Get the free Comprehensive Single Project Insurance Risk Capture Form

Get, Create, Make and Sign comprehensive single project insurance

Editing comprehensive single project insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out comprehensive single project insurance

How to fill out comprehensive single project insurance

Who needs comprehensive single project insurance?

Comprehensive Single Project Insurance Form: How-to Guide

Understanding comprehensive single project insurance

Comprehensive single project insurance is a specialized insurance policy tailored for a specific construction project. This type of coverage is essential for protecting all parties involved, including owners, contractors, and subcontractors, from various risks that may arise during the project's duration. Unlike traditional insurance policies, which may cover multiple projects or general risks, this type of insurance focuses exclusively on one singular project.

The importance of comprehensive single project insurance cannot be overstated, as it provides significant benefits such as financial protection, risk mitigation, and peace of mind. By having dedicated coverage for a single project, stakeholders can allocate their resources more efficiently and ensure that they are financially secure against unforeseen events.

Types of risks covered

This insurance form addresses various types of risks, which include:

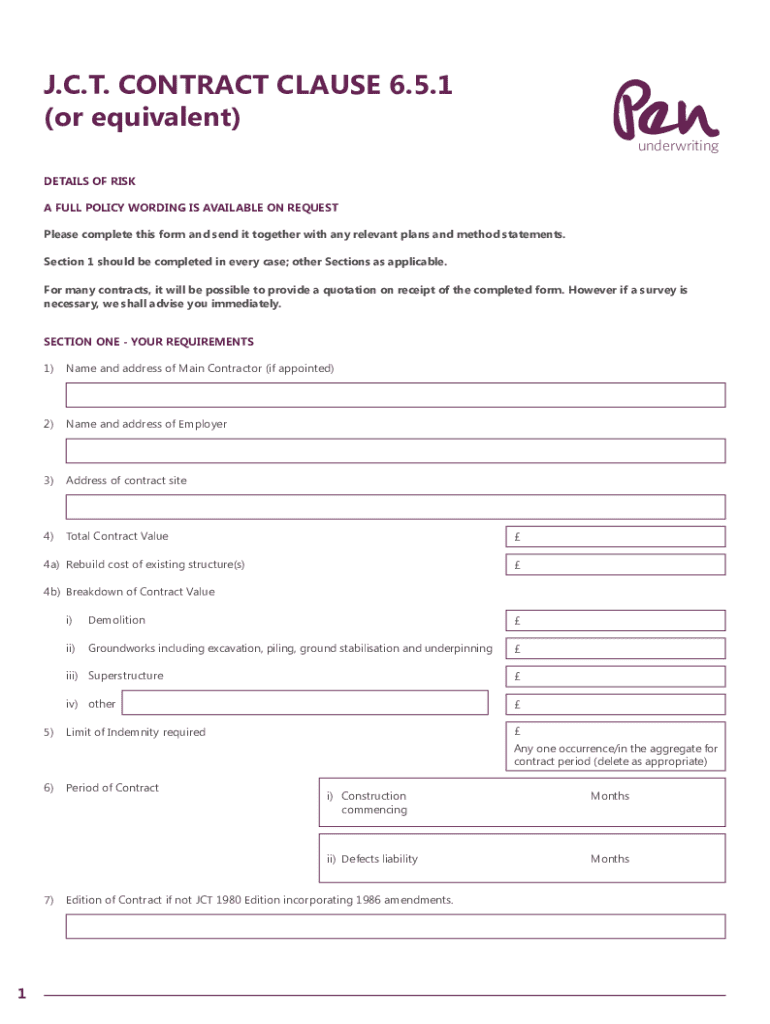

Key components of the comprehensive single project insurance form

Completing the comprehensive single project insurance form requires careful attention to specific details. Knowing what information is essential can streamline the process significantly.

The essential information required in the form includes crucial project specifics such as location, nature of work, and duration, as well as parties involved like owners, contractors, and subcontractors. Providing accurate project details forms the bedrock of a successful insurance application.

