Get the free California Schedule P (540)

Get, Create, Make and Sign california schedule p 540

Editing california schedule p 540 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california schedule p 540

How to fill out california schedule p 540

Who needs california schedule p 540?

A comprehensive guide to the California Schedule P (540) form

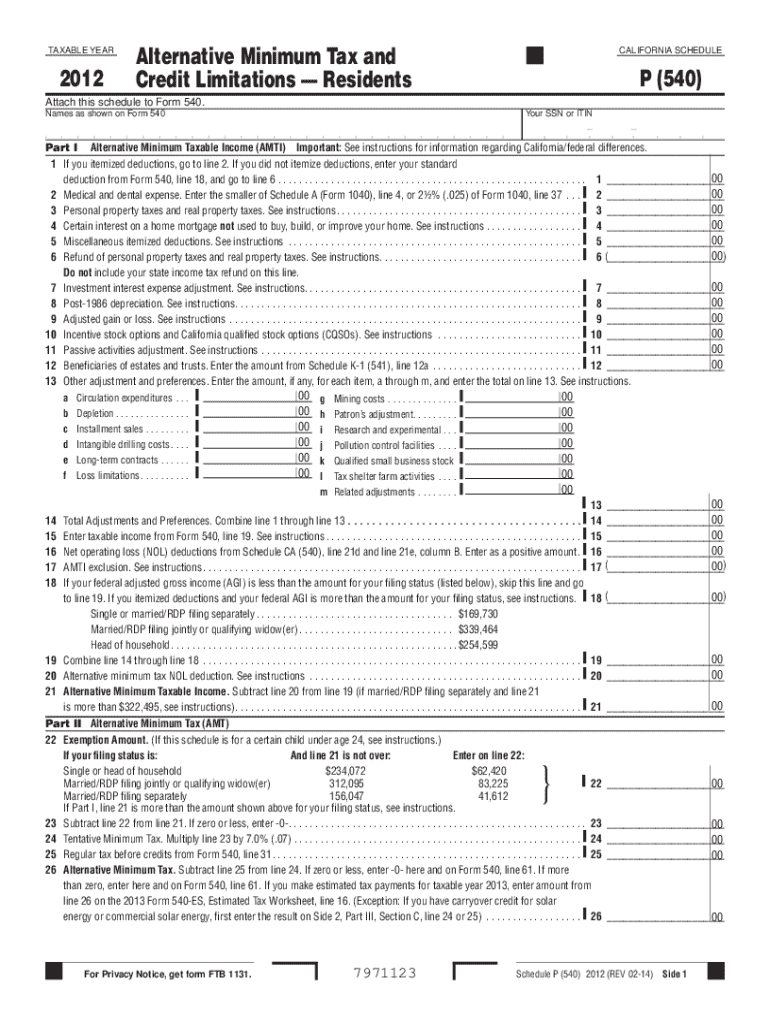

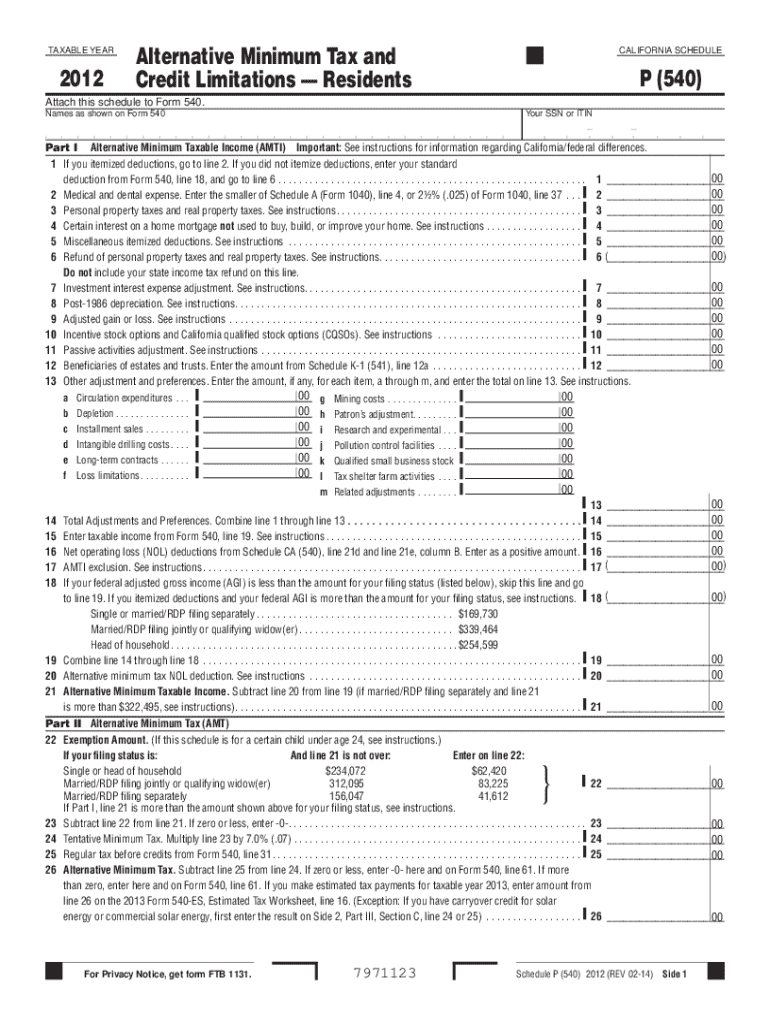

Overview of California Schedule P (540 Form)

The California Schedule P (540) form is a crucial document for taxpayers who may be liable for the Alternative Minimum Tax (AMT). It serves the purpose of allowing taxpayers to calculate their AMT liability and determine any adjustments or credits that may apply to reduce their overall tax obligations. Understanding this form is essential for California residents as it directly impacts their tax liabilities, especially for those who have complex income streams or deductions.

Individuals must file the Schedule P (540) form if they fall into specific categories such as residents of California or if they have any AMT obligations. The AMT is designed to ensure that high-income earners pay at least a minimum amount of tax, regardless of deductions or special exemptions they may qualify for. A thorough understanding of who needs to file can avoid unexpected tax liabilities.

General information about the Schedule P (540) form

The Alternative Minimum Tax (AMT) operates under a distinct set of rules that differ from standard taxation. It focuses on ensuring that taxpayers with high incomes cannot escape a minimum level of taxation. If your taxable income exceeds a certain threshold, adjustments will need to be calculated to ensure compliance with AMT regulations.

