Understanding monthly par with multiple forms

Understanding monthly par: definition and importance

Monthly par refers to the regular process of comparing an organization's financial performance against its budget or forecast, typically on a monthly basis. This technique is critical in financial management as it helps in tracking expenses, revenues, and establishing financial accountability. Companies use monthly par to ensure they are on track with their financial goals and to identify discrepancies between planned and actual performance.

The significance of monthly par lies in its ability to provide actionable insights into how well an organization is performing. It encourages proactive decision-making and enables management to address potential financial deficits before they escalate into larger issues. Key terms associated with monthly par include budget variance, actual vs. projected results, and financial forecasting, which are essential to understanding the broader concept.

Exploring different types of monthly par forms

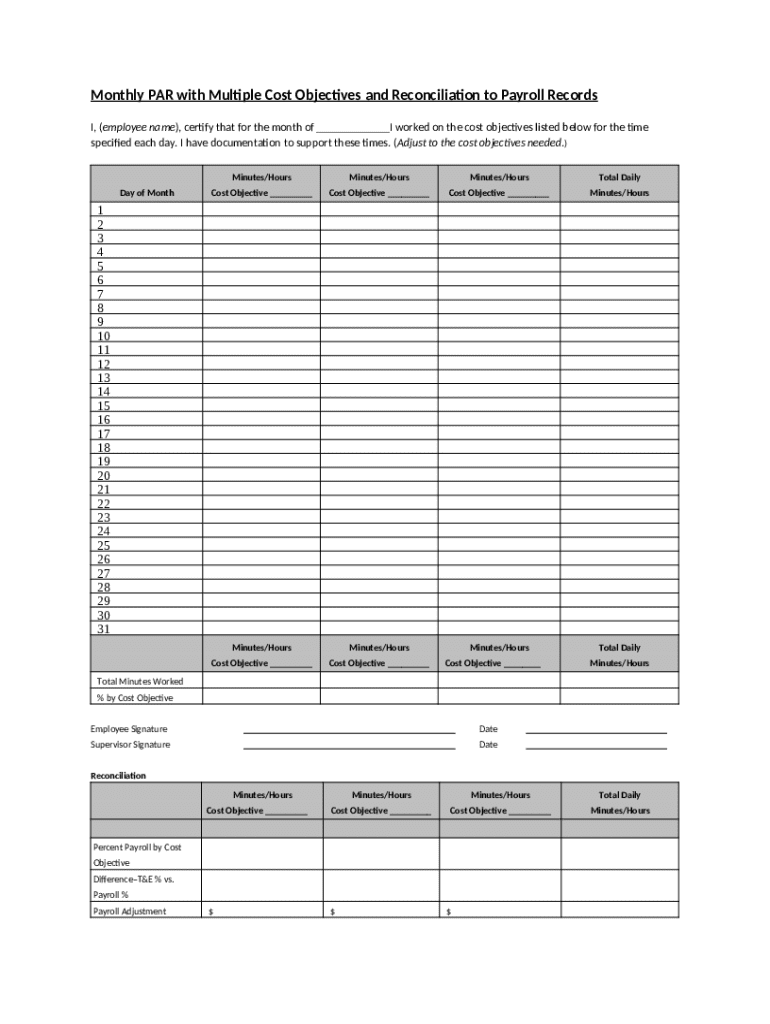

Monthly par is often documented through various forms that capture different aspects of financial performance. Common monthly par forms include expense reports, income tracking forms, and budgeting forms. Expense reports collect data on every expenditure made by the organization, while income tracking forms monitor incoming revenues. Budgeting forms assist in planning and project future financial scenarios to ensure alignment with organizational goals.

Utilizing templates can significantly streamline the monthly par process. By using pre-designed forms, teams can save time, reduce errors, and ensure consistency across reporting. pdfFiller offers a variety of customizable templates for different monthly par needs, enabling users to adapt reports to their specific requirements.

How to effectively fill out a monthly par form

Successful completion of monthly par forms requires attention to detail and organized data entry. Begin by gathering all necessary information, including invoices, receipts, and income statements. Once you have all relevant data, select the appropriate form, whether it be an expense report or a budgeting template.

Next, input the data carefully. Creating accurate records is crucial, as errors can cascade into larger financial problems. After filling out the form, review all entries to ensure their accuracy. This may involve double-checking the calculations and making sure all necessary sections are completed. Following these steps will not only promote accuracy but also enhance compliance with company policies and regulations.

