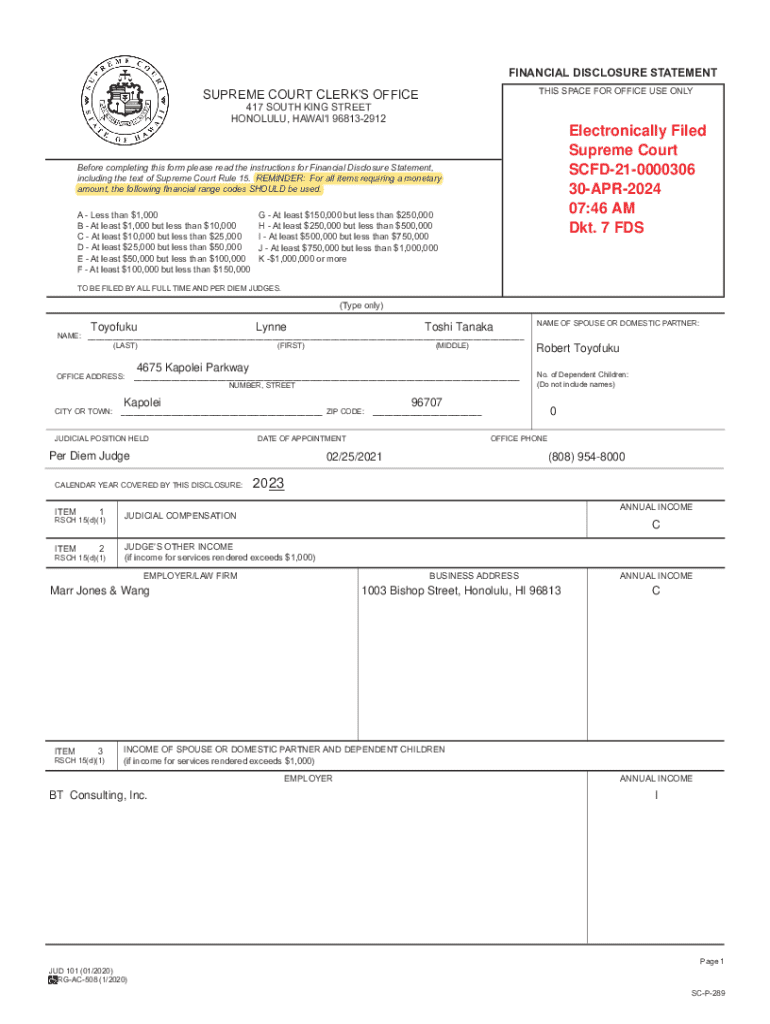

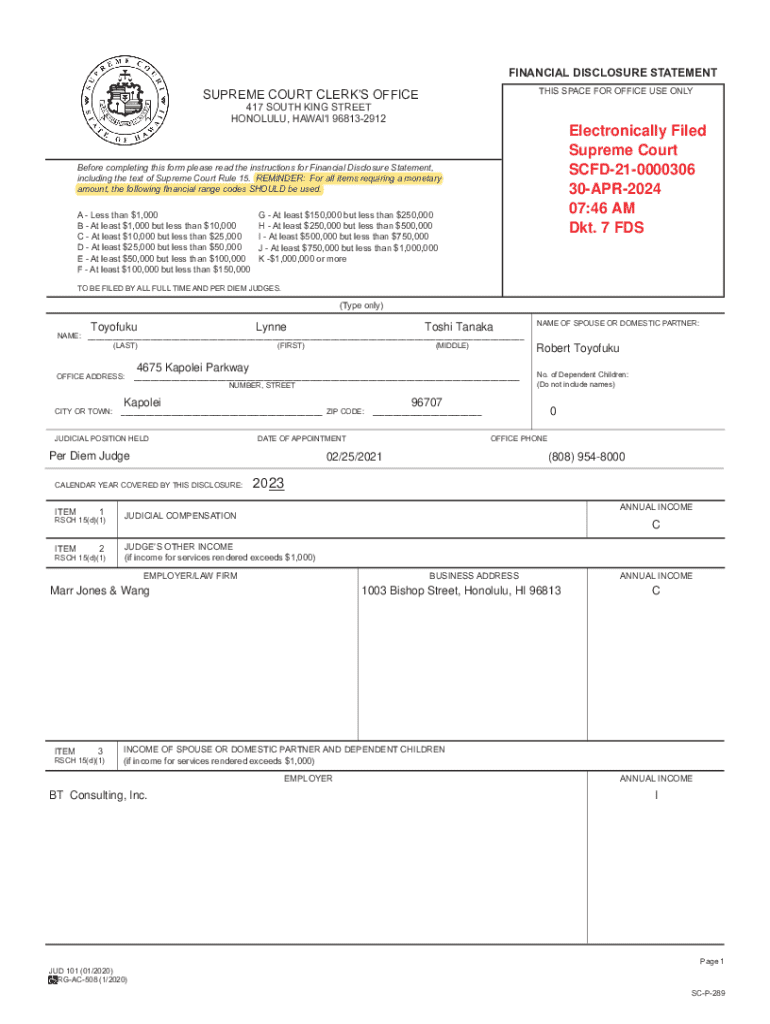

Get the free Financial Disclosure Statement

Get, Create, Make and Sign financial disclosure statement

How to edit financial disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement

How to fill out financial disclosure statement

Who needs financial disclosure statement?