In California, the Schedule P (540) form also offers clarity on various tax credits available that can directly impact your tax liabilities. Tax credits are essential as they help reduce the total amount owed to the state, ultimately benefiting taxpayers significantly. It’s paramount to note the key dates and deadlines for filing this form, as missing these dates may lead to penalties or interest on unpaid taxes.

Step-by-step instructions for completing the Schedule P (540) form

Completing the Schedule P (540) form requires careful preparation. Before diving in, gather all necessary documents such as W-2s, 1099 forms, and records of any other income. Understanding your filing status (single, married, etc.) is also crucial, as it determines various thresholds and limits. Reviewing eligibility criteria is necessary to ensure that you’re accurately representing your income and deductions.

Filling out the form involves several parts. Part I of the Schedule P (540) focuses on calculating your Alternative Minimum Taxable Income (AMTI), which includes various income types and necessary adjustments. In Part II, you will determine your AMT by following specific steps tailored to your income and deductions. Part III outlines the various credits available that can directly reduce your tax liability, enhancing the potential savings from tax credits.

Specific line instructions

Each line of the Schedule P (540) represents a specific aspect of your financial data. Understanding what each line requires can ensure precision in your filing. For instance, Line 2 covers medical and dental expenses, which are subject to limitations under AMT rules. Ensure to document any property taxes accurately on Line 3 to secure potential deductions. Understanding Line 5 concerning miscellaneous itemized deductions is equally critical as AMT applies different standards, and adjustments may vary.

