Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form - How-to Guide

Understanding credit card authorization forms

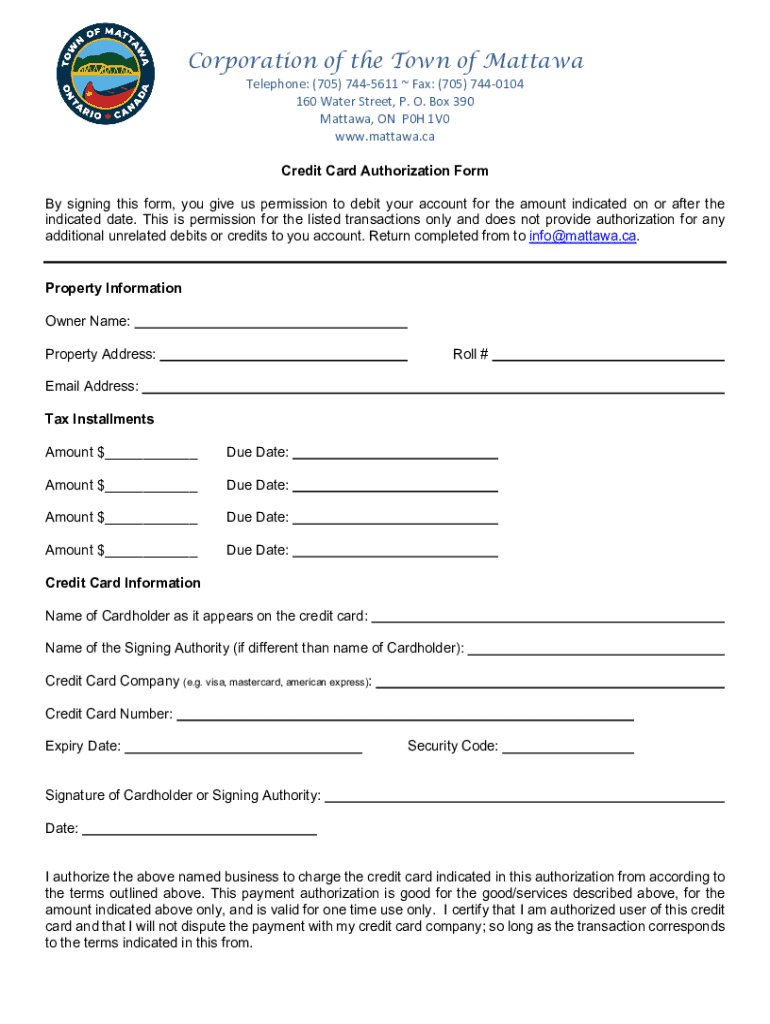

A credit card authorization form is a document that allows businesses to verify and secure payment for goods or services using a customer's credit card. This form acts as a safeguard for businesses when processing payments, ensuring the cardholder consents to the transaction and that funds are available. Without such authorization, the risk of chargebacks and fraudulent activities increases significantly.

Beyond mere validation, authorization in payment processing is crucial for ensuring the integrity of transactions. It not only protects businesses but also fosters trust with customers, as they are assured that their data is handled appropriately. Legally, businesses are responsible for following proper procedures when collecting and handling sensitive credit card information, making the usage of authorization forms essential to avoid potential legal issues.

Components of a credit card authorization form

A properly structured credit card authorization form contains several key components. Essential information required includes:

While the essential components are critical, optional fields can enhance the utility of the form. For instance, including a CVV field can further secure transactions by requiring the card's verification code. Additionally, recording the card's expiry date helps confirm its validity, while mentioning billing address verification can prevent errors or fraud.

Benefits of using credit card authorization forms

Using credit card authorization forms offers multiple benefits for businesses and customers alike. Firstly, these forms help prevent chargeback abuse, as they provide documented proof of the customer's consent for the transaction. This documented consent is vital for disputing any unauthorized claims.

Moreover, they enhance customer trust and security, reassuring customers that their financial information is treated with care. When customers know that businesses take their security seriously, they are more likely to engage without hesitation. Furthermore, employing a structured payment process streamlines operations for businesses, allowing rapid authorization and processing of transactions.

When to use a credit card authorization form

Credit card authorization forms are particularly useful in certain scenarios, such as:

Despite their utility, businesses should also be aware to avoid common pitfalls such as inadequate data security practices or unclear language in the forms, which could lead to misunderstandings or potential legal troubles.

How to fill out a credit card authorization form

Filling out a credit card authorization form is straightforward when approached with attention to detail. Here’s a step-by-step guide:

It’s important to highlight areas in the form, like the authorizing signature line and CVV section, ensuring they receive proper attention before submission. This prevents any potential delays in processing.

Editing and managing credit card authorization forms

With tools provided by pdfFiller, managing credit card authorization forms can be efficient and effective. Editing the form online allows you to modify any incorrect information easily.

You can add digital signatures to completed forms, streamlining the signing process. Additionally, collaborative features allow multiple team members to share, edit, and manage access to these documents, making it easy to maintain control over sensitive data.

Storing signed forms: best practices

Once a credit card authorization form has been signed, secure storage is essential to protecting customer data. Best practices include the use of encrypted digital storage systems to safeguard sensitive information from unauthorized access.

Compliance with data protection laws, such as GDPR or other relevant regulations, is paramount. Businesses should maintain these forms for a recommended duration—typically between three to five years—depending on their operational needs and legal requirements.

FAQs about credit card authorization forms

Related resources and templates

To streamline your credit card authorization form processes, consider downloading customizable templates from pdfFiller. These templates are designed to fit a variety of business needs and can be easily adapted to your specific circumstances.

Additionally, explore more how-to guides related to payment processing and other forms like payment reminders or consent forms to enhance your operational workflow.

Insights and tips for businesses

Integrating credit card authorization forms into your workflow can greatly improve your business operations. Consider employing analytics tools to track and analyze authorization data to identify trends and areas for improvement.

Furthermore, developing a strategic approach to preventing fraud and chargebacks is essential. This includes thorough verification steps before transactions are processed, enhancing the overall customer experience through efficient, streamlined processes.

Additional information for different sectors

Different industries have specific needs regarding credit card authorization forms. For instance, e-commerce businesses may prioritize security features, while healthcare sectors must comply strictly with patient data protection regulations.

In hospitality, clarity in billing and refund policies is crucial; thus, forms should convey these policies effectively. Understanding industry regulations and compliance requirements is vital in ensuring that all transactions remain secure and legally compliant.

Advanced features of pdfFiller

pdfFiller offers advanced features that facilitate the editing and management of credit card authorization forms. Real-time collaboration tools allow teams to simultaneously work on documents, enhancing productivity.

Automating document management processes reduces manual workload, while integrations with other platforms streamline workflows. Such capabilities ensure your business not only processes transactions securely but also efficiently, allowing faster response times and improved customer satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card authorization form to be eSigned by others?

Can I create an electronic signature for signing my credit card authorization form in Gmail?

How do I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.