Get the free Minnesota Affidavit of Collection of Estate Assets - Gary C. Dahle

Get, Create, Make and Sign minnesota affidavit of collection

Editing minnesota affidavit of collection online

Uncompromising security for your PDF editing and eSignature needs

How to fill out minnesota affidavit of collection

How to fill out minnesota affidavit of collection

Who needs minnesota affidavit of collection?

A Complete Guide to the Minnesota Affidavit of Collection Form

Understanding the Minnesota Affidavit of Collection Form

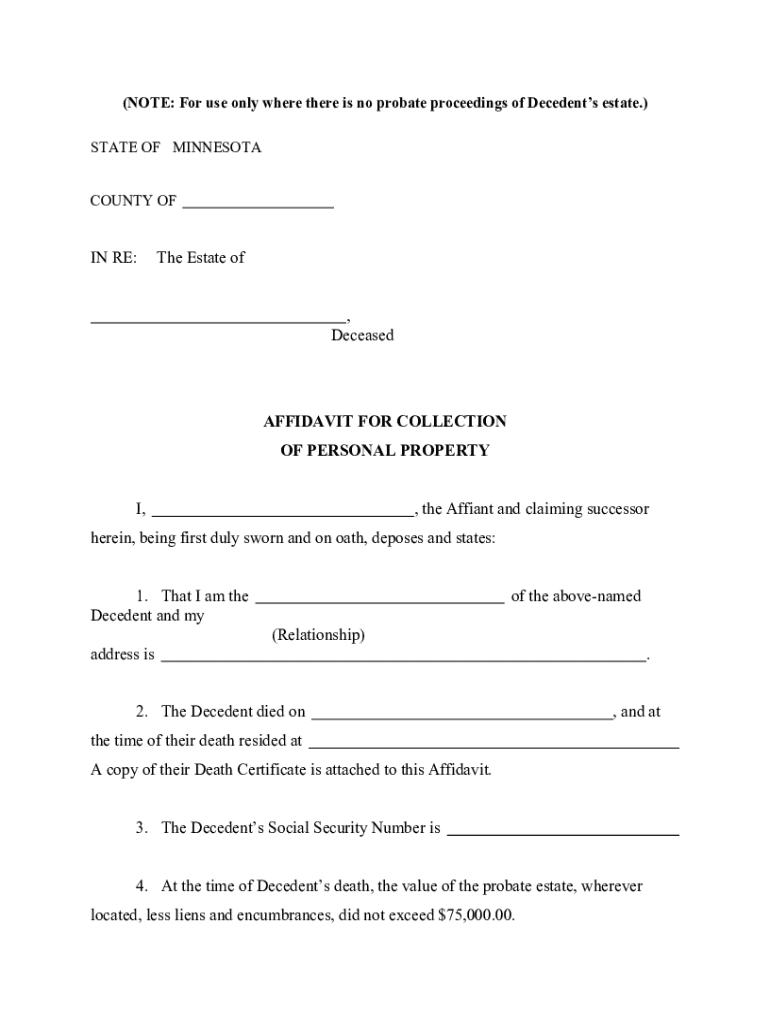

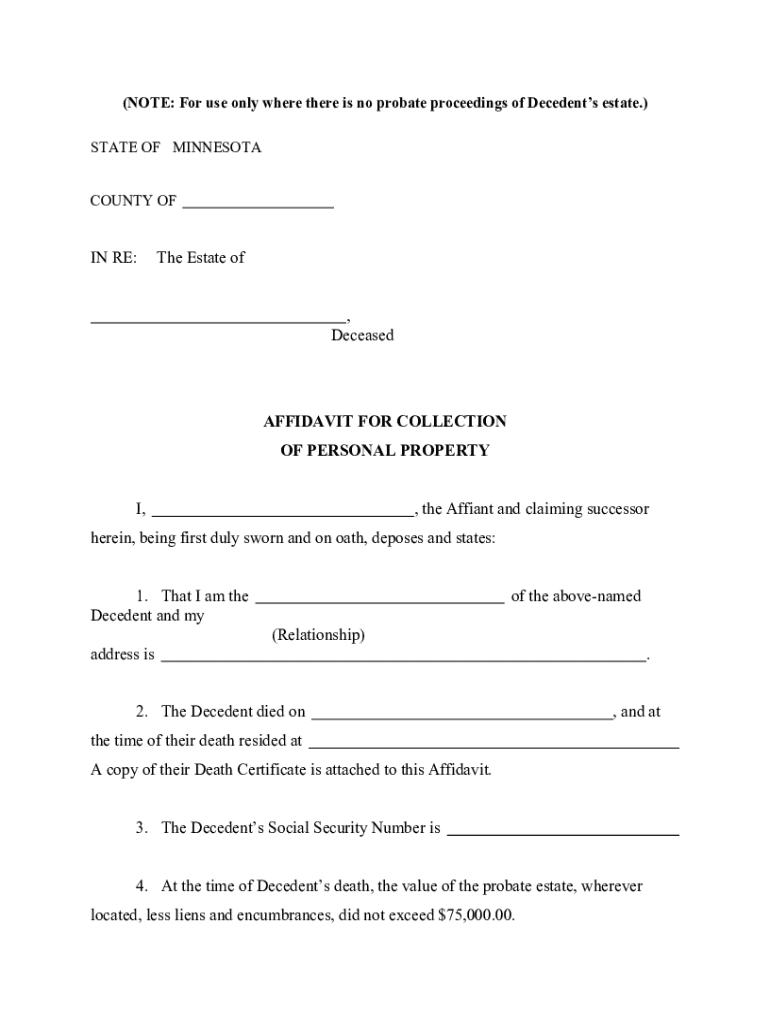

The Minnesota Affidavit of Collection Form is a legal document that empowers specific individuals, typically heirs or estate executors, to collect the assets from a deceased person's estate without going through the lengthy probate process. Its primary purpose is to simplify the transfer of property and financial assets when the estate's total value falls beneath a certain threshold, as established by Minnesota law. This form acts as a sworn statement that the affiant (the person completing the affidavit) is entitled to collect the specified assets in accordance with state regulations.

The affidavit is essential in estate administration as it helps facilitate a smoother process for those managing the decedent's affairs. By using the affidavit, heirs can bypass formal probate proceedings for smaller estates, saving time and resources. Understanding Minnesota's probate law related to affidavits is crucial for anyone involved in estate management, ensuring compliance with legal parameters while protecting the heirs' rights.

Types of collection affidavits in Minnesota

Detailed process of filling out the Minnesota Affidavit of Collection Form

Filling out the Minnesota Affidavit of Collection Form involves several critical steps to ensure accuracy and compliance with state guidelines. Begin by gathering all necessary information, including the decedent's details, the names of the heirs, and a comprehensive list of assets to be collected. Each section of the affidavit must be filled with precise information to avoid delays.

When completing the form, take care to accurately fill out each field, ensuring there are no missing entries. After filling out the affidavit, it is vital to have the document signed in the presence of a notary public to validate its authenticity. Remember, common mistakes such as inaccurate details or missing signatures can lead to complications in the asset collection process.

Specifics about different types of assets

Certain properties and assets require specific considerations when filling out the Minnesota Affidavit of Collection Form. For instance, accessing the contents of a safe deposit box necessitates additional documentation, including bank notifications and identification. The affidavit may also need particular amendments or watermarked identification for items deemed as tangible personal property.