Additionally, Lines 11 and 20 relate to passive activities adjustment and the Net Operating Loss (NOL) deduction respectively. These lines provide opportunities for deductions that can significantly impact your tax situation. As you navigate through these specific lines, keep an eye out for common errors and omissions, as these can lead to delays in processing or potential audits.

Record keeping and documentation

Maintaining accurate records when filing the Schedule P (540) form is vital. Proper documentation provides support for the figures you report, which is essential if the California Franchise Tax Board requires clarification later. Recommended documents to keep include tax returns from previous years, receipts for expenses, and any correspondence with tax authorities.

Understanding the retention timeline for these records is equally important. Ideally, you should keep your documents for at least seven years, as this covers the time frame for the California state tax authority to audit your taxes. Being organized helps to streamline the filing process, reduces stress, and ensures you have the necessary proof to support deductions and credits claimed.

Common issues & FAQs

Taxpayers often encounter issues with the Schedule P (540) form, primarily around calculations or missing information. Mistakes can lead to incorrect AMT calculations, which might necessitate an amendment to your form. If you realize you’ve made an error after submission, it's crucial to amend your Schedule P (540) as soon as possible to minimize potential penalties.

Navigating the complexities of AMT and Credits can also pose challenges for taxpayers. It’s advisable to consult with a tax professional if you encounter any difficulties with your filing or have uncertainties regarding tax credits you may be eligible for.

Related topics to explore

Understanding the intricacies of other California tax forms can further enhance your tax planning strategies. For instance, comparing the Schedule P (540) with Forms 540 and 540NR can clarify when each form should be utilized based on your residency status and income sources. Moreover, keeping abreast of recent changes to tax laws impacting Schedule P (540) in 2023 will prepare you better for future filings.

Staying informed on related tax topics can help ensure that you meet your obligations while maximizing your benefits as a taxpayer.

Interactive resources and tools

For added convenience, utilizing interactive tools can enhance your experience when working with the Schedule P (540). Access to an editable Schedule P (540) template allows users to fill out the form digitally, ensuring that information is clear and legible. Additionally, interactive tax calculators can provide real-time estimates of your potential tax obligations and credits, streamlining the filing process.

Online e-filing options are available for those who prefer to submit their forms electronically. This method is not only eco-friendly but also accelerates processing time, allowing you to receive potential refunds more quickly. These resources offer an efficient approach to managing your taxes effectively.

User rights and privacy notice

As a taxpayer in California, it’s essential to be aware of your rights when filing taxes, particularly concerning privacy and data protection. The California Franchise Tax Board has established practices that safeguard your information while ensuring compliance with state laws. Understanding these rights can empower you to maintain the privacy of your financial data during the tax process.

Staying informed about the collection and privacy practices of the Franchise Tax Board helps you navigate the complexities of tax filing and assures that you understand your protections as a taxpayer. Be proactive in safeguarding your personal information on all forms.

Support for California taxpayers

If you have further questions regarding the Schedule P (540) form or need assistance understanding your responsibilities as a taxpayer, a wealth of resources are available. Contact information for tax assistance is crucial for anyone seeking clarity on specific tax situations. Additionally, there are several resources designed to help taxpayers understand their rights, especially for registered domestic partners (RDPs) or other unique filing scenarios.

Being informed about the support available to you can make a significant difference in your tax experience. Connecting with experts or utilizing online resources ensures that you tackle your tax obligations with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send california schedule p 540 for eSignature?

How do I execute california schedule p 540 online?

Can I create an electronic signature for signing my california schedule p 540 in Gmail?

What is california schedule p 540?

Who is required to file california schedule p 540?

How to fill out california schedule p 540?

What is the purpose of california schedule p 540?

What information must be reported on california schedule p 540?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.