Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Understanding and Utilizing a Credit Card Authorization Form

What is a credit card authorization form?

A credit card authorization form is a document that a merchant uses to obtain permission from a cardholder to charge their credit card for a specific amount. This form captures essential customer data and serves as a safeguard against disputes over unauthorized charges. The key distinction here is between authorization and payment processing: while payment processing involves the actual transaction and movement of funds, authorization is about securing the cardholder's consent for that transaction. By implementing this process, businesses protect themselves against potential chargebacks, which can be financially damaging.

The importance of credit card authorization forms

Using credit card authorization forms is crucial for both businesses and consumers. One of the primary benefits is the protection against chargebacks, which can occur when customers dispute a transaction, claiming it was unauthorized. When you have a signed authorization form, you have proof of consent, making it easier to contest such chargebacks. Additionally, credit card authorization forms ensure transaction security by verifying that the person using the card is indeed the cardholder. This added layer of security is vital, especially for online transactions where identity theft is a concern.

When to use a credit card authorization form

Credit card authorization forms are essential in various scenarios. For online purchases, where physical card presence is absent, these forms provide necessary security measures for both merchants and consumers. Similarly, in subscription services and recurring payments, businesses must retain authorization to charge customers periodically without re-approval each time. Service-based industries, such as hair salons and gyms, also benefit from these forms, ensuring payment for appointments and memberships is secured upfront, preventing no-shows and unpaid services.

