Understanding Minnesota Last Will and Form

Understanding the importance of a will in Minnesota

A last will and testament is a critical legal document that outlines how your assets and responsibilities should be handled after your demise. In Minnesota, just like in other states, a will ensures that your wishes are respected regarding the distribution of your estate. Not only does it provide direction, but it also alleviates potential disputes among heirs, making the grieving process smoother.

The role of a will in estate planning cannot be overstated. It functions as a legal blueprint that communicates your decisions about your property, dependents, and other matters. Without a will, Minnesota law dictates how your assets will be distributed, potentially leading to outcomes that differ from your true desires.

Establishes clear directives for asset distribution.

Names guardians for minor children.

Helps minimize family disputes or confusion.

Speeds up the probate process.

Key concepts related to Minnesota wills

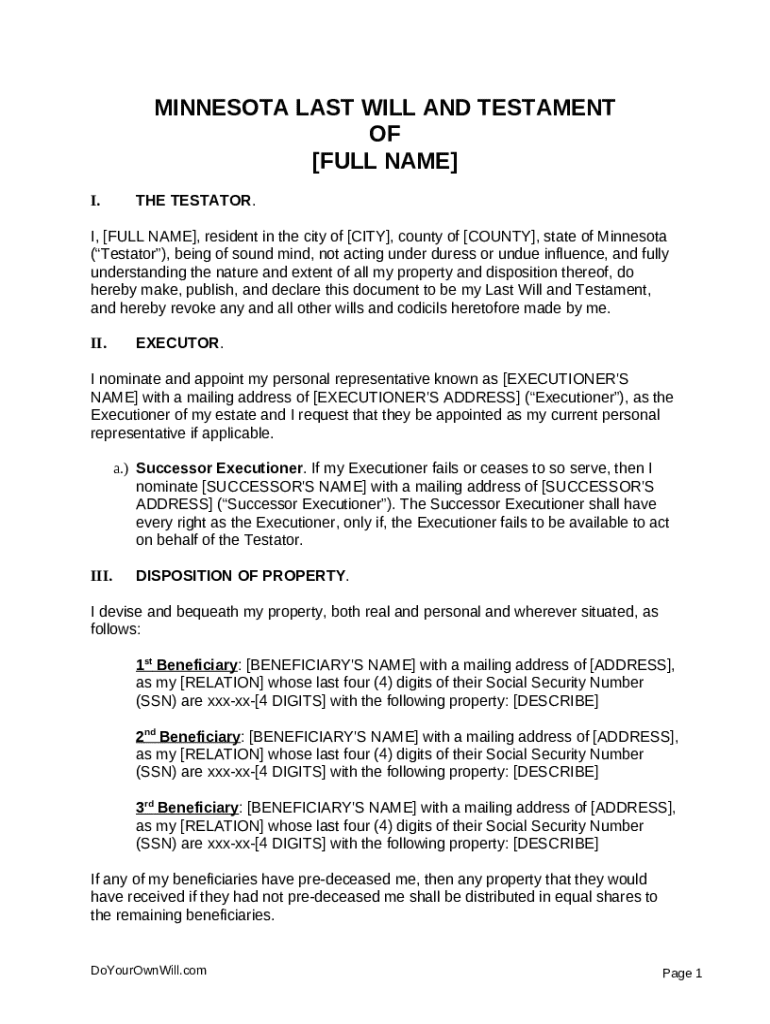

A last will and testament typically includes several essential components: a declaration that the document is a will, the identification of the testator (the person creating the will), a comprehensive list of beneficiaries, and instructions regarding the distribution of assets and care for dependents. In Minnesota, individuals can execute different types of wills such as formal wills, holographic wills (handwritten), and oral wills, although the latter are not commonly recognized in practice.

Assessing your need for a will involves introspection. Everyone's situation is unique, and many people mistakenly believe that they don’t need a will if they don't own significant assets. However, any adult can benefit from having a will, regardless of asset value. Common misconceptions include the idea that wills are only for older people or those who are wealthy.

A will is essential for anyone with children.

It’s beneficial in ensuring pets have caretakers.

Nest eggs or small savings can still warrant a will.

Wills are valuable for persons in blended families.

Legal requirements for wills in Minnesota

To create a legally valid will in Minnesota, certain requirements must be met. You must be at least 18 years of age and possess the mental capacity to understand the implications of your decisions. Additionally, your will must be signed in the presence of two witnesses, who should also sign the document, affirming that they have witnessed you sign your will.

A self-proved will in Minnesota facilitates a smoother probate process by allowing the will to be recognized as valid without requiring the witnesses to testify. This type of will contains an affidavit signed by the witnesses in the presence of a notary public at the time of the will's signing.

Must be at least 18 years old.

Should be notarized to be self-proving.

