Get the free Cancel My Insurance

Get, Create, Make and Sign cancel my insurance

How to edit cancel my insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cancel my insurance

How to fill out cancel my insurance

Who needs cancel my insurance?

Cancel my insurance form: How-to guide

Understanding the process of cancelling your insurance

Cancelling your insurance is a significant decision that requires careful consideration. You might find yourself needing to cancel your insurance for various reasons, such as finding a better deal, experiencing a life change like moving or marriage, or simply no longer needing the coverage. Before initiating the cancellation process, it’s crucial to reflect on the potential implications, especially concerning future coverage and costs.

It’s also vital to understand any potential fees or penalties associated with cancelling your policy. These can vary significantly based on your provider and the type of insurance. Familiarizing yourself with these details upfront can save you a considerable amount of time and money.

When can you cancel your insurance?

While many policies allow cancellation at any time, there may be specific conditions attached. Some insurance providers have a grace period for cancellations, which varies depending on your policy type. Understanding these policies can help you strategize the right timing for your cancellation.

Cancelling insurance mid-term might result in earned premiums being forfeited if not handled correctly. Timing your cancellation may also affect the refund you can expect, depending on the terms of your policy. Getting familiar with your provider’s specific cancellation timing policies is imperative.

Preparing to cancel your insurance

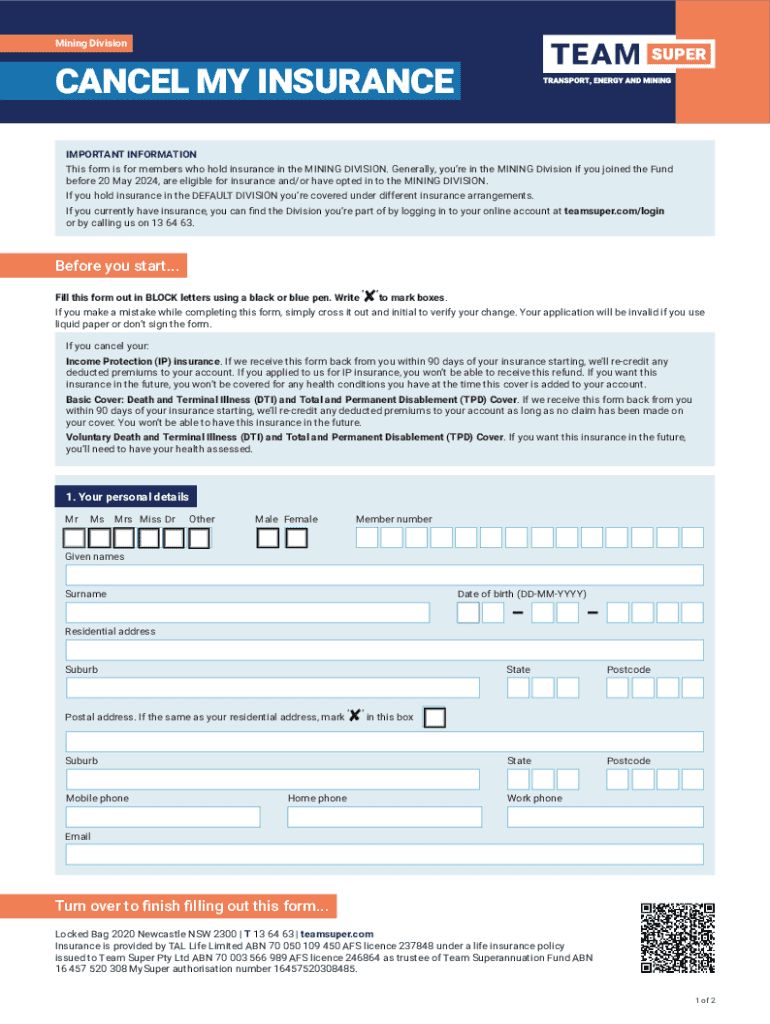

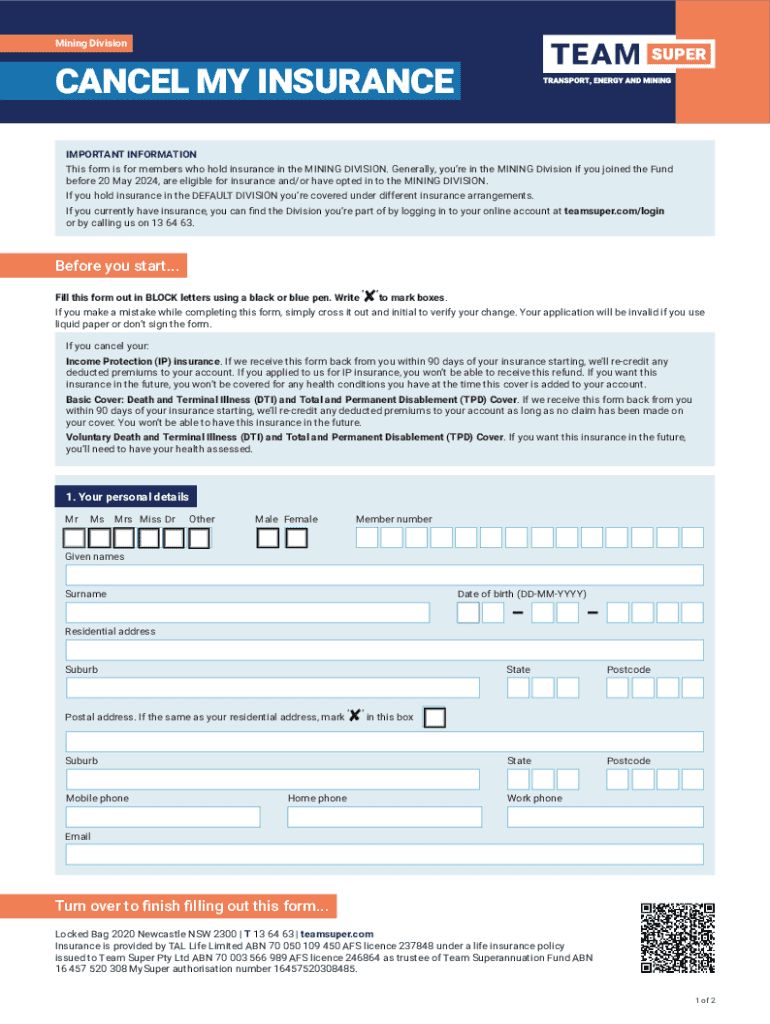

Before you fill out your 'cancel my insurance form', gather all necessary documentation. Essential documents include your policy number, identification documents, and any correspondence related to your insurance policy. This preparation will significantly streamline the process.

Next, confirm the cancellation process specific to your insurance provider. Most companies provide guidance on their website, including links to download or fill out your cancellation form online, making this step straightforward.

How to cancel your insurance

Completing the cancellation process involves filling out the 'cancel my insurance form' accurately. Ensure to include essential information like your policy number, personal details, and the desired cancellation date. Omitting any of these details can delay your request.

Submitting your cancellation can be done through various methods. Online submission is the quickest and most efficient, while mailing in your request can take longer. Cancelling by phone is also an option, but be sure to follow up in writing to have a formal record.

Avoid common mistakes, such as forgetting to sign the form or failing to confirm the cancellation method. Ensuring all details are correct reduces the likelihood of delays in processing.

