Get the free W-9

Get, Create, Make and Sign w-9

Editing w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

W-9 form: Complete Guide to Understanding and Utilizing the IRS Form

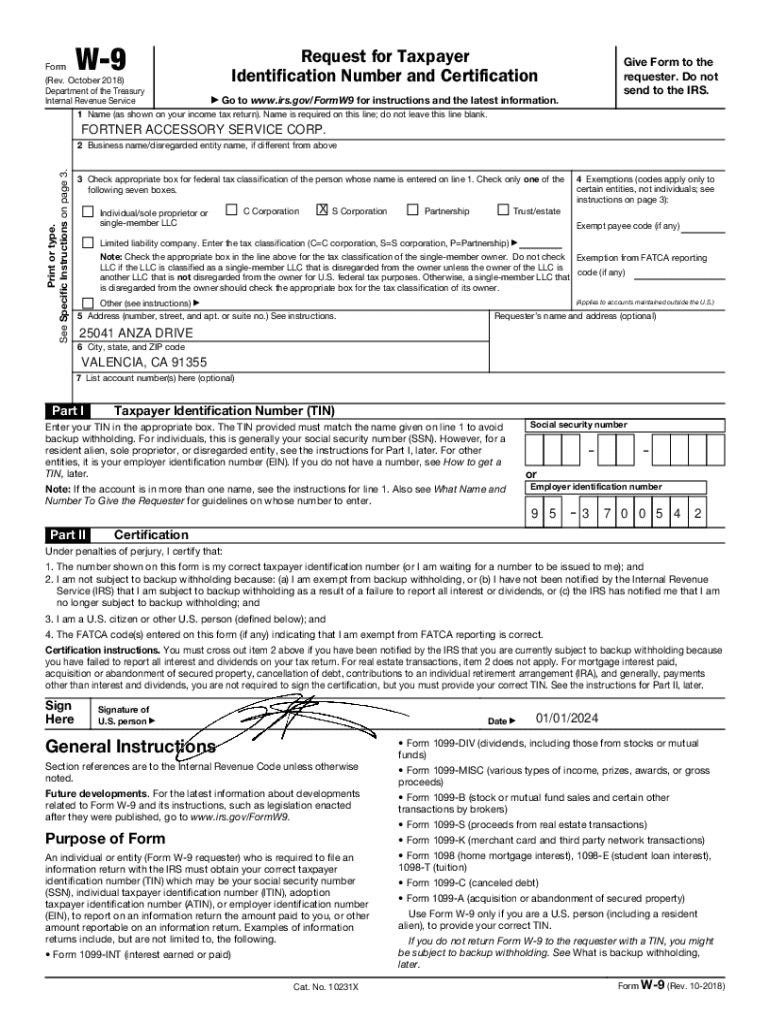

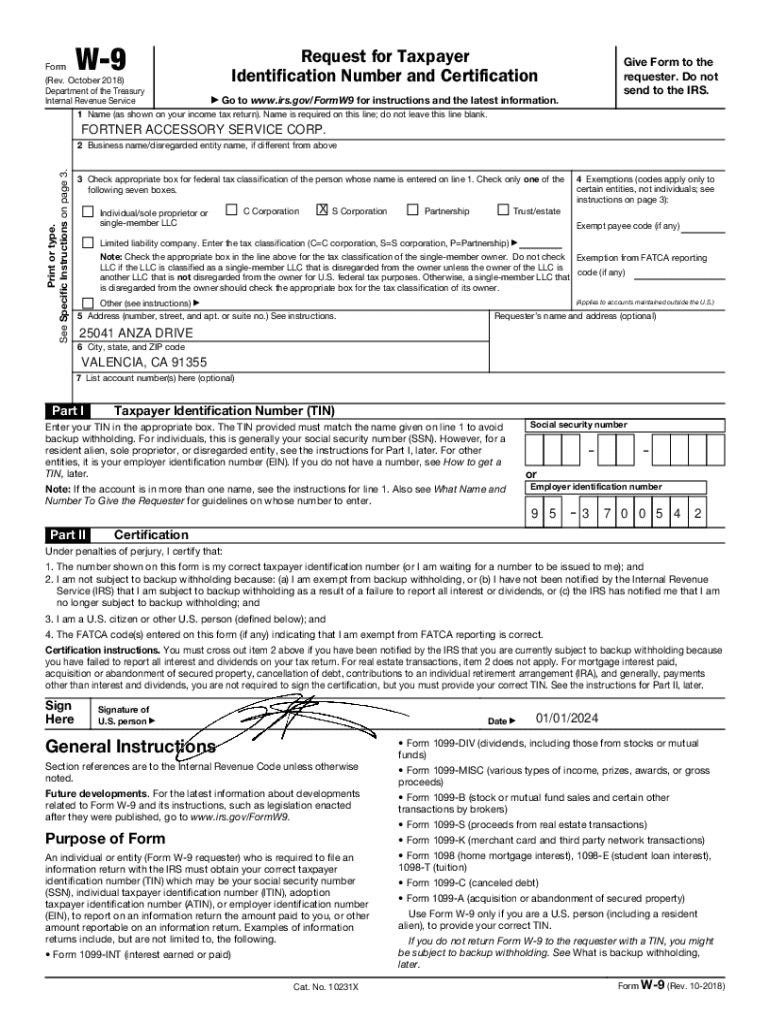

Overview of the W-9 form

The W-9 form is a crucial document introduced by the Internal Revenue Service (IRS) for U.S. taxpayers. It is primarily used to collect and verify taxpayer identification information, such as name and Taxpayer Identification Number (TIN), from individuals and entities who are obligated to report payments made to the IRS. This form is essential for situations such as freelance work, rental payments, and partnerships. Utilization of the W-9 form ensures that parties receiving payments provide accurate information, which in turn aids in proper tax reporting.

Understanding the significance of the W-9 form is vital for independent contractors, freelancers, and businesses alike. It not only helps in streamlining the payment processes but also ensures compliance with federal tax regulations. It's important for anyone engaging in business transactions to be familiar with this form, as failure to provide accurate information or submit a form can lead to problems with tax reporting.

Key components of the W-9 form

When filling out the W-9 form, it’s essential to understand its key components, as they each serve specific purposes. The first section requires the individual’s name and, if applicable, the business name. This helps clarify who is issuing the form and ensures that records can be aligned correctly. The tax classification section is next, where the filer must denote their legal status — whether an individual, a corporation, or an LLC, among other classifications.

Next is the address requirement, which must be accurate, as it is where all the tax-related documents and communications will be sent. Most importantly, the Taxpayer Identification Number (TIN) must be provided — either as a social security number or an Employer Identification Number. Providing accurate information is critical, as errors can lead to delays in payment processing and potential tax penalties.

How to fill out the W-9 form: Step-by-step instructions

Filling out the W-9 form can seem daunting, but with a structured approach, it becomes a systematic task. First, gather all necessary information, including your TIN, business name (if applicable), and address details. Having organized documentation will streamline the process and ensure accuracy.

Start filling out the form by entering your legal name, followed by your business name if you operate under a trade name. If you are an individual or sole proprietor, you will select the relevant tax classification, like individual or LLC. Don’t forget to input your accurate TIN, ensuring that it matches the details on your IRS records. After completing the form, sign it and date it to verify the accuracy of the information provided. Finally, submit your W-9 form to the requester, who may need it for their tax records.