Preparing your will

Creating a comprehensive will involves several key steps. First, begin by listing your assets, such as real estate, bank accounts, investments, and personal belongings. Consider how you would like to distribute these items among your chosen beneficiaries. Also, you should decide on a personal representative who will execute your wishes and handle the estate.

Gathering necessary documents is essential. You will need ownership documents for assets, policy details for life insurance, and any previous wills or estate planning documents. It’s crucial to think about special provisions regarding your dependents, like naming guardians for your minor children or instructions for their care.

List all your assets and possessions.

Decide beneficiaries and proportions.

Choose a trusted personal representative.

Consider guardianship for minor children.

Managing your estate

Leaving your spouse or children out of your will is legally permissible in Minnesota, but it's critical to understand the implications. Disinheritance can sometimes lead to disputes or challenges to the will. If your family dynamics are complicated — for instance, if you are part of a blended family — careful forethought is necessary to ensure fair treatment of all parties involved.

A personal representative, often referred to as an executor, is responsible for managing the estate pursuant to the terms of your will. It includes paying debts, ensuring assets are transferred according to directives, and communicating with beneficiaries. Choosing the right person is vital, ideally someone who is organized, trustworthy, and able to handle potential family conflicts.

Understand legal implications of disinheritance.

Foster open communication with family members.

Select a responsible personal representative.

Special considerations in Minnesota

When it comes to naming a guardian for minor children, Minnesota law allows parents to designate whom they wish to care for their children. This is an important decision and should reflect your values and expectations for care. You may want to discuss your choice with the potential guardian to ensure they are willing to accept this responsibility.

Blended families present unique challenges. It's vital to address these complex family structures in your will to avoid potential conflicts between step-siblings or biological children. Asset distribution strategies should be explicitly defined to reflect your intentions and maintain harmony among family members.

Identify a suitable guardian for your children.

Communicate your wishes with family.

Plan for equitable asset distribution.

Updating and modifying your will

Changes in your life circumstances can necessitate updates to your will. Major events, such as marriage, divorce, the birth of a child, or significant changes in assets may indicate that you need to revisit your will. Understanding the correct procedures for modifying an existing will is vital to ensure it remains enforceable.

If you pass away without a will, Minnesota's intestate succession laws dictate the distribution of your assets. This can lead to unintended consequences and leave certain family members without inheritance. For example, if you have a spouse and children, your assets will be divided among them based on state laws, which may not align with your wishes.

Review your will regularly, especially during major life changes.

Follow legal procedures for will modification.

Understand implications of dying intestate.

Storing and protecting your will

The safe storage of your will is crucial. You can store it in a home safe, with a trusted attorney, or at your bank in a safety deposit box. However, ensure that your personal representative and selected heirs know where your will is located for easy access following your passing.

Accessibility is vital as it can expedite the probate process. In Minnesota, delays due to misplaced documents can cause unnecessary stress for your family. Consider making copies and keeping them in secure locations while maintaining the original in a safe place.

Store your will in a safe, accessible location.

Inform your personal representative about its location.

Keep copies in addition to the original.

Utilizing pdfFiller for last will creation

pdfFiller simplifies the process of creating a Minnesota last will and form by offering user-friendly editing and customizable templates. It provides a platform where individuals can fill out necessary information seamlessly and avoid common mistakes associated with manual paperwork. Whether you're looking for a traditional will layout or specific provisions, pdfFiller facilitates easy collaboration and sharing options with trusted individuals.

Start by accessing the array of will templates available on pdfFiller. You can customize your selections to fit your situation. Once your document is complete, you can easily sign it electronically and store it securely in the cloud, ensuring that your will is accessed anywhere, anytime.

Access a variety of customizable will templates.

Follow guided steps for document completion.

Store will securely in the cloud for easy access.

Additional forms and resources related to estate planning

Beyond just a will, pdfFiller offers a variety of forms crucial for comprehensive estate planning. Formulating a power of attorney or health care directive ensures that your decisions regarding medical care and financial matters are honored when you can't advocate for yourself. It's important to coordinate these documents with your will to provide a well-rounded approach to your estate planning needs.

Additionally, considering forms for guardianship, conservatorship, and trusts can be beneficial, particularly for families with special needs or blended family scenarios. Valuable resources on pdfFiller include direct links to these forms, allowing you to complete relevant documentation easily.

Power of attorney forms for designated decision-making.

Health care directive forms for medical decisions.

Guardianship and conservatorship paperwork.

Trusts and related estate planning documents.

Disclaimers and legal information

While pdfFiller provides resources and templates for wills, it's essential to understand the limitations of relying solely on these templates for complex estate planning scenarios. Each individual's situation can vary greatly, and engaging with an estate planning attorney may be necessary for specialized needs or intricate family dynamics.

Estate planning is a significant aspect of life planning, and taking control now can prevent future distress for your loved ones. It helps ensure that your wishes are indeed carried out in a manner reflecting your values and priorities.