Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out co-op questionnaire

Who needs co-op questionnaire?

Co-op Questionnaire Form - How-to Guide

Understanding the co-op questionnaire

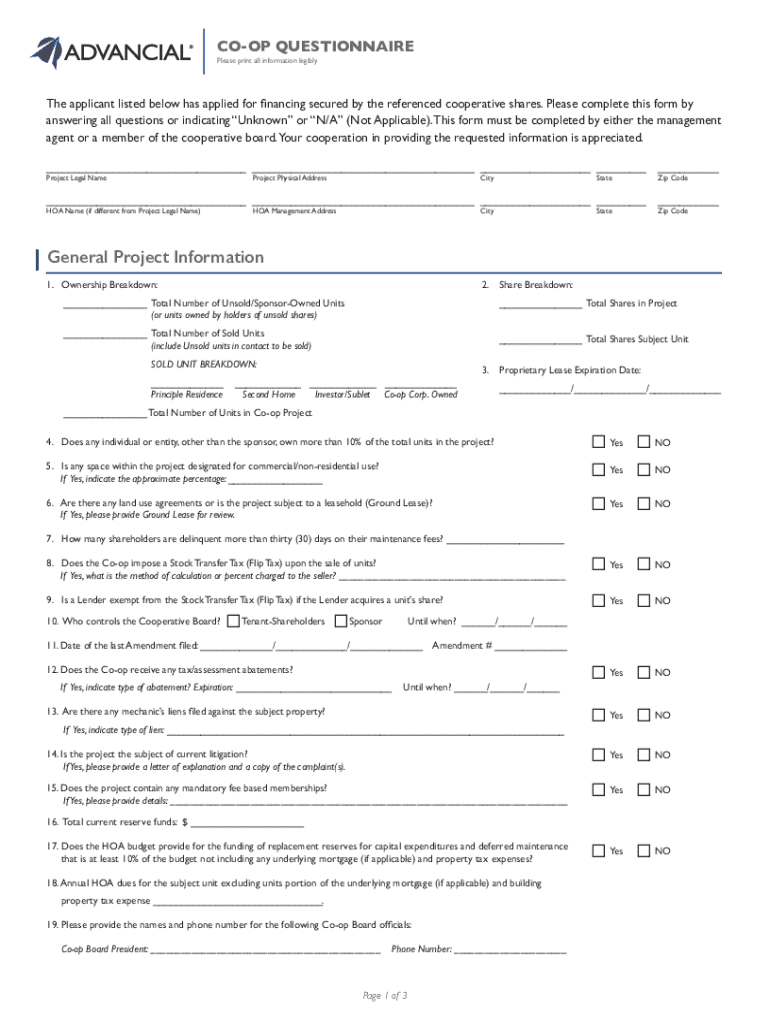

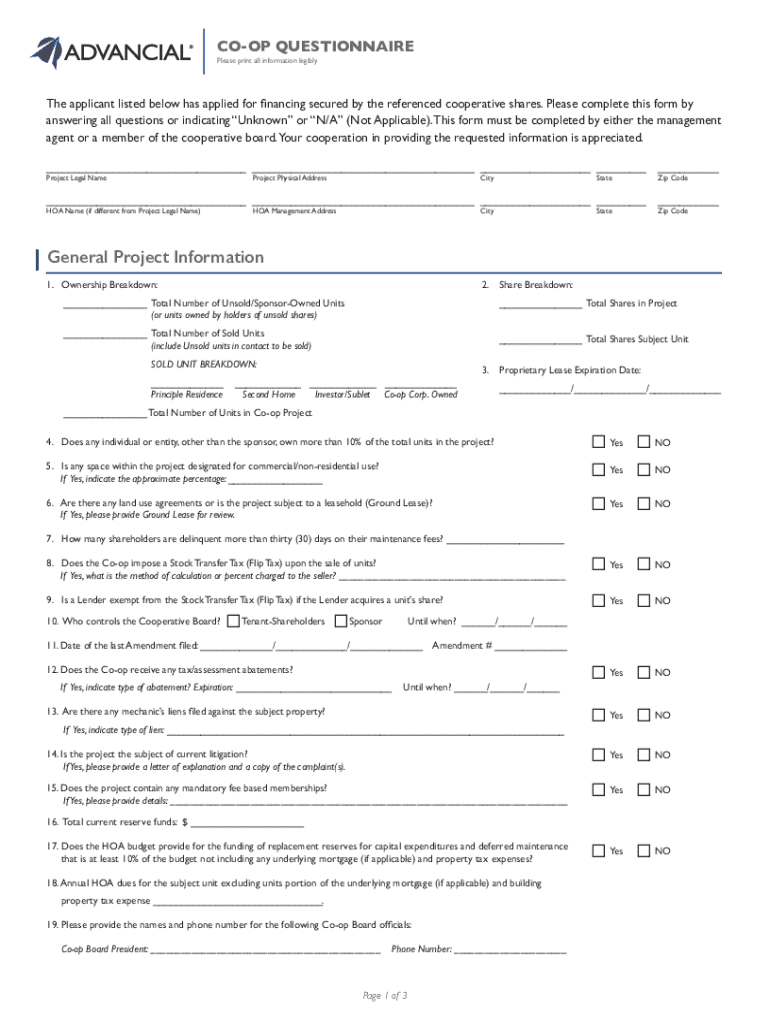

A co-op questionnaire is a critical document used primarily in the financing and purchasing process of co-operative apartments. This form acts as a summary of the building's operational and financial health, providing lenders with essential insights into the property in question.

The importance of the co-op questionnaire cannot be overstated; it assesses the risk associated with granting a mortgage by detailing important information such as financial stability and compliance with local regulations. Understanding this document is crucial for potential buyers and lenders as it directly influences financing decisions.