Common use cases for the W-9 form

The W-9 form serves several practical purposes and is widely utilized in various scenarios. Freelancers and independent contractors typically complete a W-9 when they begin working with a new client to ensure proper payment reporting. Landlords also request a W-9 from tenants for rental payments to be reported correctly on their tax returns.

Additionally, businesses working with vendors and suppliers often require a completed W-9 form before issuing payments. Moreover, financial institutions, such as banks and investment firms, use the W-9 form to obtain TINs from clients for interest payments, ensuring compliance with IRS regulations. These use cases highlight the W-9 form’s role in ensuring accuracy in financial reporting across various business landscapes.

Filing method: How to submit your W-9 form

Submitting your W-9 form can be done in several ways, tailored to convenience and speed. E-filing is increasingly popular, especially with platforms like pdfFiller, which allow you to fill out, edit, and e-sign W-9 forms online. This method not only saves time but enhances accuracy by minimizing manual input errors.

Alternatively, you can submit your W-9 form physically via mail or in-person delivery. If you choose to mail your form, use a secure method to ensure that your sensitive information isn’t compromised. Using a service like pdfFiller enhances the submission experience by providing users with an intuitive interface for document management, making it easy to upload, fill out, and send your W-9 form quickly.

Understanding deadlines associated with the W-9 form

Knowing the deadlines for the W-9 form is crucial to ensure compliance with tax regulations. Typically, recipients requiring a W-9 form should request it as soon as they engage in a financial relationship with a contractor or vendor. For most businesses, it is a best practice to obtain a completed W-9 before any payments are issued to guarantee that internal records are accurate from the outset.

Moreover, it's essential to keep track of recurring deadlines, particularly if your business has ongoing relationships with contractors or vendors that necessitate yearly W-9 updates. Frequent updates can help mitigate any issues with misreported income on future tax returns, allowing for a smoother tax filing experience each year.

Avoiding common pitfalls when submitting a W-9 form

Submitting a W-9 form is straightforward, but several common pitfalls can complicate the process. Errors, such as typos in the TIN or mismatched names, can lead to delays and complications with tax reporting. It's essential to double-check all entries before submitting the form to avoid unnecessary issues.

