Get the free Cancer Insurance Claim Form- Form Ca

Get, Create, Make and Sign cancer insurance claim form

Editing cancer insurance claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cancer insurance claim form

How to fill out cancer insurance claim form

Who needs cancer insurance claim form?

Cancer insurance claim form - How-to guide

Understanding cancer insurance claims

Cancer insurance provides a safety net for individuals diagnosed with cancer, covering various costs such as treatment, medication, and hospital stays. Understanding how to effectively navigate the claims process is crucial for policyholders, as timely submissions can significantly expedite the financial support necessary during treatment.

Filing claims promptly is vital because delays might lead to additional stress during an already challenging time. Moreover, insurers often require claims to be submitted within a certain period after receiving treatment. Familiarizing yourself with common reasons for claim denials, like incomplete documentation or misunderstanding policy terms, can save time and prevent frustration.

Types of cancer insurance policies

Understanding different types of cancer insurance policies is essential when selecting coverage that best meets individual needs. Policies can be broadly categorized into individual plans and group insurance plans offered through employers or associations. Individual plans provide tailored benefits, while group plans often offer lower premiums but may come with limited options.

Cancer insurance can also be categorized based on the extent of coverage: comprehensive coverage, which typically includes a wide range of treatment options, and limited coverage, where benefits are specified for certain cancers or treatments. When evaluating policies, consider crucial features such as waiting periods, maximum payout limits, and whether the coverage extends to experimental treatments.

