Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out flood disclosure

Who needs flood disclosure?

Understanding the Flood Disclosure Form: A Complete Guide

Understanding the flood disclosure form

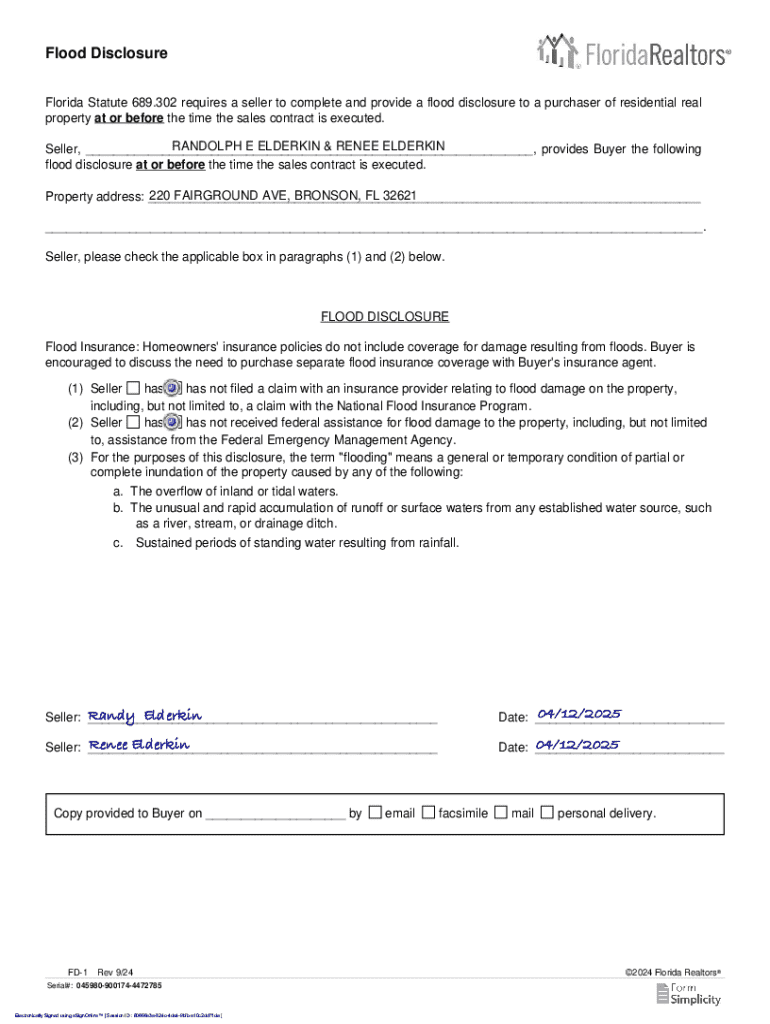

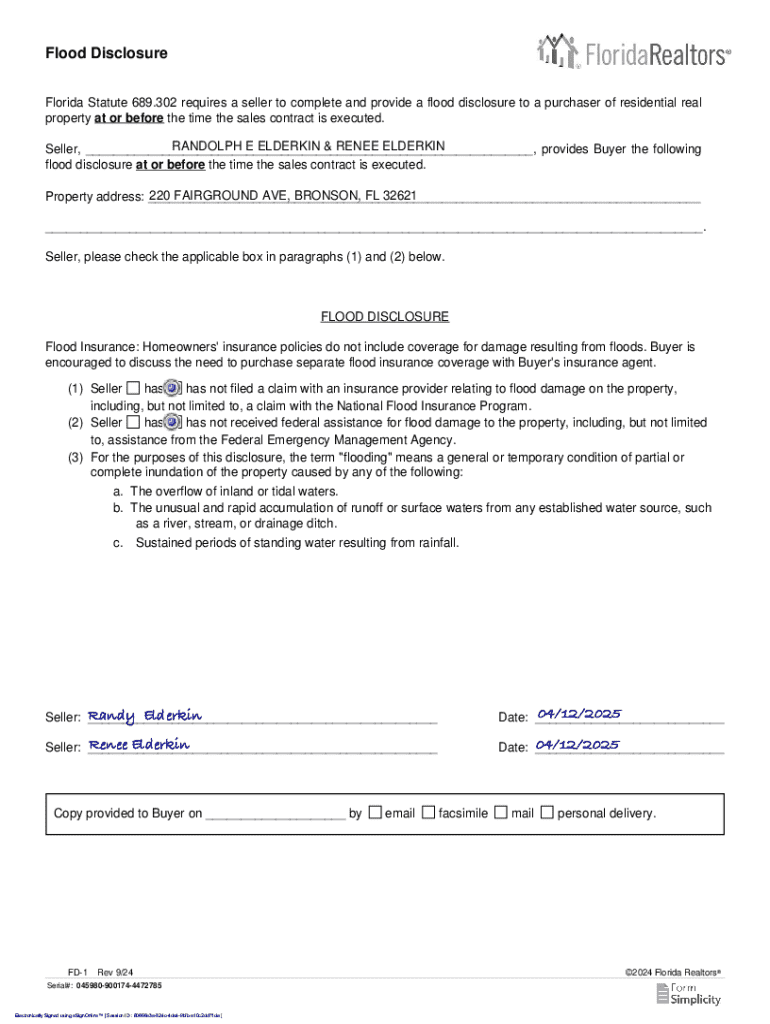

The flood disclosure form is a vital document used in real estate transactions to inform potential buyers about a property's flood risk. This form is not merely a formality; it serves the critical purpose of safeguarding buyers from unforeseen liabilities. Its importance lies in its ability to provide transparency, ensuring that buyers are fully aware of any risks associated with flooding in the area where the property is located.

