Get the free Cancer Insurance Claim Form - Form Ca

Get, Create, Make and Sign cancer insurance claim form

How to edit cancer insurance claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cancer insurance claim form

How to fill out cancer insurance claim form

Who needs cancer insurance claim form?

A comprehensive guide to navigating the cancer insurance claim form

Understanding the cancer insurance claim process

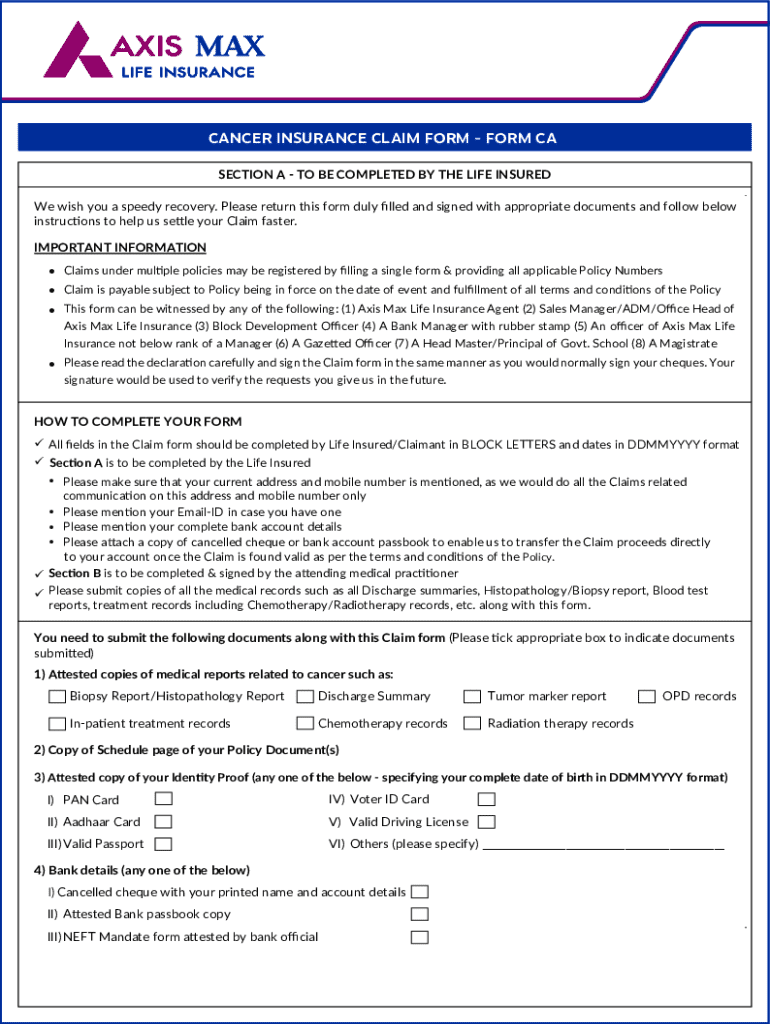

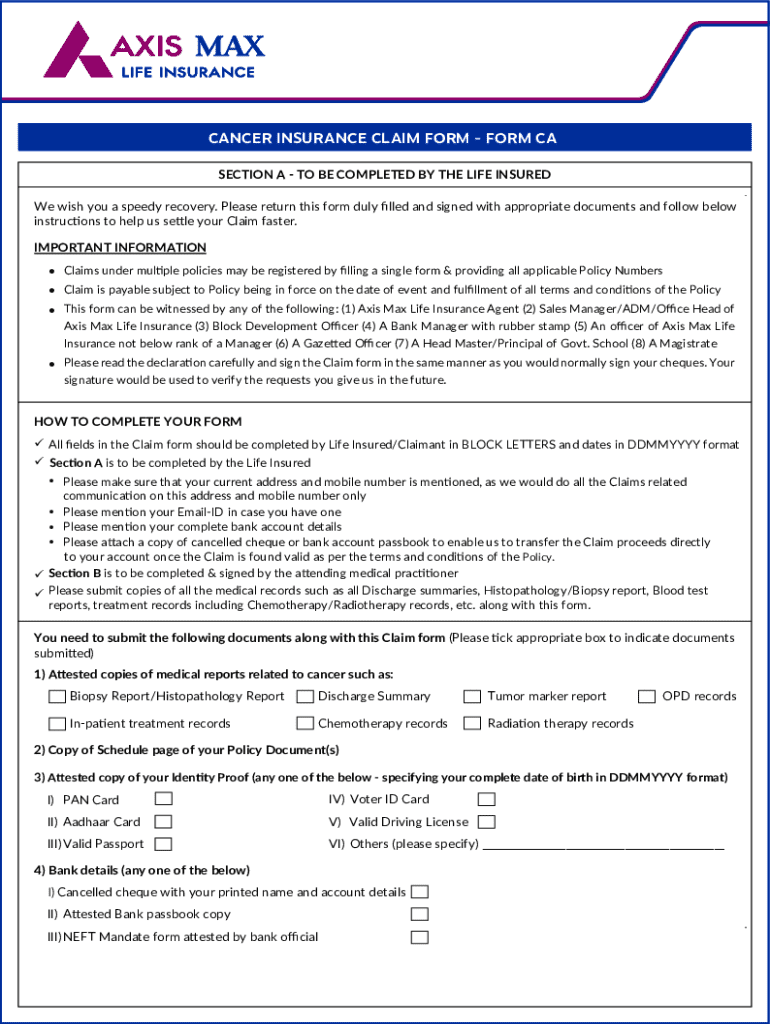

A cancer insurance claim form is a document submitted to your insurance company to request reimbursement for expenses related to cancer treatment. This form serves as a vital component of the claims process, enabling policyholders to access funds that can alleviate the financial burden of medical expenses. Completing the form accurately is crucial as any errors can lead to delays or even denial of the claim. Familiarize yourself with key terms such as 'beneficiary,' 'deductible,' and 'coverage limits,' which will help you navigate the process more effectively.