Additionally, maintaining current information is vital. If your legal name, business name, or TIN changes, you must submit an updated W-9 as soon as possible to ensure that future payments and reporting are handled correctly. Failure to do so could result in incorrect withholding amounts and penalties from the IRS.

Special situations and exceptions

In certain scenarios, there may be exceptions related to the W-9 form. For example, exempt organizations such as specific nonprofits or government entities might not be required to submit a standard W-9, but they may still need an alternative form for tax purposes. It’s crucial to assess whether your organization qualifies for any exemptions by consulting with a tax professional.

Furthermore, multi-member LLCs may present a unique case regarding tax classifications. Depending on how they are treated for tax purposes, the owners may need to fill out a W-9 as a partnership or corporation. Understanding these distinctions can help in ensuring that the appropriate form is submitted, avoiding complications in tax reporting down the road.

Understanding backup withholding

Backup withholding is an essential concept associated with the W-9 form. It is a method the IRS uses to withhold a predetermined percentage of payments to certain taxpayers when they fail to provide a correct TIN or meet other requirements. Currently, the backup withholding rate is 24%, which applies to various payments, including interest and dividends. If you receive notice from the IRS regarding backup withholding, it's crucial to address it promptly since failing to do so can result in significant financial implications.

To resolve issues related to backup withholding, taxpayers should verify their TIN and address any discrepancies immediately. If there is uncertainty regarding your status, seeking guidance from tax professionals can help clarify the next steps. Learning about your requirements concerning backup withholding can ensure compliance and avoid future financial penalties.

Related forms and resources

Understanding related forms can help clarify the distinctions among various IRS documents. Unlike the W-9 form, the W-4 is utilized by employees for tax withholding purposes, while the 1099 form reports various types of income, including payments made to independent contractors and freelancers. Misunderstanding the purpose of these forms can lead to filing errors, making a strong grasp of the W-9’s role essential.

Utilizing tools like pdfFiller can help manage multiple tax forms efficiently, ensuring that you have all the necessary documents at your fingertips. With interactive features for editing, signing, and storing these forms online, pdfFiller provides an effective solution for paperwork management, especially during tax season.

Stay informed: External links for ongoing tax guidance

Continuous learning is essential for those dealing with tax documentation. The IRS provides comprehensive resources on the W-9 form, and accessing this information ensures that you stay compliant with IRS expectations. Tax preparation resources from reputable sources can offer up-to-date information on filing requirements, ensuring that you have the guidance needed for each tax situation.

For financial professionals, understanding the implications of tax forms on client relationships is invaluable. Exploring legal advice focused on tax compliance can further empower you to navigate complex tax situations and always provide reliable advice to clients. Always be proactive in seeking knowledge about recent changes in tax laws and procedures.

Exploring business-contractor arrangements

The implementation of a W-9 form plays a crucial role in formalizing business relationships with independent contractors. When businesses hire contractors, obtaining a completed W-9 is often one of the first steps, as it protects both parties during tax reporting and compliance. A robust process for collecting W-9 forms can help streamline the administration of contractor payments, ensuring that all transactions are aligned with IRS guidelines.

Working collaboratively with contractors can lead to fruitful business relationships if managed correctly. Clear communication about payment procedures and the importance of updating W-9 forms whenever there are changes will mitigate potential complications. Developing a systematic method for storing and managing W-9 forms using tools like pdfFiller further enhances efficiency in these arrangements.

Financial institution-customer arrangements

Financial institutions rely heavily on the W-9 form to ensure compliance with tax regulations and reporting. When customers open accounts or apply for loans, banks will typically request a completed W-9 form to collect the Tax Identification Number (TIN) necessary for reporting interest payments. This requirement not only safeguards the financial institution's compliance but also helps the customer avoid issues with underreported income.

Overall, it’s best practice for clients in financial transactions to be proactive in providing W-9 forms to their financial institutions. This step ensures an efficient service, avoids delays in processing, and ultimately contributes to a smoother banking experience. Financial professionals should educate their clients on why providing accurate information on the W-9 is crucial for their financial wellbeing.

Employer-employee arrangement insights

A common misconception is that the W-9 form applies to all worker classifications, including employees; however, it serves a different purpose than the W-2 form, which is specifically designed for employee taxation. When employers need to collect information for contractor payments or other services, they typically use the W-9. It's important for employers to understand when to utilize a W-9 versus a W-2, as erroneously assigning forms can lead to reporting errors and penalties.

Employers should prioritize clarity in their employment relationships to ensure that workers understand their classifications accurately. This understanding protects both the employer and worker and supports optimal tax compliance. Implementing structured processes around the use of the W-9 and W-2 forms can enhance management and reduce administrative hurdles.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in w-9?

How do I edit w-9 in Chrome?

How do I complete w-9 on an iOS device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.