Communication with your insurance provider

Effective communication with your insurance provider during the cancellation process is essential. State clearly that you wish to cancel your policy and provide necessary details. If your cancellation request is denied, don’t hesitate to ask for clarification or an appeal process.

As a policyholder, you have rights that protect you during cancellation. Familiarizing yourself with these rights can empower you to navigate any potential issues that arise.

Post-cancellation steps

Once your cancellation is processed, ensure you receive confirmation from your provider. This confirmation is crucial for your records and serves as proof of cancellation should any disputes arise in the future. It's also important to inquire about any outstanding balances or refunds for the remaining balance of your premium.

Transitioning to a new insurance policy can be smooth when you plan your cancellation and subsequent coverage carefully. Make sure to avoid any lapses in coverage to protect yourself from potential risks.

Related articles and resources for further assistance

For more information about switching insurance providers or understanding cancellation policies, explore our related articles. Tools such as pdfFiller can assist you in managing all necessary documents efficiently, ensuring you have easy access to resources designed for your needs.

Additionally, we provide answers to frequently asked questions around insurance cancellations which can guide you further.

Frequently asked questions (FAQs) about cancelling insurance

Understanding these factors can provide clarity on the implications of cancelling your policy and what to expect after your insurance is terminated.

Additional considerations and alerts

When deciding to cancel, be aware of any critical deadlines related to your policy. Following through with your cancellation promptly is essential to avoid lapses in coverage which can lead to unintended financial risk.

As you navigate the cancellation process, keep in mind how it might impact your future insurance premiums. Insurers often assess your liability and claim history, which could affect your rates if you abruptly cancel without securing new coverage.

Connect with us

For further assistance with your cancellation process, our customer support team is readily available to provide you with the information and guidance you need. Additionally, connect with us on social media or community forums for more support and shared experiences from fellow users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cancel my insurance directly from Gmail?

How can I send cancel my insurance for eSignature?

How do I edit cancel my insurance in Chrome?

What is cancel my insurance?

Who is required to file cancel my insurance?

How to fill out cancel my insurance?

What is the purpose of cancel my insurance?

What information must be reported on cancel my insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.