Get the free Change of Insured Form

Get, Create, Make and Sign change of insured form

How to edit change of insured form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out change of insured form

How to fill out change of insured form

Who needs change of insured form?

A comprehensive guide to the change of insured form

Understanding the change of insured form

A change of insured form is a critical document in the world of insurance, designed to facilitate the modification of the named insured on a policy. This form is essential for addressing changes in ownership, ensuring that the correct individual or entity is recognized as the insured party. Such changes can occur for various reasons, ranging from personal life events to business transitions that require a complete reevaluation of coverage. Properly managing this form is key to maintaining seamless insurance coverage and ensuring that any claims can be appropriately processed.

The importance of the change of insured form cannot be overstated, as it serves several purposes. First, it helps mitigate risks associated with incorrect or outdated policy information which can lead to denied claims. Secondly, it ensures beneficiaries have access to intended funds or assets in the event of a claim. Thus, understanding how and when to use this form is essential for any individual or organization managing insurance policies.

When to consider a change of insured

There are critical moments when submitting a change of insured form becomes necessary. One primary scenario is a change in ownership—a common occurrence during business transitions when ownership stakes are transferred or when personal circumstances, such as marriage or divorce, alter the insured parties. Each of these situations can significantly impact how your insurance operates and what coverages are necessary.

Another scenario prompting a change is policy upgrades or renewals. As your needs grow or change, your insurance coverage may need to reflect those adjustments. Whether updating your business operations or ensuring a new family member is adequately covered, this form ensures that your policy aligns with current realities.

Lastly, ensuring proper assurance for different beneficiaries can also necessitate using this form. For instance, if you wish to designate a new beneficiary or clarify existing ones, changes may be required to safeguard those interests and ensure funds go to the right parties.

Preparing to complete your change of insured form

Before you dive into filling out the change of insured form, gathering the necessary documentation is essential. This typically includes your current insurance policy, verification of identity for all involved parties, and any legal documents related to ownership changes. Having accurate and complete information on hand helps streamline the process and minimize potential errors.

Assessing your policy needs is another crucial step. Review your current insurance coverage to identify any gaps or changes required due to life events or business evolution. Ask yourself what specific reasons necessitate the change—whether financial, protective, or regulatory—and ensure you are prepared to articulate these needs when completing the form.