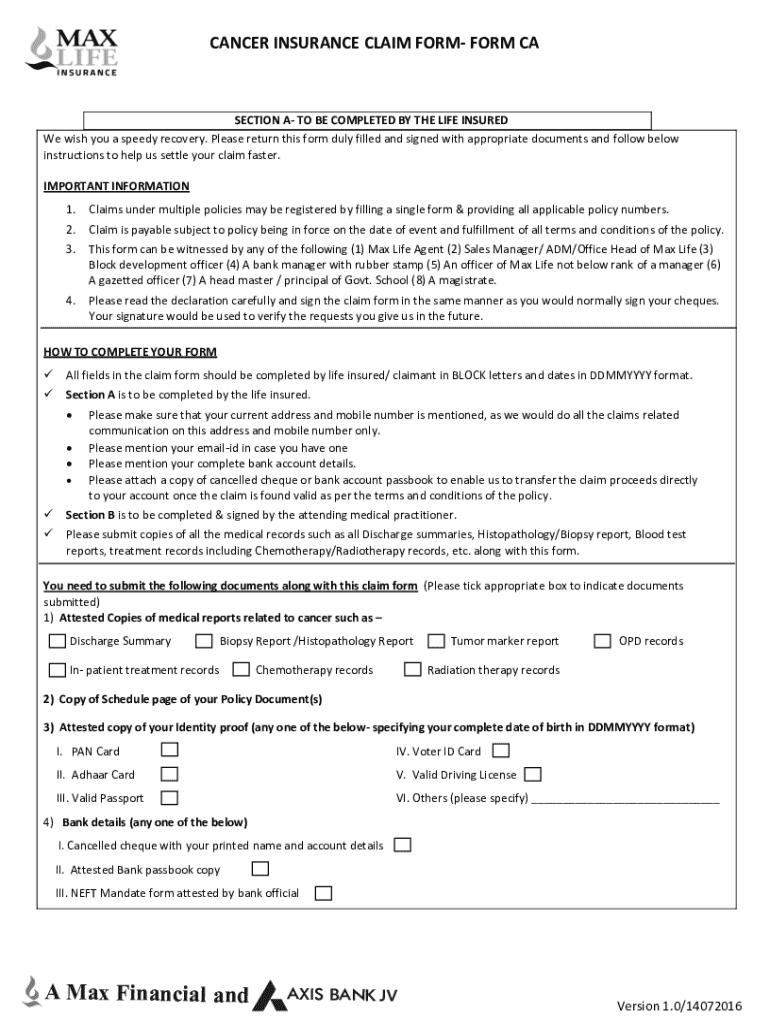

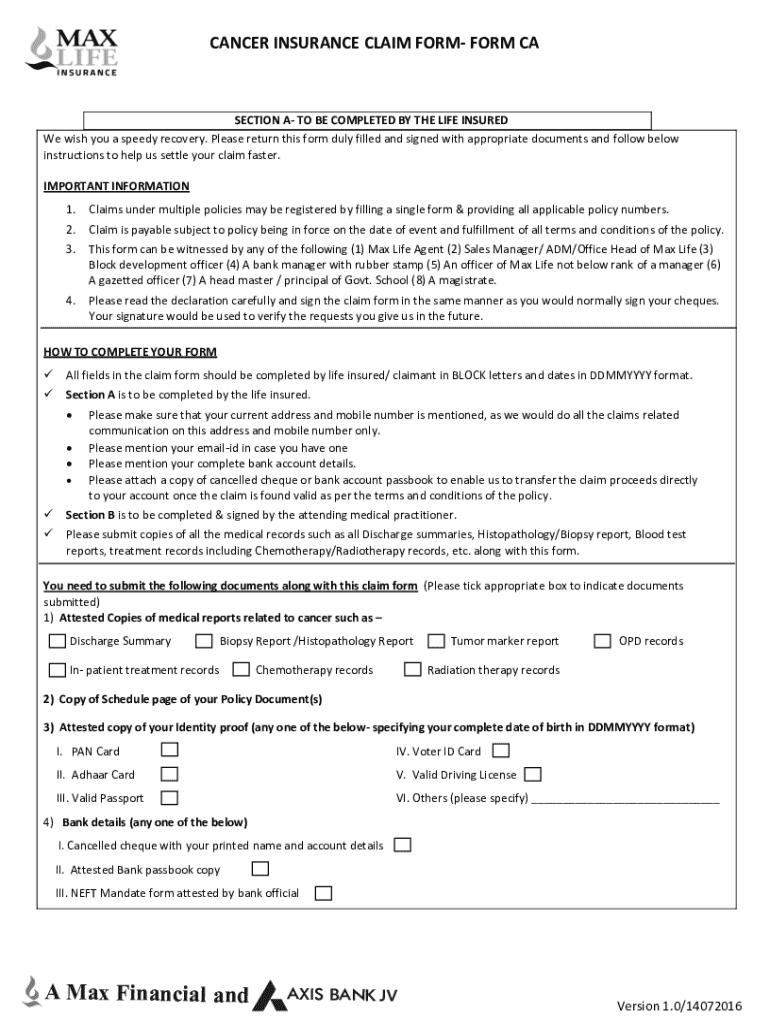

Preparing to file a cancer insurance claim

Before starting the claim process, it's crucial to gather all the necessary documentation. Having your medical records, policy information, and treatment details readily available can streamline the process and help ensure accuracy in your submission.

Claim eligibility is determined by the terms outlined in your policy, including the types of cancers covered and the treatment modalities included. Understanding these aspects can prevent mistakes when filling out forms.

Step-by-step guide to filling out the cancer insurance claim form

Filling out the cancer insurance claim form is a straightforward process when you follow the steps outlined below. Start by accessing the required form through pdfFiller’s platform for a seamless experience.

Step 1: Downloading the claim form

Visit pdfFiller and navigate to the claims section. Here, you will find various templates; select the correct cancer insurance claim form tailored for your policy. Ensure that you have a PDF viewer compatible with the document.

Step 2: Filling out personal information

Begin filling out your personal information accurately, including your name, contact details, and policy number. Double-check this information to ensure it matches your insurance documents.

Step 3: Detailing cancer diagnosis

Provide a concise yet comprehensive description of your cancer diagnosis. Attach required medical documentation, such as pathology reports and hospital discharge papers, to substantiate your claim.

Step 4: Itemizing treatments received

Specify all treatments received, which may include hospitalizations, surgeries, and various therapies. Each entry should include dates and relevant details to ensure clarity and completeness.