Financial Disclosure Statement Form: A Comprehensive How-to Guide

Understanding the Financial Disclosure Statement Form

A financial disclosure statement form serves as a crucial tool for individuals or organizations to provide a transparent overview of their financial status. It is primarily designed to disclose personal and financial information to ensure transparency and compliance, often required in various professional settings such as public service, financial institutions, or any organization where financial responsibility is critical.

These forms are important not just for regulatory compliance but also for enhancing trust between parties involved. Transparency fosters credibility; hence, a clear insight into financial dealings can maintain a healthy relationship among employees, stakeholders, or the general public.

Key benefits of using the financial disclosure statement form

The financial disclosure statement form offers several benefits, making it an indispensable resource. Firstly, it enhances transparency in finances which is vital for building trust within any organization or between individuals. Here are some key benefits:

Key components of the financial disclosure statement form

Understanding the components of the financial disclosure statement form is essential for accurate completion. Each section plays a critical role in presenting a full and transparent financial picture.

Personal information section

The personal information section collects necessary identity details including:

Income disclosure

This section includes details about various types of income such as:

Assets and liabilities

Accurate reporting of assets and liabilities is essential. Assets include property, bank accounts, and investments while liabilities encompass loans, mortgages, and credit card debt. Properly appraising and disclosing them reflects overall financial health.

Investments and financial interests

You need to report not just direct investments but also any financial interests in businesses, partnerships, or stock holdings. This enhances the transparency of potential conflicts of interest.

Certification and signature

Finally, certifying the document through electronic signatures adds a layer of validity. Digital signing tools provide efficient solutions for timely submissions.

Filling out the financial disclosure statement form

Accurately filling out the financial disclosure statement form is crucial for compliance and transparency. Here’s a step-by-step approach to complete it effectively.

Step-by-step instructions for completing the form

1. Gather all necessary documents related to income, assets, and liabilities.

2. Begin with the personal information section, ensuring all details are accurate.

3. Move onto income disclosure, listing all sources of income with supporting documents.

4. Disclose all assets and liabilities, providing a comprehensive view of your financial standing.

5. Clearly report investments, ensuring clarity on the ownership structure.

6. Review all provided information for accuracy.

7. Certify with an electronic signature before submission.

Common mistakes to avoid

Common mistakes when filling out the financial disclosure statement form often involve:

Editing and managing the financial disclosure statement form

After filling out the financial disclosure statement form, you may find the need to edit or manage the document. Utilizing tools like pdfFiller can enhance your document management process significantly.

Using pdfFiller to edit your form

pdfFiller provides a variety of editing tools that facilitate seamless changes to any financial disclosure statement form. Users can add text, edit existing details, or even annotate the document easily.

Tips for organizing your financial disclosure

Maintaining a well-organized financial disclosure statement is vital.

eSigning and submitting your financial disclosure statement

Once your financial disclosure statement form is complete, it’s essential to execute the proper eSigning and submission practices to ensure validity.

How to use eSign features in pdfFiller

To efficiently eSign your document using pdfFiller, follow these steps:

Safe submission practices

When it comes to submitting your financial disclosure statement form, security is paramount. Following these practices can help ensure a secure and safe submission:

Post-submission checklist

After submitting your financial disclosure statement form, there are follow-up actions you should consider to ensure all bases are covered.

Follow-up actions after submission

It's important to monitor any communications from relevant authorities post-submission. Consider these follow-up steps:

Keeping records of your financial disclosure

It’s vital to retain copies of your financial disclosure statement for your records. Maintaining both physical and digital backups ensures that you have easy access to your information should it be required in the future.

Common FAQs about the financial disclosure statement form

To further assist you, here are some frequently asked questions regarding the financial disclosure statement form:

Additional insights

Understanding the broader regulatory and legislative context around the financial disclosure statement form is essential.

Regulatory and legislative context

Various laws and regulations affect how financial disclosures are handled, including those related to public transparency and financial security. Being aware of these laws can help individuals and organizations understand their obligations better.

Impact of proper disclosure on reputation and compliance

Case studies illustrate the real-world implications of accurate financial disclosures. Organizations that maintain transparency often enjoy better reputations, while those that fail to disclose adequately face regulatory scrutiny and reputational damage.

Using pdfFiller for future document needs

pdfFiller can extend beyond the financial disclosure statement form, offering solutions for various document types. Its features allow users to create and manage an array of legal forms, contracts, and business documents efficiently.

Expanding your document management skills with pdfFiller

Explore additional templates to streamline business processes. Learning tools available on pdfFiller such as webinars and tutorials will further solidify your document management capabilities.

Interactive tools and resources

Interactive tools can greatly enhance your experience with the financial disclosure statement form. Utilize built-in checklists and downloadable templates to facilitate the process.

Embedded interactive checklists

Employ interactive checklists during the completion of your financial disclosure statement to ensure you don’t miss any details.

Templates for different types of financial disclosures

pdfFiller offers a variety of templates tailored for varied financial disclosures, making the process even smoother for users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify financial disclosure statement without leaving Google Drive?

How do I edit financial disclosure statement in Chrome?

Can I create an electronic signature for signing my financial disclosure statement in Gmail?

What is financial disclosure statement?

Who is required to file financial disclosure statement?

How to fill out financial disclosure statement?

What is the purpose of financial disclosure statement?

What information must be reported on financial disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.