Who requires the co-op questionnaire?

Banks and mortgage lenders require the co-op questionnaire to ensure that the property meets specific standards and criteria before approval of a loan. This requirement is particularly common in scenarios where buyers are looking to finance their purchase of a co-op apartment.

Often, a co-op mortgage will necessitate that the buyer's financial stability and the building's operational integrity are thoroughly evaluated. The questionnaire will also be a requirement if the building is newly constructed or if significant renovations have been carried out.

Key components of a co-op questionnaire

When addressing the co-op questionnaire, the first section generally consists of general property information. This includes fundamental details like the number of units, the height of the building (floors), and the overall age of the structure. Additionally, the owner occupancy ratio, which notes the percentage of residents who own their units versus those who rent, is a critical metric.

Building financials form another key component, detailing monthly maintenance fees, reserves, and current operating account balances for the co-op. These are crucial for understanding the fiscal health of the building and whether it can manage its expenses effectively.

Lastly, regulatory and compliance matters must be considered, including information on the Certificate of Occupancy (which indicates whether the building is suitable for habitation) and any compliance with relevant legislation such as Local Law 11, which mandates inspections and repairs related to the facade of buildings in cities like New York City.

Common questions found in co-op questionnaires

A well-structured co-op questionnaire will typically include due diligence questions that explore ownership rights and liabilities. For instance, items like ground leases need to be clarified, as they can significantly affect a buyer’s investment.

Another area of inquiry involves assessments and tax abatements related to the property, as these can reveal potential future costs for owners. Furthermore, property management policies are outlined, detailing subletting, pet policies, or any restrictions on smoking and moving in or out.

It's also common to encounter contingent situations such as the history of damage within the building, pest control measures, and ongoing litigation status against the property, all of which are vital for assessing risks to potential buyers.

How to fill out a co-op questionnaire

To fill out a co-op questionnaire effectively, preparation is key. Begin by gathering all necessary documents, including previous financial statements of the co-op, the latest meeting minutes from board meetings, and anything that reflects the building's financial status.

Identifying the correct contact points is also crucial. This typically involves the managing agent and board representatives who can provide accurate information needed to complete the form.

Once organized, follow a step-by-step guide for each section of the form. Take care to avoid common pitfalls, like leaving sections blank or misrepresenting facts about the property, as errors could delay processing or result in financing denials.

Tips for effectively managing co-op questionnaires

An essential part of managing co-op questionnaires involves an edit and review process. Accuracy and completeness of the information you're presenting cannot be overstated, as even small mistakes can have significant ramifications. It is advisable to collaborate with team members during this phase to ensure each aspect is thoroughly vetted.

Utilizing tools like pdfFiller can simplify this process significantly. It allows users to edit the questionnaire quickly, and integrates features for electronic signing and seamless collaboration between stakeholders. Once completed, ensure to submit the questionnaire following best practices, opting for electronic submission where possible, and follow up to confirm receipt and address any concerns that might arise.

Leveraging pdfFiller for co-op questionnaire management

pdfFiller offers tailored features to facilitate the creation and editing of co-op questionnaires. Users can take advantage of seamless PDF editing capabilities, ensuring that details can be updated easily and fields filled in correctly, which is particularly useful when dealing with time-sensitive submissions.

Additionally, pdfFiller’s collaboration tools allow for smooth eSigning and sharing of documents, simplifying the process of obtaining necessary approvals from board members or managing agents. Furthermore, the cloud-based storage system provided by pdfFiller means that documents can be accessed from anywhere, allowing for real-time collaboration even when team members aren’t physically present.

Case studies and real-life examples

Analyzing successful co-op purchases often highlights the significance of a well-prepared co-op questionnaire. For instance, in New York City, buyers who provided thorough and accurate information enabled swift mortgage approvals and smooth transactions, building trust with lenders and minimizing potential delays.

Conversely, past instances where inaccuracies in the questionnaire led to failed purchases are invaluable learning experiences. Disputes related to assessments or unresolved litigation can dramatically reduce a building's appeal to buyers, showcasing the importance of transparency and diligence in filling out the co-op questionnaire.

Frequently asked questions (FAQs)

What happens if a questionnaire is not completed properly? Inadequate completion can lead to delays in financing or even rejection of the mortgage application. It’s crucial to address all questions thoughtfully and with accurate information to streamline the approval process.

How long does it take to fill out a co-op questionnaire? Typically, it may take several hours to gather all the necessary information and complete the form accurately. Allocate sufficient time to ensure that you are diligent in every section.

Are there fees associated with obtaining a co-op questionnaire? Usually, there may be nominal fees charged for processing the questionnaire by the management company or board, which is vital to consider when budgeting for your home purchase.

Connecting with experts

Understanding when to seek assistance from real estate professionals can greatly enhance the buying process. It’s wise to consult agents or attorneys when navigating complex scenarios related to the co-op questionnaire, such as managing extensive litigation history or unique ownership structures within the building.

To find reliable property management services, consider utilizing local directory resources or seeking recommendations from real estate networks to connect with professionals who understand the nuances of co-op living.

Recommended tools and resources

For further reading on aspects of co-op living, consider looking into documents that explain financial literacy specifically tailored to co-operative apartments. These resources provide insights into costs beyond the purchase, such as maintenance fees and assessments.

Additionally, pdfFiller offers interactive tools that help in the management of document workflows. Tools that streamline the filling, editing, and signing processes can save significant time and prevent frustration during transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get pdffiller form?

Can I create an electronic signature for signing my pdffiller form in Gmail?

How can I fill out pdffiller form on an iOS device?

What is co-op questionnaire?

Who is required to file co-op questionnaire?

How to fill out co-op questionnaire?

What is the purpose of co-op questionnaire?

What information must be reported on co-op questionnaire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.