Get the free Financial Disclosure

Get, Create, Make and Sign financial disclosure

How to edit financial disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure

How to fill out financial disclosure

Who needs financial disclosure?

Financial Disclosure Form - How-to Guide Long-Read

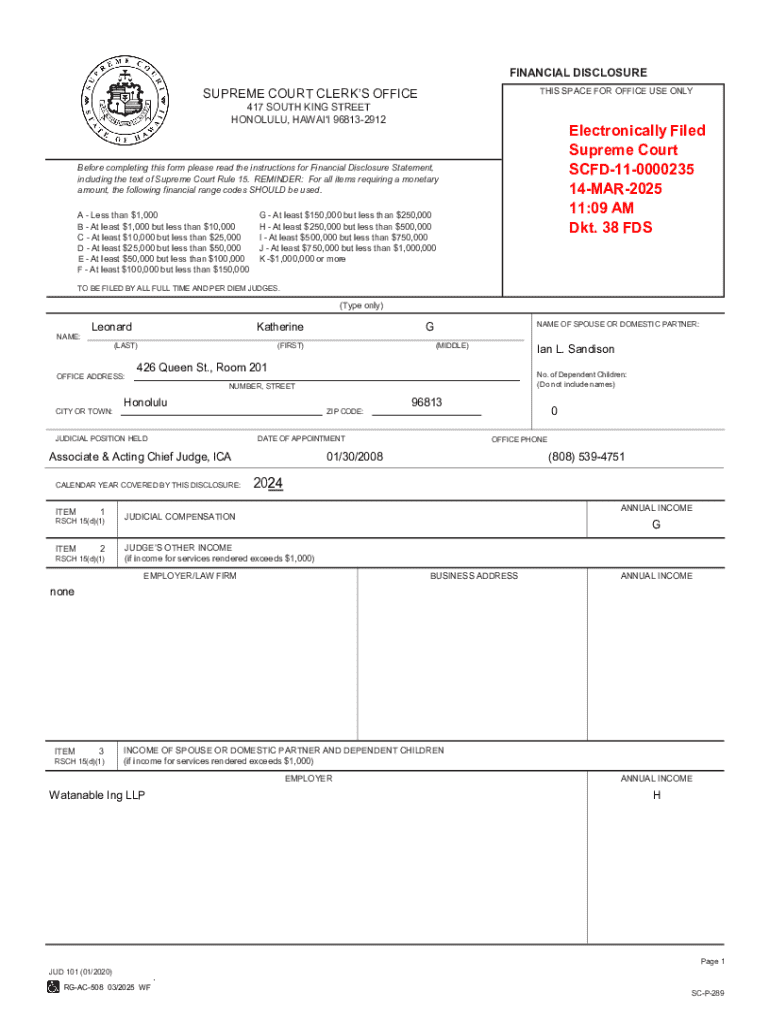

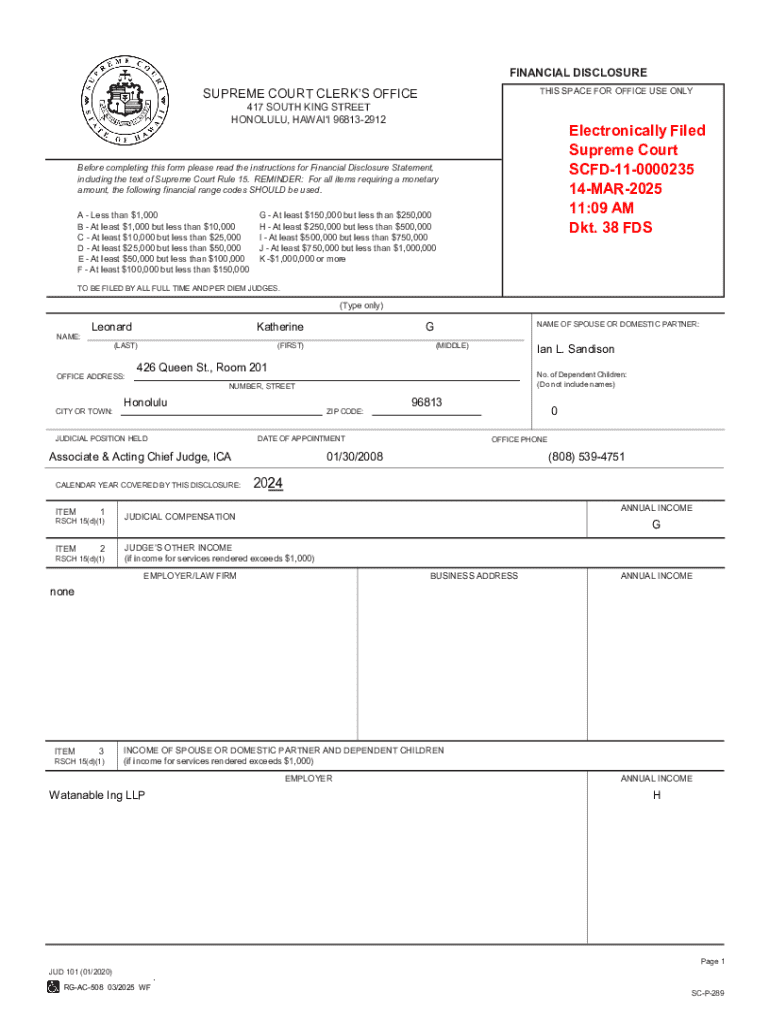

Understanding the financial disclosure form

A financial disclosure form is a document that individuals and organizations complete to report their financial interests, assets, and liabilities. Its essential role lies in promoting transparency and accountability, especially among public officials, corporate leaders, and non-profit organizations. By requiring such disclosures, governments and regulatory bodies aim to prevent conflicts of interest and corruption.

Various fields mandate different types of disclosures. Public servants, for instance, must declare their financial dealings to ensure that their decisions aren't influenced by personal financial gain. Meanwhile, corporate executives typically disclose ownership stakes in their companies and any outside financial interests that might create potential conflicts with their duties. Similarly, non-profit leaders are required to report their financial interactions to maintain public trust.

Who needs to file a financial disclosure form?

Certain individuals and groups are primarily obligated to submit a financial disclosure form. These include:

Each of these categories comes with unique filing deadlines and reporting requirements that can vary significantly by jurisdiction.

Key components of a financial disclosure form

The structure of financial disclosure forms can differ based on the authority mandating them, but typically, they contain essential sections including:

Reviewers commonly seek specific details in these forms to identify potential conflicts of interest and ensure compliance with local regulations.

Step-by-step instructions for completing the financial disclosure form

Filling out a financial disclosure form can appear daunting, but a step-by-step approach makes it manageable. Begin with preparation, which involves gathering necessary documents such as tax returns and previous disclosures. Understanding the specific requirements based on your jurisdiction ensures that you're aligned with local laws.

Next, let's break down the specific sections of the form:

Best practices include reviewing for completeness and accuracy. Omitting key assets can lead to serious repercussions, so ensure compliance with all relevant regulations.

Tips for editing and managing your financial disclosure form

After filling out the initial draft of your financial disclosure form, editing becomes crucial. Utilizing pdfFiller's editing tools, you can easily annotate and revise your forms to ensure they meet legal requirements. These features allow for seamless adjustments without the need to start from the beginning.

Additionally, implement secure and organized document management practices. Adopting a cloud-based system offers advantages such as easy access to your disclosures from anywhere, making it simple to keep documents updated. Ensure you're familiar with the best practices for electronic filing and obtaining signatures.