Preparatory steps before filling out your claim form

Before tackling the cancer insurance claim form, it's essential to gather all necessary documentation. This will ensure a smoother process and avoid potential setbacks. Key documents include your medical records, policy information, and any bills or invoices related to your treatment. Confirming coverage and benefits is vital, as it helps you understand what expenses are reimbursable.

Each policy may have specific filing requirements, such as deadlines for submissions or additional forms to include. Familiarizing yourself with these details will position you for successful claim filing. If your provider has an online claims portal, check there for up-to-date information. Being diligent in these preparatory steps can save you time and stress later on.

Step-by-step guide to completing the cancer insurance claim form

Completing the claim form involves several sections that require accurate information. Start by providing your personal information, which typically includes your name, address, and contact information. Be sure to double-check the accuracy of these entries to avoid delays.

Next, include your policy details. Finding your policy number might require some digging, but it’s essential for linking your claim to your account. Follow this with treatment information, detailing procedures, dates, and attending physicians. Finally, itemize the expenses you've incurred, offering clear breakdowns of every cost you wish to claim. This section is crucial for ensuring you receive full reimbursement.

Tips for filing a cancer claim online

Filing your cancer insurance claim online can streamline the submission process and save time. The advantages include faster processing times and easy access to your claim status. However, online filing comes with its own nuances. Ensure you familiarize yourself with the portal's interface and required file formats for document uploads.

Common mistakes when filing online include uploading incorrect documents or failing to complete all required fields. To avoid errors, maintain a checklist of items needed for submission. When you complete your online application, be sure to review everything carefully before finalizing the submission. This extra check could prevent potential issues from arising later.

What to do if you can't file online?

If online submission is not an option for you, alternative submission methods are available. Most insurance providers still accept physical mail submissions, so ensure your documentation is complete before sending. It's advisable to send forms using a method that allows tracking, ensuring that you can confirm delivery.

For those in need of assistance, many insurers offer phone claims support. When seeking help, have your policy number handy and be prepared to discuss your claim details. To increase your chances of a successful submission via mail, double-check that all documentation is complete and legible.

Navigating potential challenges in the claim process

While filing a cancer insurance claim can be straightforward, potential challenges may arise. The most common reasons for claim denials include missing information or inaccuracies in the submitted details. Therefore, it’s critical to double-check your claim and supporting documents before submission.

If your claim is denied, the first step is to carefully read the denial notice for specific reasons. You have the right to appeal the decision, and it’s often helpful to gather additional supporting documents to bolster your case. Insurance providers can be contacted for clarification or to facilitate the appeal process, which is a standard part of managing your claim.

Keeping track of your claim status

Staying informed about your claim status is crucial. Utilize notifications set up against your profile for timely updates. Regularly checking the insurance portal will allow you to stay on top of your claim's progress. Typically, insurance companies provide a time frame for claims processing; understanding this will help set your expectations post-submission.

If you find that updates are lacking, don’t hesitate to reach out to the claims department for further information. Maintaining a proactive approach regarding your claim status ensures that you can promptly address any issues should they arise.

Legal information and your rights

As a policyholder, you have specific rights regarding your cancer claim. It’s essential to know these rights, which can vary by state, affecting claims and appeals procedures. Understanding your rights will empower you to advocate effectively for your entitlements if disputes occur. Policies usually lay out requirements, and adhering to these alongside knowledge of local regulations can ease complexities during the claims process.

In cases of disputes or misunderstandings, there are resources available for legal assistance. Consulting with professionals who specialize in insurance policy disputes can provide you with insights into effective strategies or actions to take. Staying informed and aware will help you navigate the maze of the insurance landscape more competently.

Conclusion on managing your cancer insurance claim

Navigating the cancer insurance claim form does not have to be overwhelming. By maintaining diligence at each step—from initial documentation to understanding your rights—you can streamline the process and enhance your chances of claim approval. Consider using resources like pdfFiller to manage your documents, ensuring you have easy access to fill, edit, sign, and track your claim forms effortlessly.

Being proactive and informed is key, as it helps alleviate the fear of the unknown within the claim process. Embrace the tools and platforms available to facilitate these tasks, and don’t hesitate to ask for help when needed. A thorough approach can bring peace of mind during this challenging journey, allowing you to focus more on health and recovery.

Additional interactive tools and resources

To further assist you in managing your cancer insurance claims, utilize interactive tools that can guide you through the completion of claim forms or provide FAQs tailored to cancer insurance specifically. Engaging with community forums can also offer a wealth of shared experiences, where individuals discuss tips and strategies that have been beneficial to them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete cancer insurance claim form online?

How do I make edits in cancer insurance claim form without leaving Chrome?

Can I sign the cancer insurance claim form electronically in Chrome?

What is cancer insurance claim form?

Who is required to file cancer insurance claim form?

How to fill out cancer insurance claim form?

What is the purpose of cancer insurance claim form?

What information must be reported on cancer insurance claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.