Moreover, understanding the rights of successors is essential when navigating asset collection. Successors must be aware of their rights regarding accessing funds or property, and they may need additional forms specific to different assets, such as vehicles or special collectibles. In cases involving debts or financial institutions, collaborating effectively with transfer agents can streamline the estate's asset collection.

Best practices for managing documents and affidavits

Utilizing tools like pdfFiller can significantly ease the document management process when dealing with the Minnesota Affidavit of Collection Form. This platform offers a range of features that allow for easy editing of PDF files, ensuring all necessary information is captured correctly. Additionally, pdfFiller supports collaborative features that enable teams to work together seamlessly, improving efficiency in managing estate-related documentation.

Secure document storage is another critical aspect of managing affidavits. Using cloud-based solutions ensures that important documents are safe and easily accessible. Moreover, opting for electronic signatures can expedite the process, reducing the need for physical meetings and enabling documents to be signed remotely, further facilitating timely asset collection.

Navigating the broader context of Minnesota probate records

The Minnesota probate process is crucial in delineating how an estate is handled after a person passes. The Minnesota Affidavit of Collection Form falls within this broader context, which also involves various court forms and filings. Understanding these interconnections not only simplifies asset collection but also aids in comprehending the overall estate administration landscape.

A thorough understanding of related resources and links to relevant legal frameworks can also empower heirs and estate managers. Familiarity with the probate process ensures that all parties involved are aware of their rights and responsibilities, enabling them to handle estate matters more effectively.

Related topics of interest

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute minnesota affidavit of collection online?

How do I make changes in minnesota affidavit of collection?

How do I fill out minnesota affidavit of collection on an Android device?

What is minnesota affidavit of collection?

Who is required to file minnesota affidavit of collection?

How to fill out minnesota affidavit of collection?

What is the purpose of minnesota affidavit of collection?

What information must be reported on minnesota affidavit of collection?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.