Collaborating on financial disclosure forms

Financial disclosure forms often require input from multiple stakeholders. This underscores the importance of team collaboration. Involving colleagues or legal advisors during the process can bring multiple perspectives and ensure compliance with all stipulations.

Leveraging pdfFiller for collaboration can simplify this process. With shared access, commenting features, and the ability to track changes, stakeholders can effectively communicate and streamline the editing process, ensuring that everyone is on the same page before the form is submitted.

eSigning your financial disclosure form

Digital signatures play a critical role in the compliance process surrounding financial disclosure forms. They provide a legal standing that is recognized across various jurisdictions, streamlining the approval process without the need for physical signatures.

Using pdfFiller, the process of eSigning is straightforward. The platform offers quick setup for digital signatures, allowing you to sign forms securely and ensuring that each signature is validated according to jurisdiction-specific requirements.

Frequently asked questions (FAQs) about financial disclosure forms

Many individuals have similar inquiries when it comes to financial disclosure forms. Here are some common questions:

Real world examples and case studies

Analyzing how financial disclosure forms work in practice can provide valuable insights. For instance, there are success stories where organizations that adopted strict transparency measures gained public trust and enhanced their reputation. Furthermore, high-profile cases of financial disclosures have often led to scrutiny, underscoring the importance of accurate reporting.

Learning from past experiences can also lead to improvements in how disclosures are handled. Cases where inadequate disclosures led to scandals demonstrate the necessity of transparency not just legally, but ethically.

Additional tools and resources

For those looking to streamline the financial disclosure process, pdfFiller offers interactive tools that simplify the preparation and submission. These include templates tailored for different financial disclosures, as well as asset evaluation calculators that provide quick insights into your financial status.

Additionally, related document templates regarding property, taxation, and corporate governance are also available. These can support comprehensive document management and ensure you have all necessary forms at your fingertips.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify financial disclosure without leaving Google Drive?

How do I edit financial disclosure straight from my smartphone?

How do I fill out the financial disclosure form on my smartphone?

What is financial disclosure?

Who is required to file financial disclosure?

How to fill out financial disclosure?

What is the purpose of financial disclosure?

What information must be reported on financial disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.