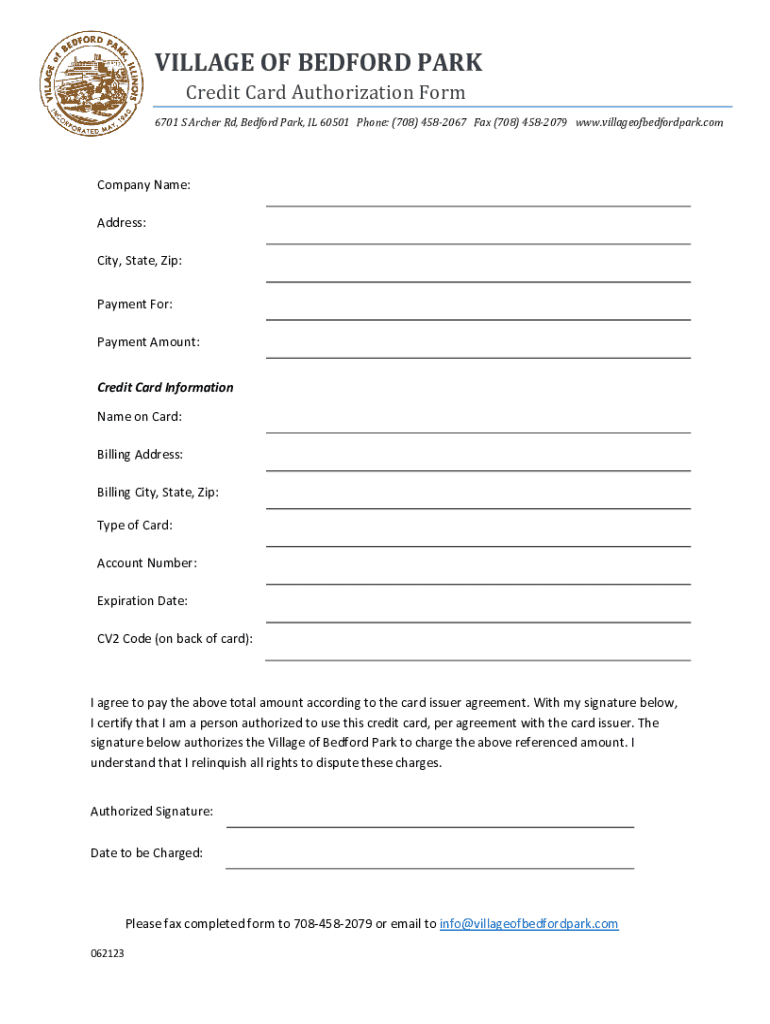

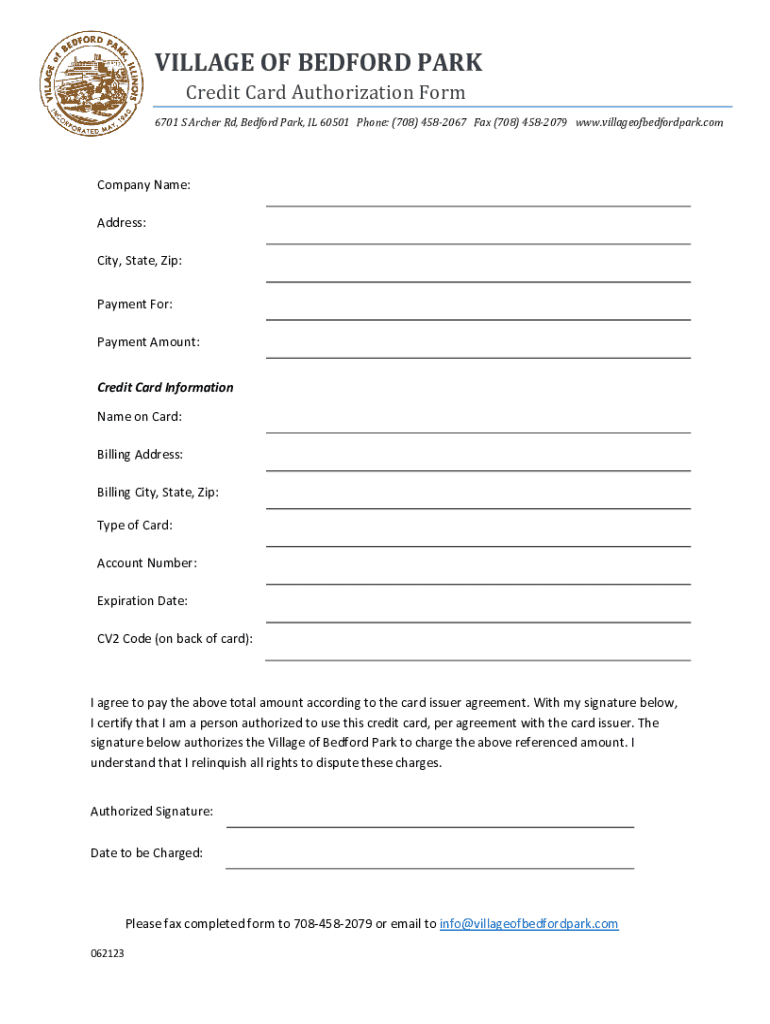

Key components of a credit card authorization form

An effective credit card authorization form should include several key components to ensure clarity and compliance. Essential fields include: cardholder information (name, address), merchant details (business name, contact information), payment amount, transaction date, and a signature line for the cardholder’s authorization. Additionally, optional fields can enhance security, such as the CVV code and card expiration date. Including as much relevant information as possible reduces the likelihood of disputes and strengthens the verification process.

Legality and compliance considerations

The legality of using credit card authorization forms may vary by region; however, it's widely regarded as a best practice in retail and service transactions. While there’s no universal law mandating their use, many businesses implement them to protect themselves from potential fraud and disputes. Compliance with the Payment Card Industry Data Security Standards (PCI DSS) is also essential. These standards dictate how credit card information should be handled and stored, emphasizing the importance of secure authorization methods. Businesses should also establish best practices for retaining authorization forms, typically suggesting a retention period of at least two years, depending on local regulations.

Best practices for filling out a credit card authorization form

Filling out a credit card authorization form requires attention to detail. Start by entering clear and accurate cardholder information, ensuring the names and addresses match the source documents. Next, specify the payment amount precisely to avoid misunderstandings. Use a signature line to capture the cardholder's consent explicitly. Common mistakes include leaving out necessary details or using incorrect amounts. To enhance clarity, review the completed form with the cardholder prior to submission. This fosters trust and ensures that both parties have a comprehensive understanding of the transaction.

How to store signed authorization forms

Storage of signed credit card authorization forms is a critical aspect of transaction management. The decision to store documents digitally or physically depends on your business needs and available technology. Digital storage is preferred for its convenience and accessibility; however, it must comply with data protection guidelines to secure sensitive information. If retaining physical copies, ensure they are kept in a locked location to prevent unauthorized access. Retention periods for these forms generally are recommended at least for two to five years after the last transaction to align with financial regulations.

Common FAQs about credit card authorization forms

As with any document, questions abound regarding credit card authorization forms. For example, if a form lacks space for the CVV code, it may raise security concerns. Alternatively, a 'Card on File' arrangement enables a business to store customer card information for future transactions, provided the customer has consented. If a customer disputes a charge despite having signed the authorization form, businesses should reference the signed document during the dispute process, showcasing that proper procedures were followed and obtaining the necessary consent.

Enhancing your payment process with pdfFiller

pdfFiller offers an innovative approach to handling credit card authorization forms. Users can create, edit, and manage their forms seamlessly within a cloud-based platform, enhancing both efficiency and accessibility. Features such as eSigning enable instantaneous authorization, while collaborative options allow multiple stakeholders to engage with the documents. This streamlined process not only saves time but also reduces the likelihood of errors in form completion. With pdfFiller, businesses can adopt a more modern payment process that is both secure and user-friendly.

Real-life examples of using a credit card authorization form

Many industries successfully employ credit card authorization forms to manage transactions effectively. For instance, a local gym uses these forms to secure memberships, ensuring that members are billed accurately every month. A landscaping service provides regular upkeep to clients, relying on signed forms to charge for services rendered without daily transactions. Testimonials reveal that these forms not only facilitate smooth transactions but also build trust between businesses and clients by reinforcing accountability.

Interactive tools for creating a credit card authorization form

pdfFiller also provides a range of interactive tools to create customized credit card authorization forms. Users can explore available templates, ensuring they meet specific business requirements and preferences. By leveraging the platform's user-friendly interface, businesses can personalize fields according to their branding and customer needs. Video tutorials and guided prompts simplify the process further, making the creation and management of these important forms accessible even for those with minimal document management experience.

Conclusion: streamlining your transactions with confidence

Credit card authorization forms are vital tools for businesses and consumers alike, significantly enhancing transaction security and trust. By implementing best practices and understanding their crucial role in payment processing, companies can protect themselves from chargebacks and disputes. Utilizing platforms like pdfFiller empowers users to streamline their payment processes, ensuring that sensitive documents are managed effectively. In an era where digital transactions are prevalent, fostering a trustworthy and efficient payment method is essential for operational success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit card authorization form?

How can I edit credit card authorization form on a smartphone?

How do I fill out the credit card authorization form form on my smartphone?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.