Step 5: Listing other insurance coverage

If you have other insurance policies covering your cancer treatment, list these to enable the coordination of benefits. This step is essential to avoid delays in claim processing.

Step 6: Signing and submitting the claim

Once you complete the form, provide your signature electronically using pdfFiller’s eSignature feature. Finally, submit the claim through your chosen method—most insurers offer online submissions, but mailing a hard copy is also an option if necessary.

Interactive tools for streamlining your claim process

Using modern digital tools can significantly enhance your claim-filing experience. pdfFiller offers various features to streamline the process, including digital signing capabilities allowing you to sign documents securely anytime, anywhere.

Additionally, pdfFiller promotes collaboration. Family members or caregivers can easily assist in filling out the claim form, ensuring every detail is accurate. Plus, the online tracking feature helps keep you updated on the status of your claim, providing peace of mind.

Tips for filing a cancer insurance claim successfully

Organizing your claim submission can enhance the likelihood of approval. Maintain copies of every document you send, as this can serve as a vital backup in case questions arise later. It's also beneficial to familiarize yourself with frequent mistakes often made in claims submissions, such as not providing enough detail or rushing the completion of forms.

After submission, follow up with your insurance provider consistently. This not only keeps you informed about your claim's progress but can also clarify any issues your provider might identify during processing.

Can’t file online? Alternatives for claim submission

While online submissions are often the quickest, there are alternatives available for those who cannot file online. Paper submissions are still accepted by many insurance companies. Be sure to collect the right documentation and send the claim form via certified mail to ensure delivery.

Telephonic support is another useful resource for claim inquiries. Many insurers provide dedicated claims support lines where you can ask questions or get clarity on the process. If you encounter issues, make sure to note down any pertinent details during your call, as this information will serve to support your case.

Engaging with customer service for assistance

When issues arise, reaching out to your insurance provider's customer service can be key to uncovering solutions. Knowing when to contact them, such as when your claim status remains pending for too long, is essential. Being prepared with your policy number and relevant document details can facilitate quicker assistance.

Navigating common queries will also alleviate concerns. This may include questions about the timeline for claim processing, the reasons behind denials, or specific requirements for supplemental information.

Resources for patients and caregivers

Navigating cancer treatment can be overwhelming, and various resources can provide support. Support groups play a vital role in offering emotional backing, and many organizations also provide financial assistance models for those facing substantial treatment costs.

Legal support for claim disputes should not be overlooked. Should you encounter significant issues or denials, consulting a legal professional who specializes in insurance can offer clarity and potential resolutions.

Industry professionals insights

Insights from industry professionals can underscore best practices when navigating cancer insurance claims. Insurance experts emphasize the importance of fully understanding the terms of your policy and maintaining communication with your insurer throughout the process.

As the insurance landscape evolves, staying abreast of emerging trends, such as telehealth services and expanded coverage for innovative treatments, is crucial. These developments can significantly affect your coverage options and claims process.

Legal information surrounding insurance claims

Understanding your rights as a policyholder is critical in navigating potential disputes with your insurance company. Familiarize yourself with the regulations outlined by relevant insurance authorities to safeguard your interests.

Consulting with a legal professional should be considered when disputes arise, especially if a claim denial hinges on unclear policy language or if procedural errors are suspected. Knowing when and how to seek legal advice can drastically improve your chances of a successful resolution.

Additional considerations

Staying informed about policy changes is vital, especially with rapid medical advancements that may impact coverage options. New treatments and technologies can alter the landscape of what's eligible for reimbursement, highlighting the importance of regular communication with your insurance provider for updates.

Preparing for future claims management involves not only understanding current policies but also anticipating potential future needs based on evolving treatment options and personal health changes. This proactive approach enables more effective interactions with your insurer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cancer insurance claim form in Gmail?

How do I complete cancer insurance claim form online?

How do I make changes in cancer insurance claim form?

What is cancer insurance claim form?

Who is required to file cancer insurance claim form?

How to fill out cancer insurance claim form?

What is the purpose of cancer insurance claim form?

What information must be reported on cancer insurance claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.