Step-by-step instructions for filling out the change of insured form

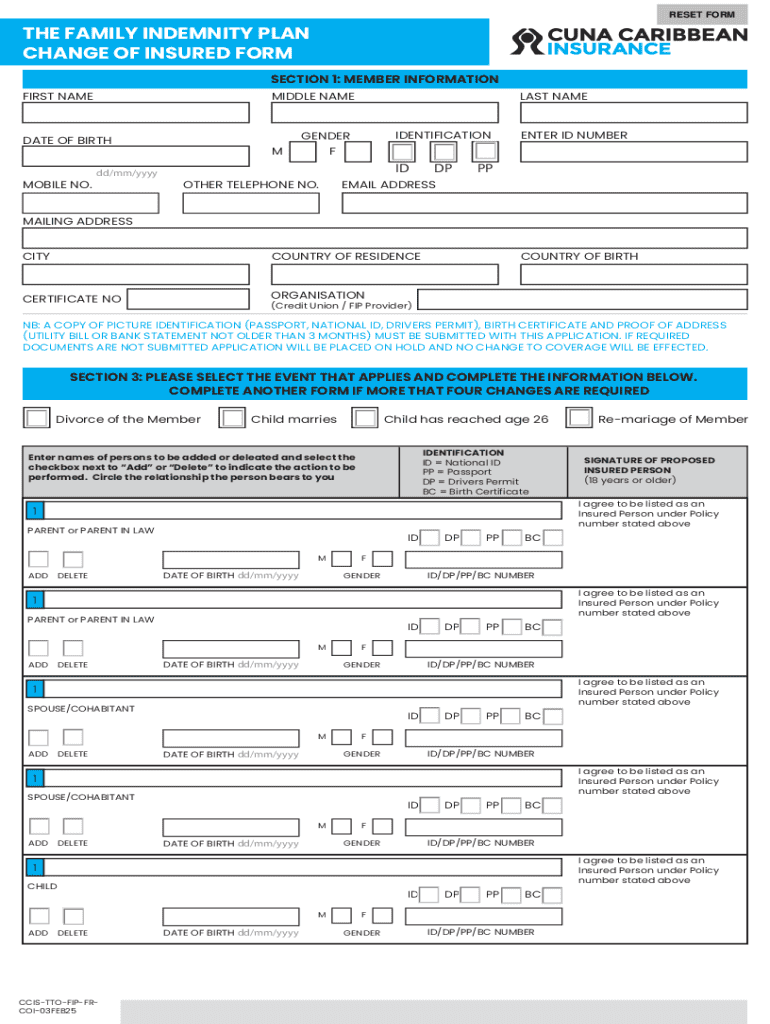

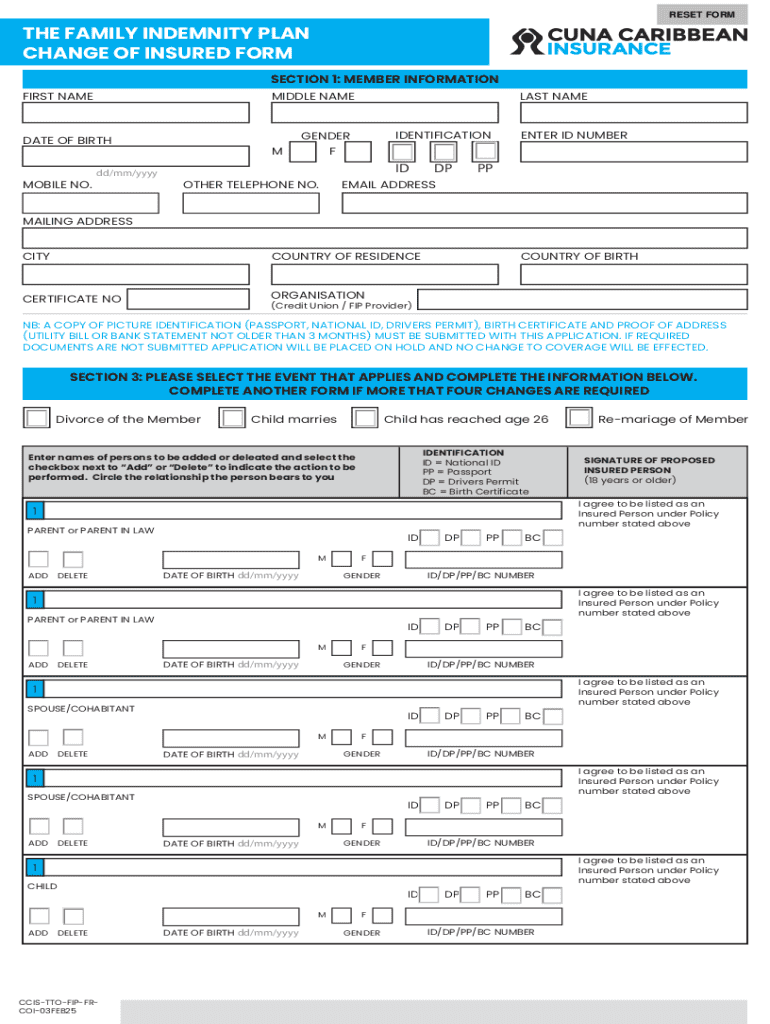

When filling out the change of insured form, attention to detail is critical. The first section typically requires entering the insured information, including full names, addresses, and contact details. Ensuring accuracy here prevents complications later in the process.

The next part usually involves policy details where you'll need to specify your current insurance policy number, coverage type, and sometimes previous insured entity information. Be cautious of common pitfalls, such as typos in policy numbers or missed sections, which can derail the submission process.

