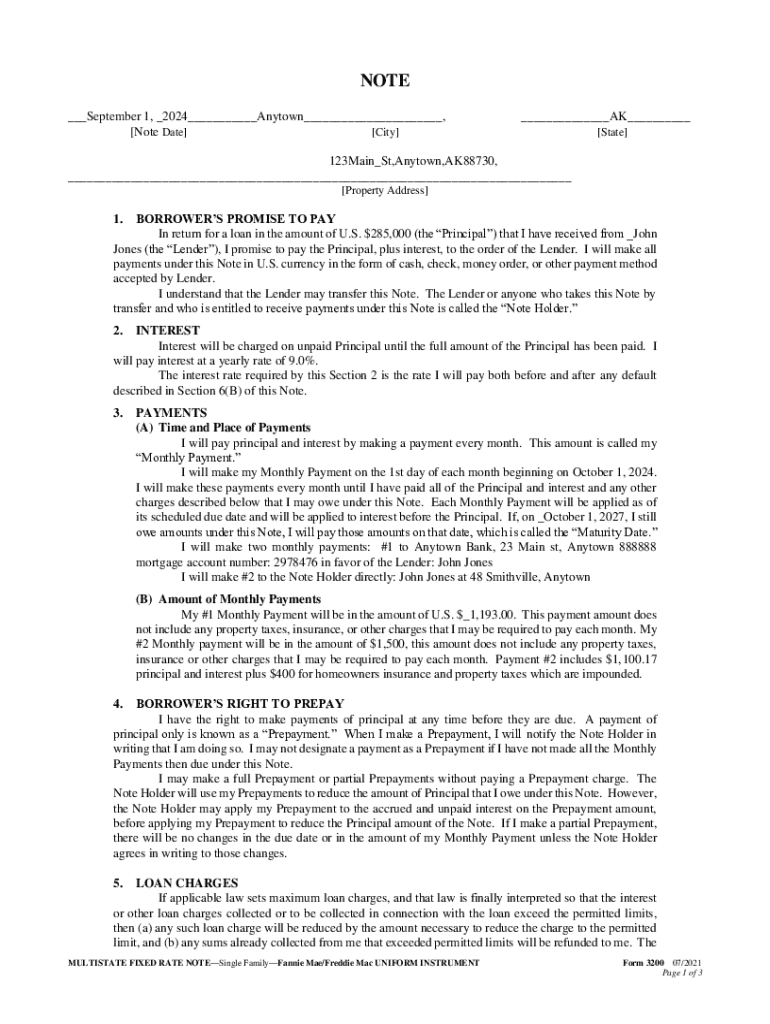

Understanding promissory notes

A promissory note is a financial instrument that contains a written promise by one party (the borrower) to pay a specified sum of money to another party (the lender) under agreed terms. This simple yet powerful document serves as a cornerstone in personal and business transactions, acting as legal evidence of a loan.

The importance of a promissory note cannot be overstated; it not only clarifies the conditions of the loan but also protects both parties involved. Without it, misunderstandings can arise, potentially leading to legal disputes. This document establishes trust and formality in financial agreements.

Legally, a promissory note is binding and enforceable, provided it meets certain criteria set by state laws. Understanding the specific legal standing associated with promissory notes in your jurisdiction ensures that both lenders and borrowers are safeguarded against future conflicts.

Customizable promissory note template overview

With the advancement of technology, creating a customizable promissory note template form has become incredibly convenient. These templates allow users to enter specific information, making the process of drafting a promissory note easier and faster. Utilizing an editable format means you can adapt the document to meet your unique needs, whether for a personal loan or a business transaction.

The benefits of using a customizable template are numerous. You save time; ensure accuracy; and reduce the risk of overlooking important elements in the agreement. Moreover, platforms like pdfFiller offer a user-friendly interface that streamlines the process of creating, editing, and managing such documents.

Accessing the template feature on pdfFiller is straightforward. All you need is an account to get started. Once logged in, you can navigate to the document creation section and select a promissory note template. The platform offers the flexibility to customize each component per your requirements, thus enhancing your document's relevance and effectiveness.

Essential components of a promissory note template

When drafting your promissory note, several key components must be included to ensure clarity and legal compliance. Understanding these elements is crucial for establishing a robust agreement between borrower and lender.

Additionally, it is wise to consider optional clauses such as pre-payment terms, default clauses, and governing jurisdiction to tailor the agreement based on specific scenarios and legal requirements.

Step-by-step guide to customizing your promissory note

Customizing your promissory note using a template is an intuitive process, especially with platforms like pdfFiller. Here's a step-by-step guide to help you navigate through effectively.

Practical tips for using the customizable template

While the customizable promissory note template simplifies the documentation process, following best practices is crucial to ensure efficiency and legality.

Interactivity with the customizable promissory note template

One of the standout features of a customizable promissory note template on pdfFiller is its interactivity. Users can utilize various functionalities that enhance the experience and make managing your documents more efficient.

Additionally, pdfFiller’s cloud-based storage solutions allow you to store and manage your notes efficiently. This cloud access ensures that you can retrieve or amend your documents anytime, from anywhere.

Scenarios for using a customizable promissory note

Customizable promissory notes are versatile documents that can be applied in various scenarios. Each situation presents unique requirements and terms that can be flexibly adapted using a template.

Legal considerations when creating a promissory note

When drafting a promissory note, understanding legal considerations is essential. The enforceability of your note can hinge on whether it complies with applicable laws, making legal literacy non-negotiable.

Troubleshooting common issues with promissory notes

Issues can arise at any point during the life of a promissory note. Recognizing common problems and having strategies to troubleshoot them can help both lenders and borrowers navigate challenges effectively.

Resources to enhance your understanding

Having access to additional resources can significantly improve your knowledge about promissory notes, enabling you to make informed decisions.

Interactive tools and support on pdfFiller

To enhance your experience with the customizable promissory note template, pdfFiller offers various interactive tools and support avenues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send customizable promissory note template to be eSigned by others?

How do I complete customizable promissory note template online?

How do I edit customizable promissory note template online?

What is customizable promissory note template?

Who is required to file customizable promissory note template?

How to fill out customizable promissory note template?

What is the purpose of customizable promissory note template?

What information must be reported on customizable promissory note template?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.