Legal obligations surrounding the flood disclosure form vary significantly across states, with both federal and state laws mandating certain disclosures. Under the National Flood Insurance Act, sellers must provide accurate flood risk information. Failure to comply can lead to severe consequences including legal repercussions and financial liability, emphasizing the necessity of careful completion and submission.

Key components of the flood disclosure form

The flood disclosure form comprises several essential sections that help convey critical information about the property. Firstly, the property information section typically includes details such as the address and legal description of the property, establishing the context for potential flood risks. Secondly, the flood risk assessment section requires the seller to evaluate and disclose any known flood risks, including whether the property is located in a FEMA-designated flood zone.

Another vital component is the buyer acknowledgment section, where potential buyers confirm their understanding of the disclosed flood risks. To bolster the information provided, supporting documentation such as maps that outline the property's flood zone designation and any records of previous flood claims should be included. This comprehensive approach equips buyers with the information they need to make informed decisions.

How to fill out the flood disclosure form

Completing the flood disclosure form can be a straightforward process if approached methodically. Follow these step-by-step instructions for smooth completion:

When filling out the flood disclosure form, common pitfalls to avoid include providing incomplete information, which can lead to misunderstandings, and failing to update the form with any recent changes, such as modifications to flood zone designations. Being thorough and accurate will help build trust with potential buyers and mitigate future complications.

Editing and signing the flood disclosure form

Editing the flood disclosure form is made seamless with pdfFiller, a cloud-based platform specifically designed for document management. Users benefit from interactive tools that allow real-time edits to the form. Key features of pdfFiller include its user-friendly interface, which caters to both individual and team needs while maintaining document integrity.

For eSigning the document, pdfFiller streamlines the process, enabling users to easily create legally valid electronic signatures. To eSign the flood disclosure form, simply follow these steps: upload the completed document, click on the 'eSign' option, and follow the prompts to create your signature. The platform also provides tips on ensuring the legal validity of electronic signatures, making it a comprehensive solution.

Managing your flood disclosure form

Once the flood disclosure form is completed and signed, proper management is vital. Storing the document digitally offers substantial benefits, such as easy access and enhanced security. Utilizing cloud storage ensures that you can retrieve the document from anywhere, facilitating collaboration among team members who may need to review it.

Moreover, pdfFiller’s collaborative features enable teams to work together efficiently. Users can invite team members to review the document, leave comments, and provide feedback, enhancing the quality of the documentation process. This collaboration is essential in ensuring that all critical perspectives are considered, reinforcing the integrity and clarity of the disclosure.

Frequently asked questions (FAQ)

Potential buyers often have questions about the implications of a flood disclosure form. For instance, what if a property is categorized in a minimal-risk area? Even properties in low-risk zones can experience unexpected flooding, making the disclosure vital for all transactions. Additionally, buyers frequently wonder how the flood disclosure form impacts closing costs. Often, the information disclosed can affect insurance premiums, which are crucial for overall cost assessment.

Lastly, if new flood risks are discovered after a disclosure has been made, it’s essential to inform the buyer as promptly as possible to maintain transparency and comply with legal obligations. Being proactive about these changes can prevent potential disputes down the road.

Resources for further information

Navigating real estate transactions and understanding flood risks can be complex, making access to resources beneficial. Property owners seeking additional information can explore related documents and forms that enhance their understanding of flood risks and compliance requirements. For further insights, reviewing sample flood disclosure forms can demonstrate best practices and common disclosures. Furthermore, accessing links to state and federal flood management agencies can provide property owners with valuable resources, including key contacts for inquiries as well as educational materials tailored to their local contexts.

Testimonials from users

Real experiences can illuminate the practical benefits of utilizing the flood disclosure form within the pdfFiller ecosystem. Users have reported that streamlining their disclosure process not only saves time but fosters a sense of security in their transactions. For instance, one user noted that leveraging pdfFiller's tools helped them present clear and organized documentation, ultimately leading to a smoother transaction process.

Success stories highlight how efficient document management can have real-life impacts, including quicker closings and reduced stress for both sellers and buyers. When users feel confident in their disclosures, they contribute to a more responsible and transparent real estate market.

Latest updates and regulatory changes

Staying informed about recent changes in flood disclosure laws is essential for both buyers and sellers. Recent trends indicate that regulatory scrutiny surrounding evidencing flood risk is tightening, which necessitates an active approach to compliance. Furthermore, as climate change continues to affect flooding patterns globally, properties previously thought to be at minimal risk may now fall into higher risk categories, prompting necessary updates to flood disclosure forms.

Understanding these dynamics not only benefits current transactions but also prepares stakeholders for future property dealings. Continuous education and awareness will help mitigate risks and improve overall compliance with both local and federal regulations.

Explore more

For those looking to optimize their document management process further, pdfFiller offers a range of additional tools and templates tailored to various needs beyond the flood disclosure form. Users can access functionalities that simplify everything from real estate contracts to maintenance logs, all within a seamless, cloud-based platform. The ability to customize paperwork and maintain control over files is a significant advantage, ensuring each user’s documentation process is as efficient as possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit pdffiller form from Google Drive?

Where do I find pdffiller form?

How can I fill out pdffiller form on an iOS device?

What is flood disclosure?

Who is required to file flood disclosure?

How to fill out flood disclosure?

What is the purpose of flood disclosure?

What information must be reported on flood disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.