Lastly, be sure to document any changes to beneficiaries clearly. This section is crucial for ensuring that the intended individuals or entities will receive the benefits of the policy upon the insured's passing or any qualifying event.

Editing and proofreading your change of insured form

Editing and proofreading the change of insured form is where clarity becomes vital. Utilizing tools like those found on pdfFiller allows you to edit and annotate fields easily. This helps ensure that any necessary adjustments are clear and easily understood. By marking corrections and highlighting critical areas, you can make sure the form is as precise as possible before submission.

Proofreading is another important step where you can catch mistakes or unclear language. Key elements to check include ensuring that all names are spelled correctly, addresses are accurate, and that the policy number is indeed valid. Peer reviews through collaboration features can also be invaluable, providing insights that you might have missed.

Signing and submitting your change of insured form

Once the form is completed and thoroughly checked, the signing process is next. Understanding the significance of a digital signature is crucial, especially in today’s fast-paced environment. Using pdfFiller’s eSign functionality ensures that your signature is legally binding and securely associated with the document.

Submission can vary by insurance provider, with options ranging from online uploads to email submissions or even traditional mail. Familiarizing yourself with your provider's specific requirements can save you time and ensure your changes are processed efficiently. Keep in mind that processing times can differ widely, so inquire about the expected timelines for your change.

Managing your insurance post-change

After you’ve submitted your change of insured form, tracking the updates is crucial. Ensuring that your insurance policy reflects the intended changes can prevent issues down the line. Utilize the management tools available on pdfFiller to create reminders to check your policy or to document any follow-ups regarding your request for change.

Using pdfFiller for ongoing document management provides a seamless experience, allowing you to store, retrieve, and manage all your insurance-related documents in one spot. This not only saves time but helps ensure that you have access to essential documentation as needed, keeping you organized and informed.

FAQs about the change of insured form

It's common to have inquiries about the change of insured form, especially regarding what to do if the form is declined. In such cases, reviewing the specific reasons provided by the insurance provider can help you amend the form or submit additional documentation. Often, minor errors like missing signatures or incorrect details can lead to declination, which may be remedied with proper adjustments.

Discrepancies in insured details are another frequent concern. If you notice any inconsistencies after submission, reach out to your insurance provider immediately for clarification. Being proactive about discrepancies can prevent complications that could hinder future claims or coverage.

Understanding limitations and exceptions

There are circumstances where changing details on your insurance policy might not be permitted. For example, some policies have stipulations surrounding who is eligible as the insured party or restrictions tied to the conditions of the policy itself. Familiarizing yourself with your specific policy's terms will give you insights into limitations and potential exceptions that may arise during the change process.

In complex scenarios—like multi-owner properties or business partnerships—additional steps might be necessary, including separate documentation from all parties involved. Consulting with an insurance professional can help clarify these situations and ensure compliance with necessary regulations.

Staying informed on policy management

To keep your insurance policies current and relevant, leveraging tools like pdfFiller for future needs can significantly ease the management process. This platform not only helps with the current change of insured form but also allows you to streamline ongoing updates across various documents. By utilizing cloud-based solutions, you empower yourself to organize and update insurance documents with ease.

Best practices for managing all insurance documents include regularly scheduling policy reviews and ensuring all parties are informed of changes. This proactive approach not only minimizes misunderstandings but also keeps everyone aligned on coverage expectations.

Exploring further: related forms and updates

Navigating insurance documentation can often lead you to encounter other related forms needing attention. Examples include beneficiary designation forms, change of address forms, and policy renewal applications. Understanding the roles of these documents in your insurance landscape can enhance your overall strategy for managing assets and risks.

Links to these other relevant forms can be found in various insurance platforms, offering insights into how they can complement your overall strategy in insurance management. Utilizing these resources alongside your change of insured form can help maintain a comprehensive approach to your insurance needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my change of insured form in Gmail?

How can I send change of insured form to be eSigned by others?

How do I complete change of insured form online?

What is change of insured form?

Who is required to file change of insured form?

How to fill out change of insured form?

What is the purpose of change of insured form?

What information must be reported on change of insured form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.