Sections of the form explained

The comprehensive single project insurance form generally consists of several key sections that must be understood before completion:

Detailed instructions for completing the form

Filling out the comprehensive single project insurance form can be straightforward if approached step-by-step. Here’s a guide to ensure all necessary information is accurately provided.

Step-by-step filling guide

Common mistakes to avoid

Even seasoned professionals can overlook details. Some common mistakes to steer clear of include missing key details, underestimating coverage limits, and failing to disclose all parties involved. Each of these oversights can lead to coverage gaps or claims disputes, so a thorough review is vital.

Editing and customizing the comprehensive insurance form

In today's digital age, customizing the comprehensive single project insurance form has become easier. Platforms like pdfFiller offer advanced tools for editing, ensuring quick modifications without the hassle of printing or scanning.

Using pdfFiller for digital edits

Adding signatures and collaborations

The platform also supports eSigning functionalities, allowing users to add signatures digitally without printing any paperwork. Collaborating with team members in real-time helps streamline the approval process, ensuring that all necessary stakeholders can contribute to the form.

Managing your comprehensive single project insurance document

Proper management of your insurance document is crucial for ensuring that all parties have access to the latest information and updates throughout the project's lifecycle.

Document storage and accessibility

Utilizing cloud-based storage solutions offers numerous benefits, such as the ability to access documents from anywhere at any time. This is especially useful for remote teams and on-site construction workers who require immediate access to insurance documentation.

Tracking changes and updates

Many platforms, including pdfFiller, offer version control features that allow users to track changes and updates to the insurance document. This ensures that all stakeholders remain informed about modifications and can refer to the most current information when needed.

Legal compliance and best practices

Understanding regulatory requirements is a critical aspect of managing comprehensive single project insurance. Each locality may have distinct laws regarding project insurance that must be adhered to.

Understanding regulatory requirements

Local laws regarding project insurance can dictate specific coverage parameters and obligations. Failing to comply can lead to severe penalties, making it crucial for stakeholders to stay informed about their local regulations.

Tips for maintaining compliance

Frequently asked questions (FAQs)

What happens if the project scope changes?

If the project scope changes significantly, it is necessary to revisit your insurance coverage. This may involve modifying your policy to ensure that it reflects the new scope of work, which may introduce additional risks.

How to modify your insurance coverage?

Modifying insurance coverage typically involves reaching out to your insurance provider to discuss changes or additional coverage requirements. Most providers are flexible and can guide you through the necessary steps.

What to do in case of an insurance claim?

In the event of an insurance claim, promptly notify your insurance company and provide all necessary documentation, including the completed comprehensive single project insurance form. Swift reporting can significantly streamline the claims process.

Interactive tools and resources

To better assess your insurance needs, various interactive tools and resources can be invaluable in your decision-making process.

Using insurance calculators

Insurance calculators can help estimate what coverage you might require based on project specifics, thereby ensuring you secure adequate insurance. This proactive approach can prevent unexpected gaps in coverage.

Helpful links to additional services

Connecting with reputable insurance providers and legal advice regarding construction insurance can further enhance your understanding and approach to comprehensive single project insurance.

Testimonials and success stories

User experiences with comprehensive single project insurance often highlight the importance of having structured coverage. Many professionals in the construction industry have reported that their robust insurance plans have minimized risk and provided them peace of mind during complex projects.

Case studies highlighting effective management and success

For instance, a construction firm undertaking a large-scale infrastructure project was able to navigate unforeseen delays and challenges effectively, thanks to their well-defined comprehensive single project insurance form. The proactive approach to coverage not only protected their financial interests but also fostered collaborative efforts among all stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete comprehensive single project insurance online?

Can I sign the comprehensive single project insurance electronically in Chrome?

Can I create an electronic signature for signing my comprehensive single project insurance in Gmail?

What is comprehensive single project insurance?

Who is required to file comprehensive single project insurance?

How to fill out comprehensive single project insurance?

What is the purpose of comprehensive single project insurance?

What information must be reported on comprehensive single project insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.