Gather required information from invoices, receipts, and income statements.

Select the relevant monthly par form based on your specific needs.

Input data accurately, ensuring all details are correct.

Review and double-check all entries for compliance and accuracy.

Editing and customizing monthly par forms

Editing and customizing your monthly par forms is essential for meeting the unique needs of your organization. pdfFiller offers robust editing tools that allow you to add custom fields, incorporate digital signatures, and modify existing templates as needed. This flexibility is key in tailoring the forms to fit specific reporting requirements or regulatory obligations.

Moreover, collaborating with team members while filling out monthly par forms can enhance accuracy and accountability. pdfFiller’s real-time editing features enable multiple users to work on documents simultaneously, ensuring that everyone is on the same page and can contribute to the final reports effectively. This collaborative approach not only minimizes the chances of errors but also enriches the data collected.

Managing monthly par: organizing and filing

Once monthly par forms are filled out, the next step is effective organization and filing of these documents. Having a systematic approach to manage monthly par documentation can streamline your financial reporting processes. One strategy is to categorize forms by month and type, making it easy to retrieve any document quickly when needed.

Utilizing digital filing systems like pdfFiller can significantly enhance document management. Not only does it allow for easy storage and retrieval, but it also provides backup options, ensuring that important financial data is never lost. Adopting best practices for document retention, such as keeping forms secure and accessible while adhering to regulatory requirements, is crucial for long-term financial integrity.

Creating monthly par reports and analyzing data

Once your monthly par forms are completed and organized, generating comprehensive monthly par reports becomes the next task. These reports act as summaries of financial performance and highlight trends over time. pdfFiller provides tools that allow you to compile data from multiple forms to create cohesive reports seamlessly.

Analyzing these reports is just as important as generating them. By reviewing monthly par reports, organizations can identify patterns, anticipate future expenses or income changes, and make informed financial decisions. Additionally, pdfFiller’s data visualization tools enable users to depict financial data graphically, helping teams to quickly grasp performance trends.

Case studies: successful implementation of monthly par

Several organizations have successfully implemented monthly par processes to enhance financial management. For instance, a mid-sized tech firm adopted a structured monthly par approach, leading to a 15% increase in operational efficiencies within a year. This success came from timely identification of budget overruns and the quick implementation of corrective measures.

From such case studies, it is evident that best practices in monthly par not only streamline documentation but also foster a proactive financial culture. Organizations that embrace transparent financial processes and encourage collaboration consistently see improved outcomes within their financial reporting.

Future of monthly par: trends and innovations

The future of monthly par is likely to be shaped by emerging technologies that enhance financial analysis and streamline processes. Automation tools and artificial intelligence (AI) are already altering how data is collected, analyzed, and reported, making it easier for organizations to maintain accuracy and efficiency.

Furthermore, the rise of digital solutions such as pdfFiller is leading the way in making monthly par management more accessible and user-friendly. Future innovations may focus on enhancing collaboration features and refining data visualization tools, enabling even greater insights for financial decision-making.

Common challenges in monthly par and how to overcome them

Organizations often encounter several challenges when implementing monthly par processes, with common issues including data inconsistencies, missed deadlines, and member engagement. Identifying these frequent issues is crucial to improving the overall process. For example, inconsistent data can arise from different team members using various templates, leading to confusion.

To overcome these challenges, organizations should establish clear guidelines regarding data submission and template usage. Regular training workshops can help ensure all team members are on the same page. Furthermore, adopting tools like pdfFiller can alleviate many issues by providing a unified platform for document creation, collaboration, and management.

Conclusion on the importance of monthly par in a business context

In summary, the implementation of monthly par with multiple forms is essential for effective financial management and accountability within an organization. It allows businesses to track their financial performance, make informed decisions, and adhere to budgets more accurately. Utilizing tools such as pdfFiller significantly simplifies tasks associated with monthly par, from filling out forms to editing and managing documentation.

By embracing the comprehensive approach provided by pdfFiller and focusing on best practices, organizations can not only overcome the challenges of monthly par but can also thrive in their financial endeavors. Continuous evaluation and adaptation of their monthly par processes will ensure that businesses remain agile in a rapidly changing financial landscape.